Exploring Urgent Financial Needs: Why You Might Need $10,000 Quickly

Life is full of unexpected twists and turns, and sometimes, these surprises can come with a hefty price tag. Medical emergencies, car repairs, and unexpected expenses can arise at any moment, leaving individuals scrambling to come up with a large sum of money quickly. In situations like these, having a plan in place can be the difference between financial stability and disaster. Knowing how to get 10 thousand dollars fast can be a lifesaver, providing a much-needed safety net during times of crisis.

For instance, a sudden medical emergency can result in a mountain of bills, from hospital stays to surgical procedures. In such cases, having access to a quick $10,000 can help cover these expenses, reducing the financial burden on the individual and their loved ones. Similarly, car repairs can be a significant expense, especially if the vehicle is essential for daily commutes or work. Having a plan to secure a quick $10,000 can help get the car back on the road, minimizing the disruption to daily life.

Unexpected expenses, such as home repairs or appliance replacements, can also arise at any moment. In these situations, having a plan to access a large sum of money quickly can help mitigate the financial impact. By understanding the importance of having a plan in place, individuals can take the first step towards securing their financial future and avoiding the stress and anxiety that comes with unexpected expenses.

So, why is it essential to have a plan to get 10 thousand dollars fast? The answer lies in the unpredictability of life. By being prepared for the unexpected, individuals can reduce their financial stress and anxiety, ensuring that they are better equipped to handle life’s surprises. In the following sections, we will explore various strategies for securing a quick $10,000, providing individuals with the knowledge and tools they need to achieve financial stability and peace of mind.

Assessing Your Financial Situation: Understanding Your Options

To determine the best course of action for securing a quick $10,000, it’s essential to evaluate your current financial situation. This involves taking a close look at your income, expenses, debts, and savings. By understanding your financial health, you can identify areas for improvement and make informed decisions about how to get 10 thousand dollars fast.

Start by gathering all relevant financial documents, including pay stubs, bank statements, and credit card bills. Next, categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies). This will help you identify areas where you can cut back and allocate funds towards more pressing needs.

Assess your debt situation, including credit card balances, loans, and mortgages. Consider consolidating debt into a single, lower-interest loan or balance transfer credit card. This can help simplify your finances and reduce monthly payments.

Evaluate your savings and emergency fund. Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account. This fund will provide a cushion in case of unexpected expenses or financial setbacks.

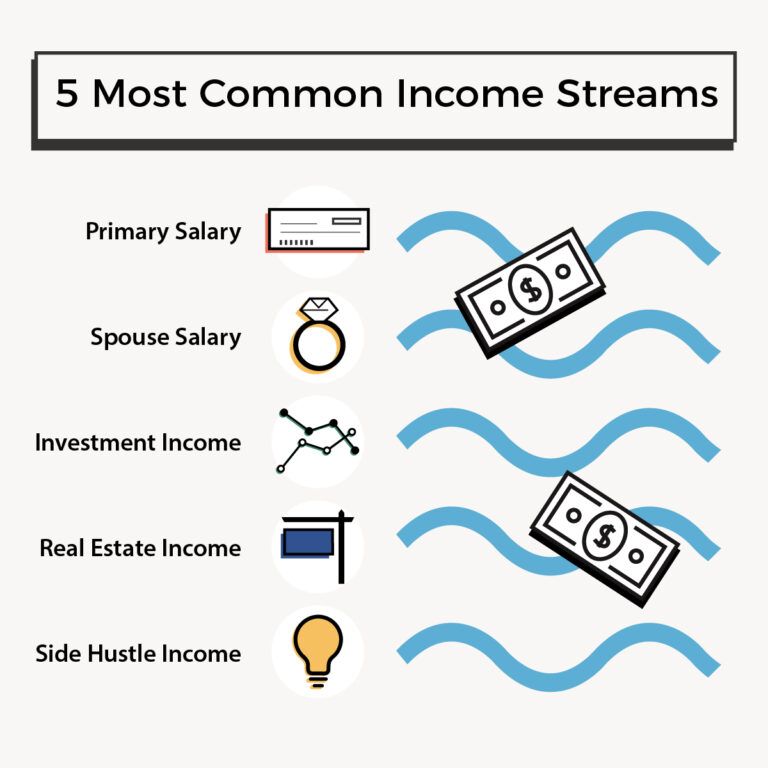

Consider your income and explore ways to increase it. This could involve taking on a side job, asking for a raise at work, or pursuing additional education or training. By boosting your income, you can accelerate your savings and debt repayment.

Once you have a clear understanding of your financial situation, you can begin to explore options for securing a quick $10,000. This might involve selling unwanted assets, freelancing, or participating in the gig economy. By taking a proactive approach to your finances, you can make informed decisions and achieve your financial goals.

Remember, getting 10 thousand dollars fast requires a combination of financial discipline, creativity, and hard work. By assessing your financial situation and exploring your options, you can set yourself up for success and achieve financial freedom.

Selling Unwanted Assets: A Quick Way to Raise Capital

Selling unwanted assets is a viable option to raise a quick $10,000. This approach requires minimal effort and can generate a substantial amount of money in a short period. To get started, take stock of your possessions and identify items that are no longer needed or used. This could include cars, jewelry, electronics, furniture, or even collectibles.

Determine the value of your assets by researching their market worth. Utilize online platforms like eBay, Craigslist, or Facebook Marketplace to gauge the demand and prices of similar items. You can also consult with experts, such as appraisers or dealers, to get a more accurate estimate of your assets’ value.

Once you have determined the value of your assets, decide where to sell them. Online marketplaces like eBay, Amazon, or specialized platforms like Poshmark or Decluttr can be a great way to reach a wide audience. You can also consider hosting a yard sale, garage sale, or auction to get rid of multiple items at once.

When selling unwanted assets, be prepared to negotiate prices and be flexible. Consider offering bundle deals or discounts to attract more buyers. Additionally, be transparent about the condition and history of your items to build trust with potential buyers.

Some popular platforms to sell unwanted assets include:

- eBay: A popular online marketplace for buying and selling new and used goods.

- Craigslist: A widely-used platform for buying and selling items locally.

- Facebook Marketplace: A convenient platform to buy and sell items within your local community.

- Poshmark: A social commerce platform for buying and selling gently used clothing and accessories.

- Decluttr: A website and app for selling CDs, DVDs, games, and electronics.

By selling unwanted assets, you can quickly raise a significant amount of money to address urgent financial needs. Remember to stay organized, be patient, and be prepared to negotiate to get the best possible price for your items. With the right strategy, you can turn your unwanted assets into a quick $10,000.

Freelancing and Gig Economy: Monetizing Your Skills

Freelancing and participating in the gig economy can be a lucrative way to earn a quick $10,000. With the rise of online platforms, it’s easier than ever to monetize your skills and connect with clients. Whether you’re a writer, designer, developer, or driver, there’s a platform out there that can help you get started.

Popular platforms like Upwork, Fiverr, and Freelancer offer a range of opportunities for freelancers to find work. These platforms allow you to create a profile, showcase your skills, and bid on projects that match your expertise. You can also use platforms like Uber, Lyft, or DoorDash to make money as a driver.

To get started, identify your strengths and skills. What are you good at? What services can you offer? Create a profile on the platforms that align with your skills, and start applying for jobs or gigs. Be sure to highlight your experience, skills, and achievements in your profile and proposals.

Some popular freelance platforms include:

- Upwork: A platform for freelancers to find work in categories like writing, design, programming, and more.

- Fiverr: A platform for freelancers to offer services starting at $5 per gig.

- Freelancer: A platform for freelancers to compete for projects in categories like design, programming, and more.

- Uber: A platform for drivers to make money by transporting passengers.

- Lyft: A platform for drivers to make money by transporting passengers.

- DoorDash: A platform for drivers to make money by delivering food.

When freelancing or participating in the gig economy, be prepared to work hard and be flexible. You may need to work irregular hours, take on multiple projects, or adapt to changing client needs. However, with the right mindset and skills, you can earn a quick $10,000 and achieve financial freedom.

Additionally, consider the following tips to succeed in freelancing and the gig economy:

- Set clear rates and expectations with clients.

- Deliver high-quality work to build your reputation.

- Be proactive and responsive to client needs.

- Continuously develop your skills to stay competitive.

By monetizing your skills and participating in the gig economy, you can earn a quick $10,000 and take the first step towards financial freedom. Remember to stay focused, work hard, and be patient, and you’ll be on your way to achieving your financial goals.

Borrowing from Friends and Family: A Last Resort Option

Borrowing from friends and family can be a viable option to raise a quick $10,000, but it should be considered a last resort. This approach can be beneficial in emergency situations, but it’s essential to approach it with caution and respect for the lender’s financial situation.

Before borrowing from friends and family, consider the potential risks and consequences. Borrowing from loved ones can strain relationships, especially if repayment terms are not clearly defined or if the borrower is unable to repay the loan. It’s crucial to set clear expectations and repayment terms to avoid any misunderstandings or conflicts.

To borrow from friends and family effectively, follow these guidelines:

- Be transparent about your financial situation and the reason for the loan.

- Set clear repayment terms, including the amount, interest rate, and repayment schedule.

- Put the agreement in writing to avoid any misunderstandings.

- Make timely repayments to maintain trust and respect.

Some benefits of borrowing from friends and family include:

- Lower interest rates compared to traditional lenders.

- Flexible repayment terms.

- No credit checks or collateral requirements.

However, there are also potential drawbacks to consider:

- Strained relationships if repayment terms are not met.

- Lack of formal agreement or contract.

- No clear consequences for non-repayment.

Before borrowing from friends and family, explore other options, such as selling unwanted assets, freelancing, or participating in the gig economy. If borrowing from loved ones is the only viable option, ensure that you approach the situation with respect, transparency, and a clear plan for repayment.

Remember, borrowing from friends and family should be a last resort. It’s essential to prioritize your financial health and explore alternative options to avoid putting a strain on your relationships.

Participating in Online Surveys and Gig Work: A Supplemental Income Stream

Participating in online surveys and gig work can be a viable option to earn a supplemental income and get closer to your goal of how to get 10 thousand dollars fast. This approach requires minimal effort and can be done in your spare time. With the rise of online platforms, it’s easier than ever to find opportunities to earn extra money.

Popular platforms like Swagbucks, Survey Junkie, and Vindale Research offer a range of opportunities to earn money through online surveys, gig work, and other activities. These platforms allow you to create a profile, complete surveys, and participate in gig work to earn rewards and cash.

To get started, sign up for the platforms that align with your interests and skills. Complete your profile, and start applying for surveys and gig work that match your demographics and expertise. Be sure to read the terms and conditions of each platform to understand the rewards and payment structures.

Some benefits of participating in online surveys and gig work include:

- Flexibility to work on your own schedule.

- Opportunity to earn extra money in your spare time.

- No experience or skills required.

- Low commitment and risk.

However, there are also potential drawbacks to consider:

- Low earning potential compared to other options.

- Time-consuming and may require a significant amount of time to earn substantial rewards.

- May require a strong internet connection and computer or mobile device.

To maximize your earnings, consider the following tips:

- Sign up for multiple platforms to increase your opportunities.

- Complete your profile fully to increase your chances of being selected for surveys and gig work.

- Be proactive and apply for opportunities regularly.

- Take advantage of bonus and referral programs to increase your earnings.

While participating in online surveys and gig work may not make you rich quickly, it can be a viable option to earn a supplemental income and get closer to your goal of how to get 10 thousand dollars fast. Remember to stay patient, persistent, and flexible, and you’ll be on your way to earning extra money in your spare time.

Creating and Selling a Product or Service: A More Sustainable Option

Creating and selling a product or service can be a more sustainable option to earn a quick $10,000 and achieve long-term financial success. This approach requires effort and dedication, but it can provide a steady income stream and help you build a valuable skill set.

To get started, identify your strengths and passions. What are you good at? What do you enjoy doing? Create a product or service that leverages your skills and expertise, and solves a problem or meets a need in the market.

Some popular options for creating and selling a product or service include:

- Handmade goods, such as jewelry, crafts, or artwork.

- Consulting services, such as coaching, mentoring, or strategy development.

- Digital products, such as ebooks, courses, or software.

- Service-based businesses, such as pet-sitting, house-sitting, or lawn care.

To create a marketable product or service, consider the following tips:

- Conduct market research to understand your target audience and their needs.

- Develop a unique value proposition that sets your product or service apart from the competition.

- Create a high-quality product or service that meets the needs of your target audience.

- Develop a marketing strategy to reach your target audience and promote your product or service.

Some benefits of creating and selling a product or service include:

- Potential for high earnings and scalability.

- Opportunity to build a valuable skill set and expertise.

- Flexibility to work on your own schedule and terms.

- Potential for long-term financial success and stability.

However, there are also potential drawbacks to consider:

- Requires effort and dedication to create a high-quality product or service.

- May require a significant upfront investment of time and money.

- May involve risk and uncertainty, especially in the early stages.

To succeed in creating and selling a product or service, stay focused, persistent, and patient. Continuously evaluate and improve your product or service, and be willing to adapt to changes in the market. With the right mindset and strategy, you can create a successful and sustainable business that helps you achieve your financial goals.

Staying Disciplined and Patient: The Key to Long-Term Financial Success

Staying disciplined and patient is crucial when working towards long-term financial goals, including how to get 10 thousand dollars fast. It’s easy to get caught up in the excitement of quick fixes and get-rich-quick schemes, but these approaches often lead to financial instability and disappointment.

Creating a budget and saving regularly are essential steps towards achieving financial stability. A budget helps you track your income and expenses, identify areas for improvement, and make informed financial decisions. Saving regularly, even if it’s just a small amount each month, can add up over time and provide a safety net for unexpected expenses.

Avoiding get-rich-quick schemes is also vital for long-term financial success. These schemes often promise unrealistic returns and can lead to financial losses and stress. Instead, focus on building a solid financial foundation through smart investing, saving, and budgeting.

Some benefits of staying disciplined and patient include:

- Long-term financial stability and security.

- Increased savings and wealth over time.

- Improved financial literacy and decision-making skills.

- Reduced stress and anxiety related to financial uncertainty.

To stay disciplined and patient, consider the following tips:

- Set clear financial goals and priorities.

- Create a budget and track your expenses regularly.

- Automate your savings and investments.

- Avoid impulse purchases and stay focused on your long-term goals.

Remember, achieving financial success takes time, effort, and discipline. By staying patient and focused on your long-term goals, you can build a solid financial foundation and achieve financial freedom.

In conclusion, staying disciplined and patient is essential for achieving long-term financial success. By creating a budget, saving regularly, and avoiding get-rich-quick schemes, you can build a solid financial foundation and achieve your financial goals, including how to get 10 thousand dollars fast.