Understanding the Factors that Affect Your Car Insurance Rates

When it comes to getting cheap car insurance, understanding the factors that affect your rates is crucial. Car insurance companies use a variety of factors to determine your premium, including your age, driving history, location, and vehicle type. By understanding how these factors impact your rates, you can take steps to reduce your costs and get the best possible deal.

One of the most significant factors that affects your car insurance rates is your age. Younger drivers, typically those under the age of 25, are considered higher-risk drivers and are often charged higher premiums. On the other hand, older drivers, typically those over the age of 50, are considered lower-risk drivers and may be eligible for lower premiums.

Your driving history is also a critical factor in determining your car insurance rates. Drivers with a clean driving record, free from accidents and tickets, are often rewarded with lower premiums. Conversely, drivers with a history of accidents or tickets may be charged higher premiums.

Location is another important factor that affects your car insurance rates. Drivers who live in urban areas, where there is a higher risk of accidents and theft, may be charged higher premiums than those who live in rural areas. Additionally, drivers who live in areas with high crime rates may be charged higher premiums due to the increased risk of theft.

Finally, the type of vehicle you drive can also impact your car insurance rates. Vehicles with advanced safety features, such as lane departure warning systems and blind spot monitoring, may be eligible for lower premiums. On the other hand, vehicles with high-performance engines or those that are more prone to theft may be charged higher premiums.

By understanding these factors and how they impact your car insurance rates, you can take steps to reduce your costs and get the best possible deal. For example, you may consider taking a defensive driving course to improve your driving record, or shopping around for quotes from multiple insurance providers to find the best rate. By taking these steps, you can get cheap car insurance and save money on your premiums.

How to Shop Around for the Best Car Insurance Deals

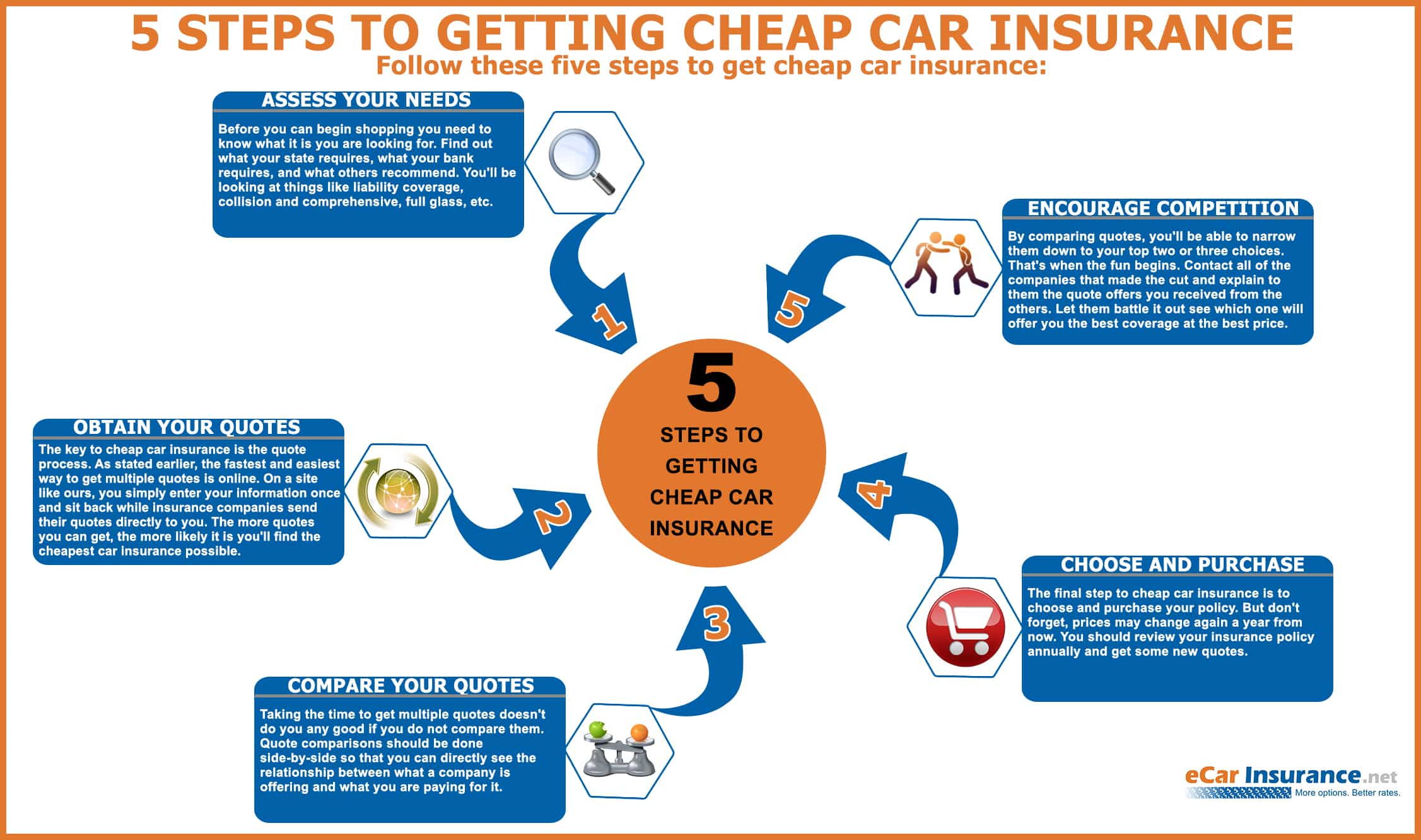

Shopping around for car insurance can be a daunting task, but it’s essential to find the best deals and save money on your premiums. With so many insurance providers and online marketplaces available, it’s easier than ever to compare quotes and find the best rates. In this section, we’ll discuss the importance of comparing quotes and provide tips on how to use online tools to find discounts and get cheap car insurance.

One of the most effective ways to shop around for car insurance is to use online comparison tools. These tools allow you to enter your information and receive quotes from multiple insurance providers in just a few minutes. Some popular online comparison tools include NerdWallet, Bankrate, and Insurance.com. By using these tools, you can quickly and easily compare rates and find the best deals.

Another way to shop around for car insurance is to visit the websites of individual insurance providers. Many insurance companies offer online quotes and allow you to customize your policy to fit your needs. Some popular insurance providers include Geico, Progressive, and State Farm. By visiting these websites, you can get a better understanding of the different types of policies available and find the best rates.

In addition to using online tools and visiting insurance provider websites, it’s also important to consider working with an independent insurance agent. Independent agents can help you shop around for car insurance and find the best deals. They often have access to multiple insurance providers and can help you customize your policy to fit your needs.

When shopping around for car insurance, it’s also important to consider the discounts and incentives offered by different insurance providers. Many insurance companies offer discounts for things like good grades, military service, and low mileage. By taking advantage of these discounts, you can save even more money on your premiums and get cheap car insurance.

Finally, it’s essential to carefully review your policy and make sure you’re getting the best rates. Be sure to read the fine print and ask questions if you’re unsure about anything. By taking the time to shop around and carefully review your policy, you can find the best car insurance deals and save money on your premiums.

Optimizing Your Vehicle for Lower Insurance Rates

When it comes to getting cheap car insurance, the type of vehicle you drive can play a significant role in determining your rates. Insurance companies consider various factors, including safety features, engine size, and theft rates, when calculating premiums. By choosing a vehicle that is optimized for lower insurance rates, you can save money on your premiums and get cheap car insurance.

One of the most important factors to consider when choosing a vehicle for lower insurance rates is safety features. Vehicles with advanced safety features, such as lane departure warning systems, blind spot monitoring, and forward collision warning systems, are often eligible for lower premiums. This is because these features can help prevent accidents and reduce the risk of injury or damage.

Another factor to consider is engine size. Vehicles with smaller engines, typically those with 4-cylinder or 6-cylinder engines, are often less expensive to insure than those with larger engines. This is because smaller engines are generally less powerful and less likely to be involved in high-speed accidents.

Theft rates are also an important consideration when choosing a vehicle for lower insurance rates. Vehicles that are more prone to theft, such as luxury cars or cars with high-performance engines, are often more expensive to insure. On the other hand, vehicles that are less prone to theft, such as sedans or SUVs, are often less expensive to insure.

In addition to these factors, insurance companies also consider the overall cost of repairing or replacing a vehicle when determining premiums. Vehicles that are less expensive to repair or replace, such as those with lower-cost parts or simpler designs, are often less expensive to insure.

So, what types of vehicles are optimized for lower insurance rates? Some examples include:

- Sedans, such as the Toyota Camry or Honda Civic

- SUVs, such as the Honda CR-V or Toyota RAV4

- Minivans, such as the Toyota Sienna or Honda Odyssey

- Small trucks, such as the Ford Ranger or Chevrolet Colorado

By choosing a vehicle that is optimized for lower insurance rates, you can save money on your premiums and get cheap car insurance. Remember to also consider other factors, such as safety features, engine size, and theft rates, when making your decision.

Improving Your Driving Record to Reduce Insurance Costs

A good driving record is essential for getting cheap car insurance. Insurance companies view drivers with a clean record as lower-risk and therefore offer them lower premiums. On the other hand, drivers with a history of accidents, tickets, or claims are considered higher-risk and are often charged higher premiums.

So, how can you improve your driving record and reduce your insurance costs? Here are some tips:

First, take a defensive driving course. These courses teach you how to drive safely and avoid accidents. Many insurance companies offer discounts to drivers who complete a defensive driving course.

Second, install a dash cam in your vehicle. A dash cam can provide evidence in the event of an accident, which can help to reduce your insurance costs.

Third, avoid speeding and other traffic violations. Speeding tickets and other traffic violations can increase your insurance costs, so it’s essential to drive safely and follow the rules of the road.

Fourth, avoid accidents. This may seem obvious, but it’s essential to drive safely and avoid accidents to keep your insurance costs low.

Fifth, consider using a usage-based insurance program. These programs use data from a device installed in your vehicle to track your driving habits and offer discounts to safe drivers.

In addition to these tips, it’s also essential to regularly review your driving record and dispute any errors or inaccuracies. You can obtain a copy of your driving record from your state’s Department of Motor Vehicles (DMV) or equivalent agency.

By following these tips, you can improve your driving record and reduce your insurance costs. Remember, a good driving record is essential for getting cheap car insurance, so it’s worth taking the time to improve your driving habits and reduce your risk of accidents or tickets.

Maximizing Discounts and Incentives

Insurance companies offer a variety of discounts and incentives to help drivers save money on their car insurance premiums. By taking advantage of these discounts, you can significantly reduce your insurance costs and get cheap car insurance.

One of the most common discounts offered by insurance companies is the multi-car discount. If you have multiple vehicles insured with the same company, you may be eligible for a discount on your premiums. This discount can range from 10% to 20% off your total premium, depending on the insurance company and the number of vehicles you have insured.

Another discount that is often offered is the good student discount. If you are a student with good grades, you may be eligible for a discount on your car insurance premiums. This discount is typically offered to students who maintain a GPA of 3.0 or higher.

Low-mileage discounts are also available to drivers who drive fewer than a certain number of miles per year. This discount is typically offered to drivers who drive fewer than 7,500 miles per year.

In addition to these discounts, some insurance companies also offer discounts for drivers who have certain safety features installed in their vehicles, such as anti-theft devices or lane departure warning systems.

To maximize your discounts and incentives, it’s essential to shop around and compare rates from multiple insurance companies. You should also ask about any discounts or incentives that may be available to you, as not all insurance companies offer the same discounts.

Some other discounts and incentives that you may be eligible for include:

- Defensive driving course discount

- Driver’s education course discount

- Membership discount (e.g., AAA, AARP)

- Occupational discount (e.g., military, teacher)

- Vehicle safety feature discount

By taking advantage of these discounts and incentives, you can significantly reduce your car insurance costs and get cheap car insurance.

Bundling and Consolidating Insurance Policies

Bundling and consolidating insurance policies can be a great way to save money on your car insurance premiums. By combining multiple policies with the same provider, you can take advantage of discounts and simplified billing.

One of the main benefits of bundling insurance policies is the discount you can receive. Many insurance companies offer a discount for bundling multiple policies, such as car and home insurance. This discount can range from 5% to 20% off your total premium, depending on the insurance company and the policies you bundle.

In addition to the discount, bundling insurance policies can also simplify your billing. Instead of receiving multiple bills from different insurance companies, you’ll receive one bill from your single provider. This can make it easier to keep track of your payments and avoid late fees.

Another benefit of bundling insurance policies is the convenience of having a single provider. If you have multiple policies with different companies, you’ll need to contact each company separately to make changes or ask questions. By bundling your policies with a single provider, you can contact one company for all your insurance needs.

To bundle and consolidate your insurance policies, start by contacting your current insurance providers. Ask about their bundling options and discounts. You can also shop around and compare rates from different insurance companies to find the best deal.

Some popular insurance companies that offer bundling discounts include:

- State Farm

- Allstate

- Geico

- Progressive

When bundling your insurance policies, make sure to carefully review your policies and ensure you’re getting the best rates. You should also ask about any additional discounts or incentives that may be available to you.

By bundling and consolidating your insurance policies, you can save money on your car insurance premiums and simplify your billing. Remember to shop around and compare rates to find the best deal, and don’t hesitate to ask about additional discounts or incentives.

Understanding the Role of Credit Score in Car Insurance Rates

Credit score can play a significant role in determining car insurance rates. Insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A good credit score can lead to lower insurance rates, while a poor credit score can result in higher rates.

Insurance companies use credit-based insurance scores to evaluate the likelihood of a driver filing a claim. Drivers with good credit scores are considered to be lower-risk and are therefore offered lower insurance rates. On the other hand, drivers with poor credit scores are considered to be higher-risk and are offered higher insurance rates.

The use of credit-based insurance scores is not universal, and some states have banned the practice. However, in states where it is allowed, insurance companies can use credit scores to determine insurance rates.

So, how can you improve your credit score and reduce your insurance costs? Here are some tips:

First, check your credit report regularly to ensure it is accurate. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year.

Second, pay your bills on time. Late payments can negatively impact your credit score, so make sure to pay your bills on time.

Third, keep your credit utilization ratio low. This means keeping your credit card balances low compared to your credit limits.

Fourth, avoid applying for too many credit cards or loans. This can negatively impact your credit score, as it can indicate to lenders that you are taking on too much debt.

By following these tips, you can improve your credit score and reduce your insurance costs. Remember, a good credit score can lead to lower insurance rates, so it’s worth taking the time to improve your credit score.

In addition to improving your credit score, you can also shop around for insurance quotes to find the best rates. Some insurance companies may offer better rates than others, even if you have a poor credit score.

By understanding the role of credit score in car insurance rates, you can take steps to improve your credit score and reduce your insurance costs. Remember to always shop around for insurance quotes and to carefully review your policy to ensure you’re getting the best rates.

Reviewing and Adjusting Your Policy Regularly

Regularly reviewing and adjusting your car insurance policy is crucial to ensure you’re getting the best rates. Insurance companies often change their rates and policies, so it’s essential to stay on top of these changes to avoid overpaying for your insurance.

Here are some tips on how to review and adjust your policy:

First, review your policy annually to ensure you’re getting the best rates. Check for any changes in your driving record, vehicle usage, or other factors that may impact your insurance rates.

Second, check for any discounts or incentives that you may be eligible for. Many insurance companies offer discounts for things like good grades, military service, or low mileage.

Third, consider adjusting your policy limits or deductibles. If you have a good driving record and a reliable vehicle, you may be able to lower your policy limits or increase your deductibles to save money on your premiums.

Fourth, shop around for insurance quotes to compare rates and find the best deals. You can use online tools or work with an insurance agent to find the best rates.

Fifth, consider bundling your insurance policies with the same provider. Many insurance companies offer discounts for bundling multiple policies, such as car and home insurance.

By regularly reviewing and adjusting your policy, you can ensure you’re getting the best rates and saving money on your car insurance premiums. Remember to stay on top of changes in your driving record, vehicle usage, and other factors that may impact your insurance rates.

In addition to reviewing and adjusting your policy, you can also take steps to improve your driving record and reduce your insurance costs. Consider taking defensive driving courses or installing a dash cam to improve your driving record and reduce your insurance costs.

By following these tips, you can get cheap car insurance and save money on your premiums. Remember to always shop around for insurance quotes and to carefully review your policy to ensure you’re getting the best rates.