Understanding the Importance of Emergency Savings

Having a cushion of savings to fall back on in case of unexpected expenses or financial setbacks is crucial for maintaining financial stability. This safety net can provide peace of mind and reduce stress, allowing individuals to focus on their financial goals without worrying about the unexpected. When considering how much savings you should have, it’s essential to think about the importance of emergency savings in your overall financial plan.

Emergency savings can help cover unexpected expenses, such as car repairs, medical bills, or losing a job. Without a safety net, individuals may be forced to go into debt or make difficult financial decisions, which can have long-term consequences. By having a cushion of savings, individuals can avoid these financial pitfalls and maintain their financial stability.

In addition to providing peace of mind, emergency savings can also help individuals achieve their long-term financial goals. By having a safety net in place, individuals can take calculated risks and make investments that may have higher returns, but also come with higher risks. This can help individuals build wealth over time and achieve their financial goals.

When determining how much savings you should have, it’s essential to consider your individual financial situation and goals. This includes thinking about your income, expenses, debt, and financial obligations. By taking a comprehensive approach to your finances, you can determine the right amount of savings for your emergency fund and achieve financial stability.

So, how much savings should you have in your emergency fund? A general rule of thumb is to have three to six months’ worth of living expenses set aside. However, this amount may vary depending on your individual circumstances. For example, if you have a stable job and few expenses, you may need less in your emergency fund. On the other hand, if you have a variable income or high expenses, you may need more.

Ultimately, the key is to find a balance between saving for the unexpected and achieving your long-term financial goals. By prioritizing emergency savings and taking a comprehensive approach to your finances, you can achieve financial stability and build wealth over time.

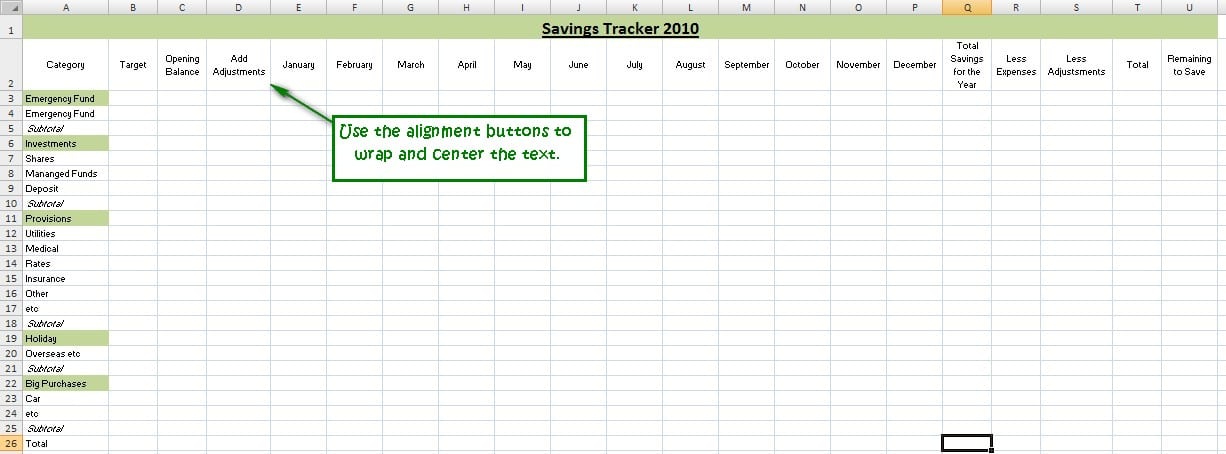

Calculating Your Savings Goals: A Step-by-Step Guide

Calculating how much savings you should aim for can be a daunting task, but it doesn’t have to be. By following a simple, step-by-step process, you can determine a realistic savings goal that aligns with your financial situation and goals.

Step 1: Determine Your Net Income

Start by calculating your net income, which is your take-home pay after taxes and other deductions. This will give you a clear picture of how much money you have available for savings each month.

Step 2: Calculate Your Monthly Expenses

Next, calculate your monthly expenses, including essential expenses such as rent/mortgage, utilities, groceries, and transportation. You should also include non-essential expenses, such as entertainment and hobbies.

Step 3: Determine Your Debt Obligations

If you have any high-interest debt, such as credit card balances, calculate your monthly debt payments. This will help you determine how much you need to allocate towards debt repayment each month.

Step 4: Consider Your Financial Goals

Think about your short-term and long-term financial goals, such as saving for a down payment on a house, retirement, or a big purchase. Determine how much you need to save each month to reach these goals.

Step 5: Calculate Your Savings Rate

Using the 50/30/20 rule as a guideline, allocate 50% of your net income towards essential expenses, 30% towards non-essential expenses, and 20% towards savings and debt repayment.

Step 6: Determine Your Ideal Savings Amount

Based on your calculations, determine how much you should aim to save each month. Consider your financial goals, debt obligations, and expenses to determine a realistic savings goal.

For example, if you determine that you need to save 20% of your net income towards savings and debt repayment, and your net income is $4,000 per month, you would aim to save $800 per month.

By following these steps, you can determine a realistic savings goal that aligns with your financial situation and goals. Remember to review and adjust your savings plan regularly to ensure you’re on track to meet your goals.

Assessing Your Financial Situation: A Reality Check

Before determining how much savings you should aim for, it’s essential to take an honest look at your financial situation. This self-assessment will help you understand your income, expenses, debts, and financial obligations, and determine a realistic savings goal.

Start by gathering all your financial documents, including pay stubs, bank statements, and bills. This will give you a clear picture of your income and expenses. Next, make a list of your debts, including credit card balances, loans, and mortgages. Note the interest rates and minimum payments for each debt.

Now, calculate your net income, which is your take-home pay after taxes and other deductions. This will give you a clear picture of how much money you have available for savings each month.

Next, categorize your expenses into essential and non-essential expenses. Essential expenses include rent/mortgage, utilities, groceries, and transportation. Non-essential expenses include entertainment, hobbies, and travel.

Be honest with yourself about your spending habits. Are there areas where you can cut back on non-essential expenses and allocate more funds towards savings? Consider ways to reduce your expenses, such as canceling subscription services or finding ways to save on groceries.

Now, consider your financial goals. Do you want to save for a down payment on a house, retirement, or a big purchase? Determine how much you need to save each month to reach these goals.

By taking an honest look at your financial situation, you’ll be able to determine a realistic savings goal that aligns with your income, expenses, debts, and financial goals. Remember, this is not a one-time assessment, but rather an ongoing process that requires regular review and adjustment.

When determining how much savings you should have, consider the following questions:

- What are my short-term and long-term financial goals?

- How much do I need to save each month to reach these goals?

- What are my essential and non-essential expenses?

- Are there areas where I can cut back on non-essential expenses and allocate more funds towards savings?

- What is my net income, and how much can I realistically allocate towards savings each month?

By answering these questions and taking an honest look at your financial situation, you’ll be able to determine a realistic savings goal that aligns with your financial situation and goals.

The 50/30/20 Rule: A Simple Savings Framework

The 50/30/20 rule is a simple, widely-used framework for allocating income towards savings, expenses, and debt repayment. This rule can help readers prioritize their savings goals and make the most of their income.

The 50/30/20 rule is based on the idea that 50% of your income should go towards essential expenses, such as rent/mortgage, utilities, groceries, and transportation. 30% should go towards non-essential expenses, such as entertainment, hobbies, and travel. And 20% should go towards savings and debt repayment.

This rule can help readers prioritize their savings goals by allocating a fixed percentage of their income towards savings each month. By doing so, readers can make savings a habit and ensure that they are setting aside enough money for their short-term and long-term financial goals.

For example, if you earn $4,000 per month, you would allocate 50% ($2,000) towards essential expenses, 30% ($1,200) towards non-essential expenses, and 20% ($800) towards savings and debt repayment.

The 50/30/20 rule is not a one-size-fits-all solution, and readers may need to adjust the proportions based on their individual financial situation. However, this rule can provide a useful starting point for readers who are looking to prioritize their savings goals and make the most of their income.

When using the 50/30/20 rule, readers should consider the following tips:

- Be flexible: The 50/30/20 rule is a guideline, not a hard and fast rule. Readers may need to adjust the proportions based on their individual financial situation.

- Prioritize needs over wants: Essential expenses, such as rent/mortgage and utilities, should take priority over non-essential expenses, such as entertainment and hobbies.

- Make savings a habit: By allocating a fixed percentage of income towards savings each month, readers can make savings a habit and ensure that they are setting aside enough money for their short-term and long-term financial goals.

By using the 50/30/20 rule, readers can create a simple and effective savings framework that helps them prioritize their savings goals and make the most of their income.

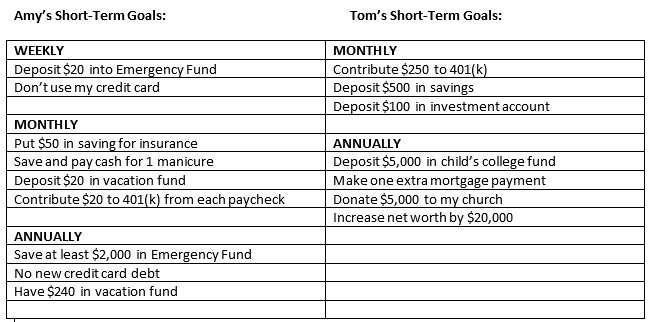

Considering Your Financial Goals: Short-Term and Long-Term

When determining how much to save, it’s essential to consider both short-term and long-term financial goals. Short-term goals may include saving for a down payment on a house, a vacation, or a big purchase. Long-term goals may include saving for retirement, a child’s education, or a major financial milestone.

Short-term goals typically have a shorter time horizon, usually less than five years. These goals require a more aggressive savings strategy to achieve the desired outcome. For example, if you want to save for a down payment on a house, you may need to save a significant amount each month to reach your goal within a shorter time frame.

Long-term goals, on the other hand, have a longer time horizon, typically more than five years. These goals require a more patient approach to savings, as the money has time to grow and compound over time. For example, if you’re saving for retirement, you may be able to contribute a smaller amount each month, but over a longer period, to reach your goal.

When considering your financial goals, ask yourself the following questions:

- What are my short-term financial goals, and how much do I need to save each month to achieve them?

- What are my long-term financial goals, and how much do I need to save each month to achieve them?

- How much time do I have to reach my financial goals, and what’s the best savings strategy to achieve them?

By considering both short-term and long-term financial goals, you can create a comprehensive savings plan that helps you achieve your desired outcomes. Remember to review and adjust your plan regularly to ensure you’re on track to meet your goals.

Some common financial goals to consider include:

- Saving for a down payment on a house

- Saving for a vacation or a big purchase

- Saving for retirement

- Saving for a child’s education

- Saving for a major financial milestone, such as paying off debt or achieving a certain level of wealth

By prioritizing your financial goals and creating a savings plan that aligns with your goals, you can make progress towards achieving financial stability and security.

Automating Your Savings: Making it Easy and Painless

Automating your savings can be a game-changer when it comes to building a safety net. By setting up automatic transfers from your checking account to your savings account, you can make saving easier and less prone to being neglected.

One of the main benefits of automating your savings is that it reduces the likelihood of overspending. When you have to manually transfer money to your savings account, it’s easy to put it off or forget. But with automatic transfers, the money is moved automatically, so you can’t spend it on something else.

Another benefit of automating your savings is that it makes saving a habit. When you set up automatic transfers, you’re committing to saving a certain amount of money each month. This can help you build a consistent savings habit and make progress towards your financial goals.

To automate your savings, follow these steps:

- Set up a separate savings account specifically for your emergency fund or other savings goals.

- Link your checking account to your savings account.

- Set up automatic transfers from your checking account to your savings account.

- Choose a transfer frequency that works for you, such as weekly, biweekly, or monthly.

Some popular ways to automate your savings include:

- Setting up automatic transfers through your bank’s online platform or mobile app.

- Using a savings app that allows you to set up automatic transfers and track your progress.

- Setting up a payroll deduction to transfer a portion of your paycheck directly to your savings account.

By automating your savings, you can make building a safety net easier and less prone to being neglected. Remember to review and adjust your automatic transfers regularly to ensure you’re on track to meet your financial goals.

Automating your savings can also help you avoid common savings pitfalls, such as:

- Forgetting to transfer money to your savings account.

- Spending money on non-essential items instead of saving it.

- Not having enough money in your savings account to cover unexpected expenses.

By making saving easier and less prone to being neglected, automating your savings can help you build a safety net and achieve your financial goals.

Reviewing and Adjusting Your Savings Plan

Regularly reviewing and adjusting your savings plan is crucial to ensure you’re on track to meet your financial goals. By reassessing your savings progress and making adjustments as needed, you can stay motivated and focused on building a safety net.

When reviewing your savings plan, consider the following factors:

- Income changes: Have you experienced a change in income, such as a raise or a job loss?

- Expense changes: Have you experienced a change in expenses, such as a move or a change in family size?

- Debt changes: Have you paid off debt or taken on new debt?

- Financial goal changes: Have your financial goals changed, such as saving for a down payment on a house or retirement?

By considering these factors, you can determine if your savings plan needs to be adjusted. Ask yourself the following questions:

- Am I on track to meet my savings goals?

- Do I need to adjust my savings amount or frequency?

- Are there any changes in my financial situation that require adjustments to my savings plan?

When adjusting your savings plan, consider the following tips:

- Reassess your income and expenses to determine if you can allocate more funds towards savings.

- Consider automating your savings to make it easier and less prone to being neglected.

- Review your financial goals and adjust your savings plan accordingly.

By regularly reviewing and adjusting your savings plan, you can stay on track to meet your financial goals and build a safety net. Remember, saving is a long-term process, and it’s essential to be patient and persistent.

Some common mistakes to avoid when reviewing and adjusting your savings plan include:

- Not regularly reviewing your savings progress.

- Not adjusting your savings plan to reflect changes in your financial situation.

- Not considering all factors that may impact your savings plan.

By avoiding these common mistakes, you can ensure that your savings plan is working effectively and helping you build a safety net.

Staying Motivated: Tips for Maintaining a Savings Mindset

Staying motivated to save can be challenging, but there are several strategies that can help. By incorporating these tips into your savings routine, you can maintain a savings mindset and reach your financial goals.

Celebrate Small Victories

Celebrating small victories can help you stay motivated to save. Set specific savings goals, such as saving a certain amount each month or reaching a specific savings milestone. When you reach these goals, celebrate your success by treating yourself to something special.

Find a Savings Buddy

Having a savings buddy can provide accountability and motivation. Share your savings goals with a trusted friend or family member and ask them to hold you accountable. You can also join a savings group or find an online community of savers to connect with.

Reward Yourself for Reaching Milestones

Rewarding yourself for reaching savings milestones can help you stay motivated. Set specific rewards for reaching certain savings goals, such as a weekend getaway or a new gadget. When you reach these goals, treat yourself to the reward you’ve been working towards.

Make Savings a Habit

Making savings a habit can help you stay motivated. Set up automatic transfers from your checking account to your savings account, and make savings a regular part of your routine. You can also try incorporating savings into your daily routine, such as by setting aside a certain amount each day or week.

Visualize Your Goals

Visualizing your goals can help you stay motivated to save. Create a vision board or write down your savings goals and post them somewhere visible. This can help you stay focused on your goals and motivated to reach them.

Stay Positive and Patient

Staying positive and patient can help you stay motivated to save. Remember that saving is a long-term process, and it may take time to reach your goals. Stay positive and focused on your goals, and celebrate your progress along the way.

By incorporating these tips into your savings routine, you can maintain a savings mindset and reach your financial goals. Remember to stay positive and patient, and celebrate your progress along the way.