Understanding the Basics of Income Tax Calculation

Income tax is a mandatory contribution to the government, and calculating it accurately is crucial to avoid penalties and fines. The process of calculating income tax can seem daunting, but with the right guidance, individuals can navigate it with ease. To begin, it’s essential to understand the basics of income tax calculation, including the different types of income, deductions, and exemptions. This knowledge will help individuals make informed decisions about their tax obligations and ensure they are in compliance with tax laws.

Income tax is typically calculated as a percentage of an individual’s taxable income. Taxable income includes earnings from employment, self-employment, investments, and other sources. The tax rate applied to taxable income depends on the individual’s filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Understanding how to calculate income tax requires knowledge of these factors and how they interact.

Fortunately, calculating income tax is a straightforward process that can be completed using tax tables or tax software. Tax tables provide a list of tax rates and corresponding taxable income ranges, making it easy to determine the correct tax amount. Tax software, on the other hand, automates the calculation process, reducing the risk of errors and ensuring accuracy.

By understanding the basics of income tax calculation, individuals can take control of their tax obligations and ensure they are meeting their responsibilities. This knowledge is especially important for those who are self-employed or have complex tax situations. By following the steps outlined in this guide, individuals can learn how to calculate income tax with confidence and accuracy.

Gathering Essential Documents: What You Need to Get Started

To calculate income tax accurately, it’s essential to gather all the necessary documents. These documents serve as the foundation for determining taxable income, deductions, and exemptions. The most common documents required for calculating income tax include:

W-2 forms: These forms show an individual’s income from employment, including wages, salaries, and tips. Employers typically provide W-2 forms to employees by January 31st of each year.

1099 forms: These forms report income from self-employment, freelance work, and other sources. Individuals who receive 1099 forms should keep them on file, as they will need to report this income on their tax return.

Receipts for deductions: Individuals can claim deductions for expenses related to charitable donations, medical expenses, and mortgage interest. Keeping receipts for these expenses will help support the deduction claims.

Identification numbers: A Social Security number or Individual Taxpayer Identification Number (ITIN) is required to file a tax return. Ensure that this information is accurate and up-to-date.

To ensure a smooth calculation process, it’s crucial to organize these documents in a logical and accessible manner. Consider creating a folder or digital file with separate sections for each type of document. This will save time and reduce stress when preparing the tax return.

When gathering documents, it’s also essential to verify their accuracy. Check for errors or discrepancies on W-2 and 1099 forms, and ensure that receipts for deductions are legible and complete. By taking the time to gather and organize essential documents, individuals can ensure that their tax return is accurate and complete.

Determining Your Filing Status: How It Impacts Your Tax Liability

Filing status is a critical factor in determining tax liability, as it affects the tax rates and deductions available to individuals. The Internal Revenue Service (IRS) recognizes five filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Each filing status has its own set of rules and implications for tax liability.

Single filers are unmarried individuals or those who are separated and do not qualify for another filing status. Married couples can file jointly or separately, depending on their individual circumstances. Filing jointly often results in a lower tax liability, as the couple can combine their income and deductions. However, filing separately may be beneficial in certain situations, such as when one spouse has significant medical expenses or other deductions.

Head of household is a filing status available to unmarried individuals who have dependents and meet certain requirements. This filing status can provide a lower tax rate and higher standard deduction compared to single filers. Qualifying widow(er) is a filing status available to individuals who have lost their spouse and meet certain requirements. This filing status can provide a lower tax rate and higher standard deduction compared to single filers.

Understanding the different filing statuses and their implications is essential for accurately calculating income tax. By selecting the correct filing status, individuals can minimize their tax liability and ensure they are in compliance with tax laws. When determining filing status, it’s essential to consider factors such as marital status, dependents, and income level.

For example, a married couple with two children may benefit from filing jointly, as they can combine their income and claim the child tax credit. On the other hand, a single individual with significant medical expenses may benefit from filing as head of household, as they can claim a higher standard deduction and lower tax rate.

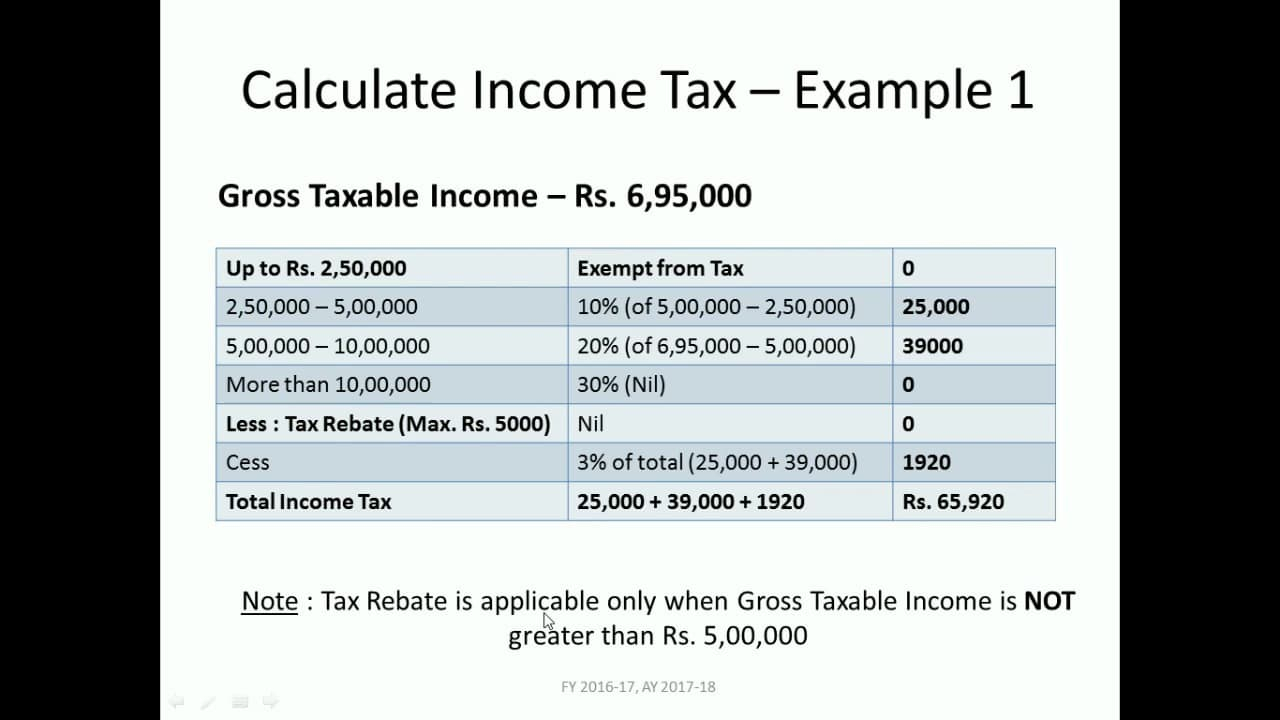

Calculating Your Taxable Income: Gross Income vs. Adjusted Gross Income

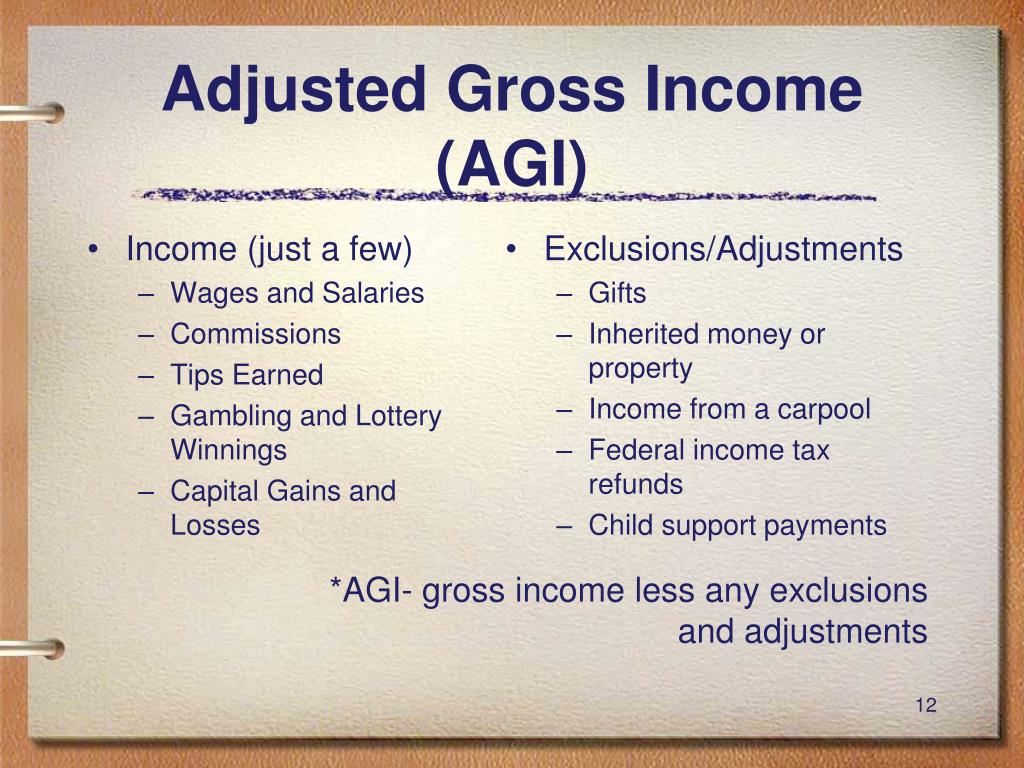

Calculating taxable income is a crucial step in determining tax liability. Taxable income is the amount of income that is subject to income tax, and it’s calculated by subtracting deductions and exemptions from gross income. Gross income includes all income earned from various sources, such as employment, self-employment, investments, and other sources.

Adjusted Gross Income (AGI) is the result of subtracting deductions and exemptions from gross income. AGI is an important concept in income tax calculation, as it determines the tax rate and the amount of tax liability. To calculate AGI, individuals must first determine their gross income, then subtract deductions and exemptions.

Deductions and exemptions can significantly reduce taxable income, resulting in lower tax liability. Common deductions include mortgage interest, charitable donations, and medical expenses. Exemptions include the personal exemption and dependent exemption. By claiming these deductions and exemptions, individuals can minimize their tax liability and ensure they are in compliance with tax laws.

For example, let’s say an individual has a gross income of $50,000 and claims a standard deduction of $12,000. Their AGI would be $38,000 ($50,000 – $12,000). If they also claim a personal exemption of $4,000, their taxable income would be $34,000 ($38,000 – $4,000). This taxable income would then be subject to income tax, and the individual would be required to pay taxes on this amount.

Understanding the difference between gross income and AGI is essential for accurately calculating income tax. By subtracting deductions and exemptions from gross income, individuals can determine their AGI and taxable income, which is a critical step in determining tax liability.

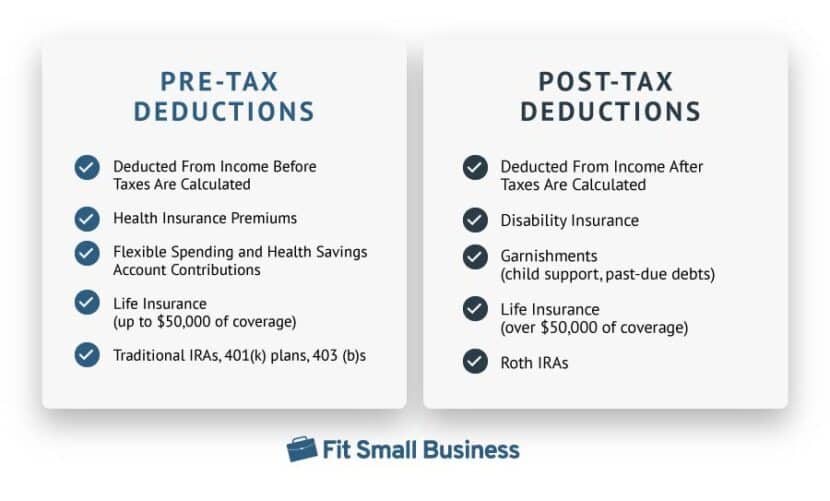

Deductions and Exemptions: Maximizing Your Tax Savings

Deductions and exemptions are essential components of the income tax calculation process. By claiming these deductions and exemptions, individuals can minimize their tax liability and reduce their tax bill. There are two types of deductions: standard deduction and itemized deductions.

The standard deduction is a fixed amount that can be claimed by individuals, and it varies based on filing status. For example, single filers can claim a standard deduction of $12,000, while married couples filing jointly can claim a standard deduction of $24,000. Itemized deductions, on the other hand, are expenses that can be claimed as deductions, such as mortgage interest, charitable donations, and medical expenses.

Exemptions are also an important part of the income tax calculation process. There are two types of exemptions: personal exemption and dependent exemption. The personal exemption is a fixed amount that can be claimed by individuals, and it varies based on filing status. The dependent exemption is a fixed amount that can be claimed for each dependent, such as children or elderly parents.

Claiming deductions and exemptions can significantly reduce tax liability. For example, let’s say an individual has a taxable income of $50,000 and claims a standard deduction of $12,000. Their tax liability would be reduced by $12,000, resulting in a lower tax bill. Additionally, if they claim a personal exemption of $4,000, their tax liability would be further reduced by $4,000.

It’s essential to note that deductions and exemptions can be subject to phase-outs and limitations. For example, the standard deduction may be phased out for high-income individuals, and itemized deductions may be limited to a certain percentage of adjusted gross income. Therefore, it’s crucial to understand the rules and limitations surrounding deductions and exemptions to maximize tax savings.

Applying Tax Credits: Reducing Your Tax Bill

Tax credits are a type of tax incentive that can help reduce an individual’s tax bill. Unlike deductions, which reduce taxable income, tax credits directly reduce the amount of tax owed. There are several types of tax credits available, including the earned income tax credit, child tax credit, and education credits.

The earned income tax credit (EITC) is a refundable tax credit designed to help low-income working individuals and families. The credit is based on earned income and family size, and it can provide a significant reduction in tax liability. For example, a single parent with two children and an earned income of $30,000 may be eligible for an EITC of $5,000.

The child tax credit is a non-refundable tax credit that can help reduce tax liability for families with children. The credit is worth up to $2,000 per child, and it can be claimed by families with children under the age of 17. For example, a family with two children under the age of 17 may be eligible for a child tax credit of $4,000.

Education credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit, can help reduce tax liability for individuals pursuing higher education. These credits can be worth up to $2,500 per year, and they can be claimed by individuals who are pursuing a degree or certificate.

Applying tax credits can significantly reduce tax liability, and it’s essential to understand the eligibility requirements and rules surrounding each credit. By claiming tax credits, individuals can minimize their tax bill and maximize their refund.

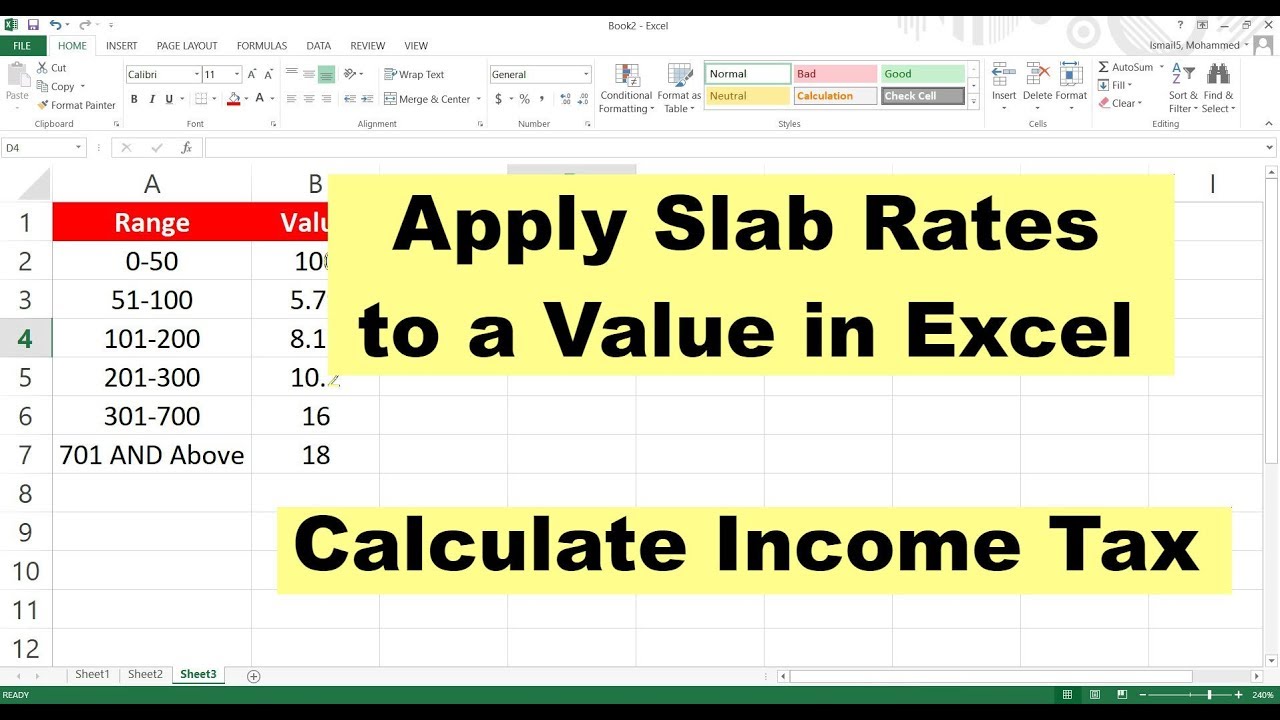

Using Tax Tables or Tax Software: Simplifying the Calculation Process

Calculating income tax can be a complex process, but there are tools available to simplify the calculation. Two popular options are tax tables and tax software. Tax tables provide a list of tax rates and corresponding taxable income ranges, making it easy to determine the correct tax amount. Tax software, on the other hand, automates the calculation process, reducing the risk of errors and ensuring accuracy.

Tax tables are a useful resource for individuals who want to calculate their income tax manually. The tables provide a list of tax rates and corresponding taxable income ranges, making it easy to determine the correct tax amount. However, using tax tables can be time-consuming and prone to errors, especially for individuals with complex tax situations.

Tax software, such as TurboTax or H&R Block, is a more convenient and accurate option for calculating income tax. These programs automate the calculation process, reducing the risk of errors and ensuring accuracy. They also provide guidance and support throughout the calculation process, making it easier for individuals to navigate the tax code.

When choosing between tax tables and tax software, it’s essential to consider the complexity of the tax situation and the level of accuracy required. For simple tax situations, tax tables may be sufficient. However, for more complex tax situations, tax software is likely a better option.

Regardless of the method chosen, it’s essential to ensure accuracy and completeness when calculating income tax. This includes verifying the accuracy of the tax return and ensuring that all necessary documents and information are included.

Reviewing and Submitting Your Tax Return: Avoiding Common Mistakes

Once the tax return is complete, it’s essential to review and verify the accuracy of the information before submission. This includes checking for errors in calculations, ensuring that all necessary documents and information are included, and verifying that the tax return is signed and dated.

Common mistakes to avoid when reviewing and submitting the tax return include:

Math errors: Double-check calculations to ensure accuracy.

Missing information: Ensure that all necessary documents and information are included.

Incorrect filing status: Verify that the correct filing status is selected.

Unsigned or undated return: Ensure that the tax return is signed and dated.

By taking the time to review and verify the accuracy of the tax return, individuals can avoid common mistakes and ensure a smooth filing process.

Additionally, it’s essential to submit the tax return on time to avoid penalties and interest. The deadline for submitting the tax return is typically April 15th, but this date may vary depending on the individual’s circumstances.

By following these steps and avoiding common mistakes, individuals can ensure that their tax return is accurate and complete, and that they are in compliance with tax laws.