Understanding the Benefits of Buying an Established Business

Purchasing an existing business can be a lucrative opportunity for entrepreneurs and investors. By acquiring a established business, individuals can reap the benefits of reduced startup costs, an established customer base, and immediate cash flow. This can be a significant advantage over starting a business from scratch, as it allows the new owner to hit the ground running and focus on growth and expansion.

One of the primary benefits of buying an existing business is the reduced financial risk. When starting a new business, there is always a degree of uncertainty surrounding its success. However, when purchasing an established business, the financial performance and customer base are already established, providing a more stable foundation for future growth.

In addition to reduced financial risk, buying an existing business also provides access to an established customer base. This can be a significant advantage, as it eliminates the need to spend time and resources on marketing and customer acquisition. Instead, the new owner can focus on building on the existing customer relationships and expanding the business through new products or services.

Furthermore, buying an existing business can also provide immediate cash flow. This can be a significant advantage, as it allows the new owner to generate revenue from day one and focus on growing the business. In contrast, starting a new business can often require significant upfront investment and may take several months or even years to generate significant revenue.

When considering how to buy someone’s business, it’s essential to weigh the benefits and drawbacks of this approach. While buying an existing business can provide a range of advantages, it’s crucial to carefully evaluate the business’s financial performance, customer base, and growth potential before making a decision.

Identifying the Right Business to Buy: Key Factors to Consider

When considering how to buy someone’s business, it’s essential to identify the right business to purchase. This involves evaluating various factors, including industry trends, market demand, financial performance, and growth potential. By carefully assessing these factors, entrepreneurs and investors can make informed decisions and increase their chances of success.

Industry trends play a significant role in determining the viability of a business. It’s crucial to research the industry and understand its current state, growth prospects, and potential challenges. This can be done by analyzing industry reports, attending conferences, and speaking with industry experts.

Market demand is another critical factor to consider. It’s essential to assess the demand for the business’s products or services and determine whether it’s increasing, decreasing, or remaining stable. This can be done by analyzing market research reports, customer feedback, and sales data.

Financial performance is also a key factor to evaluate. It’s essential to review the business’s financial statements, including income statements, balance sheets, and cash flow statements. This will provide insight into the business’s revenue, expenses, profits, and cash flow.

Growth potential is another important factor to consider. It’s essential to assess the business’s potential for growth and determine whether it’s likely to increase in value over time. This can be done by analyzing the business’s products or services, market trends, and competitive landscape.

When searching for a business to buy, it’s also essential to consider the business’s management structure, employee dynamics, and operational efficiency. A well-managed business with a strong team and efficient operations is more likely to be successful than a poorly managed business with a weak team and inefficient operations.

By carefully evaluating these factors, entrepreneurs and investors can increase their chances of success when buying a business. It’s essential to take a thorough and systematic approach to identifying the right business to purchase, and to seek professional advice when needed.

Evaluating the Business’s Financial Health: A Comprehensive Review

When considering how to buy someone’s business, it’s essential to evaluate the business’s financial health. This involves reviewing the business’s financial statements, including income statements, balance sheets, and cash flow statements. By analyzing these statements, entrepreneurs and investors can gain a comprehensive understanding of the business’s financial performance and make informed decisions.

The income statement provides a snapshot of the business’s revenue and expenses over a specific period. It’s essential to review the income statement to understand the business’s revenue streams, cost structure, and profitability. Look for trends in revenue and expenses, and analyze the business’s gross margin, operating margin, and net profit margin.

The balance sheet provides a snapshot of the business’s assets, liabilities, and equity at a specific point in time. It’s essential to review the balance sheet to understand the business’s capital structure, asset utilization, and liquidity. Look for trends in asset growth, debt levels, and equity, and analyze the business’s debt-to-equity ratio and current ratio.

The cash flow statement provides a snapshot of the business’s inflows and outflows of cash over a specific period. It’s essential to review the cash flow statement to understand the business’s ability to generate cash, manage its working capital, and invest in its growth. Look for trends in cash flow, and analyze the business’s cash conversion cycle and cash flow margin.

Financial ratios are also essential in evaluating the business’s financial health. Common financial ratios include the debt-to-equity ratio, current ratio, and return on equity (ROE). By analyzing these ratios, entrepreneurs and investors can gain a deeper understanding of the business’s financial performance and identify potential areas for improvement.

When evaluating the business’s financial health, it’s also essential to identify potential red flags. These may include declining revenue, increasing expenses, high debt levels, and poor cash flow. By identifying these red flags, entrepreneurs and investors can take steps to address them and improve the business’s financial health.

By conducting a comprehensive review of the business’s financial statements and analyzing financial ratios, entrepreneurs and investors can gain a thorough understanding of the business’s financial health. This will enable them to make informed decisions when considering how to buy someone’s business and ensure a successful acquisition.

Assessing the Business’s Operations and Management

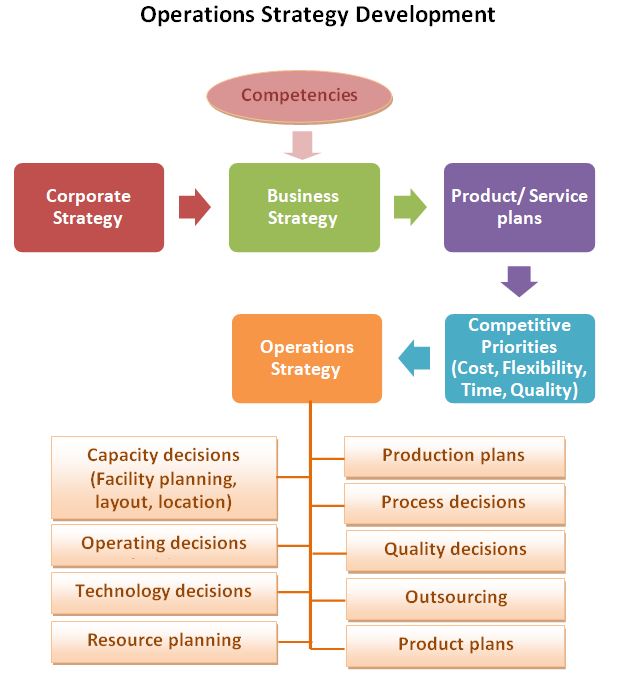

When considering how to buy someone’s business, it’s essential to assess the business’s operational efficiency, management structure, and employee dynamics. This involves evaluating the business’s systems, processes, and culture to determine whether they are well-established, efficient, and effective.

Operational efficiency is critical to the success of any business. It’s essential to evaluate the business’s production processes, supply chain management, and inventory control to determine whether they are streamlined and efficient. Look for opportunities to improve operational efficiency, such as implementing new technology or streamlining processes.

Management structure is also crucial to the success of a business. It’s essential to evaluate the business’s organizational chart, management team, and leadership style to determine whether they are effective and efficient. Look for a strong management team with a clear vision and strategy for the business.

Employee dynamics are also important to consider. It’s essential to evaluate the business’s employee morale, turnover rates, and training programs to determine whether they are positive and productive. Look for a business with a strong company culture and a motivated workforce.

To assess the business’s operations and management, it’s essential to conduct a thorough review of the business’s systems, processes, and culture. This may involve conducting interviews with employees, reviewing company documents, and observing business operations firsthand.

When evaluating the business’s operations and management, it’s also essential to consider the business’s scalability and growth potential. Look for a business with a strong foundation for growth, including a solid management team, efficient operations, and a positive company culture.

By assessing the business’s operations and management, entrepreneurs and investors can gain a comprehensive understanding of the business’s strengths and weaknesses. This will enable them to make informed decisions when considering how to buy someone’s business and ensure a successful acquisition.

Some key questions to ask when assessing the business’s operations and management include:

- What are the business’s core competencies and competitive advantages?

- How does the business manage its supply chain and inventory?

- What is the business’s organizational structure and management team like?

- How does the business approach employee training and development?

- What is the business’s company culture like, and how does it impact employee morale and productivity?

Negotiating the Purchase Price: Strategies and Tactics

When considering how to buy someone’s business, negotiating the purchase price is a critical step in the acquisition process. It’s essential to approach the negotiation with a clear understanding of the business’s value and a well-thought-out strategy. In this section, we’ll provide guidance on how to negotiate the purchase price, including how to determine a fair market value, identify potential concessions, and navigate the negotiation process.

Determining a fair market value is the first step in negotiating the purchase price. This involves conducting a thorough analysis of the business’s financial statements, industry trends, and market conditions. Consider hiring a professional appraiser or using online valuation tools to determine a fair market value.

Once you have a fair market value in mind, it’s essential to identify potential concessions that can be made during the negotiation process. This may include offering a lower purchase price, requesting seller financing, or proposing a earn-out structure. Be creative and think outside the box when it comes to concessions.

Navigating the negotiation process requires skill and strategy. It’s essential to build a rapport with the seller and establish a positive relationship. Be transparent and open in your communication, and be willing to walk away if the terms are not favorable.

Some key negotiation tactics to keep in mind include:

- Start with a low offer and be willing to negotiate

- Use data and analysis to support your offer

- Be creative with concessions and think outside the box

- Build a rapport with the seller and establish a positive relationship

- Be transparent and open in your communication

- Be willing to walk away if the terms are not favorable

By following these negotiation strategies and tactics, entrepreneurs and investors can successfully negotiate the purchase price and achieve a favorable outcome when buying a business.

Additionally, consider the following tips when negotiating the purchase price:

- Use a professional negotiator or attorney to represent you

- Keep the negotiation process confidential

- Be prepared to provide financial statements and other documentation

- Be flexible and willing to compromise

- Use time to your advantage and don’t rush the negotiation process

Due Diligence: A Critical Step in the Acquisition Process

When considering how to buy someone’s business, conducting thorough due diligence is a critical step in the acquisition process. Due diligence involves a comprehensive review of the business’s contracts, liabilities, and potential risks. This step is essential to ensure that the buyer is making an informed decision and to avoid potential pitfalls.

A thorough due diligence process should include a review of the business’s contracts, including employment contracts, supplier contracts, and customer contracts. This will help the buyer understand the business’s obligations and potential liabilities.

Assessing liabilities is also a critical part of the due diligence process. This includes reviewing the business’s financial statements, tax returns, and other documentation to identify potential liabilities, such as outstanding debts or pending lawsuits.

Evaluating potential risks is also essential during the due diligence process. This includes reviewing the business’s industry trends, market conditions, and competitive landscape to identify potential risks and opportunities.

A checklist of key items to investigate during the due diligence process should include:

- Review of contracts, including employment contracts, supplier contracts, and customer contracts

- Assessment of liabilities, including outstanding debts and pending lawsuits

- Evaluation of potential risks, including industry trends, market conditions, and competitive landscape

- Review of financial statements, tax returns, and other documentation

- Assessment of the business’s management structure and employee dynamics

- Evaluation of the business’s systems, processes, and culture

By conducting thorough due diligence, entrepreneurs and investors can ensure that they are making an informed decision when buying a business. This step is critical to avoiding potential pitfalls and ensuring a successful acquisition.

Additionally, consider the following tips when conducting due diligence:

- Use a professional advisor, such as an attorney or accountant, to assist with the due diligence process

- Be thorough and meticulous in your review of the business’s contracts, liabilities, and potential risks

- Ask questions and seek clarification on any issues that arise during the due diligence process

- Use the due diligence process as an opportunity to negotiate the purchase price or terms of the acquisition

Structuring the Deal: Financing Options and Tax Implications

When considering how to buy someone’s business, structuring the deal is a critical step in the acquisition process. This involves determining the best financing options and understanding the tax implications of each option. In this section, we’ll discuss the various financing options available for buying a business, including loans, equity investments, and seller financing.

Loans are a common financing option for buying a business. This can include traditional bank loans, alternative loans, or Small Business Administration (SBA) loans. When considering a loan, it’s essential to evaluate the interest rate, repayment terms, and fees associated with the loan.

Equity investments are another financing option for buying a business. This can include investing in the business through a private equity firm or venture capital firm. When considering an equity investment, it’s essential to evaluate the potential return on investment and the level of control the investor will have in the business.

Seller financing is also a financing option for buying a business. This involves the seller providing financing to the buyer, either through a loan or an earn-out structure. When considering seller financing, it’s essential to evaluate the terms of the financing and the potential risks associated with the arrangement.

When structuring the deal, it’s also essential to consider the tax implications of each financing option. This can include evaluating the tax benefits of each option, such as depreciation and amortization, and understanding the potential tax liabilities associated with each option.

A checklist of key items to consider when structuring the deal should include:

- Evaluating the financing options available, including loans, equity investments, and seller financing

- Understanding the tax implications of each financing option

- Evaluating the potential return on investment and level of control associated with each financing option

- Assessing the potential risks associated with each financing option

- Considering the terms of the financing, including interest rates, repayment terms, and fees

By carefully evaluating the financing options and tax implications, entrepreneurs and investors can structure a deal that meets their needs and minimizes their risks.

Additionally, consider the following tips when structuring the deal:

- Seek professional advice from a financial advisor or attorney

- Carefully evaluate the terms of the financing and the potential risks associated with each option

- Consider the tax implications of each financing option and how they may impact the business

- Be prepared to negotiate the terms of the financing and the deal structure

Closing the Deal: Finalizing the Acquisition

When considering how to buy someone’s business, closing the deal is the final step in the acquisition process. This involves reviewing and signing the purchase agreement, transferring ownership, and updating records. In this section, we’ll outline the final steps involved in closing the deal and provide tips on how to ensure a smooth transition and minimize disruptions to the business.

Reviewing and signing the purchase agreement is a critical step in closing the deal. This involves carefully reviewing the agreement to ensure that all terms and conditions are met, and that the buyer and seller are in agreement. It’s essential to have a lawyer or attorney review the agreement to ensure that it is legally binding and enforceable.

Transferring ownership is also a critical step in closing the deal. This involves transferring the ownership of the business from the seller to the buyer, and updating all relevant records and documents. This may include updating the business’s registration, licenses, and permits, as well as notifying customers, suppliers, and employees of the change in ownership.

Updating records is also an essential step in closing the deal. This involves updating all relevant records and documents, including financial statements, tax returns, and employee records. It’s essential to ensure that all records are accurate and up-to-date, and that the buyer has access to all necessary information.

A checklist of key items to consider when closing the deal should include:

- Reviewing and signing the purchase agreement

- Transferring ownership of the business

- Updating all relevant records and documents

- Notifying customers, suppliers, and employees of the change in ownership

- Ensuring that all records are accurate and up-to-date

By following these steps and tips, entrepreneurs and investors can ensure a smooth transition and minimize disruptions to the business when buying someone’s business.

Additionally, consider the following tips when closing the deal:

- Seek professional advice from a lawyer or attorney

- Ensure that all terms and conditions are met and that the buyer and seller are in agreement

- Update all relevant records and documents in a timely manner

- Notify all relevant parties of the change in ownership

- Ensure that the buyer has access to all necessary information