What Affects the Cost of Car Insurance?

When it comes to determining the cost of car insurance, several factors come into play. Understanding these factors can help you navigate the complex world of car insurance and make informed decisions about your coverage. The average cost of car insurance varies significantly depending on a range of variables, including age, driving history, location, and type of vehicle.

Age is a significant factor in determining car insurance premiums. Young drivers, typically those under the age of 25, are considered high-risk drivers and are often charged higher premiums. This is because statistics show that young drivers are more likely to be involved in accidents. On the other hand, older drivers, typically those over the age of 50, are considered lower-risk drivers and may be eligible for lower premiums.

Driving history is another crucial factor in determining car insurance premiums. Drivers with a clean driving record, free from accidents and traffic violations, are typically charged lower premiums. Conversely, drivers with a history of accidents or traffic violations may be charged higher premiums. The severity of the accidents or violations can also impact the premium amount.

Location also plays a significant role in determining car insurance premiums. Drivers living in urban areas, where the risk of accidents and theft is higher, may be charged higher premiums. In contrast, drivers living in rural areas, where the risk of accidents and theft is lower, may be charged lower premiums.

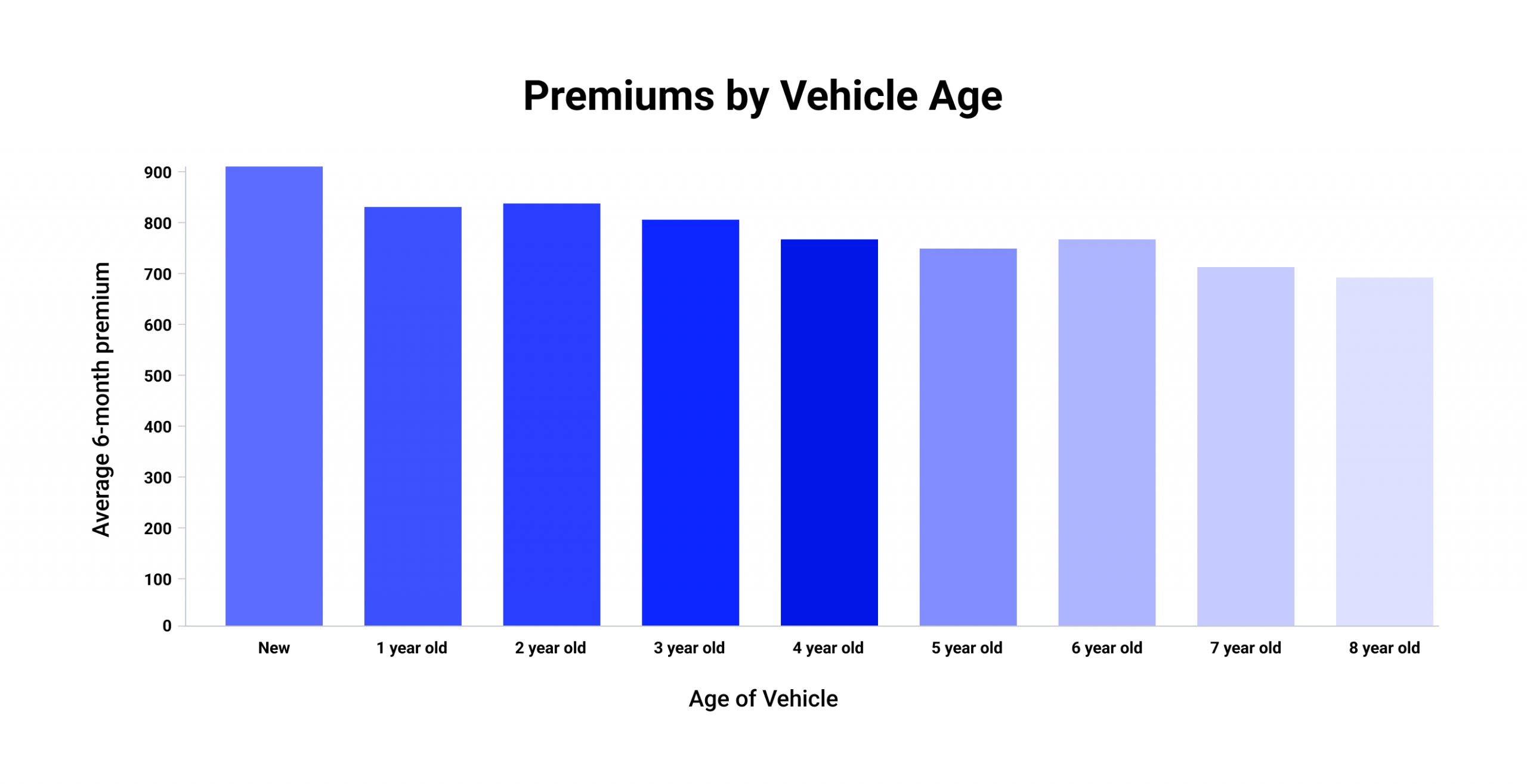

The type of vehicle you drive can also impact your car insurance premiums. Luxury vehicles, high-performance vehicles, and vehicles with advanced safety features may be more expensive to insure. On the other hand, economy vehicles and vehicles with basic safety features may be less expensive to insure.

Other factors, such as credit score, annual mileage, and coverage limits, can also influence the cost of car insurance. By understanding these factors and how they impact your premiums, you can make informed decisions about your car insurance coverage and potentially lower your costs.

How to Get the Best Car Insurance Rates

Securing the best car insurance rates requires a combination of research, comparison, and strategic planning. By following these tips, you can find affordable car insurance that meets your needs and budget.

Shopping around is one of the most effective ways to find the best car insurance rates. Compare rates from multiple insurance companies, including well-established providers and newer entrants in the market. Consider factors such as coverage limits, deductibles, and discounts when evaluating different policies.

Bundling policies is another way to secure better car insurance rates. Many insurance companies offer discounts for bundling multiple policies, such as home and auto insurance. This can help you save money on your overall insurance costs.

Taking advantage of discounts is also crucial for securing the best car insurance rates. Many insurance companies offer discounts for things like good grades, low mileage, and safety features. Be sure to ask about available discounts when shopping for car insurance.

Some popular car insurance companies that offer competitive rates include Geico, Progressive, and State Farm. These companies often offer a range of discounts and promotions that can help you save money on your car insurance.

For example, Geico offers a discount for drivers who have a clean driving record and a good credit score. Progressive offers a discount for drivers who bundle multiple policies, such as home and auto insurance. State Farm offers a discount for drivers who complete a defensive driving course.

When shopping for car insurance, be sure to read reviews and check ratings from reputable sources like the Better Business Bureau and J.D. Power. This can help you get a sense of an insurance company’s reputation and customer satisfaction.

Ultimately, finding the best car insurance rates requires patience, research, and comparison. By following these tips and staying informed, you can find affordable car insurance that meets your needs and budget.

The Average Cost of Car Insurance: A State-by-State Breakdown

The cost of car insurance varies significantly from state to state. According to data from the National Association of Insurance Commissioners (NAIC), the average cost of car insurance in the United States is around $1,300 per year. However, this number can range from as low as $900 in some states to over $2,000 in others.

Some of the most expensive states for car insurance include Michigan, Louisiana, and New York. In these states, the average cost of car insurance can range from $2,000 to over $3,000 per year. This is due to a variety of factors, including high population density, high crime rates, and strict insurance regulations.

On the other hand, some of the most affordable states for car insurance include Iowa, Nebraska, and Kansas. In these states, the average cost of car insurance can range from $900 to $1,200 per year. This is due to factors such as low population density, low crime rates, and more relaxed insurance regulations.

Here is a breakdown of the average cost of car insurance in different states, based on data from the NAIC:

Most Expensive States:

- Michigan: $2,394 per year

- Louisiana: $2,339 per year

- New York: $2,283 per year

- California: $2,188 per year

- New Jersey: $2,144 per year

Most Affordable States:

- Iowa: $942 per year

- Nebraska: $1,014 per year

- Kansas: $1,043 per year

- Oklahoma: $1,072 per year

- Arkansas: $1,083 per year

It’s worth noting that these numbers are just averages, and the actual cost of car insurance can vary significantly depending on a variety of factors, including the driver’s age, driving history, and type of vehicle.

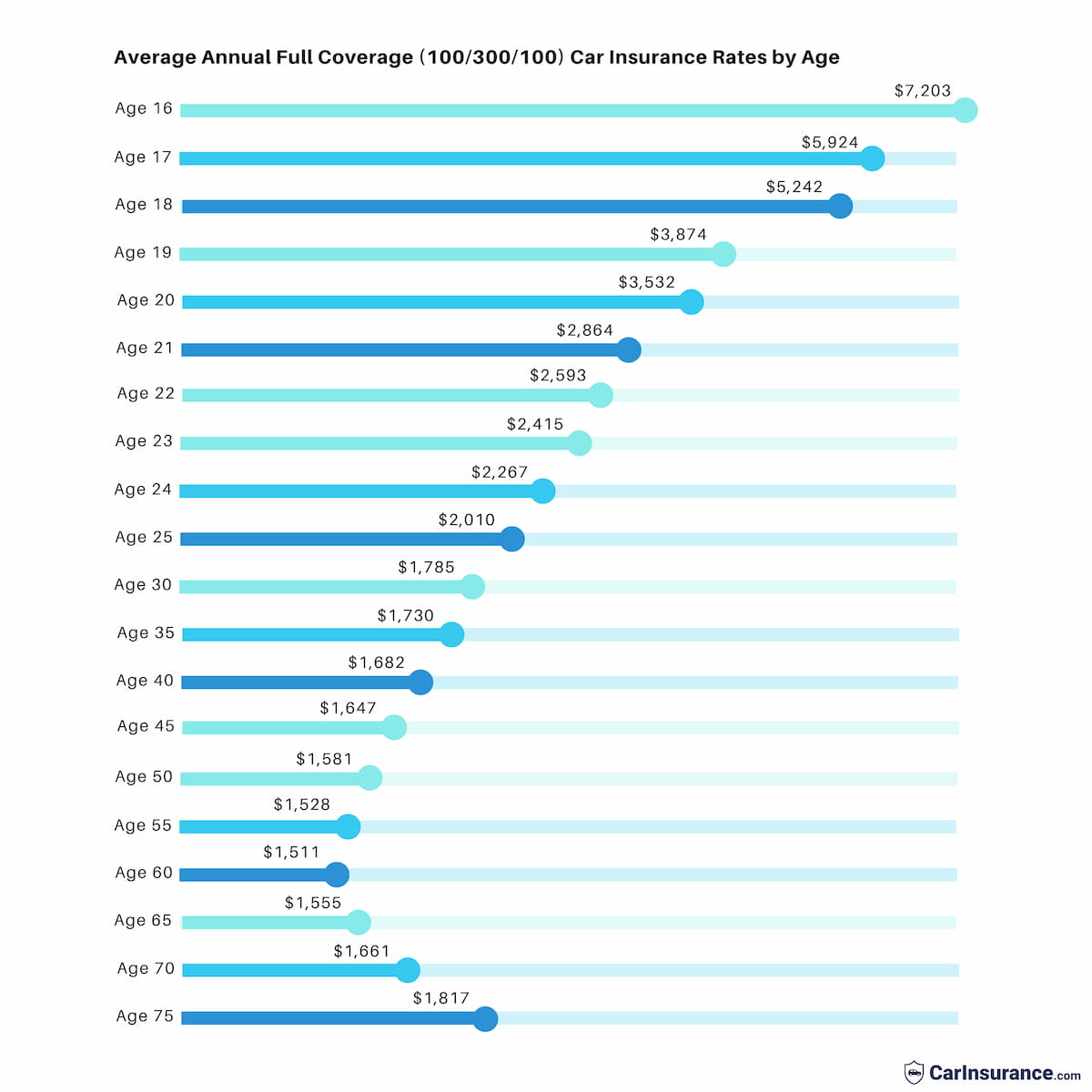

Car Insurance Premiums by Age Group

Car insurance premiums can vary significantly depending on the age group of the driver. Young drivers, typically those under the age of 25, are considered high-risk drivers and are often charged higher premiums. This is because young drivers are more likely to be involved in accidents and have less driving experience.

According to data from the Insurance Institute for Highway Safety (IIHS), the average car insurance premium for a 20-year-old driver is around $2,500 per year. This is compared to an average premium of around $1,200 per year for a 40-year-old driver.

Middle-aged drivers, typically those between the ages of 40 and 60, are considered to be in a lower-risk category. They have more driving experience and are less likely to be involved in accidents. As a result, their car insurance premiums are often lower, with an average premium of around $1,000 per year.

Seniors, typically those over the age of 65, are also considered to be in a lower-risk category. However, their car insurance premiums can be higher due to factors such as declining health and reduced reaction time. According to data from the IIHS, the average car insurance premium for a 70-year-old driver is around $1,500 per year.

It’s worth noting that these are just general trends, and car insurance premiums can vary significantly depending on a variety of factors, including driving history, location, and type of vehicle.

To mitigate the costs of car insurance, young drivers can consider taking a defensive driving course or installing safety features in their vehicle. Middle-aged drivers can consider shopping around for car insurance quotes or bundling their policies with other types of insurance. Seniors can consider taking a mature driver course or installing safety features in their vehicle.

Ultimately, the key to finding affordable car insurance is to shop around, compare rates, and take advantage of discounts. By doing so, drivers of all ages can find car insurance that meets their needs and budget.

How Credit Score Impacts Car Insurance Rates

Credit score is a significant factor in determining car insurance rates. Insurance companies use credit scores to assess the risk of insuring a driver. A poor credit score can increase car insurance premiums, while a good credit score can lead to lower rates.

According to a study by the Insurance Information Institute (III), drivers with poor credit scores (below 600) pay an average of 20% more for car insurance than drivers with good credit scores (above 700). This is because insurance companies view drivers with poor credit scores as higher-risk drivers.

There are several reasons why credit score impacts car insurance rates. One reason is that drivers with poor credit scores are more likely to file claims. According to the III, drivers with poor credit scores are 40% more likely to file a claim than drivers with good credit scores.

Another reason is that credit score is a reflection of a driver’s financial responsibility. Insurance companies view drivers with good credit scores as more responsible and less likely to default on payments.

So, how can you improve your credit score to lower your car insurance rates? Here are some tips:

- Check your credit report for errors and dispute any inaccuracies.

- Pay your bills on time and make regular payments.

- Keep your credit utilization ratio low (below 30%).

- Avoid applying for multiple credit cards or loans in a short period.

- Monitor your credit score regularly and adjust your habits accordingly.

By improving your credit score, you can lower your car insurance rates and save money on your premiums. Remember, a good credit score is not only important for car insurance, but also for other financial aspects of your life.

Car Insurance Discounts: What You Need to Know

Car insurance discounts can help you save money on your premiums. There are several types of discounts available, and understanding how they work can help you take advantage of them.

Multi-car discounts are one of the most common types of discounts. If you have multiple cars in your household, you may be eligible for a discount on your premiums. This is because insurance companies view households with multiple cars as lower-risk.

Low-mileage discounts are another type of discount. If you drive fewer than a certain number of miles per year (usually around 7,500), you may be eligible for a discount. This is because insurance companies view drivers who drive fewer miles as lower-risk.

Good student discounts are also available. If you are a student with good grades (usually a B average or higher), you may be eligible for a discount. This is because insurance companies view students with good grades as more responsible and lower-risk.

Other types of discounts include:

- Defensive driving course discounts: If you take a defensive driving course, you may be eligible for a discount.

- Anti-theft device discounts: If you have an anti-theft device installed in your car, you may be eligible for a discount.

- Bundle discounts: If you bundle your car insurance with other types of insurance (such as home or life insurance), you may be eligible for a discount.

To qualify for these discounts, you will typically need to meet certain requirements. For example, to qualify for a good student discount, you will need to provide proof of your grades. To qualify for a multi-car discount, you will need to have multiple cars in your household.

It’s worth noting that not all insurance companies offer the same discounts, and the amount of the discount can vary. Be sure to shop around and compare rates to find the best discounts for your situation.

By taking advantage of car insurance discounts, you can save money on your premiums and get the coverage you need at a price you can afford.

Real-Life Examples of Car Insurance Costs

To illustrate how the factors discussed earlier impact car insurance premiums, let’s consider some real-life examples.

Example 1: A 25-year-old driver with a clean driving record and a good credit score, living in California and driving a Toyota Camry. According to data from the National Association of Insurance Commissioners, the average annual premium for this driver would be around $1,400.

Example 2: A 40-year-old driver with a few traffic tickets and a poor credit score, living in New York and driving a Ford F-150. According to data from the National Association of Insurance Commissioners, the average annual premium for this driver would be around $2,500.

Example 3: A 60-year-old driver with a clean driving record and a good credit score, living in Florida and driving a Honda Civic. According to data from the National Association of Insurance Commissioners, the average annual premium for this driver would be around $1,200.

These examples illustrate how different factors, such as age, driving history, location, and credit score, can impact car insurance premiums. By understanding these factors and how they impact premiums, drivers can make informed decisions about their car insurance coverage.

For example, the 25-year-old driver in California could consider shopping around for car insurance quotes to find a better rate. The 40-year-old driver in New York could consider improving their credit score to lower their premiums. The 60-year-old driver in Florida could consider taking advantage of discounts, such as a multi-car discount or a good student discount, to lower their premiums.

By taking a proactive approach to car insurance, drivers can save money on their premiums and get the coverage they need at a price they can afford.

Conclusion: Finding Affordable Car Insurance

As we’ve discussed throughout this article, finding affordable car insurance requires a combination of research, comparison, and strategic planning. By understanding the factors that impact car insurance premiums, such as age, driving history, location, and credit score, drivers can make informed decisions about their coverage.

Shopping around for car insurance quotes, bundling policies, and taking advantage of discounts are all effective ways to lower premiums. Additionally, improving credit score, maintaining a clean driving record, and choosing the right type of vehicle can also help to reduce costs.

By following these tips and staying informed, drivers can find affordable car insurance that meets their needs and budget. Remember, the key to finding affordable car insurance is to be proactive and take control of your coverage.

Don’t settle for high premiums or inadequate coverage. Take the time to research and compare car insurance rates, and don’t be afraid to ask questions or seek advice from a licensed insurance professional.

By doing so, you can drive away with confidence, knowing that you have the right coverage at the right price.