Why Business Insurance is Crucial for Your Company’s Success

Business insurance is a vital component of any successful company’s risk management strategy. It provides financial protection against unexpected events, such as lawsuits, natural disasters, and employee injuries, which can have a devastating impact on a business’s bottom line. By investing in business insurance, companies can mitigate financial losses, ensure business continuity, and protect their assets. In fact, having the right insurance coverage can be the difference between staying in business and being forced to close your doors. When considering how to get business insurance, it’s essential to understand the importance of this type of coverage and how it can benefit your company.

One of the primary reasons business insurance is crucial is that it helps protect against lawsuits. In today’s litigious society, companies are at risk of being sued by customers, employees, or other parties. Business insurance can provide liability coverage, which can help pay for legal fees, settlements, and judgments. This type of coverage can be especially important for companies in high-risk industries, such as healthcare or construction.

In addition to liability coverage, business insurance can also provide protection against property damage. This can include coverage for buildings, equipment, and inventory, which can be essential for companies that rely on physical assets to operate. Business insurance can also provide coverage for business interruption, which can help companies recover from unexpected events, such as natural disasters or power outages.

Furthermore, business insurance can provide coverage for employee injuries, which can be a significant risk for companies with employees. Workers’ compensation insurance can help pay for medical expenses and lost wages, which can be essential for companies that want to protect their employees and maintain a positive reputation.

In conclusion, business insurance is a critical component of any successful company’s risk management strategy. By investing in the right insurance coverage, companies can protect their assets, mitigate financial losses, and ensure business continuity. When considering how to get business insurance, it’s essential to understand the importance of this type of coverage and how it can benefit your company.

Understanding the Types of Business Insurance: A Comprehensive Overview

When it comes to getting business insurance, it’s essential to understand the different types of coverage available. Each type of insurance is designed to protect against specific risks, and choosing the right combination of policies can help ensure that your business is adequately protected. In this section, we’ll provide an overview of the main types of business insurance, including liability insurance, property insurance, workers’ compensation insurance, and business interruption insurance.

Liability insurance is one of the most common types of business insurance. It provides protection against lawsuits and other claims that may arise from your business operations. Liability insurance can help pay for legal fees, settlements, and judgments, which can be a significant financial burden for businesses. There are several types of liability insurance, including general liability insurance, professional liability insurance, and product liability insurance.

Property insurance is another essential type of business insurance. It provides protection against damage to your business property, including buildings, equipment, and inventory. Property insurance can help pay for repairs or replacement of damaged property, which can help minimize downtime and get your business back up and running quickly. There are several types of property insurance, including commercial property insurance, inland marine insurance, and equipment breakdown insurance.

Workers’ compensation insurance is a type of insurance that provides benefits to employees who are injured on the job. It can help pay for medical expenses, lost wages, and rehabilitation costs, which can be a significant financial burden for businesses. Workers’ compensation insurance is typically mandatory for businesses with employees, and it can help protect your business from lawsuits and other claims related to employee injuries.

Business interruption insurance is a type of insurance that provides protection against business interruptions, such as natural disasters, power outages, and equipment failures. It can help pay for lost revenue, expenses, and other costs associated with business interruptions, which can help minimize downtime and get your business back up and running quickly.

When considering how to get business insurance, it’s essential to understand the different types of coverage available and how they can help protect your business. By choosing the right combination of policies, you can help ensure that your business is adequately protected against a range of risks and uncertainties.

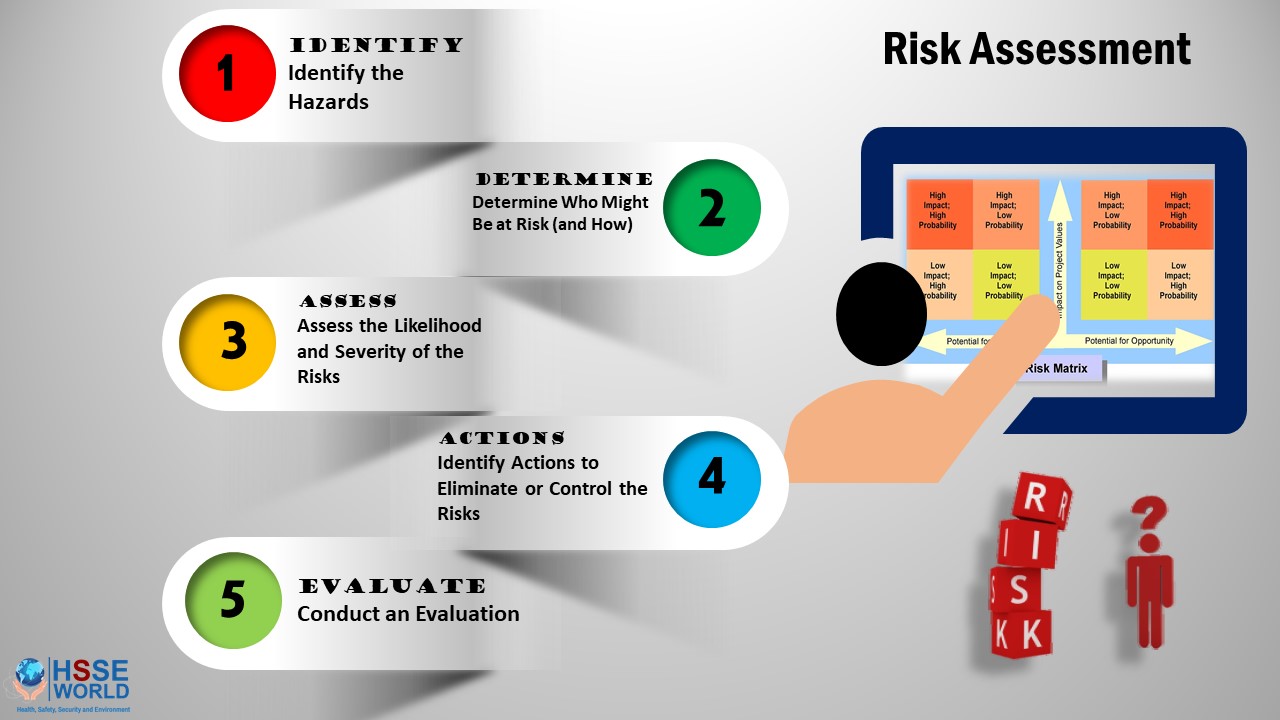

Assessing Your Business Risks: Identifying Areas of Vulnerability

Assessing your business risks is a crucial step in determining the right type and amount of insurance coverage. By identifying areas of vulnerability, you can take steps to mitigate potential risks and ensure that your business is adequately protected. When considering how to get business insurance, it’s essential to understand the different types of risks that your business may face.

Industry-specific risks are a significant concern for many businesses. For example, companies in the healthcare industry may be at risk of medical malpractice lawsuits, while companies in the construction industry may be at risk of accidents and injuries. Understanding the specific risks associated with your industry can help you determine the right type and amount of insurance coverage.

Location-based risks are another important consideration. Businesses located in areas prone to natural disasters, such as earthquakes or hurricanes, may need to purchase additional insurance coverage to protect against these risks. Similarly, businesses located in areas with high crime rates may need to purchase insurance coverage to protect against theft and vandalism.

Employee-related risks are also a significant concern for many businesses. Companies with employees may be at risk of workers’ compensation claims, employment practices liability claims, and other types of employee-related lawsuits. Understanding the risks associated with your employees can help you determine the right type and amount of insurance coverage.

To assess your business risks, it’s essential to conduct a thorough risk assessment. This may involve reviewing your business operations, identifying potential risks, and determining the likelihood and potential impact of each risk. By conducting a thorough risk assessment, you can identify areas of vulnerability and take steps to mitigate potential risks.

When assessing your business risks, it’s also essential to consider the following factors:

- Business operations: What types of activities does your business engage in? What are the potential risks associated with these activities?

- Industry: What are the specific risks associated with your industry? How can you mitigate these risks?

- Location: What are the potential risks associated with your business location? How can you mitigate these risks?

- Employees: What are the potential risks associated with your employees? How can you mitigate these risks?

By considering these factors and conducting a thorough risk assessment, you can identify areas of vulnerability and take steps to mitigate potential risks. This can help you determine the right type and amount of insurance coverage and ensure that your business is adequately protected.

How to Choose the Right Business Insurance Policy for Your Company

Choosing the right business insurance policy can be a daunting task, especially for small business owners who are new to the world of insurance. However, with a little guidance, you can make an informed decision that protects your business and its assets. When considering how to get business insurance, it’s essential to understand the different factors that affect the cost and coverage of your policy.

Policy limits are one of the most critical factors to consider when choosing a business insurance policy. Policy limits refer to the maximum amount of coverage provided by the policy. It’s essential to choose a policy with limits that are sufficient to cover your business’s assets and potential liabilities. For example, if your business has a high-value inventory, you’ll want to choose a policy with a high enough limit to cover the cost of replacing or repairing that inventory.

Deductibles are another important factor to consider when choosing a business insurance policy. A deductible is the amount of money that you must pay out of pocket before your insurance coverage kicks in. Choosing a policy with a low deductible can provide peace of mind, but it may also increase your premium costs. On the other hand, choosing a policy with a high deductible can lower your premium costs, but it may also leave you with a higher out-of-pocket expense in the event of a claim.

Premium costs are also a critical factor to consider when choosing a business insurance policy. Premium costs refer to the amount of money that you must pay to maintain your insurance coverage. Choosing a policy with a low premium cost can be tempting, but it’s essential to ensure that the policy provides adequate coverage for your business. A policy with a low premium cost may not provide enough coverage to protect your business, leaving you with a higher out-of-pocket expense in the event of a claim.

When choosing a business insurance policy, it’s also essential to read the policy documents carefully and ask questions before purchasing. This will help you understand the terms and conditions of the policy, including the coverage, exclusions, and limitations. It’s also essential to work with a reputable insurance agent or broker who can provide guidance and support throughout the process.

Some other factors to consider when choosing a business insurance policy include:

- Claims process: How easy is it to file a claim, and how quickly will the insurance company respond?

- Customer service: How responsive is the insurance company to your needs and concerns?

- Financial stability: Is the insurance company financially stable, and will it be able to pay out claims in the event of a disaster?

- Reputation: What is the insurance company’s reputation in the industry, and do they have a history of paying out claims fairly and promptly?

By considering these factors and doing your research, you can choose a business insurance policy that provides adequate coverage for your business and its assets. Remember, the key to getting the right insurance coverage is to understand your business’s unique needs and risks, and to choose a policy that addresses those needs and risks.

Working with an Insurance Agent or Broker: What to Expect

When it comes to navigating the complex world of business insurance, working with an insurance agent or broker can be a valuable asset. These professionals have extensive knowledge of the insurance industry and can help businesses find the right coverage to meet their unique needs. But what can businesses expect when working with an agent or broker, and how can they get the most out of the relationship?

First and foremost, insurance agents and brokers will ask questions to understand the business’s operations, risks, and goals. This information will help them identify the types of insurance coverage the business needs and provide recommendations for policy limits, deductibles, and premium costs. Businesses should be prepared to provide detailed information about their operations, including financial statements, employee data, and industry-specific risks.

Agents and brokers will also help businesses compare insurance policies from different providers, explaining the benefits and limitations of each option. They can provide guidance on how to choose the right policy, including factors to consider such as policy limits, deductibles, and premium costs. Additionally, they can help businesses understand the claims process and what to expect if they need to file a claim.

One of the key benefits of working with an insurance agent or broker is their ability to negotiate with insurance providers on behalf of the business. They can help businesses get the best possible rates and terms, and ensure that they are getting the coverage they need at a price they can afford. Agents and brokers can also help businesses resolve any issues that may arise with their insurance coverage, such as disputes over claims or policy cancellations.

To get the most out of the relationship, businesses should be prepared to ask questions and seek guidance from their agent or broker. Some questions to ask include: What types of insurance coverage do I need for my business? How much will the premiums cost, and what are the deductibles? What is the claims process, and how long will it take to resolve a claim? By asking these questions and seeking guidance from an experienced agent or broker, businesses can ensure that they are getting the right insurance coverage to protect their assets and achieve their goals.

When searching for an insurance agent or broker, businesses should look for professionals who have experience working with businesses in their industry. They should also check for licenses and certifications, such as the Certified Insurance Counselor (CIC) or Chartered Property Casualty Underwriter (CPCU) designations. By working with a qualified and experienced agent or broker, businesses can trust that they are getting the best possible advice and guidance on how to get business insurance that meets their unique needs.

Business Insurance Costs: What to Expect and How to Save

When it comes to business insurance, costs can vary widely depending on the type of coverage, policy limits, and deductibles. Understanding the costs associated with business insurance can help businesses make informed decisions about their coverage and budget. In this section, we’ll explore the typical costs of business insurance, including premium costs, deductibles, and other expenses, and provide tips on how to save on business insurance costs.

Premium costs are the most significant expense associated with business insurance. These costs can vary depending on the type of coverage, policy limits, and deductibles. For example, liability insurance premiums can range from 1% to 3% of the business’s annual revenue, while property insurance premiums can range from 0.5% to 2% of the business’s annual revenue. Workers’ compensation insurance premiums are typically based on the business’s payroll and can range from 2% to 5% of the business’s annual payroll.

Deductibles are another expense associated with business insurance. A deductible is the amount of money the business must pay out-of-pocket before the insurance coverage kicks in. Deductibles can range from $500 to $5,000 or more, depending on the type of coverage and policy limits. Businesses can often lower their premium costs by increasing their deductibles, but this can also increase their out-of-pocket expenses in the event of a claim.

Other expenses associated with business insurance include administrative fees, taxes, and surcharges. These fees can add up quickly, so it’s essential to factor them into the business’s budget. Businesses can often save on these fees by bundling policies with a single insurance provider or by working with an insurance agent or broker who can negotiate on their behalf.

So, how can businesses save on business insurance costs? Here are a few tips:

1. Bundling policies: Bundling policies with a single insurance provider can often result in discounts and lower premium costs.

2. Improving risk management practices: Businesses can lower their premium costs by implementing risk management practices, such as safety training programs, security measures, and emergency preparedness plans.

3. Shopping around: Businesses should shop around and compare insurance quotes from multiple providers to ensure they’re getting the best rates.

4. Working with an insurance agent or broker: Insurance agents and brokers can often negotiate better rates and terms on behalf of the business.

5. Increasing deductibles: Businesses can lower their premium costs by increasing their deductibles, but this can also increase their out-of-pocket expenses in the event of a claim.

By understanding the costs associated with business insurance and implementing these cost-saving strategies, businesses can ensure they’re getting the right coverage at a price they can afford. Remember, business insurance is an essential investment in the business’s future, and it’s worth taking the time to get it right. By following these tips and working with an insurance agent or broker, businesses can find the right coverage and save on business insurance costs.

Common Mistakes to Avoid When Buying Business Insurance

When it comes to buying business insurance, there are several common mistakes that businesses can make. These mistakes can lead to inadequate coverage, financial losses, and even business closure. In this section, we’ll identify some of the most common mistakes businesses make when buying insurance and provide guidance on how to avoid them.

1. Underinsuring: One of the most common mistakes businesses make is underinsuring. This can happen when a business purchases a policy with inadequate coverage limits or fails to purchase additional coverage for specific risks. Underinsuring can leave a business vulnerable to financial losses in the event of a claim.

2. Overinsuring: On the other hand, some businesses may overinsure, purchasing more coverage than they need. This can result in unnecessary premium costs and may not provide any additional benefits in the event of a claim.

3. Failing to read policy documents carefully: Businesses should always read policy documents carefully before purchasing. This includes understanding the policy limits, deductibles, and exclusions. Failing to read policy documents carefully can lead to unexpected surprises in the event of a claim.

4. Not asking questions: Businesses should always ask questions before purchasing a policy. This includes asking about the types of coverage, policy limits, and deductibles. Failing to ask questions can lead to inadequate coverage and financial losses.

5. Not reviewing and updating policies regularly: Businesses should regularly review and update their policies to ensure they have adequate coverage. This includes reviewing policy limits, deductibles, and exclusions. Failing to review and update policies regularly can lead to inadequate coverage and financial losses.

6. Not considering additional coverage options: Businesses should consider additional coverage options, such as umbrella insurance or cyber insurance. These types of coverage can provide additional protection against specific risks and financial losses.

7. Not working with a licensed insurance agent or broker: Businesses should always work with a licensed insurance agent or broker. These professionals can provide guidance on the types of coverage, policy limits, and deductibles. They can also help businesses navigate the claims process and ensure they receive fair compensation.

By avoiding these common mistakes, businesses can ensure they have adequate coverage and minimize financial losses. Remember, business insurance is an essential investment in the business’s future, and it’s worth taking the time to get it right. By following these tips and working with a licensed insurance agent or broker, businesses can find the right coverage and avoid common mistakes when buying business insurance.

Next Steps: Getting Started with Business Insurance Today

Now that you have a better understanding of the importance of business insurance and how to get the right coverage, it’s time to take action. Don’t wait until it’s too late to protect your business from unexpected events and financial losses. By following the steps outlined in this article, you can ensure that your business is properly insured and prepared for the future.

Here are some next steps to consider:

1. Contact an insurance agent or broker: Reach out to a licensed insurance agent or broker who can help you navigate the complex world of business insurance. They can provide guidance on the types of coverage you need and help you find the right policy for your business.

2. Assess your business risks: Take the time to assess your business risks and identify areas of vulnerability. This will help you determine the right type and amount of insurance coverage you need.

3. Compare insurance policies: Shop around and compare insurance policies from different providers. This will help you find the best coverage at the best price.

4. Read policy documents carefully: Always read policy documents carefully before purchasing. This will help you understand the terms and conditions of the policy and ensure that you have the right coverage.

5. Ask questions: Don’t be afraid to ask questions. If you’re unsure about something, ask your insurance agent or broker for clarification.

By following these next steps, you can ensure that your business is properly insured and prepared for the future. Remember, business insurance is an essential investment in your business’s success. Don’t wait until it’s too late to protect your business.

Get started today and take the first step towards protecting your business with the right insurance coverage. Contact an insurance agent or broker and start the process of getting the right business insurance for your company.