Lost and Found: The Importance of Tracking Down Old 401k Accounts

For many individuals, retirement savings are a crucial aspect of their financial security. However, it’s not uncommon for people to lose track of their 401k accounts, especially after changing jobs or companies. In fact, it’s estimated that millions of dollars in unclaimed 401k funds are left behind each year. Finding old 401k accounts can be a daunting task, but it’s essential to reclaim these lost funds to maximize retirement savings. By understanding the importance of tracking down old 401k accounts, individuals can take the first step towards securing their financial future.

The consequences of leaving old 401k accounts unclaimed can be significant. Not only can it result in lost retirement savings, but it can also lead to missed investment opportunities and reduced financial security. Furthermore, unclaimed 401k accounts can be subject to escheatment, where the funds are turned over to the state, making it even more challenging to recover them. By taking proactive steps to find old 401k accounts, individuals can avoid these consequences and ensure that their retirement savings are working for them.

Fortunately, finding old 401k accounts for free is a feasible task. With the right strategies and resources, individuals can track down their lost accounts and reclaim their retirement savings. In this article, we’ll provide a comprehensive guide on how to find old 401k accounts for free, including steps to review old pay stubs and employment records, utilize online resources and databases, and contact former employers and plan administrators.

Why Old 401k Accounts Go Missing in the First Place

Old 401k accounts can become lost or forgotten due to various reasons. One of the most common causes is job changes. When individuals switch jobs, they may forget to take their 401k accounts with them or may not know how to manage their accounts after leaving their previous employer. Company mergers and acquisitions can also lead to lost 401k accounts, as plan administrators and account information may change during the transition.

Another reason why old 401k accounts go missing is the lack of organization and record-keeping. Many individuals may not keep track of their account information, including account numbers, plan administrators, and login credentials. This can make it challenging to locate old 401k accounts, especially if the individual has changed jobs or moved to a new location.

Additionally, the complexity of 401k plans can also contribute to lost accounts. With various plan options, investment choices, and administrative fees, it can be overwhelming for individuals to manage their accounts effectively. As a result, old 401k accounts may be left behind, and individuals may not even realize that they have unclaimed retirement savings.

Fortunately, finding old 401k accounts for free is possible, and it starts with understanding why these accounts become lost in the first place. By recognizing the common reasons for lost 401k accounts, individuals can take proactive steps to locate their missing accounts and reclaim their retirement savings.

How to Find Old 401k Accounts for Free: A Comprehensive Approach

Finding old 401k accounts can be a daunting task, but it’s essential to reclaim these lost funds to maximize retirement savings. Fortunately, it’s possible to find old 401k accounts for free, without incurring costs or hiring a professional service. In this article, we’ll provide a step-by-step guide on how to find old 401k accounts for free, including reviewing old pay stubs and employment records, utilizing online resources and databases, and contacting former employers and plan administrators.

Our comprehensive approach will cover the following steps:

Step 1: Review Your Old Pay Stubs and Employment Records – We’ll show you how to gather information about past 401k accounts, including account numbers and plan administrators.

Step 2: Utilize Online Resources and Databases – We’ll discuss online resources and databases that can help you find old 401k accounts, such as the National Registry of Unclaimed Retirement Benefits or the Department of Labor’s Employee Benefits Security Administration website.

Step 3: Contact Former Employers and Plan Administrators – We’ll offer advice on how to reach out to former employers and plan administrators to inquire about old 401k accounts, including sample scripts and email templates.

Step 4: Consider Hiring a Professional Service (Optional) – We’ll explain the option of hiring a professional service to help locate old 401k accounts, including the potential benefits and drawbacks of this approach.

By following these steps, you’ll be able to find old 401k accounts for free and take the first step towards securing your financial future. Let’s get started!

Step 1: Review Your Old Pay Stubs and Employment Records

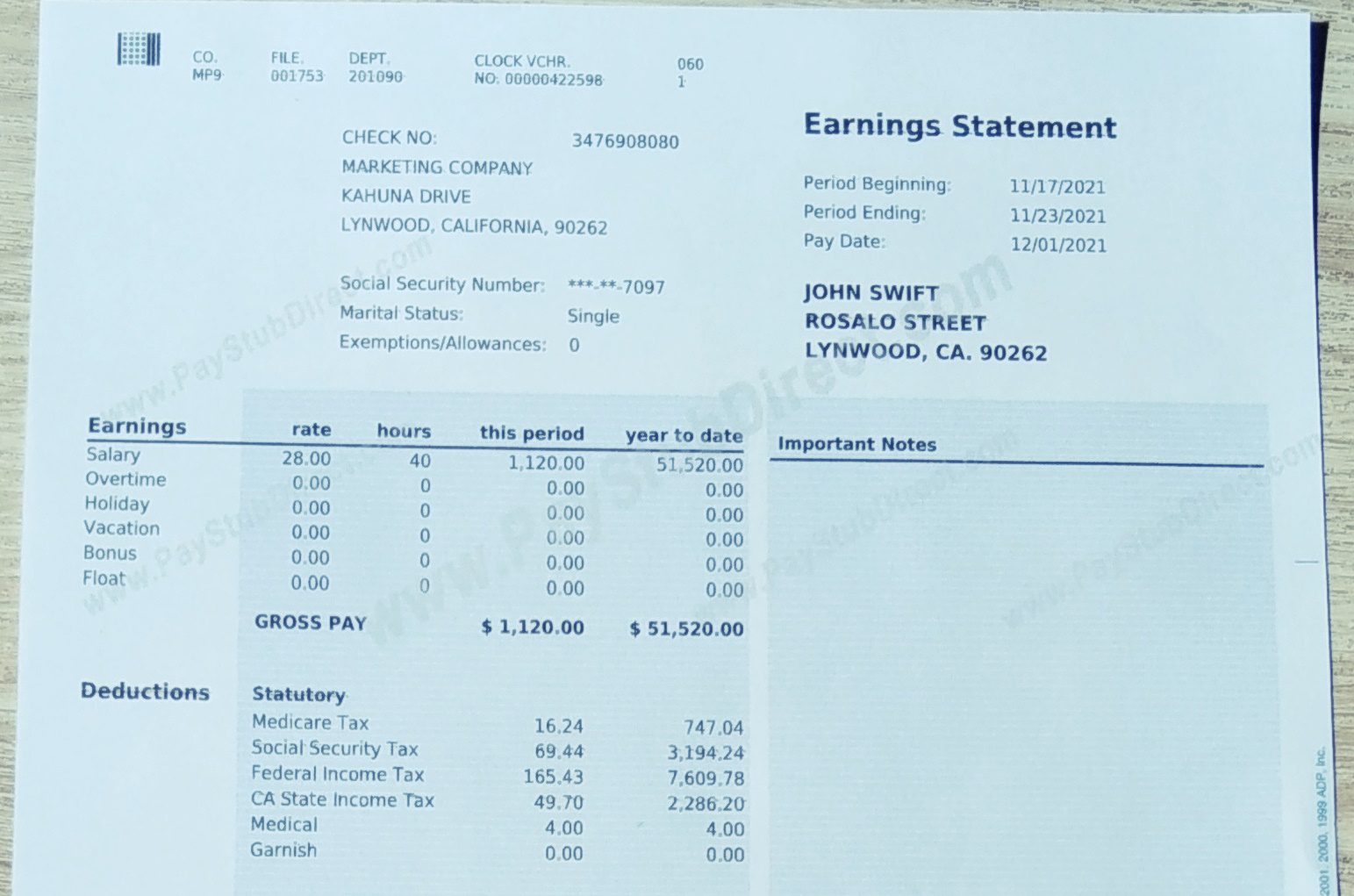

Reviewing old pay stubs and employment records is a crucial step in finding old 401k accounts. These documents often contain valuable information about past 401k accounts, including account numbers, plan administrators, and contribution amounts. To start, gather all your old pay stubs and employment records, including W-2 forms, 1099 forms, and any other relevant documents.

Next, carefully review each document to identify any information related to your 401k accounts. Look for account numbers, plan administrators, and contribution amounts. Make a note of any relevant information you find, including the name of the plan administrator, the account number, and the contribution amount.

It’s also a good idea to check your old employment records for any information about your 401k accounts. Your HR department or former employer may have records of your 401k account, including account numbers and plan administrators. Don’t hesitate to reach out to your former employer or HR department to request this information.

By reviewing your old pay stubs and employment records, you can gather valuable information about your past 401k accounts and take the first step towards finding your old 401k accounts for free. Remember to keep all your documents and notes organized, as you’ll need this information for the next steps in the process.

Step 2: Utilize Online Resources and Databases

Utilizing online resources and databases is a crucial step in finding old 401k accounts. There are several online resources and databases that can help individuals locate their old 401k accounts, including the National Registry of Unclaimed Retirement Benefits and the Department of Labor’s Employee Benefits Security Administration website.

The National Registry of Unclaimed Retirement Benefits is a free online database that allows individuals to search for unclaimed retirement benefits, including 401k accounts. To use this database, simply enter your name and state of residence, and the database will search for any unclaimed retirement benefits in your name.

The Department of Labor’s Employee Benefits Security Administration website also provides a wealth of information on finding old 401k accounts. This website includes a database of abandoned 401k plans, as well as a tool to help individuals search for their old 401k accounts.

In addition to these online resources, there are also several other databases and websites that can help individuals find old 401k accounts. These include the Pension Benefit Guaranty Corporation (PBGC) website and the Social Security Administration (SSA) website.

By utilizing these online resources and databases, individuals can increase their chances of finding their old 401k accounts and taking the first step towards securing their financial future. Remember to always verify the accuracy of any information found online, and to follow up with any leads or potential matches.

Step 3: Contact Former Employers and Plan Administrators

Contacting former employers and plan administrators is a crucial step in finding old 401k accounts. This step can help individuals gather more information about their old 401k accounts, including account balances, investment options, and contact information for the plan administrator.

To contact former employers and plan administrators, individuals can start by searching for their old employer’s contact information online or through their HR department. They can also check their old pay stubs and employment records for contact information for the plan administrator.

When reaching out to former employers and plan administrators, individuals should be prepared to provide their name, Social Security number, and any other identifying information that may be required to verify their identity. They should also be prepared to ask specific questions about their old 401k account, such as the account balance, investment options, and any fees associated with the account.

Here is a sample script that individuals can use when contacting former employers and plan administrators:

“Hello, my name is [Name] and I am trying to locate my

Step 4: Consider Hiring a Professional Service (Optional)

If you’re having trouble finding your old 401k account on your own, you may want to consider hiring a professional service to help you locate it. There are several companies that specialize in helping individuals find lost or forgotten 401k accounts.

These companies typically use advanced search techniques and have access to proprietary databases to help locate old 401k accounts. They may also be able to provide additional services, such as account consolidation and rollover assistance.

However, it’s essential to note that hiring a professional service may come with a cost. Some companies may charge a flat fee or a percentage of the account balance, so it’s crucial to carefully review the terms and conditions before hiring a service.

Additionally, it’s also important to research the company thoroughly to ensure they are reputable and have a good track record of success. You can check online reviews, ask for referrals, and verify their credentials before making a decision.

Some benefits of hiring a professional service include:

– Expertise: Professional services have the knowledge and experience to help you locate your old 401k account quickly and efficiently.

– Time-saving: Let the professionals handle the search, so you can focus on other important tasks.

– Convenience: Many professional services offer online platforms and mobile apps, making it easy to access your account information and track your progress.

However, there are also some potential drawbacks to consider:

– Cost: Hiring a professional service may come with a cost, which could eat into your retirement savings.

– Risk: There is always a risk of scams or unscrupulous companies, so it’s essential to do your research and choose a reputable service.

Ultimately, whether or not to hire a professional service is up to you. If you’re having trouble finding your old 401k account on your own, it may be worth considering. However, if you’re able to find your account using the steps outlined in this article, you may be able to save money and avoid the potential risks associated with hiring a professional service.

What to Do Once You’ve Found Your Old 401k Account

Once you’ve located your old 401k account, you’ll need to decide what to do with it. You have several options, including consolidating accounts, rolling over funds, or leaving the account as is.

Consolidating accounts can be a good option if you have multiple 401k accounts from previous employers. By consolidating your accounts, you can simplify your retirement savings and make it easier to manage your investments.

Rolling over funds is another option. You can roll over your old 401k account into a new employer’s 401k plan or into an IRA. This can be a good option if you want to take control of your investments and have more flexibility in your retirement savings.

Leaving the account as is may also be an option. If you’re happy with the investment options and fees associated with your old 401k account, you may choose to leave it as is. However, it’s essential to review the account regularly to ensure it’s still aligned with your retirement goals.

Regardless of which option you choose, it’s crucial to review the account’s investment options, fees, and terms to ensure it’s still aligned with your retirement goals. You may also want to consider consulting with a financial advisor to determine the best course of action for your specific situation.

By taking control of your old 401k account, you can ensure that your retirement savings are working for you and help you achieve your long-term financial goals.