Understanding the Need for Instant Cash

Life is full of unexpected expenses, medical emergencies, and financial setbacks. In such situations, having access to instant cash can be a lifesaver. Whether it’s a car repair, a medical bill, or a sudden loss of income, the need for quick financial relief is a common experience for many individuals. The question is, how to get free cash instantly to cover these unexpected expenses?

In today’s fast-paced world, financial emergencies can arise at any moment, leaving individuals scrambling to find a solution. The traditional banking system often falls short in providing instant cash, leading people to seek alternative solutions. This is where the concept of instant cash solutions comes into play. By understanding the need for instant cash, individuals can take proactive steps to prepare for financial emergencies and avoid the stress and anxiety that comes with them.

Instant cash solutions can provide a much-needed safety net, allowing individuals to cover unexpected expenses without going into debt or dipping into their savings. However, it’s essential to approach these solutions with caution, as some may come with hidden fees or risks. By exploring legitimate ways to get free cash instantly, individuals can make informed decisions about their financial well-being and avoid potential pitfalls.

In the following sections, we’ll delve into the world of instant cash solutions, exploring the various options available, from cashback apps and online surveys to selling unwanted items and instant cash loans. By the end of this article, readers will have a comprehensive understanding of how to get free cash instantly and make informed decisions about their financial future.

Exploring Legitimate Ways to Get Free Cash Instantly

When it comes to getting free cash instantly, it’s essential to separate the legitimate opportunities from the scams and illegitimate schemes. With the rise of digital technology, numerous platforms and apps have emerged, offering ways to earn cash quickly and easily. However, not all of these opportunities are created equal, and some may come with hidden fees or risks.

One of the most popular ways to get free cash instantly is through cashback apps and rewards programs. These platforms offer cash rewards for everyday purchases, such as groceries, gas, and online shopping. By using cashback apps like Ibotta, Rakuten, and Fetch Rewards, individuals can earn cash back on their purchases and redeem their rewards instantly.

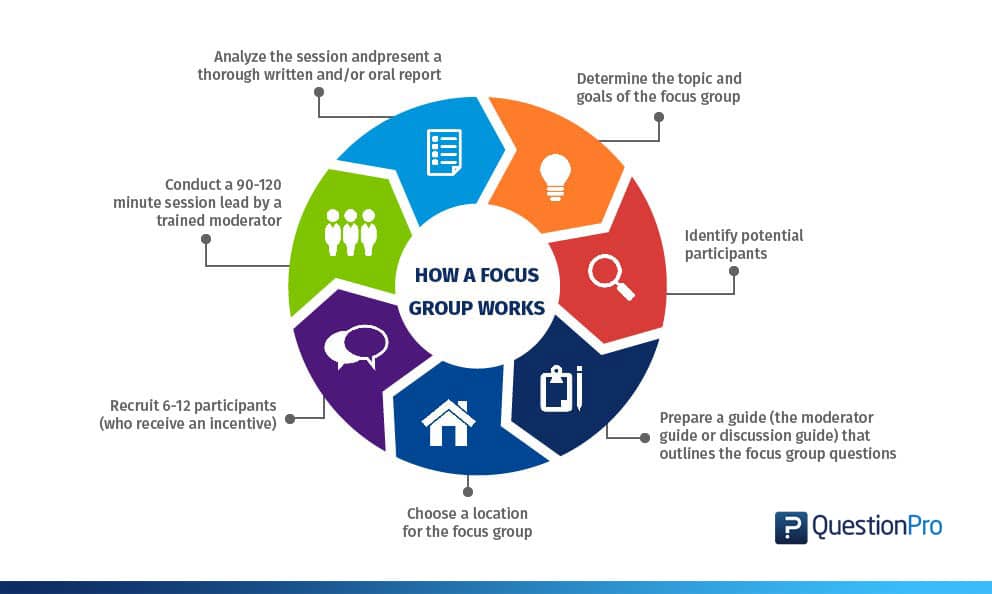

Another legitimate way to get free cash instantly is through online surveys and focus groups. Reputable websites and platforms, such as Swagbucks and Survey Junkie, offer cash rewards for participating in online surveys and focus groups. These opportunities allow individuals to share their opinions and earn cash quickly and easily.

It’s crucial to note that when exploring legitimate ways to get free cash instantly, individuals should be cautious of scams and illegitimate schemes. These may include opportunities that require an upfront fee, promise unrealistic returns, or ask for sensitive personal information. By doing their research and reading reviews, individuals can ensure that they are using legitimate platforms and avoiding potential pitfalls.

By exploring legitimate ways to get free cash instantly, individuals can take control of their finances and build a safety net for long-term financial stability. Whether it’s through cashback apps, online surveys, or other opportunities, getting free cash instantly can provide a much-needed financial boost. In the next section, we’ll delve into the world of cashback apps and rewards programs, exploring the top apps and programs that can help individuals maximize their cashback rewards.

Maximizing Cashback Rewards: Top Apps and Programs

Cashback apps and programs have become increasingly popular in recent years, offering individuals a way to earn cash back on their everyday purchases. With so many options available, it can be overwhelming to choose the best apps and programs to maximize cashback rewards. In this section, we’ll review some of the top cashback apps and programs, including Ibotta, Rakuten, and Fetch Rewards.

Ibotta is one of the most popular cashback apps, offering users cash back on groceries, gas, and other purchases. With Ibotta, users can browse offers, shop, and then upload their receipts to earn cash back. Rakuten, formerly known as Ebates, is another well-known cashback program that offers users cash back on online purchases. Fetch Rewards is a newer app that offers users cash back on gas, groceries, and other purchases, with no coupons or codes required.

To maximize cashback rewards, it’s essential to understand how each app and program works. For example, Ibotta offers users cash back on specific grocery items, while Rakuten offers cash back on online purchases from partner retailers. Fetch Rewards, on the other hand, offers users cash back on gas and grocery purchases, with no coupons or codes required.

Another way to maximize cashback rewards is to use multiple apps and programs in conjunction with each other. For example, users can use Ibotta for grocery purchases and Rakuten for online purchases. By using multiple apps and programs, users can earn cash back on a wider range of purchases and maximize their rewards.

Finally, it’s essential to read the terms and conditions of each app and program to understand any fees or limitations associated with cashback rewards. By understanding the terms and conditions, users can avoid any surprises and maximize their cashback rewards.

By using the top cashback apps and programs and maximizing cashback rewards, individuals can earn cash back on their everyday purchases and get free cash instantly. In the next section, we’ll explore the opportunities for earning cash through online surveys and focus groups.

Getting Paid for Your Opinion: Online Surveys and Focus Groups

Online surveys and focus groups have become a popular way for individuals to earn cash and share their opinions on various products and services. With the rise of digital technology, numerous websites and platforms have emerged, offering individuals the opportunity to participate in online surveys and focus groups and get paid for their opinions.

Swagbucks and Survey Junkie are two reputable websites that offer individuals the opportunity to earn cash through online surveys and focus groups. Swagbucks rewards users with points for participating in surveys, watching videos, and shopping online, which can be redeemed for cash or gift cards. Survey Junkie offers users points for participating in surveys, which can be redeemed for cash or e-gift cards.

Another way to earn cash through online surveys and focus groups is through websites like Vindale Research and Toluna. Vindale Research offers users cash payouts for participating in surveys, as well as the opportunity to review products and services. Toluna offers users points for participating in surveys, which can be redeemed for cash or gift cards.

When participating in online surveys and focus groups, it’s essential to understand the terms and conditions of each website and platform. Some websites may require users to complete a profile or qualify for certain surveys, while others may offer cash payouts or rewards points. By understanding the terms and conditions, individuals can maximize their earnings and get free cash instantly.

Online surveys and focus groups offer individuals a flexible and convenient way to earn cash and share their opinions. By participating in online surveys and focus groups, individuals can earn cash, influence product development, and contribute to market research. In the next section, we’ll explore the benefits of selling unwanted items and generating quick cash.

Selling Unwanted Items: A Quick Way to Generate Cash

Selling unwanted items is a quick and easy way to generate cash, especially when you need it instantly. With the rise of online marketplaces and social media platforms, it’s easier than ever to sell unwanted items and get free cash instantly. In this section, we’ll explore the benefits of selling unwanted items and provide tips on how to sell items online through platforms like eBay, Craigslist, and Facebook Marketplace.

Decluttering and selling unwanted items can be a great way to generate cash quickly. Not only can you get rid of items you no longer need or use, but you can also earn some extra cash in the process. Whether it’s old electronics, furniture, or clothing, there’s likely someone out there who is willing to buy it.

When selling unwanted items online, it’s essential to choose the right platform. eBay, Craigslist, and Facebook Marketplace are popular options, but each has its own fees and requirements. eBay, for example, charges a listing fee and a final value fee, while Craigslist is free to use but requires you to handle the transaction yourself. Facebook Marketplace, on the other hand, is free to use and allows you to connect with potential buyers in your local area.

To sell items online successfully, it’s crucial to take good photos, write a detailed description, and set a competitive price. You should also be prepared to handle inquiries and negotiate with potential buyers. By following these tips, you can sell your unwanted items quickly and easily and get free cash instantly.

Selling unwanted items is a great way to generate cash quickly, but it’s also important to consider the potential risks. Be cautious of scams and ensure that you’re dealing with reputable buyers. By being aware of the potential risks and taking steps to mitigate them, you can sell your unwanted items safely and securely.

By selling unwanted items, individuals can generate cash quickly and easily, which can be especially helpful in emergency situations. In the next section, we’ll explore the options for instant cash loans and the risks and fees associated with these loans.

Instant Cash Loans: Understanding the Options and Risks

Instant cash loans can be a tempting solution for individuals who need quick financial relief. However, it’s essential to understand the options and risks associated with these loans. In this section, we’ll discuss the different types of instant cash loans, including payday loans and title loans, and emphasize the importance of understanding the risks and fees associated with these loans.

Payday loans are a type of instant cash loan that allows individuals to borrow a small amount of money, typically up to $1,000, until their next payday. These loans are often characterized by high interest rates and fees, which can lead to a cycle of debt if not managed properly. Title loans, on the other hand, require individuals to use their vehicle as collateral in exchange for a loan. These loans can be riskier than payday loans, as individuals may lose their vehicle if they fail to repay the loan.

When considering instant cash loans, it’s crucial to understand the risks and fees associated with these loans. Payday loans, for example, can have interest rates as high as 300% APR, while title loans can have fees that add up to 25% of the loan amount. Additionally, instant cash loans can have strict repayment terms, which can lead to financial difficulties if not managed properly.

To avoid the risks associated with instant cash loans, individuals should consider alternative solutions, such as cashback apps, rewards programs, and online surveys. These solutions can provide quick financial relief without the risk of debt or financial difficulties. Additionally, individuals should prioritize building a safety net, such as creating an emergency fund, budgeting, and saving, to avoid the need for instant cash loans in the first place.

By understanding the options and risks associated with instant cash loans, individuals can make informed decisions about their financial well-being. In the next section, we’ll discuss strategies for building a safety net and avoiding the need for instant cash loans.

Building a Safety Net: Strategies for Avoiding Instant Cash Needs

Having a safety net in place can help individuals avoid the need for instant cash loans and other financial solutions. By building a safety net, individuals can ensure that they have a financial cushion to fall back on in case of unexpected expenses or financial setbacks. In this section, we’ll discuss strategies for building a safety net and avoiding the need for instant cash.

Creating an emergency fund is one of the most effective ways to build a safety net. An emergency fund is a pool of money set aside to cover unexpected expenses, such as car repairs or medical bills. By having an emergency fund in place, individuals can avoid the need for instant cash loans and other financial solutions. Aim to save 3-6 months’ worth of living expenses in your emergency fund.

Budgeting and saving are also essential strategies for building a safety net. By creating a budget and prioritizing savings, individuals can ensure that they have a financial cushion to fall back on in case of unexpected expenses or financial setbacks. Consider using the 50/30/20 rule, where 50% of your income goes towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Another strategy for building a safety net is to reduce debt and avoid high-interest loans. By paying off high-interest debt and avoiding new debt, individuals can free up more money in their budget to save and invest. Consider consolidating debt into a lower-interest loan or credit card, and make a plan to pay off debt as quickly as possible.

By building a safety net and avoiding the need for instant cash loans, individuals can achieve long-term financial stability and security. In the next section, we’ll summarize the importance of having access to instant cash solutions and the benefits of exploring legitimate ways to get free cash instantly.

Conclusion: Achieving Financial Stability with Instant Cash Solutions

In conclusion, having access to instant cash solutions can be a lifesaver in times of financial need. By exploring legitimate ways to get free cash instantly, such as cashback apps, rewards programs, and online surveys, individuals can avoid the risks and fees associated with instant cash loans and other financial solutions.

Building a safety net and avoiding the need for instant cash is also crucial for achieving long-term financial stability. By creating an emergency fund, budgeting, and saving, individuals can ensure that they have a financial cushion to fall back on in case of unexpected expenses or financial setbacks.

By taking control of their finances and building a safety net, individuals can achieve financial stability and security. Instant cash solutions can provide quick financial relief, but it’s essential to use them responsibly and avoid the risks and fees associated with them.

In today’s fast-paced world, financial emergencies can arise at any moment. By having access to instant cash solutions and building a safety net, individuals can ensure that they are prepared for any financial situation that may arise. Remember, achieving financial stability is a long-term process, but with the right strategies and tools, it is possible.

By following the tips and strategies outlined in this article, individuals can take control of their finances and achieve financial stability. Whether it’s through cashback apps, online surveys, or building a safety net, there are many ways to get free cash instantly and achieve financial stability.