Understanding the Fundamentals of Earning a Consistent Income

Earning a consistent income is a crucial aspect of achieving financial stability and security. In today’s fast-paced and ever-changing economy, having a stable job, a side hustle, or a entrepreneurial venture is essential for generating a steady income stream. For many individuals, earning $2000 a month is a realistic goal that can be achieved with the right mindset and strategy. However, it requires a deep understanding of the fundamentals of earning a consistent income.

To start, it’s essential to recognize that earning a consistent income is not just about having a job or a business. It’s about creating a system that generates revenue on a regular basis. This can be achieved through various means, such as freelancing, online tutoring, or selling products online. The key is to identify opportunities that align with your skills, interests, and resources.

Moreover, earning a consistent income requires a long-term perspective. It’s not about making a quick buck or getting rich overnight. Rather, it’s about building a sustainable income stream that can support your financial goals and aspirations. This means being patient, persistent, and willing to learn and adapt to changing circumstances.

Furthermore, earning a consistent income is closely tied to personal development. As individuals, we need to continually develop our skills, knowledge, and expertise to stay competitive in the job market or to grow our businesses. This can be achieved through various means, such as taking online courses, attending workshops, or seeking mentorship.

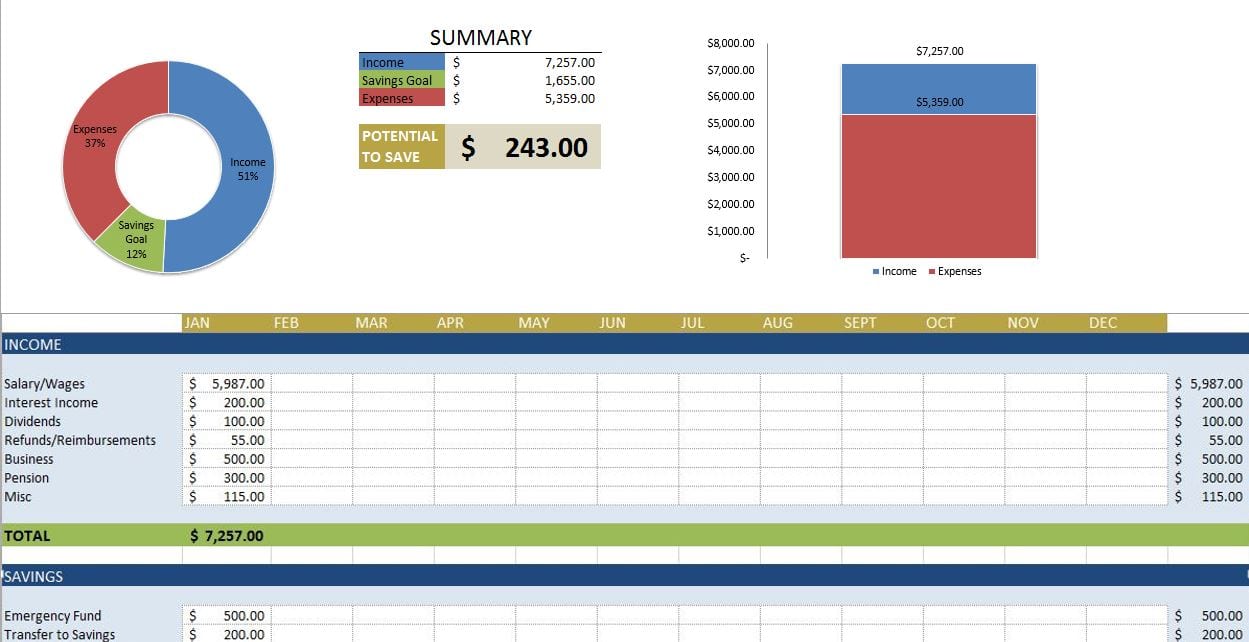

In addition, earning a consistent income requires effective financial management. This means creating a budget, tracking expenses, and making smart financial decisions. By doing so, individuals can ensure that they are making the most of their income and achieving their financial goals.

Finally, earning a consistent income is not just about personal fulfillment; it’s also about contributing to the economy and society as a whole. By generating a steady income stream, individuals can support their families, communities, and causes they care about.

In conclusion, earning a consistent income is a multifaceted concept that requires a deep understanding of various factors, including personal development, financial management, and long-term perspective. By grasping these fundamentals, individuals can create a sustainable income stream that supports their financial goals and aspirations.

Identifying Lucrative Opportunities: Exploring High-Paying Jobs and Side Hustles

For individuals seeking to earn $2000 a month, identifying lucrative opportunities is crucial. High-paying jobs and side hustles can provide a significant boost to one’s income, enabling them to achieve their financial goals. In this section, we will explore some of the most promising opportunities that can help individuals earn a substantial income.

Freelancing is one of the most popular side hustles that can generate a significant income. Platforms like Upwork, Fiverr, and Freelancer offer a range of opportunities for freelancers to showcase their skills and bid on projects. With the rise of the gig economy, freelancing has become a viable option for many individuals seeking to supplement their income.

Online tutoring is another lucrative opportunity that can help individuals earn a substantial income. With the increasing demand for online education, platforms like TutorMe, Chegg, and Varsity Tutors offer opportunities for tutors to connect with students and provide their services. For those with teaching or tutoring experience, online tutoring can be a rewarding and profitable side hustle.

Selling products online is another way to earn a significant income. E-commerce platforms like Amazon, Etsy, and eBay offer opportunities for individuals to sell their products and reach a wider audience. With the rise of social media, selling products online has become easier than ever, and many individuals have successfully turned their passion into a profitable business.

Examples of successful individuals who have achieved this income level include entrepreneurs like Chris Guillebeau, who has built a successful online business through his blog and podcast. Another example is Michelle Schroeder-Gardner, who has built a successful online business through her blog and affiliate marketing.

These examples demonstrate that earning $2000 a month is achievable with the right mindset and strategy. By identifying lucrative opportunities and taking action, individuals can increase their earning potential and achieve their financial goals.

In addition to these opportunities, there are many other ways to earn a significant income. Some individuals may choose to start their own business, while others may opt for a side hustle that aligns with their skills and interests. The key is to identify opportunities that align with one’s strengths and passions, and to take action to pursue them.

By exploring these opportunities and taking action, individuals can increase their earning potential and achieve their financial goals. Whether it’s through freelancing, online tutoring, selling products online, or starting a business, there are many ways to earn a significant income and achieve financial success.

Developing a Valuable Skillset: Investing in Personal Development

Developing a valuable skillset is crucial for increasing earning potential and achieving financial success. In today’s fast-paced and competitive job market, having a valuable skillset can make all the difference in securing a high-paying job or attracting high-paying clients. For individuals seeking to earn $2000 a month, investing in personal development is essential.

One of the most effective ways to develop a valuable skillset is by taking online courses or attending workshops. Online platforms like Udemy, Coursera, and LinkedIn Learning offer a wide range of courses on various topics, from programming and marketing to finance and entrepreneurship. By taking these courses, individuals can acquire in-demand skills and boost their earning potential.

Another way to develop a valuable skillset is by attending conferences and seminars. These events provide opportunities for individuals to network with industry experts, learn about the latest trends and technologies, and gain valuable insights and knowledge. By attending these events, individuals can stay up-to-date with the latest developments in their field and increase their earning potential.

In addition to taking courses and attending events, individuals can also develop a valuable skillset by reading books and articles, watching videos, and participating in online communities. By staying informed and up-to-date with the latest developments in their field, individuals can increase their earning potential and achieve financial success.

Examples of valuable skillsets that can increase earning potential include programming languages like Python and Java, digital marketing skills like SEO and social media marketing, and creative skills like graphic design and writing. By developing these skillsets, individuals can increase their earning potential and achieve financial success.

Moreover, developing a valuable skillset can also increase job security and stability. In today’s fast-paced and competitive job market, having a valuable skillset can make all the difference in securing a high-paying job or attracting high-paying clients. By investing in personal development, individuals can increase their earning potential, achieve financial success, and enjoy a more stable and secure financial future.

In conclusion, developing a valuable skillset is essential for increasing earning potential and achieving financial success. By taking online courses, attending workshops and events, reading books and articles, and participating in online communities, individuals can acquire in-demand skills and boost their earning potential. Whether it’s programming, digital marketing, or creative skills, developing a valuable skillset can make all the difference in achieving financial success and enjoying a more stable and secure financial future.

Creating a Budget and Tracking Expenses: Taking Control of Finances

Creating a budget and tracking expenses is a crucial step in managing finances effectively and achieving financial success. For individuals seeking to earn $2000 a month, having a clear understanding of their financial situation is essential. By creating a budget and tracking expenses, individuals can identify areas where they can cut back, make adjustments, and optimize their financial resources.

A budget is a plan for how to allocate financial resources towards different expenses, such as rent, utilities, groceries, and entertainment. By creating a budget, individuals can prioritize their spending, make conscious financial decisions, and avoid overspending. A budget can be created using a spreadsheet, a budgeting app, or even just a piece of paper and a pen.

Tracking expenses is also an essential part of managing finances effectively. By tracking expenses, individuals can identify areas where they can cut back, make adjustments, and optimize their financial resources. Expenses can be tracked using a spreadsheet, a budgeting app, or even just a piece of paper and a pen.

Some tips for creating a budget that accounts for irregular income and expenses include:

- Identifying fixed expenses, such as rent and utilities, and prioritizing them

- Estimating variable expenses, such as groceries and entertainment, and allocating a budget for them

- Setting aside a portion of income for savings and emergency funds

- Reviewing and adjusting the budget regularly to ensure it is working effectively

Additionally, individuals can use the 50/30/20 rule as a guideline for allocating their income. This rule suggests that 50% of income should go towards fixed expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

By creating a budget and tracking expenses, individuals can take control of their finances, make conscious financial decisions, and achieve financial success. Whether it’s earning $2000 a month or achieving a different financial goal, having a clear understanding of one’s financial situation is essential.

In conclusion, creating a budget and tracking expenses is a crucial step in managing finances effectively and achieving financial success. By following the tips outlined above, individuals can create a budget that accounts for irregular income and expenses, and take control of their financial resources.

Building Multiple Income Streams: Diversifying Your Earnings

Building multiple income streams is a crucial step in achieving financial stability and security. By diversifying your earnings, you can reduce your reliance on a single income source and increase your overall earning potential. For individuals seeking to earn $2000 a month, building multiple income streams can help them achieve their financial goals and enjoy a more stable financial future.

One of the most effective ways to build multiple income streams is by investing in stocks or real estate. These investments can provide a steady stream of passive income, which can help supplement your primary income source. Additionally, investing in stocks or real estate can provide a hedge against inflation and market volatility, helping to protect your wealth over the long term.

Another way to build multiple income streams is by starting a side hustle or freelancing. This can provide an additional source of income, which can help supplement your primary income source. Additionally, starting a side hustle or freelancing can help you develop new skills and build your professional network, which can lead to new opportunities and increased earning potential.

Other ways to build multiple income streams include:

- Creating and selling digital products, such as ebooks or courses

- Participating in affiliate marketing or online surveys

- Renting out a spare room on Airbnb or renting out a vacation home

- Creating a mobile app or game

By building multiple income streams, individuals can reduce their reliance on a single income source and increase their overall earning potential. This can help them achieve their financial goals and enjoy a more stable financial future.

Additionally, building multiple income streams can provide a sense of security and peace of mind. By having multiple sources of income, individuals can feel more confident in their ability to meet their financial obligations and achieve their financial goals.

In conclusion, building multiple income streams is a crucial step in achieving financial stability and security. By diversifying your earnings and investing in stocks or real estate, starting a side hustle or freelancing, or creating and selling digital products, individuals can reduce their reliance on a single income source and increase their overall earning potential.

Staying Motivated and Focused: Overcoming Obstacles and Staying on Track

Staying motivated and focused is crucial for achieving financial success and earning $2000 a month. However, it can be challenging to maintain motivation and focus, especially when faced with obstacles and setbacks. In this section, we will discuss strategies for staying motivated and focused, including tips on how to overcome obstacles and stay on track.

One of the most effective ways to stay motivated and focused is by setting clear and achievable goals. By setting specific, measurable, and attainable goals, individuals can create a roadmap for success and stay motivated to achieve their objectives. Additionally, setting goals can help individuals prioritize their time and energy, ensuring that they are focusing on the most important tasks and activities.

Another way to stay motivated and focused is by creating a support system. Having a support system of friends, family, or colleagues can provide individuals with the encouragement and motivation they need to stay on track. Additionally, having a support system can provide individuals with a sounding board for ideas and a source of accountability, helping them to stay motivated and focused.

Overcoming obstacles is also an essential part of staying motivated and focused. When faced with obstacles, individuals can use problem-solving skills to overcome them. This can involve identifying the root cause of the obstacle, brainstorming solutions, and taking action to overcome the obstacle. Additionally, individuals can use positive self-talk and visualization techniques to stay motivated and focused, even in the face of obstacles.

Some additional tips for staying motivated and focused include:

- Breaking down large tasks into smaller, manageable chunks

- Creating a schedule and sticking to it

- Using productivity tools and apps to stay organized and focused

- Celebrating small wins and acknowledging progress

By following these tips and strategies, individuals can stay motivated and focused on earning $2000 a month. Remember, achieving financial success takes time, effort, and perseverance. By staying motivated and focused, individuals can overcome obstacles and achieve their financial goals.

In addition to these strategies, it’s also important to prioritize self-care and make time for activities that bring joy and fulfillment. By taking care of oneself and engaging in activities that bring happiness, individuals can maintain their motivation and focus, even in the face of challenges and obstacles.

Scaling Your Income: Strategies for Long-Term Growth

Once a consistent income stream of $2000 a month is established, the next step is to scale it for long-term growth. This involves continuously evaluating and improving business strategies to increase earning potential. One effective way to scale income is to increase prices. This can be achieved by offering premium services, creating high-ticket products, or providing exclusive experiences that justify higher prices. For instance, a freelance writer can offer high-end content creation services, such as ghostwriting or copywriting, to command higher rates.

Another strategy for scaling income is to expand services. This can involve offering complementary services, creating new products, or exploring new markets. For example, an online tutor can expand their services to include course creation, coaching, or consulting. This not only increases earning potential but also diversifies income streams. Additionally, exploring new markets can help tap into new customer bases, increasing revenue and growth potential.

Investing in technology and automation is also crucial for scaling income. This can involve using tools and software to streamline processes, automate tasks, and increase efficiency. For instance, a seller on an e-commerce platform can use automation tools to manage inventory, fulfill orders, and provide customer support. This not only saves time but also increases productivity and earning potential.

Furthermore, building strategic partnerships and collaborations can help scale income. This can involve partnering with other businesses, influencers, or experts to offer joint services, products, or experiences. For example, a freelance graphic designer can partner with a web developer to offer comprehensive branding services. This not only increases earning potential but also expands the customer base and increases credibility.

Lastly, continuously evaluating and improving business strategies is essential for scaling income. This involves monitoring finances, tracking progress, and making adjustments as needed. It’s also important to stay up-to-date with industry trends, best practices, and new technologies to stay ahead of the competition. By implementing these strategies, individuals can scale their income and achieve long-term financial success.

Maintaining a Work-Life Balance: Prioritizing Self-Care and Well-being

Achieving a sustainable income stream of $2000 a month requires more than just financial management; it also demands a healthy work-life balance. Neglecting self-care and well-being can lead to burnout, decreased productivity, and ultimately, a decline in income. It’s essential to prioritize activities that bring joy and fulfillment, ensuring a balanced lifestyle that supports long-term success.

One effective way to maintain a work-life balance is to set clear boundaries between work and personal life. This can involve establishing a dedicated workspace, setting regular working hours, and avoiding work-related activities during personal time. Additionally, scheduling time for self-care activities, such as exercise, meditation, or hobbies, can help reduce stress and increase overall well-being.

It’s also crucial to recognize the importance of taking breaks and practicing self-compassion. Taking short breaks throughout the day can help recharge energy levels and improve focus, while practicing self-compassion can help manage stress and anxiety. This can involve treating oneself with kindness, acknowledging accomplishments, and reframing negative self-talk.

Furthermore, building a support network of family, friends, and colleagues can provide a sense of community and help share the workload. This can involve delegating tasks, seeking advice, or simply having someone to talk to. Having a support system can help reduce feelings of isolation and increase motivation, ultimately contributing to a more sustainable income stream.

In addition, prioritizing activities that bring joy and fulfillment can help increase motivation and overall well-being. This can involve pursuing hobbies, learning new skills, or volunteering for causes that align with personal values. By incorporating activities that bring joy and fulfillment, individuals can maintain a positive outlook and increase their resilience to challenges.

Lastly, recognizing the signs of burnout and taking proactive steps to prevent it is essential for maintaining a work-life balance. This can involve monitoring energy levels, recognizing patterns of negative self-talk, and seeking help when needed. By prioritizing self-care and well-being, individuals can reduce the risk of burnout and maintain a sustainable income stream of $2000 a month.