Setting the Foundation for Success: Mindset and Goal-Setting

When it comes to earning your first million, having a clear mindset and setting specific, achievable goals are crucial for success. A positive mindset and well-defined objectives can help drive motivation and focus, enabling individuals to overcome obstacles and stay committed to their financial goals. By adopting a growth mindset and setting SMART (Specific, Measurable, Achievable, Relevant, and Time-bound) goals, individuals can create a roadmap for achieving financial freedom.

Research has shown that individuals who set clear goals are more likely to achieve success than those who do not. By setting specific goals, such as earning a certain amount of money or achieving a specific level of financial independence, individuals can create a sense of direction and purpose. Additionally, breaking down larger goals into smaller, manageable tasks can help make the process feel less overwhelming and more achievable.

Moreover, having a positive mindset is essential for overcoming the inevitable setbacks and challenges that arise when working towards a goal. By cultivating a growth mindset and focusing on progress rather than perfection, individuals can develop the resilience and determination needed to stay on track. As the saying goes, “believe you can and you’re halfway there.” By adopting a positive mindset and setting clear goals, individuals can set themselves up for success and make significant progress towards earning their first million.

So, how can you set yourself up for success and start working towards your goal of earning your first million? Start by taking some time to reflect on your values and goals. What is driving your desire to earn a million dollars? Is it to achieve financial independence, to provide for your family, or to pursue your passions? Once you have a clear understanding of your motivations, you can start setting specific, achievable goals that align with your values.

Remember, earning your first million is not just about the money; it’s about the freedom and opportunities that come with it. By adopting a positive mindset and setting clear goals, you can create a roadmap for achieving financial freedom and start working towards a brighter financial future.

Understanding the Power of Compound Interest: Investing for Growth

Compound interest is a powerful tool for growing wealth over time, and it can be a key component of a successful strategy for earning your first million. By understanding how compound interest works and leveraging it through smart investing, individuals can potentially earn significant returns on their investments and accelerate their progress towards financial freedom.

Compound interest is the process of earning interest on both the principal amount and any accrued interest over time. This can create a snowball effect, where small, consistent investments can grow into substantial sums over the long term. For example, if an individual invests $1,000 per year for 10 years, earning an average annual return of 7%, they can potentially earn over $13,000 in interest alone, bringing their total balance to over $23,000.

So, how can you harness the power of compound interest to help you earn your first million? One strategy is to invest in dividend-paying stocks, which can provide a regular stream of income and potentially lower volatility. Another approach is to invest in real estate, which can provide a tangible asset and potentially higher returns over the long term. Additionally, individuals can consider investing in index funds or ETFs, which can provide broad diversification and potentially lower fees.

It’s also important to note that compound interest can work against you if you’re not careful. For example, if you have high-interest debt, such as credit card balances, the compound interest can quickly add up and make it difficult to pay off the principal amount. Therefore, it’s essential to prioritize debt repayment and focus on building wealth through smart investing.

When it comes to investing for growth, it’s essential to have a long-term perspective and avoid getting caught up in short-term market fluctuations. By staying disciplined and focused on your goals, you can potentially earn significant returns on your investments and make progress towards earning your first million. Remember, compound interest is a powerful tool, but it requires patience, discipline, and a well-thought-out investment strategy.

By incorporating compound interest into your investment strategy, you can potentially accelerate your progress towards financial freedom and earn your first million. Whether you’re investing in stocks, real estate, or other assets, understanding the power of compound interest can help you make informed decisions and achieve your long-term goals.

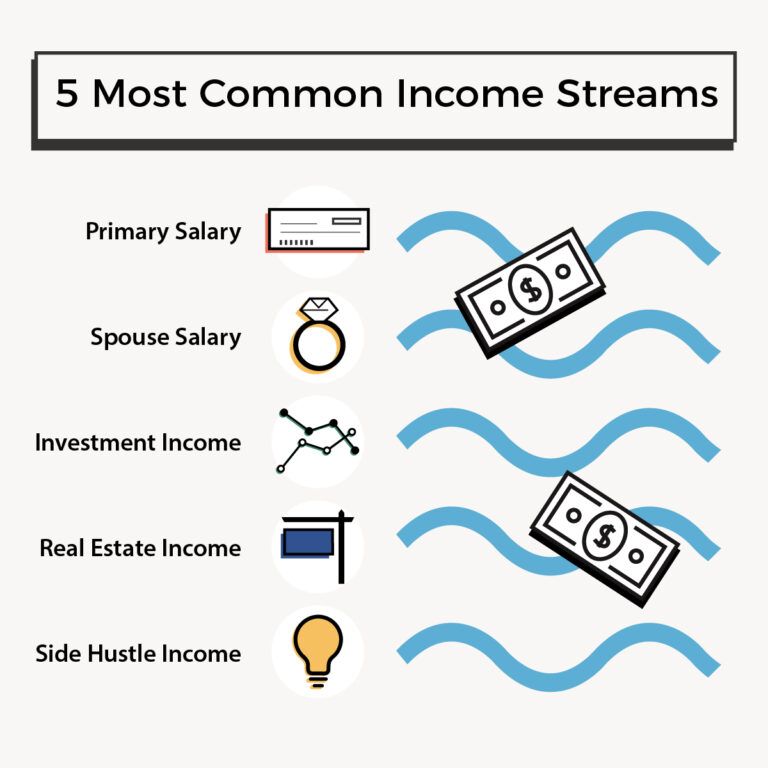

Building Multiple Income Streams: Diversifying Your Earnings

Having multiple income streams is a crucial aspect of achieving financial freedom and earning your first million. By diversifying your earnings, you can reduce your reliance on a single source of income and create a more stable financial foundation. This can also help you to weather financial storms and take advantage of new opportunities as they arise.

There are many different types of income streams that you can create, depending on your skills, interests, and resources. Some examples include starting a side business, investing in stocks or real estate, or generating passive income through online platforms. You can also create income streams through freelancing, consulting, or coaching, or by creating and selling digital products.

One of the key benefits of having multiple income streams is that it can help you to achieve financial independence. By having a diverse range of income sources, you can reduce your reliance on a single job or income source and create a more stable financial foundation. This can also give you the freedom to pursue your passions and interests, rather than just working for a paycheck.

Another benefit of having multiple income streams is that it can help you to build wealth over time. By investing in assets that generate passive income, such as real estate or dividend-paying stocks, you can create a steady stream of income that can help you to build wealth over time. You can also use your income streams to invest in other assets, such as businesses or real estate, which can help you to build even more wealth.

So, how can you start building multiple income streams and achieving financial freedom? The first step is to identify your skills and interests and think about how you can monetize them. You can also start by investing in assets that generate passive income, such as real estate or dividend-paying stocks. Additionally, you can start a side business or freelance in your spare time to create an additional income stream.

Remember, building multiple income streams takes time and effort, but it can be a key component of achieving financial freedom and earning your first million. By diversifying your earnings and creating a stable financial foundation, you can set yourself up for long-term financial success and achieve your goals.

By having multiple income streams, you can also reduce your financial stress and anxiety, and have more freedom to pursue your passions and interests. You can also use your income streams to invest in other assets, such as businesses or real estate, which can help you to build even more wealth.

Minimizing Debt and Maximizing Savings: Managing Your Finances Effectively

Managing your finances effectively is a crucial step in achieving financial freedom and earning your first million. By minimizing debt and maximizing savings, you can create a stable financial foundation and set yourself up for long-term success. In this article, we will discuss the importance of managing your finances effectively and provide tips on how to minimize debt and maximize savings.

Debt can be a major obstacle to achieving financial freedom. High-interest debt, such as credit card balances, can quickly add up and make it difficult to pay off the principal amount. To minimize debt, it’s essential to create a budget and prioritize debt repayment. Consider consolidating high-interest debt into a lower-interest loan or balance transfer credit card, and make regular payments to pay off the principal amount.

Maximizing savings is also crucial for achieving financial freedom. By saving a portion of your income each month, you can build an emergency fund and create a cushion against financial shocks. Consider setting up automatic transfers from your checking account to your savings or investment accounts, and take advantage of tax-advantaged savings vehicles such as 401(k) or IRA accounts.

Creating a budget is also essential for managing your finances effectively. By tracking your income and expenses, you can identify areas where you can cut back and allocate more funds towards savings and debt repayment. Consider using the 50/30/20 rule, where 50% of your income goes towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

Another key aspect of managing your finances effectively is to avoid lifestyle inflation. As your income increases, it’s tempting to inflate your lifestyle by spending more on luxuries and comforts. However, this can quickly erode your savings and make it difficult to achieve financial freedom. Instead, consider directing excess funds towards savings and debt repayment, and prioritize long-term financial goals over short-term indulgences.

By minimizing debt and maximizing savings, you can create a stable financial foundation and set yourself up for long-term success. Remember, achieving financial freedom and earning your first million requires discipline, patience, and a well-thought-out plan. By following these tips and staying committed to your goals, you can achieve financial freedom and live the life you’ve always wanted.

Additionally, consider taking advantage of tax-advantaged savings vehicles, such as 401(k) or IRA accounts, to maximize your savings and reduce your tax liability. You can also consider working with a financial advisor to create a personalized financial plan that takes into account your unique financial goals and circumstances.

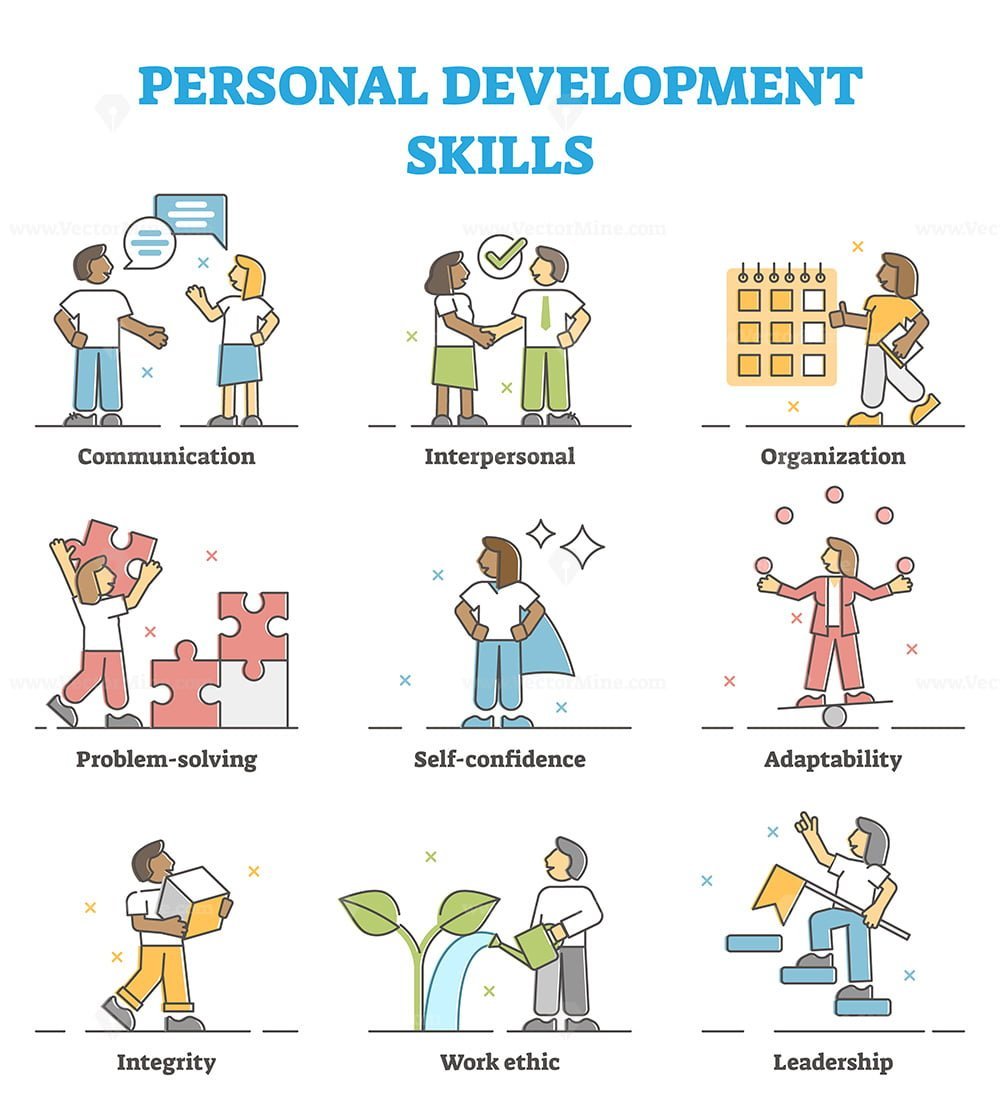

Developing Valuable Skills: Investing in Your Education and Personal Growth

Investing in your education and personal growth is a crucial step in achieving financial freedom and earning your first million. By developing valuable skills, such as coding, writing, or design, you can increase your earning potential and open up new opportunities. In this article, we will discuss the importance of investing in your education and personal growth and provide tips on how to get started.

Developing valuable skills can help you to stand out in a competitive job market and increase your earning potential. For example, learning to code can open up opportunities in the tech industry, while developing writing or design skills can help you to succeed in creative fields. Additionally, investing in your education and personal growth can help you to stay ahead of the curve and adapt to changing industry trends.

So, how can you get started with investing in your education and personal growth? One way is to take online courses or attend workshops and conferences in your field. This can help you to learn new skills and stay up-to-date with the latest industry trends. You can also consider pursuing a degree or certification in a field that interests you, such as business, technology, or healthcare.

Another way to invest in your education and personal growth is to read books and articles related to your field. This can help you to stay informed and learn new skills, and can also help you to develop a deeper understanding of your industry. You can also consider joining online communities or networking groups to connect with others in your field and learn from their experiences.

In addition to developing valuable skills, investing in your education and personal growth

Developing Valuable Skills: Investing in Your Education and Personal Growth

Investing in your education and personal growth is a crucial step in achieving financial freedom and earning your first million. By developing valuable skills, such as coding, writing, or design, you can increase your earning potential and open up new opportunities. In this article, we will discuss the importance of investing in your education and personal growth and provide tips on how to get started.

Developing valuable skills can help you to stand out in a competitive job market and increase your earning potential. For example, learning to code can open up opportunities in the tech industry, while developing writing or design skills can help you to succeed in creative fields. Additionally, investing in your education and personal growth can help you to stay ahead of the curve and adapt to changing industry trends.

So, how can you get started with investing in your education and personal growth? One way is to take online courses or attend workshops and conferences in your field. This can help you to learn new skills and stay up-to-date with the latest industry trends. You can also consider pursuing a degree or certification in a field that interests you, such as business, technology, or healthcare.

Another way to invest in your education and personal growth is to read books and articles related to your field. This can help you to stay informed and learn new skills, and can also help you to develop a deeper understanding of your industry. You can also consider joining online communities or networking groups to connect with others in your field and learn from their experiences.

In addition to developing valuable skills, investing in your education and personal growth

Developing Valuable Skills: Investing in Your Education and Personal Growth

Investing in your education and personal growth is a crucial step in achieving financial freedom and earning your first million. By developing valuable skills, such as coding, writing, or design, you can increase your earning potential and open up new opportunities. In this article, we will discuss the importance of investing in your education and personal growth and provide tips on how to get started.

Developing valuable skills can help you to stand out in a competitive job market and increase your earning potential. For example, learning to code can open up opportunities in the tech industry, while developing writing or design skills can help you to succeed in creative fields. Additionally, investing in your education and personal growth can help you to stay ahead of the curve and adapt to changing industry trends.

So, how can you get started with investing in your education and personal growth? One way is to take online courses or attend workshops and conferences in your field. This can help you to learn new skills and stay up-to-date with the latest industry trends. You can also consider pursuing a degree or certification in a field that interests you, such as business, technology, or healthcare.

Another way to invest in your education and personal growth is to read books and articles related to your field. This can help you to stay informed and learn new skills, and can also help you to develop a deeper understanding of your industry. You can also consider joining online communities or networking groups to connect with others in your field and learn from their experiences.

In addition to developing valuable skills, investing in your education and personal growth

Developing Valuable Skills: Investing in Your Education and Personal Growth

Investing in your education and personal growth is a crucial step in achieving financial freedom and earning your first million. By developing valuable skills, such as coding, writing, or design, you can increase your earning potential and open up new opportunities. In this article, we will discuss the importance of investing in your education and personal growth and provide tips on how to get started.

Developing valuable skills can help you to stand out in a competitive job market and increase your earning potential. For example, learning to code can open up opportunities in the tech industry, while developing writing or design skills can help you to succeed in creative fields. Additionally, investing in your education and personal growth can help you to stay ahead of the curve and adapt to changing industry trends.

So, how can you get started with investing in your education and personal growth? One way is to take online courses or attend workshops and conferences in your field. This can help you to learn new skills and stay up-to-date with the latest industry trends. You can also consider pursuing a degree or certification in a field that interests you, such as business, technology, or healthcare.

Another way to invest in your education and personal growth is to read books and articles related to your field. This can help you to stay informed and learn new skills, and can also help you to develop a deeper understanding of your industry. You can also consider joining online communities or networking groups to connect with others in your field and learn from their experiences.

In addition to developing valuable skills, investing in your education and personal growth