The Shift Towards Result-Based Compensation

The modern work landscape is experiencing a significant transformation in compensation structures, with a growing emphasis on result-based payment systems. These innovative approaches focus on tying remuneration directly to specific, measurable outcomes, moving away from traditional salary structures. This shift is becoming increasingly popular across various industries, including sales, marketing, and freelancing.

The allure of result-based payment systems lies in their potential to create a meritocratic environment where individuals are rewarded for their accomplishments and contributions. By aligning compensation with performance, organizations can foster a culture of accountability, motivation, and continuous improvement. Moreover, employees benefit from the potential for higher earnings, as their income becomes directly linked to their achievements.

As a result, businesses adopting these systems often experience increased productivity, employee satisfaction, and overall financial success. However, implementing a result-based payment system requires careful planning and consideration to ensure its effectiveness and sustainability. Critical components include identifying appropriate result metrics, negotiating clear terms, and addressing potential challenges to maintain a healthy work-life balance and motivation.

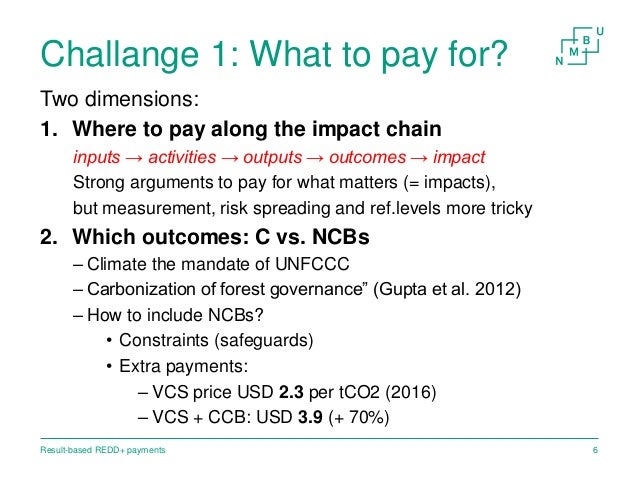

Identifying Appropriate Result Metrics

Implementing a result-based payment system requires careful consideration of the metrics that will be used to evaluate performance. Clear, measurable, and relevant result metrics are essential for ensuring the success and fairness of the system. These metrics should directly relate to the employee’s role and responsibilities and align with the organization’s overall objectives.

For instance, in the sales industry, suitable result metrics may include sales revenue, the number of new clients acquired, or the conversion rate of leads. In marketing, metrics could focus on the generation of leads, the growth of social media following, or the success of specific campaigns. For freelancers, project completion rate, client satisfaction, or the number of successful project deliveries could serve as appropriate result metrics.

When selecting result metrics, it is crucial to consider the following factors:

- Relevance: Ensure that the metrics directly relate to the employee’s role and the organization’s goals.

- Measurability: The metrics should be quantifiable and easily tracked.

- Transparency: Both the employer and employee should have a clear understanding of how the metrics are calculated and evaluated.

- Fairness: The metrics should not be overly influenced by external factors beyond the employee’s control.

By carefully selecting and communicating appropriate result metrics, organizations can create a result-based payment system that fosters accountability, motivation, and financial success for all parties involved.

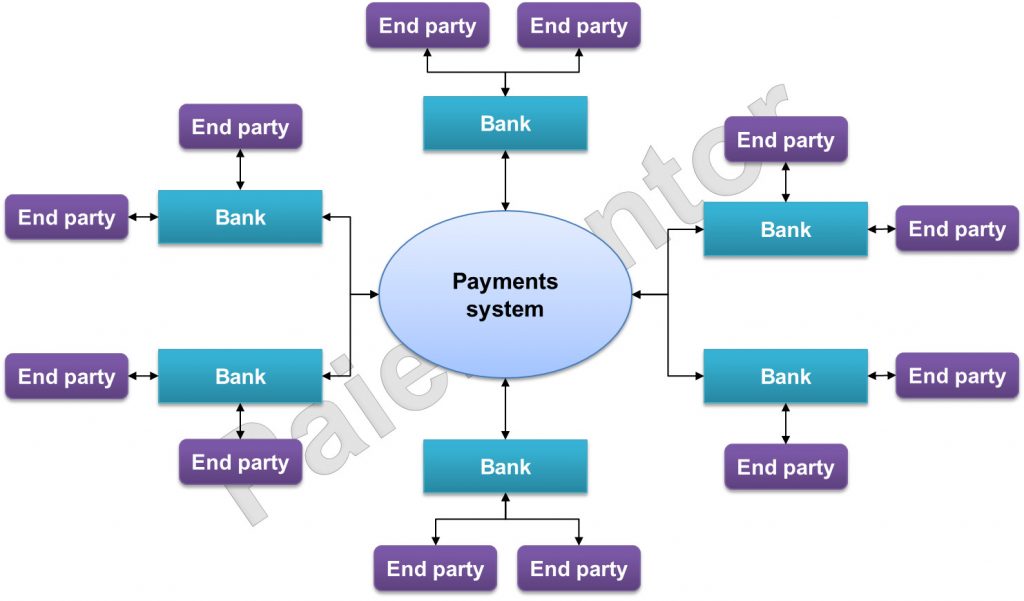

Implementing a Result-Based Payment Structure

Transitioning to a result-based payment structure can be a significant shift for both employers and employees. By following a few essential steps, organizations can successfully implement this system and reap its benefits.

- Set clear goals: Begin by establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals for each role. These goals should directly tie to the organization’s overall objectives and the employee’s responsibilities.

- Negotiate terms: Clearly communicate the result-based payment structure to employees, including the metrics used for evaluation and the potential rewards. Allow for open discussions and negotiations to ensure mutual understanding and agreement.

- Track progress: Regularly monitor and evaluate employees’ performance using the predefined result metrics. This can be done through various tracking tools, such as project management software, CRM systems, or custom-built dashboards.

- Review and adjust: Periodically review the effectiveness of the result-based payment system and make adjustments as needed. This may include revising the result metrics, modifying the reward structure, or providing additional training and support to employees.

To ensure a smooth transition to a result-based payment system, consider the following tips:

- Maintain transparency: Be open and honest about the reasons for implementing a result-based payment structure and how it will impact employees. Clear communication can help alleviate concerns and foster trust.

- Provide support: Offer training, resources, and coaching to help employees adapt to the new system and achieve their goals.

- Encourage collaboration: Promote a team-oriented environment where employees feel comfortable sharing ideas, strategies, and best practices for achieving results.

- Recognize and reward: Regularly acknowledge employees’ achievements and provide rewards that are meaningful and aligned with their efforts.

By carefully planning and implementing a result-based payment structure, organizations can create a motivating and accountable work environment that drives financial success for all parties involved.

Overcoming Challenges in Result-Based Payment Systems

Implementing a result-based payment system can bring numerous benefits, but it also comes with its own set of challenges. Addressing these challenges effectively is crucial for maintaining a healthy work-life balance and motivation among employees.

- Unpredictable income: One of the primary concerns with result-based payment systems is the potential for income instability. To mitigate this issue, organizations can implement a minimum base salary, ensuring a level of financial security while still incentivizing high performance.

- Performance pressure: Result-based payment systems can create additional pressure on employees to constantly perform at their best. To prevent burnout, employers should encourage regular breaks, provide stress management resources, and promote a healthy work-life balance.

- Demotivation: If employees consistently fail to meet their targets, they may become demotivated. To avoid this, set realistic and achievable goals, provide regular feedback, and offer support and resources to help employees improve their performance.

To maintain motivation and a positive work environment, consider the following strategies:

- Celebrate milestones: Recognize and celebrate employees’ achievements, even small ones, to foster a sense of accomplishment and motivation.

- Offer non-monetary rewards: Provide rewards that go beyond financial incentives, such as additional vacation days, flexible work hours, or professional development opportunities.

- Create a supportive culture: Foster a culture that values collaboration, open communication, and continuous learning. Encourage employees to share their challenges and work together to find solutions.

- Regularly review and adjust: Continuously monitor the effectiveness of the result-based payment system and make adjustments as needed. This may include revising the result metrics, modifying the reward structure, or providing additional support and resources to employees.

By addressing these challenges and implementing strategies to maintain motivation and a healthy work-life balance, organizations can create a positive and productive work environment that drives financial success through result-based payment systems.

Real-Life Applications: Success Stories in Result-Based Payment Systems

Transitioning to a result-based payment system can significantly impact financial success. Various industries have embraced this approach, leading to remarkable achievements. Here, we explore some inspiring success stories that highlight the benefits of result-based payments.

Sales Industry Success Story

ABC Corporation, a leading sales organization, adopted a result-based payment system to motivate its sales team. By setting clear, measurable sales targets, the company experienced a 30% increase in annual revenue within a year. This shift not only boosted financial success but also fostered a competitive and driven work environment, where employees felt empowered to excel and directly benefit from their hard work.

Marketing Industry Success Story

XYZ Marketing Agency adopted a result-based payment system tied to client acquisition and retention metrics. As a result, the agency saw a 40% increase in client acquisition and a 25% decrease in client churn. This approach allowed the agency to attract top marketing talent and fostered a culture of innovation and continuous improvement, directly contributing to its financial success.

Freelancing Industry Success Story

Top Freelancer, a platform connecting businesses with freelancers, implemented a result-based payment system for its service providers. This change resulted in a 50% increase in high-quality work submissions and a 35% decrease in project completion time. Freelancers were motivated to deliver exceptional results, and businesses benefited from faster project turnaround and increased satisfaction.

These success stories demonstrate that adopting a result-based payment system can lead to substantial financial gains and improved performance. By setting clear, measurable, and relevant result metrics, organizations can create a motivating environment that drives success and fosters a culture of continuous improvement.

Balancing Result-Based and Fixed Payments

When implementing a result-based payment system, it’s essential to strike a balance between performance-driven rewards and financial stability. Combining result-based and fixed payments can ensure motivation and consistent income for both employers and employees.

Advantages of Combining Result-Based and Fixed Payments

Merging the two systems offers several benefits. First, it provides a safety net for employees, reducing anxiety related to unpredictable income. Second, it ensures a consistent income stream for organizations, allowing them to plan and allocate resources effectively. Lastly, it maintains motivation by offering performance-based incentives, encouraging employees to excel and reach their full potential.

How to Strike a Balance

To effectively combine result-based and fixed payments, consider the following steps:

- Analyze your industry: Understand the norms and expectations in your industry. For example, sales roles may lean more towards result-based payments, while administrative positions may require more stable income.

- Set clear goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) objectives for your result-based payments. This will help employees understand what they need to accomplish and how it impacts their income.

- Negotiate terms: Clearly communicate the balance between fixed and result-based payments during the hiring process or performance reviews. Ensure both parties agree on the terms and understand the benefits and risks involved.

- Monitor performance: Regularly track progress towards result-based goals and adjust payments accordingly. This will help maintain motivation and ensure financial stability.

By combining result-based and fixed payments, organizations can create a balanced compensation structure that fosters motivation, financial stability, and long-term success.

Legal and Ethical Considerations in Result-Based Payment Systems

Implementing a result-based payment system requires careful consideration of legal and ethical aspects to maintain a positive work environment. By addressing these concerns, organizations can build trust, promote fairness, and ensure compliance with regulations.

Contract Agreements

Clearly outline the terms and conditions of the result-based payment system in a written contract. This should include the result metrics, payment structure, timeline, and any contingencies. A well-drafted contract can help prevent misunderstandings and potential disputes between parties.

Transparency

Maintain transparency in your result-based payment system by openly communicating the rules, expectations, and performance data. This fosters trust and helps employees understand how their efforts contribute to the organization’s success. Regularly update employees on their progress and provide constructive feedback to encourage improvement.

Fairness

Ensure that your result-based payment system is fair and equitable. Avoid biases in setting result metrics and determining payments. Regularly review the system to ensure it does not disproportionately favor certain individuals or groups. Provide opportunities for employees to voice their concerns and make adjustments as needed.

Legal Compliance

Familiarize yourself with local, state, and federal labor laws when implementing a result-based payment system. Some jurisdictions may have specific regulations regarding performance-based compensation, such as minimum wage laws or restrictions on incentive-based pay. Consult with a legal professional to ensure your organization’s compliance.

By addressing legal and ethical considerations, organizations can create a result-based payment system that promotes fairness, trust, and compliance. This not only benefits employees but also contributes to the long-term success and sustainability of the organization.

Continuous Improvement: Adapting and Evolving Your Result-Based Payment System

A result-based payment system should be regularly reviewed and updated to ensure its effectiveness and relevance. By monitoring performance, gathering feedback, and making improvements, organizations can maintain a positive work environment and promote long-term success.

Monitor Performance

Track the performance of your result-based payment system by analyzing key metrics and evaluating the overall impact on your organization. Regularly reviewing performance data can help you identify trends, strengths, and areas for improvement. Adjust your system as needed to optimize results and maintain motivation.

Gather Feedback

Solicit feedback from employees and stakeholders to gain insights into the effectiveness and fairness of your result-based payment system. Encourage open communication and provide multiple channels for feedback, such as surveys, focus groups, or one-on-one meetings. Use this feedback to make data-driven decisions and address any concerns or challenges.

Make Improvements

Incorporate feedback and performance data into your continuous improvement process. Make adjustments to your result-based payment system as needed to ensure fairness, transparency, and motivation. Regularly update your system to reflect changes in your organization, industry, or market conditions.

By prioritizing continuous improvement, organizations can maintain a result-based payment system that adapts and evolves with their needs. This not only promotes financial success but also fosters a positive work environment that supports growth and development.