Understanding the Benefits of Buying a Small Business

Buying a small business can be a smart alternative to starting from scratch. Not only does it offer lower startup costs, but it also provides an established customer base and potential for quick returns on investment. When considering how to buy small businesses, it’s essential to understand the benefits that come with acquiring an existing entity. For instance, a small business with a proven track record can provide a steady stream of revenue, allowing you to focus on growth and expansion rather than struggling to find your footing.

Moreover, buying a small business can be less risky than starting a new venture. With an existing business, you can review financial statements, assess market demand, and research the competition to get a clear picture of the business’s potential. This information can help you make informed decisions and avoid costly mistakes. Additionally, an established business often comes with a trained staff, established relationships with suppliers, and a functional infrastructure, which can save you time and resources.

Another significant advantage of buying a small business is the potential for quick returns on investment. With a proven business model and existing customer base, you can start generating revenue immediately. This can be particularly appealing to entrepreneurs who want to see a rapid return on their investment. Furthermore, buying a small business can provide a sense of security and stability, as you’re acquiring a business with a established reputation and customer loyalty.

When exploring how to buy small businesses, it’s crucial to consider the long-term potential of the business. Look for a business with a strong foundation, a solid financial record, and a growth potential. With the right mindset and strategy, buying a small business can be a lucrative and rewarding venture. By understanding the benefits of buying a small business, you can make informed decisions and set yourself up for success in the world of entrepreneurship.

Identifying the Right Business for You

When considering how to buy small businesses, finding the right business that aligns with your skills, interests, and financial goals is crucial. A thorough evaluation of potential businesses is essential to ensure a successful acquisition. To start, research the industry and market trends to identify areas with growth potential. Review financial statements, such as balance sheets and income statements, to assess the business’s financial health and potential for returns on investment.

Assessing market demand is also vital in determining the viability of a business. Analyze the competition, target market, and customer base to understand the business’s position in the market. Evaluate the business’s products or services, pricing strategy, and marketing efforts to determine its competitive advantage. Additionally, research the business’s reputation online, including reviews and ratings, to gauge customer satisfaction.

Another critical aspect of evaluating a potential business is assessing the seller’s motivations. Understanding why the seller is looking to sell can provide valuable insights into the business’s potential. Is the seller looking to retire, or is the business facing financial difficulties? Knowing the seller’s motivations can help you negotiate a better price and make informed decisions about the acquisition.

When researching potential businesses, it’s also essential to evaluate the management team and employees. A skilled and dedicated team can be a significant asset to the business, while a poorly managed team can be a liability. Assess the team’s experience, skills, and culture to determine if they align with your vision and goals.

Finally, consider the business’s growth potential and scalability. Can the business be expanded through new markets, products, or services? Are there opportunities for cost savings and efficiency improvements? Evaluating the business’s potential for growth and scalability can help you determine if it’s the right fit for your investment goals.

By taking the time to thoroughly research and evaluate potential businesses, you can increase your chances of success when buying a small business. Remember to stay focused on your goals and priorities, and don’t be afraid to walk away if the business doesn’t meet your criteria.

Assessing the Financial Health of a Business

When considering how to buy small businesses, assessing the financial health of the business is a critical step in the acquisition process. A thorough review of the business’s financial statements can provide valuable insights into its revenue, profitability, cash flow, and debt. By evaluating these key financial metrics, you can determine the business’s potential for growth and returns on investment.

Start by reviewing the business’s income statement, which provides a snapshot of its revenue and expenses over a specific period. Look for trends in revenue growth, gross margin, and operating expenses. A stable or increasing revenue stream, combined with a healthy gross margin, can indicate a profitable business. On the other hand, high operating expenses can erode profitability and impact cash flow.

Next, review the business’s balance sheet, which provides a snapshot of its assets, liabilities, and equity. Look for signs of financial distress, such as high levels of debt, low cash reserves, or a high accounts payable balance. A business with a strong balance sheet, including a healthy cash position and manageable debt, is more likely to be financially stable.

Cash flow is another critical financial metric to evaluate when buying a small business. A business with a strong cash flow can invest in growth initiatives, pay off debt, and weather financial storms. Look for signs of cash flow problems, such as a high accounts receivable balance or a low cash reserve. A business with a weak cash flow may struggle to meet its financial obligations.

Finally, evaluate the business’s debt structure, including the type and amount of debt, interest rates, and repayment terms. A business with high levels of debt, particularly high-interest debt, may struggle to meet its financial obligations. Look for signs of debt distress, such as missed payments or debt restructuring.

By thoroughly reviewing the business’s financial statements and evaluating its key financial metrics, you can gain a comprehensive understanding of its financial health and potential for growth. This information can help you make informed decisions when buying a small business and avoid potential pitfalls.

Remember, assessing the financial health of a business is an ongoing process that requires regular monitoring and evaluation. By staying on top of the business’s financial performance, you can identify areas for improvement and make data-driven decisions to drive growth and profitability.

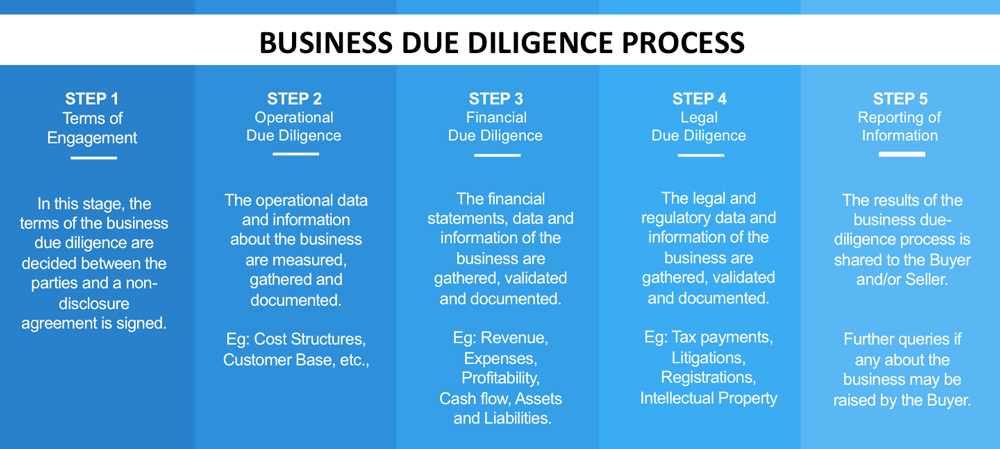

Conducting Due Diligence: A Comprehensive Checklist

When buying a small business, conducting thorough due diligence is crucial to avoid potential pitfalls and ensure a successful acquisition. Due diligence involves investigating various aspects of the business, including its financials, operations, and management. By following a comprehensive checklist, you can ensure that you don’t miss any critical information that could impact your decision to buy the business.

Start by reviewing the business’s contracts, including those with suppliers, customers, and employees. Look for any potential liabilities or obligations that could impact the business’s financials or operations. Next, assess the business’s employee relationships, including their skills, experience, and morale. A well-trained and motivated workforce can be a significant asset to the business.

Evaluate the business’s equipment and assets, including their condition, age, and maintenance requirements. Consider the potential costs of replacing or upgrading equipment, as well as any potential liabilities associated with asset ownership. Review the business’s insurance policies, including liability, property, and workers’ compensation insurance.

Assess the business’s intellectual property, including patents, trademarks, and copyrights. Consider the potential risks and liabilities associated with intellectual property ownership, as well as any potential opportunities for growth and development. Review the business’s regulatory compliance, including any licenses, permits, or certifications required to operate the business.

Investigate the business’s customer base, including their demographics, needs, and preferences. Consider the potential risks and opportunities associated with customer relationships, as well as any potential liabilities associated with customer contracts. Evaluate the business’s supplier relationships, including their reliability, quality, and pricing.

Finally, review the business’s financial statements, including its balance sheet, income statement, and cash flow statement. Look for any potential red flags, such as high levels of debt, low cash reserves, or declining revenue. Consider the potential risks and opportunities associated with the business’s financials, as well as any potential liabilities associated with financial obligations.

By following this comprehensive checklist, you can ensure that you conduct thorough due diligence and avoid potential pitfalls when buying a small business. Remember to stay organized, focused, and thorough in your investigation, and don’t be afraid to seek professional advice if needed.

Negotiating the Purchase Price: Strategies and Tactics

When buying a small business, negotiating the purchase price is a critical step in the acquisition process. A well-negotiated price can ensure a successful acquisition and a strong return on investment. To negotiate the purchase price effectively, it’s essential to understand the seller’s motivations, use data to support your offer, and be prepared to walk away if necessary.

Start by understanding the seller’s motivations. Why are they selling the business? Are they looking to retire, or are they facing financial difficulties? Understanding the seller’s motivations can help you tailor your offer and negotiation strategy. For example, if the seller is looking to retire, they may be more willing to accept a lower price in exchange for a quick sale.

Use data to support your offer. Review the business’s financial statements, including its income statement, balance sheet, and cash flow statement. Analyze the business’s revenue, profitability, and cash flow to determine a fair purchase price. Consider hiring a professional appraiser or business broker to help you determine the business’s value.

Be prepared to walk away if necessary. Negotiation is a give-and-take process, and it’s essential to be willing to walk away if the terms of the sale are not favorable. This shows the seller that you are not desperate, and it can help you negotiate a better price. Remember, it’s better to walk away from a bad deal than to overpay for a business.

Consider using creative negotiation strategies, such as offering a contingent payment structure or a earn-out clause. These strategies can help you negotiate a lower purchase price while still providing the seller with a fair return on their investment.

Finally, be transparent and honest in your negotiation. Provide the seller with clear and concise information about your offer, and be willing to answer any questions they may have. This can help build trust and ensure a smooth negotiation process.

By following these strategies and tactics, you can effectively negotiate the purchase price of a small business and ensure a successful acquisition. Remember to stay calm, professional, and patient during the negotiation process, and don’t be afraid to seek professional advice if needed.

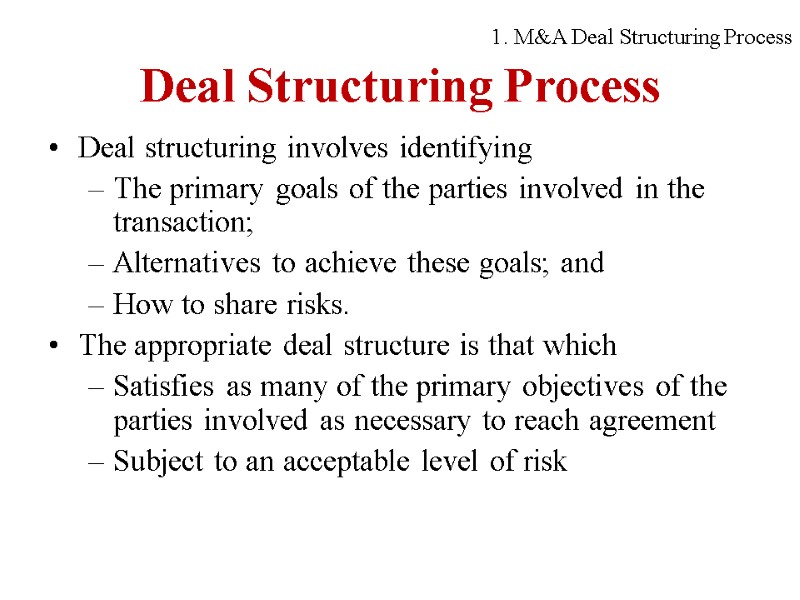

Structuring the Deal: Financing Options and Tax Implications

When buying a small business, structuring the deal is a critical step in the acquisition process. The financing options and tax implications of the deal can have a significant impact on the success of the acquisition. In this article, we will discuss the various financing options available for buying a small business, including loans, equity investments, and seller financing. We will also explain the tax implications of each option and provide guidance on how to structure the deal to minimize tax liabilities.

Loans are a common financing option for buying a small business. There are several types of loans available, including term loans, lines of credit, and Small Business Administration (SBA) loans. Each type of loan has its own advantages and disadvantages, and the choice of loan will depend on the specific needs of the buyer and the seller.

Equity investments are another financing option for buying a small business. This involves investing in the business in exchange for a share of ownership. Equity investments can be a good option for buyers who want to share the risk and reward of the business with investors.

Seller financing is a financing option that involves the seller providing financing to the buyer. This can be a good option for buyers who are unable to secure traditional financing. Seller financing can also be beneficial for the seller, as it allows them to receive a steady stream of income over time.

The tax implications of the deal will depend on the financing option chosen. For example, loans are generally tax-deductible, while equity investments are not. Seller financing can also have tax implications, as the seller will need to report the income from the financing as taxable income.

To minimize tax liabilities, it’s essential to structure the deal carefully. This may involve working with a tax professional to ensure that the deal is structured in a way that minimizes tax liabilities. It’s also essential to consider the tax implications of the deal when choosing a financing option.

In conclusion, structuring the deal is a critical step in the acquisition process when buying a small business. The financing options and tax implications of the deal can have a significant impact on the success of the acquisition. By understanding the various financing options available and the tax implications of each option, buyers can make informed decisions and structure the deal in a way that minimizes tax liabilities.

Post-Acquisition Integration: Ensuring a Smooth Transition

When buying a small business, post-acquisition integration is a critical step in ensuring a smooth transition and minimizing disruption to the business. This involves planning for the integration of the business’s operations, systems, and culture, as well as communicating with employees, customers, and suppliers.

Communicating with employees is essential during the post-acquisition integration process. This involves informing them of the changes that will be taking place, as well as providing training and support to help them adapt to the new ownership. It’s also important to address any concerns or questions that employees may have, and to provide them with a clear understanding of their roles and responsibilities within the new organization.

Communicating with customers is also crucial during the post-acquisition integration process. This involves informing them of the changes that will be taking place, as well as providing them with a clear understanding of how the acquisition will affect their relationship with the business. It’s also important to address any concerns or questions that customers may have, and to provide them with a high level of service and support during the transition period.

Addressing potential cultural and operational differences is also an important part of the post-acquisition integration process. This involves identifying any differences in culture, values, or operating procedures between the two businesses, and developing a plan to address these differences. It’s also important to establish a clear understanding of the new organization’s culture and values, and to communicate these to all employees and stakeholders.

Providing training and support to employees is also essential during the post-acquisition integration process. This involves providing them with the training and resources they need to adapt to the new ownership and to perform their jobs effectively. It’s also important to provide employees with a clear understanding of their roles and responsibilities within the new organization, and to establish a clear chain of command and communication.

Finally, it’s essential to monitor the progress of the post-acquisition integration process and to make any necessary adjustments. This involves tracking key performance indicators, such as employee satisfaction and customer retention, and making any necessary changes to the integration plan. It’s also important to establish a clear understanding of the new organization’s goals and objectives, and to communicate these to all employees and stakeholders.

Overcoming Common Challenges: Lessons from Experienced Buyers

When buying a small business, it’s essential to be aware of the common challenges that can arise during the acquisition process. Experienced buyers have learned that overcoming these challenges requires careful planning, effective communication, and a willingness to adapt to changing circumstances.

One of the most significant challenges that buyers face is integrating different systems and cultures. This can be particularly difficult when the acquired business has a unique culture or way of operating. To overcome this challenge, buyers should take the time to understand the acquired business’s culture and systems, and develop a plan to integrate them into the existing organization.

Another common challenge that buyers face is managing the expectations of employees, customers, and suppliers. This can be particularly difficult during the transition period, when there may be uncertainty about the future of the business. To overcome this challenge, buyers should communicate clearly and transparently with all stakeholders, and provide them with regular updates on the progress of the acquisition.

Experienced buyers also know that overcoming common challenges requires a willingness to adapt to changing circumstances. This can include changes in the market, changes in the business’s financial performance, or changes in the regulatory environment. To overcome this challenge, buyers should be prepared to pivot their strategy as needed, and be willing to make tough decisions when necessary.

Finally, experienced buyers know that overcoming common challenges requires a strong support network. This can include advisors, mentors, and peers who can provide guidance and support during the acquisition process. To overcome this challenge, buyers should build a strong support network, and be willing to seek help when needed.

By learning from the experiences of other buyers, you can overcome the common challenges that arise during the acquisition process. Remember to stay flexible, communicate effectively, and be prepared to adapt to changing circumstances. With careful planning and a willingness to learn, you can overcome any challenge that comes your way.