Understanding the Impact of Credit Utilization on Your Credit Score

Credit utilization is a critical component of credit scoring, accounting for approximately 30% of an individual’s overall credit score. It is essential to understand the significance of credit utilization in determining credit scores, as it can significantly impact creditworthiness and loan eligibility. A healthy credit utilization ratio is crucial for maintaining good credit health, and it can be achieved by keeping credit utilization ratios low.

Credit utilization refers to the percentage of available credit being used, and it is calculated by dividing total debt by total available credit. For instance, if an individual has a credit card with a $1,000 limit and a balance of $300, their credit utilization ratio would be 30%. This means that 30% of the available credit is being used.

A high credit utilization ratio can negatively impact credit scores, making it more challenging to obtain loans or credit at favorable interest rates. On the other hand, a low credit utilization ratio demonstrates responsible credit behavior and can help to improve credit scores over time. By understanding the impact of credit utilization on credit scores, individuals can take control of their credit health and make informed decisions about their credit usage.

Maintaining a healthy credit utilization ratio is essential for achieving long-term financial stability. It can help individuals to qualify for better loan terms, lower interest rates, and increased credit eligibility. Furthermore, a healthy credit utilization ratio can also help to reduce debt and improve overall financial well-being.

In the next section, we will explore what credit utilization is and how it is calculated, providing a comprehensive understanding of this critical credit scoring component.

What is Credit Utilization and How is it Calculated?

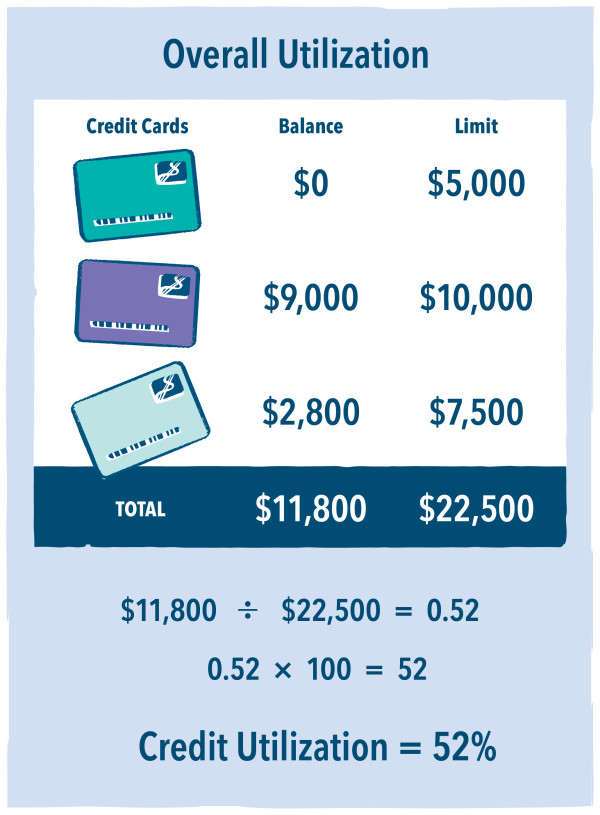

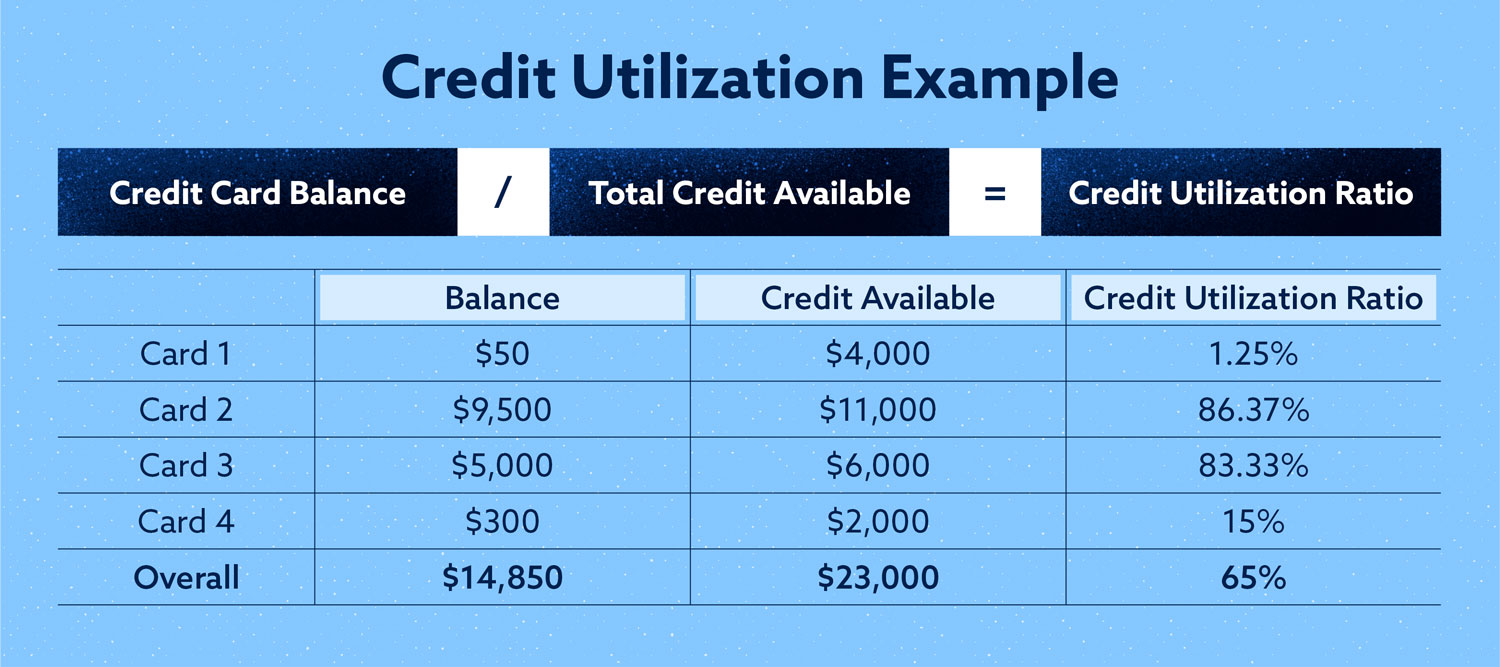

Credit utilization is the percentage of available credit being used, and it is a critical component of credit scoring. To calculate credit utilization, you need to know the total debt and total available credit. The formula for calculating credit utilization is: Total Debt ÷ Total Available Credit = Credit Utilization Ratio.

For example, let’s say you have two credit cards: one with a $2,000 limit and a balance of $500, and another with a $1,500 limit and a balance of $300. To calculate the credit utilization ratio, you would add the balances together ($500 + $300 = $800) and divide by the total available credit ($2,000 + $1,500 = $3,500). The credit utilization ratio would be 22.9% ($800 ÷ $3,500).

Understanding how to calculate credit utilization is essential for maintaining a healthy credit utilization ratio. By keeping credit utilization ratios low, individuals can demonstrate responsible credit behavior and improve their credit scores over time. It’s also important to note that credit utilization is calculated for each credit account individually, as well as for the overall credit portfolio.

In addition to the credit utilization ratio, credit scoring models also consider other factors, such as payment history, credit age, and credit mix. However, credit utilization is a significant component of credit scoring, and it’s essential to understand how to calculate it and maintain a healthy ratio.

In the next section, we will provide a step-by-step guide on how to calculate credit utilization, including how to gather necessary information and provide a sample calculation to demonstrate the process.

How to Calculate Credit Utilization: A Step-by-Step Guide

Calculating credit utilization is a straightforward process that requires some basic information about your credit accounts. To calculate credit utilization, you will need to know the following:

- Credit card balances: The current balance on each of your credit cards.

- Credit limits: The maximum amount you can charge on each of your credit cards.

Once you have this information, you can follow these steps to calculate your credit utilization:

- Add up the balances on all of your credit cards.

- Add up the credit limits on all of your credit cards.

- Divide the total balance by the total credit limit.

- Multiply the result by 100 to convert it to a percentage.

For example, let’s say you have two credit cards with the following information:

- Credit card A: Balance = $500, Credit limit = $2,000

- Credit card B: Balance = $300, Credit limit = $1,500

To calculate the credit utilization, you would add up the balances ($500 + $300 = $800) and add up the credit limits ($2,000 + $1,500 = $3,500). Then, you would divide the total balance by the total credit limit ($800 ÷ $3,500 = 0.229) and multiply by 100 to convert it to a percentage (22.9%).

By following these steps, you can easily calculate your credit utilization and get a better understanding of your credit health. Remember to regularly review your credit utilization to ensure you are maintaining a healthy ratio.

Factors That Affect Credit Utilization: Credit Limits, Balances, and More

Credit utilization is influenced by several factors, including credit limits, outstanding balances, and credit mix. Understanding these factors is crucial for maintaining a healthy credit utilization ratio and improving overall credit health.

Credit limits play a significant role in determining credit utilization. A higher credit limit can help to lower credit utilization, as it increases the total available credit. However, it’s essential to avoid applying for multiple credit cards or increasing credit limits unnecessarily, as this can negatively impact credit scores.

Outstanding balances also impact credit utilization. High balances can lead to high credit utilization, which can negatively affect credit scores. Paying down debt and reducing outstanding balances can help to lower credit utilization and improve credit health.

Credit mix is another factor that influences credit utilization. A diverse credit mix, including different types of credit accounts, such as credit cards, loans, and mortgages, can help to improve credit scores. However, it’s essential to avoid applying for too many credit accounts, as this can negatively impact credit utilization and credit scores.

Other factors that can impact credit utilization include credit age, payment history, and new credit inquiries. A longer credit history and a good payment history can help to improve credit scores, while new credit inquiries can negatively impact credit utilization and credit scores.

By understanding the factors that affect credit utilization, individuals can take steps to maintain a healthy credit utilization ratio and improve overall credit health. This includes monitoring credit reports, paying down debt, and avoiding unnecessary credit inquiries.

In the next section, we will discuss the ideal credit utilization ratio and provide tips on how to improve it, including paying down debt, increasing credit limits, and avoiding new credit inquiries.

Credit Utilization Ratio: What’s a Good Score and How to Improve It

A good credit utilization ratio is generally considered to be below 30%. This means that for every dollar of available credit, you should aim to use less than 30 cents. However, the ideal credit utilization ratio can vary depending on individual circumstances and credit scoring models.

To improve your credit utilization ratio, there are several strategies you can use. One of the most effective ways is to pay down debt. By reducing your outstanding balances, you can lower your credit utilization ratio and improve your credit scores. Another strategy is to increase your credit limits. This can help to lower your credit utilization ratio by increasing the total available credit.

It’s also important to avoid new credit inquiries, as these can negatively impact your credit utilization ratio and credit scores. Additionally, you should aim to maintain a diverse credit mix, including different types of credit accounts, such as credit cards, loans, and mortgages.

By following these strategies, you can improve your credit utilization ratio and maintain a healthy credit profile. Remember, a good credit utilization ratio is just one aspect of maintaining good credit health. Regularly monitoring your credit reports and scores, and avoiding common mistakes when calculating credit utilization, are also essential for achieving long-term financial stability.

In the next section, we will discuss common mistakes to avoid when calculating credit utilization, including neglecting to include all credit accounts or using incorrect credit limits. We will also provide advice on how to avoid these mistakes and maintain a healthy credit utilization ratio.

Common Mistakes to Avoid When Calculating Credit Utilization

When calculating credit utilization, there are several common mistakes that people make. One of the most common mistakes is neglecting to include all credit accounts. This can lead to an inaccurate calculation of credit utilization, which can negatively impact credit scores.

Another common mistake is using incorrect credit limits. This can occur when credit limits are not updated or when credit accounts are not properly reported to the credit bureaus. Using incorrect credit limits can lead to an inaccurate calculation of credit utilization, which can negatively impact credit scores.

Additionally, some people may make the mistake of not considering all types of credit accounts when calculating credit utilization. This can include neglecting to include installment loans, mortgages, or other types of credit accounts. Failing to consider all types of credit accounts can lead to an inaccurate calculation of credit utilization, which can negatively impact credit scores.

To avoid these mistakes, it’s essential to carefully review credit reports and ensure that all credit accounts are included in the calculation. It’s also important to verify credit limits and ensure that they are accurate. By avoiding these common mistakes, individuals can ensure that their credit utilization ratio is accurate and that their credit scores are not negatively impacted.

In the next section, we will discuss the importance of regularly monitoring credit utilization and provide tips on how to maintain a healthy ratio, such as setting up credit alerts and reviewing credit reports.

Monitoring and Maintaining a Healthy Credit Utilization Ratio

Regularly monitoring credit utilization is crucial for maintaining a healthy credit utilization ratio. By keeping track of credit utilization, individuals can identify potential issues and take corrective action before they negatively impact credit scores.

One way to monitor credit utilization is to set up credit alerts. Credit alerts can notify individuals when their credit utilization ratio exceeds a certain threshold, allowing them to take action to reduce their debt and improve their credit utilization ratio.

Another way to monitor credit utilization is to review credit reports regularly. Credit reports provide a comprehensive overview of an individual’s credit history, including credit utilization ratios. By reviewing credit reports regularly, individuals can identify errors or inaccuracies and take steps to correct them.

In addition to monitoring credit utilization, individuals can also take steps to maintain a healthy credit utilization ratio. One way to do this is to pay down debt regularly. By reducing outstanding balances, individuals can lower their credit utilization ratio and improve their credit scores.

Another way to maintain a healthy credit utilization ratio is to avoid new credit inquiries. New credit inquiries can negatively impact credit scores, so it’s essential to avoid applying for too many credit accounts or loans.

By monitoring credit utilization and taking steps to maintain a healthy credit utilization ratio, individuals can improve their credit scores and achieve long-term financial stability.

In the next section, we will summarize the key takeaways from the article and encourage readers to take control of their credit utilization by following the guidelines and best practices outlined in the article.

Conclusion: Taking Control of Your Credit Utilization

In conclusion, mastering credit utilization is a crucial aspect of maintaining good credit health. By understanding how to calculate credit utilization, individuals can take control of their credit utilization ratio and improve their credit scores.

Throughout this article, we have discussed the significance of credit utilization in determining credit scores, how to calculate credit utilization, and the factors that affect credit utilization. We have also provided tips on how to improve credit utilization ratios, avoid common mistakes, and maintain a healthy credit utilization ratio.

By following the guidelines and best practices outlined in this article, individuals can take control of their credit utilization and achieve long-term financial stability. Remember, maintaining a healthy credit utilization ratio is essential for achieving good credit health and improving credit scores.

Don’t let credit utilization ratios hold you back from achieving your financial goals. Take control of your credit utilization today and start building a stronger financial future.