Why Financial Literacy Matters for 14-Year-Olds

As a parent, it’s essential to teach your teenager the value of money and the importance of financial literacy. At 14, they’re at an age where they’re starting to develop their own spending habits and making financial decisions that can impact their future. Teaching them how to manage their finances effectively can benefit them in the long run, helping them make informed decisions about money and setting them up for financial stability. One of the most common questions parents ask is “how much money should a 14 year old have” in terms of allowance. While there’s no one-size-fits-all answer, it’s crucial to consider their age, responsibilities, and expenses when determining a fair amount.

Financial literacy is a vital life skill that can help your teenager navigate the complexities of personal finance, including saving, budgeting, and responsible spending. By teaching them how to manage their money effectively, you can help them develop healthy financial habits that will serve them well into adulthood. Moreover, financial literacy can also help them make informed decisions about education, career, and other life choices that can impact their financial future.

Research has shown that teenagers who receive financial education are more likely to make smart financial decisions, have better money management skills, and are less likely to accumulate debt. Furthermore, financial literacy can also help them develop a sense of financial responsibility, which is critical for achieving long-term financial stability. As a parent, it’s essential to take an active role in teaching your teenager about personal finance and helping them develop the skills they need to succeed.

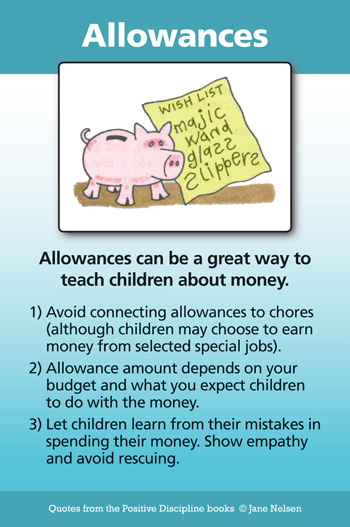

So, how can you start teaching your teenager about financial literacy? Begin by having open and honest conversations about money, including discussions about budgeting, saving, and responsible spending. You can also encourage them to take ownership of their finances by giving them a allowance or encouraging them to earn their own money through part-time jobs or entrepreneurship. By taking a proactive approach to teaching financial literacy, you can help your teenager develop the skills they need to achieve financial stability and success.

How to Determine a Fair Allowance for Your Teen

Determining a fair allowance for your 14-year-old can be a challenging task, especially when considering the question of “how much money should a 14 year old have.” The key is to find a balance between teaching your teen the value of money and providing them with enough financial freedom to make their own decisions. To start, consider your teen’s age, responsibilities, and expenses. For example, if your teen is responsible for paying for their own extracurricular activities or saving for college, they may require a higher allowance.

Another factor to consider is the cost of living in your area. If you live in a city with a high cost of living, your teen may require a higher allowance to cover basic expenses such as transportation, food, and entertainment. On the other hand, if you live in a rural area with a lower cost of living, your teen may require a lower allowance.

It’s also essential to set clear expectations and boundaries when it comes to your teen’s allowance. For example, you may want to consider setting a budget for specific expenses such as clothing, entertainment, and savings. This will help your teen understand the value of money and make smart financial decisions.

When determining a fair allowance, it’s also important to consider the frequency of payments. Some parents prefer to give their teens a weekly allowance, while others prefer to give a monthly allowance. The key is to find a frequency that works for your teen and your family’s financial situation.

Ultimately, the goal of giving your teen an allowance is to teach them the value of money and help them develop good financial habits. By considering your teen’s age, responsibilities, expenses, and the cost of living in your area, you can determine a fair allowance that will help them achieve financial stability and success.

As a general rule of thumb, many experts recommend giving teens an allowance of $10 to $20 per week, depending on their age and responsibilities. However, this is just a rough estimate, and the right allowance for your teen will depend on your family’s unique financial situation and values.

The Pros and Cons of Giving Your Teen a Weekly or Monthly Allowance

When it comes to giving your teen an allowance, one of the most common questions parents ask is whether to give a weekly or monthly allowance. Both options have their pros and cons, and the right choice for your family will depend on your teen’s individual needs and financial goals.

Weekly allowances can be beneficial for teens who need to learn how to budget and manage their money on a regular basis. By giving them a set amount of money each week, you can help them develop a sense of financial responsibility and teach them how to prioritize their spending. Additionally, weekly allowances can help teens learn how to make smart financial decisions, such as saving for short-term goals or avoiding impulse purchases.

On the other hand, monthly allowances can provide teens with a sense of financial freedom and flexibility. By giving them a larger sum of money at the beginning of each month, you can encourage them to take ownership of their finances and make smart decisions about how to allocate their funds. Monthly allowances can also help teens learn how to budget and plan for longer-term goals, such as saving for college or a car.

However, there are also some potential drawbacks to consider when giving your teen a weekly or monthly allowance. For example, if you give your teen too much money, they may be tempted to spend it all at once, rather than saving for the future. On the other hand, if you give them too little money, they may feel frustrated or restricted, which can lead to negative attitudes towards money.

Ultimately, the decision to give your teen a weekly or monthly allowance will depend on their individual needs and financial goals. By considering their age, responsibilities, and expenses, you can determine the best approach for teaching them how to manage their money effectively. When determining “how much money should a 14 year old have,” it’s essential to consider their financial maturity and ability to make smart decisions about their money.

It’s also important to remember that an allowance is not just about giving your teen money, but also about teaching them the value of money and how to manage it effectively. By providing guidance and support, you can help your teen develop good financial habits that will serve them well throughout their lives.

Encouraging Your Teen to Earn Their Own Money

Encouraging your teen to earn their own money can be a valuable way to teach them the value of hard work and financial responsibility. By earning their own money, teens can develop a sense of independence and self-reliance, and learn how to manage their finances effectively.

There are many ways for teens to earn their own money, including part-time jobs, entrepreneurship, and freelancing. Part-time jobs can provide teens with a steady income and valuable work experience, while entrepreneurship and freelancing can allow them to pursue their passions and interests.

When encouraging your teen to earn their own money, it’s essential to provide guidance and support. This can include helping them find job opportunities, teaching them how to create a budget and manage their finances, and encouraging them to save for long-term goals.

One of the most significant benefits of encouraging your teen to earn their own money is that it can help them develop a sense of financial responsibility. By earning their own money, teens can learn how to prioritize their spending, save for the future, and make smart financial decisions.

When determining “how much money should a 14 year old have,” it’s essential to consider their earning potential and financial goals. By encouraging your teen to earn their own money, you can help them develop a sense of financial independence and responsibility, and set them up for long-term financial success.

In addition to providing financial benefits, encouraging your teen to earn their own money can also have a positive impact on their self-esteem and confidence. By earning their own money, teens can develop a sense of pride and accomplishment, and learn how to take ownership of their financial decisions.

Ultimately, encouraging your teen to earn their own money is an essential part of teaching them financial literacy and responsibility. By providing guidance and support, you can help your teen develop the skills they need to succeed financially and set them up for long-term financial stability.

Teaching Your Teen to Budget and Save

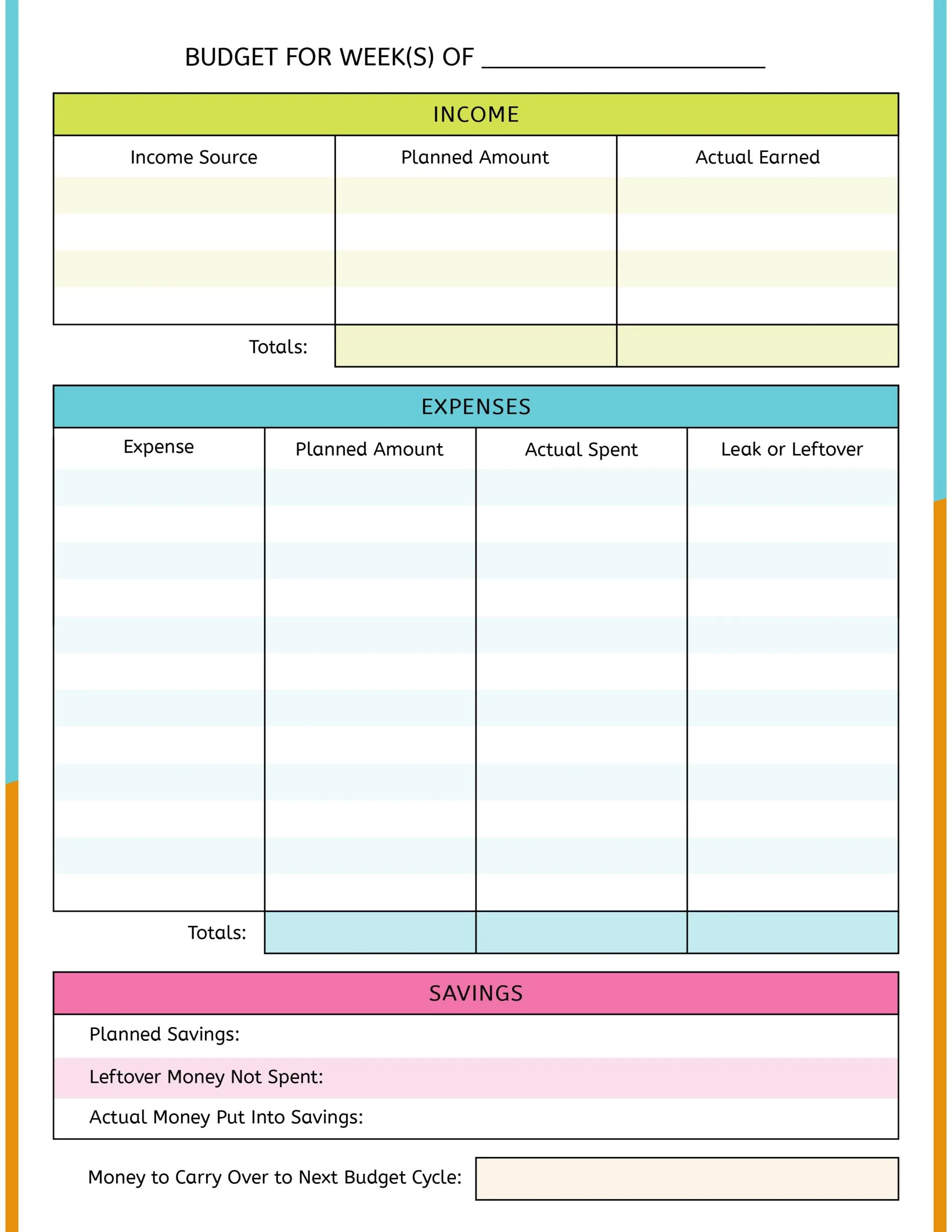

Teaching your teen to budget and save is an essential part of their financial education. By learning how to prioritize needs over wants, create a budget plan, and set financial goals, your teen can develop good financial habits that will serve them well throughout their lives.

One of the most effective ways to teach your teen to budget and save is to use the 50/30/20 rule. This rule suggests that 50% of their income should go towards necessary expenses such as rent, utilities, and food, 30% towards discretionary spending such as entertainment and hobbies, and 20% towards saving and debt repayment.

Another important aspect of teaching your teen to budget and save is to help them understand the difference between needs and wants. Needs are essential expenses that are necessary for survival, such as food and shelter, while wants are discretionary expenses that are not essential, such as entertainment and hobbies.

When determining “how much money should a 14 year old have,” it’s essential to consider their financial goals and priorities. By teaching your teen to budget and save, you can help them develop a sense of financial responsibility and set them up for long-term financial success.

In addition to teaching your teen to budget and save, it’s also essential to encourage them to set financial goals. This can include short-term goals such as saving for a car or college, as well as long-term goals such as retirement and wealth accumulation.

By teaching your teen to budget and save, you can help them develop good financial habits that will serve them well throughout their lives. Remember to provide guidance and support, and encourage them to take ownership of their financial decisions.

Ultimately, teaching your teen to budget and save is an investment in their financial future. By providing them with the skills and knowledge they need to manage their finances effectively, you can help them achieve financial stability and success.

How to Monitor and Adjust Your Teen’s Allowance as Needed

Monitoring and adjusting your teen’s allowance as needed is an essential part of teaching them financial responsibility. By regularly reviewing their spending habits and financial goals, you can help them stay on track and make adjustments to their allowance accordingly.

One way to monitor your teen’s allowance is to use a budgeting app or spreadsheet to track their income and expenses. This can help you identify areas where they may be overspending or undersaving, and make adjustments to their allowance accordingly.

Another way to monitor your teen’s allowance is to have regular conversations with them about their financial goals and spending habits. This can help you understand their financial priorities and make adjustments to their allowance to support their goals.

When determining “how much money should a 14 year old have,” it’s essential to consider their financial responsibility and ability to manage their allowance. By regularly monitoring and adjusting their allowance, you can help them develop good financial habits and achieve their financial goals.

In addition to monitoring and adjusting your teen’s allowance, it’s also essential to provide them with guidance and support. This can include teaching them how to budget and save, and providing them with resources and tools to help them manage their finances effectively.

By regularly monitoring and adjusting your teen’s allowance, you can help them develop financial responsibility and achieve their financial goals. Remember to provide guidance and support, and encourage them to take ownership of their financial decisions.

Ultimately, monitoring and adjusting your teen’s allowance is an ongoing process that requires regular attention and effort. By staying involved and engaged, you can help your teen develop good financial habits and achieve financial stability and success.

Real-Life Examples of Teen Allowances: What Works and What Doesn’t

When it comes to determining “how much money should a 14 year old have,” there is no one-size-fits-all answer. Every family is different, and what works for one family may not work for another. However, by looking at real-life examples of teen allowances, we can gain a better understanding of what works and what doesn’t.

For example, one family may choose to give their 14-year-old a weekly allowance of $20, while another family may choose to give their teen a monthly allowance of $100. Both approaches can be effective, depending on the individual needs and financial goals of the teen.

Another example is a family that chooses to pay their teen for completing chores and tasks around the house. This approach can help teach the teen the value of hard work and responsibility, and can also provide them with a sense of financial independence.

On the other hand, some families may choose to give their teen a lump sum of money at the beginning of each month, and let them manage it themselves. This approach can help teach the teen how to budget and make financial decisions, but can also lead to overspending and financial irresponsibility if not managed properly.

Ultimately, the key to determining a fair and effective allowance for your teen is to consider their individual needs and financial goals. By taking the time to understand their financial situation and goals, you can create an allowance system that works for them and helps them develop good financial habits.

By looking at real-life examples of teen allowances, we can gain a better understanding of what works and what doesn’t. By considering the individual needs and financial goals of our teens, we can create an allowance system that helps them develop good financial habits and sets them up for long-term financial success.

Some successful examples of teen allowances include:

- Paying teens for completing chores and tasks around the house

- Providing a weekly or monthly allowance based on the teen’s financial needs and goals

- Encouraging teens to earn their own money through part-time jobs or entrepreneurship

- Teaching teens how to budget and make financial decisions

By following these examples and considering the individual needs and financial goals of our teens, we can create an allowance system that helps them develop good financial habits and sets them up for long-term financial success.

Raising Financially Responsible Teens: A Long-Term Investment

Teaching financial literacy and responsibility to teens is a long-term investment in their future. By providing them with the skills and knowledge they need to manage their finances effectively, parents can help their teens develop good financial habits that will serve them well throughout their lives.

One of the most important things parents can do to raise financially responsible teens is to lead by example. By modeling good financial behavior themselves, parents can show their teens the importance of responsible money management and encourage them to follow suit.

Another key aspect of raising financially responsible teens is to provide them with hands-on experience managing money. This can include giving them a allowance, encouraging them to earn their own money through part-time jobs or entrepreneurship, and teaching them how to budget and save.

When determining “how much money should a 14 year old have,” it’s essential to consider their individual needs and financial goals. By providing them with a fair and reasonable allowance, parents can help their teens develop a sense of financial responsibility and independence.

In addition to providing financial support, parents can also play a critical role in teaching their teens about financial literacy. This can include discussing topics such as saving, budgeting, and investing, and providing them with resources and tools to help them make informed financial decisions.

By investing time and effort into teaching financial literacy and responsibility to their teens, parents can help them develop the skills and knowledge they need to succeed financially in the long run. This can include achieving financial independence, building wealth, and making smart financial decisions.

Ultimately, raising financially responsible teens requires a long-term commitment to teaching and guiding them. By providing them with the skills and knowledge they need to manage their finances effectively, parents can help their teens develop good financial habits that will serve them well throughout their lives.