Understanding the Factors That Affect Pet Insurance Costs

Pet insurance costs can vary significantly depending on several factors, including the age, breed, health, and location of your pet. Understanding these factors can help you make informed decisions when selecting a pet insurance policy and budgeting for the associated costs.

One of the primary factors that affect pet insurance costs is the age of your pet. As pets get older, they become more prone to age-related health issues, which can increase the cost of insurance premiums. For example, a pet insurance policy for a 5-year-old dog may cost around $50 per month, while a policy for a 10-year-old dog may cost over $100 per month.

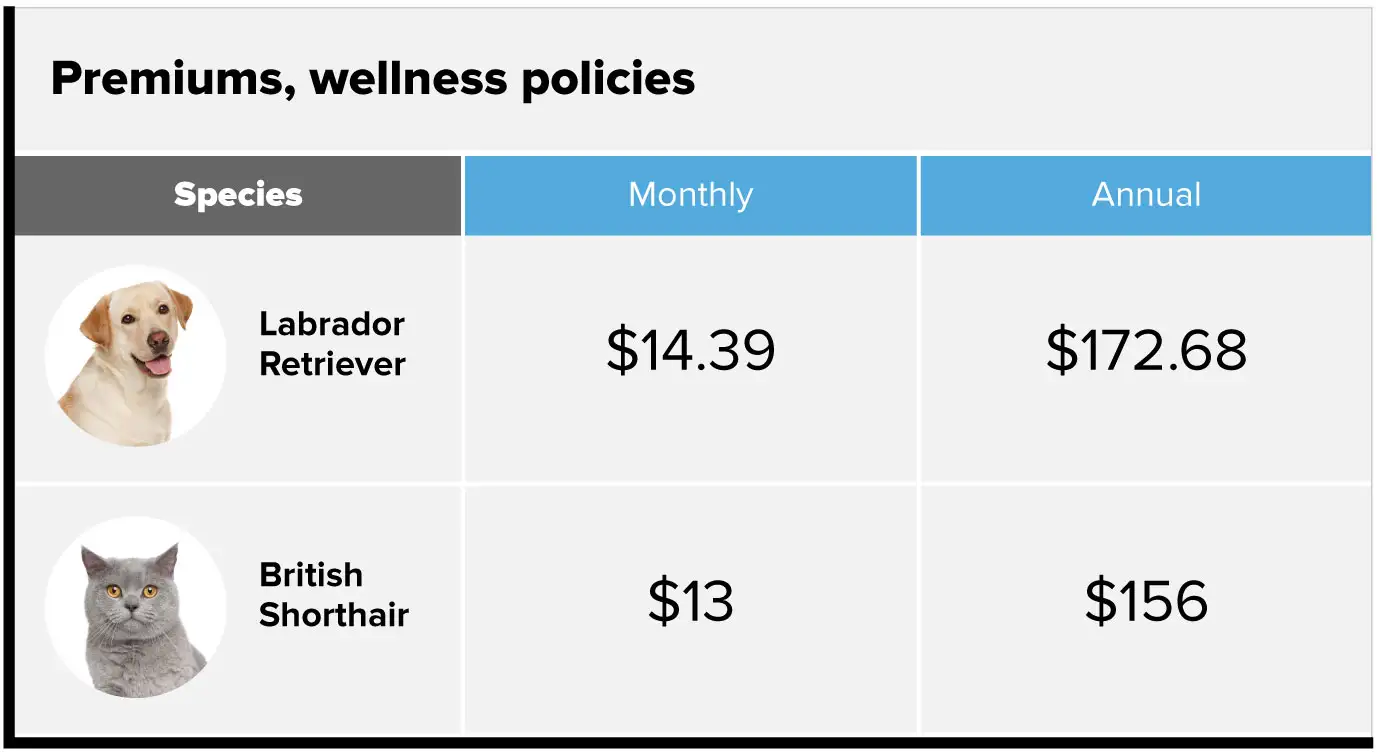

The breed of your pet is another significant factor that can impact insurance costs. Certain breeds, such as Bulldogs and Pugs, are more prone to specific health issues, which can increase the cost of insurance premiums. For instance, a pet insurance policy for a Bulldog may cost around $70 per month, while a policy for a mixed-breed dog may cost around $40 per month.

Your pet’s health is also a crucial factor in determining insurance costs. Pets with pre-existing medical conditions may be more expensive to insure, as they are more likely to require veterinary care. Additionally, pets that are overweight or obese may also be more expensive to insure, as they are at a higher risk of developing health problems.

Location is another factor that can affect pet insurance costs. The cost of living and veterinary care can vary significantly depending on where you live, which can impact insurance premiums. For example, pet owners living in urban areas may pay more for insurance than those living in rural areas.

Other factors that can impact pet insurance costs include the level of coverage, deductible, and copay. Policies with higher levels of coverage, lower deductibles, and lower copays may be more expensive, but they can provide greater financial protection in the event of unexpected veterinary expenses.

When searching for pet insurance, it’s essential to consider these factors and how they may impact your premiums. By understanding the factors that affect pet insurance costs, you can make informed decisions and find a policy that fits your budget and provides the necessary coverage for your pet.

How to Choose the Right Pet Insurance Policy for Your Budget

Choosing the right pet insurance policy can be overwhelming, especially with the numerous options available in the market. However, by considering a few key factors, you can select a policy that fits your financial situation and provides the necessary coverage for your pet.

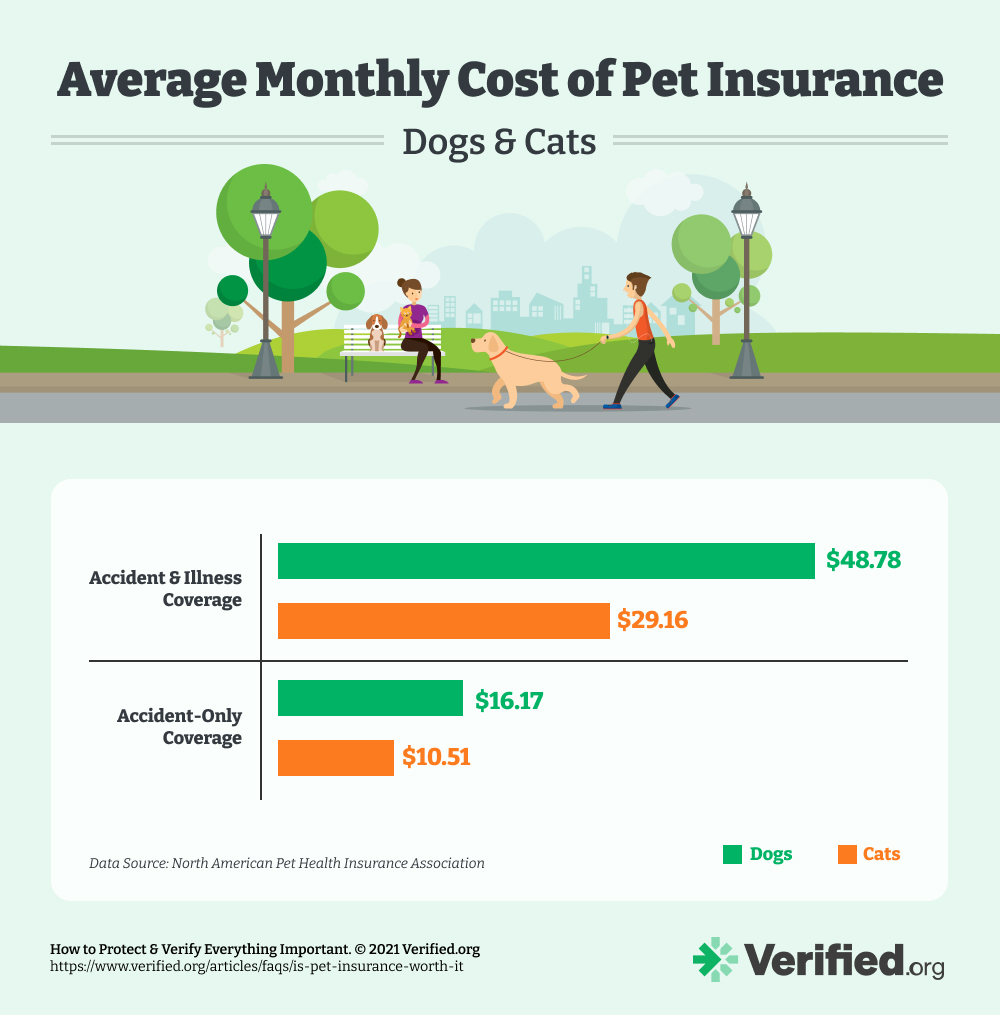

One of the most critical factors to consider is the level of coverage. Pet insurance policies can range from basic accident-only coverage to comprehensive policies that cover accidents, illnesses, and wellness care. The level of coverage you choose will significantly impact your premiums, so it’s essential to consider your pet’s needs and your budget.

Deductibles and copays are also crucial factors to consider. A deductible is the amount you pay out-of-pocket before your insurance kicks in, while a copay is the percentage of the veterinary bill you pay after the deductible. Policies with lower deductibles and copays may be more expensive, but they can provide greater financial protection in the event of unexpected veterinary expenses.

Another factor to consider is the reputation and financial stability of the insurance provider. Look for providers with a strong reputation, high customer satisfaction ratings, and a stable financial history. Some popular pet insurance providers include Nationwide and Trupanion, which offer a range of policies to suit different budgets and needs.

When selecting a pet insurance policy, it’s also essential to read the fine print and understand what’s covered and what’s not. Look for policies that cover chronic conditions, genetic disorders, and prescription medication. Additionally, consider policies that offer wellness care coverage, which can help prevent illnesses and reduce veterinary costs in the long run.

To get the best value from your pet insurance policy, consider the following tips:

- Choose a policy with a deductible and copay that fits your budget.

- Select a policy that covers chronic conditions and genetic disorders.

- Consider a policy that offers wellness care coverage.

- Read the fine print and understand what’s covered and what’s not.

- Research and compare different insurance providers to find the best fit for your pet and budget.

By considering these factors and tips, you can choose a pet insurance policy that fits your financial situation and provides the necessary coverage for your pet. Remember, the cost of pet insurance can vary significantly depending on several factors, including the level of coverage, deductibles, and copays. However, by doing your research and selecting the right policy, you can ensure that your pet receives the best possible care without breaking the bank.

The Average Cost of Pet Insurance: A Comprehensive Breakdown

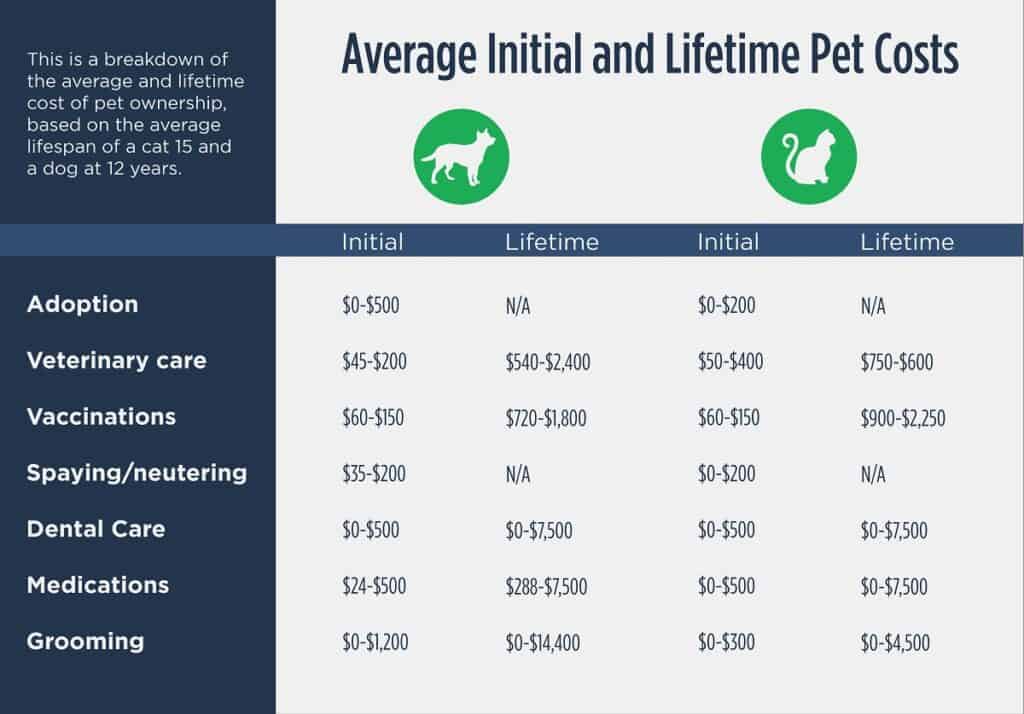

The cost of pet insurance can vary significantly depending on several factors, including the type of pet, age, breed, and location. In this section, we’ll provide a detailed analysis of the average cost of pet insurance, including monthly and annual premiums for different types of pets.

On average, the monthly premium for a pet insurance policy can range from $20 to $100 or more, depending on the level of coverage and the type of pet. For example, a basic accident-only policy for a dog may cost around $20 per month, while a comprehensive policy that covers accidents, illnesses, and wellness care may cost $50 to $100 per month or more.

Here’s a breakdown of the average monthly and annual premiums for different types of pets:

- Dogs:

- Basic accident-only policy: $20-$30 per month, $240-$360 per year

- Comprehensive policy: $50-$100 per month, $600-$1,200 per year

- Cats:

- Basic accident-only policy: $15-$25 per month, $180-$300 per year

- Comprehensive policy: $30-$70 per month, $360-$840 per year

- Exotic animals (e.g., birds, reptiles, small mammals):

- Basic accident-only policy: $10-$20 per month, $120-$240 per year

- Comprehensive policy: $20-$50 per month, $240-$600 per year

It’s essential to note that these are just general estimates, and the actual cost of pet insurance can vary significantly depending on several factors, including the pet’s age, breed, health, and location. Additionally, some pet insurance providers may offer discounts for multi-pet households, military personnel, or students, which can help reduce the cost of premiums.

When researching pet insurance policies, it’s crucial to consider the level of coverage, deductibles, and copays, as well as the reputation and financial stability of the insurance provider. By doing your research and selecting the right policy, you can ensure that your pet receives the best possible care without breaking the bank.

So, how much is pet insurance? The answer depends on several factors, but by understanding the average costs and what’s included in a typical policy, you can make informed decisions and find the best fit for your pet and budget.

What’s Included in a Typical Pet Insurance Policy?

A typical pet insurance policy includes a range of features and benefits designed to provide financial protection and peace of mind for pet owners. While policies can vary depending on the provider and level of coverage, here are some common features and benefits you can expect to find in a standard pet insurance policy:

Accident and Illness Coverage: This is the most basic level of coverage, which provides reimbursement for veterinary expenses related to accidents or illnesses. This can include coverage for injuries, infections, and diseases.

Wellness Care: Many pet insurance policies include wellness care coverage, which provides reimbursement for routine care such as vaccinations, dental cleanings, and check-ups. This can help prevent illnesses and reduce veterinary costs in the long run.

Prescription Medication Coverage: If your pet requires prescription medication, a pet insurance policy can help cover the costs. This can include coverage for medications related to chronic conditions, such as arthritis or allergies.

Surgical Coverage: If your pet requires surgery, a pet insurance policy can help cover the costs. This can include coverage for emergency surgeries, as well as elective procedures such as spaying or neutering.

Diagnostic Testing: Pet insurance policies often include coverage for diagnostic testing, such as X-rays, MRIs, and blood work. This can help diagnose and treat illnesses and injuries.

Alternative Therapies: Some pet insurance policies include coverage for alternative therapies, such as acupuncture, chiropractic care, and physical therapy. This can help provide additional treatment options for pets with chronic conditions.

Reimbursement Rates: Pet insurance policies typically have reimbursement rates, which determine how much of the veterinary bill will be covered. Reimbursement rates can vary depending on the policy and provider, but common rates include 70%, 80%, and 90%.

Deductibles and Copays: Pet insurance policies often have deductibles and copays, which can affect the overall cost of the policy. Deductibles are the amount you pay out-of-pocket before the insurance kicks in, while copays are the percentage of the veterinary bill you pay after the deductible.

Pre-existing Conditions: Pet insurance policies often have exclusions for pre-existing conditions, which are health issues that existed before the policy was purchased. However, some policies may offer coverage for pre-existing conditions after a certain period of time.

By understanding what’s included in a typical pet insurance policy, you can make informed decisions and choose a policy that provides the right level of coverage for your pet. Remember to always read the fine print and ask questions before purchasing a policy.

How to Get the Best Value from Your Pet Insurance Policy

While pet insurance can provide financial protection and peace of mind, it’s essential to maximize the value of your policy to get the most out of your investment. Here are some tips to help you get the best value from your pet insurance policy:

Take Advantage of Preventive Care: Many pet insurance policies include coverage for preventive care, such as vaccinations, dental cleanings, and check-ups. By taking advantage of these services, you can help prevent illnesses and reduce veterinary costs in the long run.

Understand Policy Exclusions: It’s essential to understand what’s excluded from your pet insurance policy, including pre-existing conditions, genetic disorders, and certain breeds. By knowing what’s excluded, you can avoid unexpected veterinary expenses and make informed decisions about your pet’s care.

File Claims Efficiently: If you need to file a claim, make sure to do so efficiently to minimize delays and maximize reimbursement. Keep detailed records of your pet’s veterinary expenses, and submit claims promptly to ensure timely reimbursement.

Choose a Policy with a High Reimbursement Rate: Reimbursement rates can vary significantly depending on the policy and provider. Choose a policy with a high reimbursement rate to maximize the value of your investment.

Consider a Policy with a Low Deductible: Deductibles can impact the overall cost of your pet insurance policy. Consider a policy with a low deductible to minimize out-of-pocket expenses and maximize reimbursement.

Take Advantage of Wellness Programs: Many pet insurance providers offer wellness programs that provide discounts on preventive care services, such as vaccinations and dental cleanings. By taking advantage of these programs, you can help prevent illnesses and reduce veterinary costs.

Monitor Policy Changes: Pet insurance policies can change over time, including changes to coverage, deductibles, and reimbursement rates. Monitor policy changes to ensure you’re getting the best value from your investment.

By following these tips, you can maximize the value of your pet insurance policy and ensure you’re getting the best possible care for your pet. Remember, pet insurance is an investment in your pet’s health and well-being, and by choosing the right policy and taking advantage of its features, you can provide your pet with the best possible care.

When considering how much is pet insurance, it’s essential to factor in the value of the policy and the benefits it provides. By choosing a policy that meets your needs and budget, you can ensure your pet receives the best possible care without breaking the bank.

Pet Insurance Discounts and Promotions: What You Need to Know

Pet insurance providers offer various discounts and promotions to help pet owners save money on their premiums. Understanding these discounts can help you get the best value from your pet insurance policy. Here are some common discounts and promotions to look out for:

Multi-pet discounts: If you have multiple pets, you may be eligible for a discount on your premiums. This can range from 5% to 15% off your total premium, depending on the provider.

Military discounts: Some pet insurance providers offer discounts to military personnel and their families. These discounts can range from 5% to 10% off your premiums.

Student discounts: Students with a valid student ID may be eligible for discounts on their pet insurance premiums.

Senior discounts: Some providers offer discounts to seniors, typically defined as individuals 65 years or older.

Promotional codes: Keep an eye out for promotional codes and coupons that can be used to get discounts on your pet insurance premiums. These codes can be found on the provider’s website, social media, or through email marketing campaigns.

Loyalty discounts: Some providers offer loyalty discounts to customers who have been with them for a certain period. This can be a great way to save money on your premiums over time.

Bundling discounts: If you have other insurance policies with the same provider, such as home or auto insurance, you may be eligible for a bundling discount on your pet insurance premiums.

It’s essential to note that not all providers offer these discounts, and the terms and conditions may vary. Be sure to ask about available discounts when shopping for pet insurance or renewing your policy. By taking advantage of these discounts, you can save money on your premiums and get the best value from your pet insurance policy.

When shopping for pet insurance, it’s crucial to consider the cost of premiums and the discounts available. The average cost of pet insurance can vary depending on several factors, including the type of pet, age, breed, and health conditions. On average, pet insurance premiums can range from $20 to $100 per month, depending on the level of coverage and the provider. By understanding the discounts and promotions available, you can make an informed decision and find a policy that fits your budget and meets your pet’s needs.

Real-Life Examples of Pet Insurance Costs: Case Studies

To help illustrate the costs and benefits

Real-Life Examples of Pet Insurance Costs: Case Studies

To help illustrate the costs and benefits of pet insurance, let’s take a look at some real-life examples of pet owners who have saved money or received reimbursement for veterinary expenses.

Case Study 1: Max, the Golden Retriever

Max’s owner, Sarah, purchased a pet insurance policy for her 3-year-old Golden Retriever. The policy had a monthly premium of $50 and a deductible of $250. One day, Max injured his leg while playing fetch, and Sarah took him to the vet for treatment. The total cost of the vet bill was $1,200. Thanks to her pet insurance policy, Sarah was reimbursed $950, which helped her cover the majority of the cost.

Case Study 2: Whiskers, the Cat

Whiskers’ owner, John, had a pet insurance policy with a monthly premium of $30 and a deductible of $100. When Whiskers developed a urinary tract infection, John took her to the vet for treatment. The total cost of the vet bill was $800. John’s pet insurance policy covered $700 of the cost, leaving him to pay only $100 out of pocket.

Case Study 3: Bella, the Labrador Mix

Bella’s owner, Emily, purchased a pet insurance policy with a monthly premium of $40 and a deductible of $200. When Bella was diagnosed with hip dysplasia, Emily was faced with a costly surgery bill of $2,500. Thanks to her pet insurance policy, Emily was reimbursed $2,000, which helped her cover the majority of the cost.

These case studies demonstrate how pet insurance can help pet owners save money on veterinary expenses. By understanding how much is pet insurance and what it covers, pet owners can make informed decisions about their pet’s health and well-being.

In each of these cases, the pet owners were able to receive reimbursement for a significant portion of their veterinary expenses, thanks to their pet insurance policies. This highlights the importance of having pet insurance in place to help cover unexpected veterinary costs.

When considering pet insurance, it’s essential to think about the potential costs of veterinary care and how a policy can help mitigate those costs. By doing so, pet owners can ensure that their furry friends receive the best possible care, without breaking the bank.