Why You Need a Wholesale License in Texas

Obtaining a wholesale license in Texas is a crucial step for businesses looking to expand their operations and increase their profit margins. With a wholesale license, businesses can purchase products at a lower cost and resell them to customers at a markup, resulting in higher profits. Additionally, having a wholesale license in Texas can provide businesses with access to a wider range of products, including those that are not available to the general public.

In Texas, a wholesale license is required for businesses that engage in the sale of products to other businesses or individuals for resale. This includes businesses that sell products online, in-store, or through other channels. By obtaining a wholesale license, businesses can ensure that they are complying with state regulations and avoiding any potential penalties or fines.

Furthermore, having a wholesale license in Texas can enhance a business’s credibility with suppliers and customers. Suppliers are more likely to work with businesses that have a wholesale license, as it indicates that the business is legitimate and compliant with state regulations. Customers are also more likely to trust businesses that have a wholesale license, as it provides assurance that the business is operating legally and ethically.

For businesses looking to get started with obtaining a wholesale license in Texas, it is essential to understand the requirements and process involved. This includes registering the business, obtaining necessary licenses and permits, and meeting insurance requirements. By following these steps and obtaining a wholesale license, businesses can unlock new opportunities and take their operations to the next level.

When it comes to getting a wholesale license in Texas, it is crucial to follow the correct procedures to avoid any delays or issues. This includes submitting the required documentation, paying the necessary fees, and waiting for approval. By doing so, businesses can ensure that they are compliant with state regulations and can start operating as a licensed wholesaler in Texas.

In summary, obtaining a wholesale license in Texas is a vital step for businesses looking to expand their operations and increase their profit margins. By understanding the requirements and process involved, businesses can ensure that they are compliant with state regulations and can start operating as a licensed wholesaler in Texas. Whether you’re looking to get started with obtaining a wholesale license in Texas or want to learn more about the process, this guide will provide you with the information you need to succeed.

Understanding Texas Wholesale License Requirements

To obtain a wholesale license in Texas, businesses must meet certain requirements. These requirements are in place to ensure that businesses operate in a fair and transparent manner, and to protect consumers from unfair practices. The first step in obtaining a wholesale license in Texas is to register the business with the Texas Secretary of State’s office. This involves filing articles of incorporation or articles of organization, depending on the type of business structure chosen.

In addition to business registration, wholesale businesses in Texas must also comply with tax obligations. This includes obtaining a sales tax permit from the Texas Comptroller’s office, which allows businesses to collect and remit sales tax on taxable sales. Wholesale businesses must also register for federal taxes, including obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

Insurance requirements are also an essential part of obtaining a wholesale license in Texas. Wholesale businesses must have liability insurance to protect against claims for damages or injuries. Property insurance is also required to protect against losses or damages to business property. Additionally, wholesale businesses with employees must have workers’ compensation insurance to provide benefits to employees who are injured on the job.

Other requirements for obtaining a wholesale license in Texas include obtaining any necessary licenses or permits from local governments, and complying with state regulations related to the sale of goods. Wholesale businesses must also maintain accurate records of sales and purchases, and make these records available for inspection by state authorities.

It’s essential to note that the specific requirements for obtaining a wholesale license in Texas may vary depending on the type of business and the products being sold. Businesses should consult with the Texas Secretary of State’s office and the Texas Comptroller’s office to ensure that they are meeting all the necessary requirements.

By understanding the requirements for obtaining a wholesale license in Texas, businesses can ensure that they are operating in compliance with state regulations and can avoid any potential penalties or fines. This is an essential step in getting a wholesale license in Texas and unlocking the opportunities that come with it.

How to Register Your Business in Texas

Registering a business in Texas is a crucial step in obtaining a wholesale license. The process involves several steps, including choosing a business structure, obtaining necessary licenses and permits, and registering for state and federal taxes. In this section, we will provide a step-by-step guide on how to register a business in Texas.

The first step in registering a business in Texas is to choose a business structure. The most common business structures in Texas are sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each business structure has its own advantages and disadvantages, and the choice of structure will depend on the specific needs and goals of the business.

Once the business structure has been chosen, the next step is to obtain any necessary licenses and permits. This may include a sales tax permit, a use tax permit, and any other licenses or permits required by the state or local government. The Texas Comptroller’s office is responsible for issuing sales tax permits, and the application process can be completed online or by mail.

In addition to obtaining licenses and permits, businesses in Texas must also register for state and federal taxes. This includes obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS), which is used to identify the business for tax purposes. Businesses must also register for state taxes, including sales tax and use tax, with the Texas Comptroller’s office.

Another important step in registering a business in Texas is to file for a fictitious business name, also known as a DBA (doing business as). This is required if the business is operating under a name that is different from the owner’s name. The application process for a fictitious business name can be completed online or by mail with the Texas Secretary of State’s office.

Finally, businesses in Texas must also comply with any local regulations and ordinances. This may include obtaining a business license from the city or county, and complying with any zoning or land use regulations. By following these steps, businesses can ensure that they are properly registered and compliant with all state and local regulations.

Registering a business in Texas is a critical step in obtaining a wholesale license and unlocking the opportunities that come with it. By following the steps outlined above, businesses can ensure that they are properly registered and compliant with all state and local regulations.

Obtaining a Sales Tax Permit in Texas

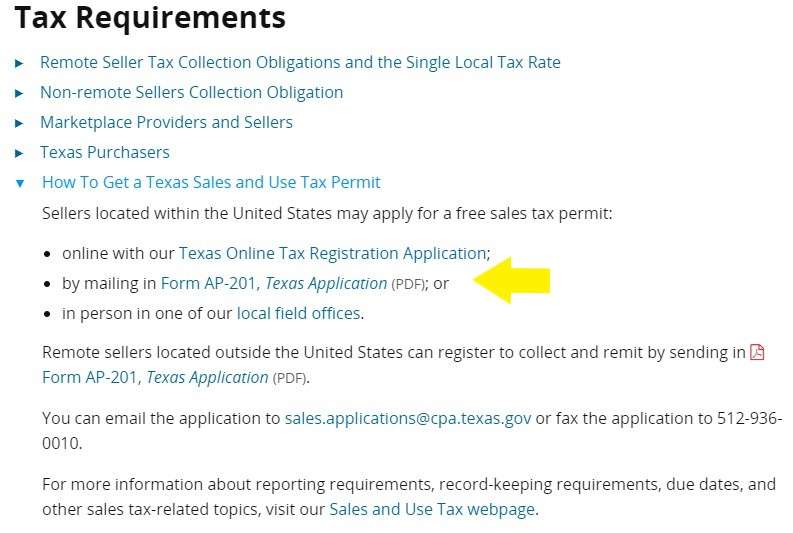

Obtaining a sales tax permit is a crucial step in the process of getting a wholesale license in Texas. The sales tax permit is required for any business that sells taxable goods or services in the state of Texas. In this section, we will explain the process of obtaining a sales tax permit in Texas, including the application process, required documentation, and ongoing compliance requirements.

The application process for a sales tax permit in Texas can be completed online or by mail. To apply online, businesses can visit the Texas Comptroller’s website and submit an application through the online portal. To apply by mail, businesses can download and complete the sales tax permit application form and mail it to the Texas Comptroller’s office.

As part of the application process, businesses will need to provide certain documentation, including a copy of their business registration, a copy of their federal tax ID number, and a copy of their sales tax permit application form. Businesses will also need to pay a fee for the sales tax permit, which is currently $0 for online applications and $50 for mail applications.

Once the sales tax permit application has been submitted, businesses will need to wait for approval from the Texas Comptroller’s office. This can take several days or weeks, depending on the complexity of the application and the workload of the Comptroller’s office. Once the sales tax permit has been approved, businesses will receive a permit number and a certificate of registration, which must be displayed prominently at the business location.

In addition to obtaining a sales tax permit, businesses in Texas must also comply with ongoing compliance requirements. This includes filing sales tax returns on a monthly or quarterly basis, depending on the business’s sales tax liability. Businesses must also pay any sales tax due to the state of Texas, and must maintain accurate records of sales tax transactions.

Failure to comply with sales tax requirements can result in penalties and fines, so it’s essential that businesses understand their obligations and take steps to comply. By obtaining a sales tax permit and complying with ongoing requirements, businesses can ensure that they are in compliance with state regulations and can avoid any potential penalties or fines.

Obtaining a sales tax permit is an essential step in the process of getting a wholesale license in Texas. By following the steps outlined above, businesses can ensure that they are in compliance with state regulations and can avoid any potential penalties or fines.

Meeting Insurance Requirements for Texas Wholesale Businesses

Insurance is a critical component of any business, and wholesale businesses in Texas are no exception. In order to operate a wholesale business in Texas, you will need to meet certain insurance requirements. In this section, we will discuss the types of insurance required for wholesale businesses in Texas, including liability insurance, property insurance, and workers’ compensation insurance.

Liability insurance is a type of insurance that protects your business in the event that you are sued for damages or injuries. This type of insurance is essential for wholesale businesses, as it can help to protect your business from costly lawsuits. In Texas, liability insurance is required for all wholesale businesses, and the minimum coverage limits are $500,000 for bodily injury and $100,000 for property damage.

Property insurance is another type of insurance that is required for wholesale businesses in Texas. This type of insurance protects your business from damage to your property, including your building, equipment, and inventory. Property insurance can help to protect your business from losses due to theft, vandalism, and natural disasters.

Workers’ compensation insurance is also required for wholesale businesses in Texas that have employees. This type of insurance provides benefits to employees who are injured on the job, including medical expenses and lost wages. In Texas, workers’ compensation insurance is required for all businesses with employees, and the minimum coverage limits are $100,000 for medical expenses and $500,000 for lost wages.

In addition to these types of insurance, wholesale businesses in Texas may also want to consider other types of insurance, such as business interruption insurance and cyber insurance. Business interruption insurance can help to protect your business from losses due to unexpected events, such as natural disasters or power outages. Cyber insurance can help to protect your business from losses due to cyber attacks and data breaches.

It’s essential to note that insurance requirements for wholesale businesses in Texas can vary depending on the type of business and the products being sold. Businesses should consult with an insurance professional to determine the specific insurance requirements for their business.

By meeting the insurance requirements for wholesale businesses in Texas, you can help to protect your business from costly lawsuits and losses. This can provide peace of mind and help to ensure the long-term success of your business.

Applying for a Wholesale License in Texas

Once you have completed the necessary steps to register your business and obtain any required licenses and permits, you can apply for a wholesale license in Texas. The application process for a wholesale license in Texas is relatively straightforward, but it does require some documentation and information.

To apply for a wholesale license in Texas, you will need to submit an application to the Texas Comptroller’s office. The application will require you to provide information about your business, including your business name, address, and tax ID number. You will also need to provide documentation, such as a copy of your business registration and a copy of your sales tax permit.

In addition to the application and documentation, you will also need to pay a fee for the wholesale license. The fee for a wholesale license in Texas is currently $100, and it is valid for one year. You will need to renew your license annually to continue operating as a wholesale business in Texas.

Once you have submitted your application and paid the fee, you will need to wait for approval from the Texas Comptroller’s office. This can take several days or weeks, depending on the workload of the office. Once your application has been approved, you will receive a wholesale license that you can use to operate your business in Texas.

It’s essential to note that the application process for a wholesale license in Texas can vary depending on the type of business you are operating and the products you are selling. You may need to provide additional documentation or information, and you may need to meet specific requirements or regulations.

By following the steps outlined above, you can apply for a wholesale license in Texas and start operating your business. Remember to carefully review the application and documentation requirements, and to ensure that you meet all of the necessary requirements and regulations.

Applying for a wholesale license in Texas is a critical step in the process of getting a wholesale license in Texas. By following the steps outlined above, you can ensure that you are in compliance with state regulations and can start operating your business as a licensed wholesaler in Texas.

Maintaining Your Texas Wholesale License

Once you have obtained a wholesale license in Texas, it is essential to maintain it to continue operating your business. Maintaining a wholesale license in Texas requires ongoing compliance with state regulations and requirements. In this section, we will explain the ongoing requirements for maintaining a wholesale license in Texas.

One of the most critical ongoing requirements for maintaining a wholesale license in Texas is renewing your license annually. The Texas Comptroller’s office requires all wholesale businesses to renew their licenses every year to continue operating. The renewal process typically involves submitting an application and paying a fee, which is currently $100.

In addition to renewing your license, you will also need to update your business information with the Texas Comptroller’s office. This includes updating your business name, address, and tax ID number, as well as any other relevant information. You can update your business information online or by mail.

Complying with state regulations is also an essential part of maintaining a wholesale license in Texas. This includes complying with sales tax regulations, insurance requirements, and other state laws and regulations. Failure to comply with state regulations can result in penalties and fines, so it’s essential to stay up-to-date on all requirements.

Another important aspect of maintaining a wholesale license in Texas is maintaining accurate records. This includes keeping records of all sales, purchases, and inventory, as well as any other relevant business records. Accurate records can help you to stay organized and ensure that you are complying with all state regulations.

By following these ongoing requirements, you can maintain your wholesale license in Texas and continue to operate your business. Remember to stay up-to-date on all state regulations and requirements, and to update your business information as needed.

Maintaining a wholesale license in Texas is a critical part of the process of getting a wholesale license in Texas. By following the steps outlined above, you can ensure that you are in compliance with state regulations and can continue to operate your business as a licensed wholesaler in Texas.

Common Mistakes to Avoid When Applying for a Texas Wholesale License

When applying for a wholesale license in Texas, it’s essential to avoid common mistakes that can delay or even prevent approval. In this section, we will highlight some of the most common mistakes to avoid when applying for a wholesale license in Texas.

One of the most common mistakes is submitting an incomplete application. This can include failing to provide required documentation, such as business registration or tax ID numbers, or failing to complete all sections of the application. To avoid this mistake, make sure to carefully review the application and ensure that all required information is provided.

Another common mistake is failing to meet the requirements for a wholesale license in Texas. This can include failing to register for state and federal taxes, failing to obtain necessary licenses and permits, or failing to meet insurance requirements. To avoid this mistake, make sure to carefully review the requirements for a wholesale license in Texas and ensure that your business meets all of the necessary requirements.

Non-compliance with state regulations is also a common mistake to avoid when applying for a wholesale license in Texas. This can include failing to comply with sales tax regulations, failing to maintain accurate records, or failing to comply with other state laws and regulations. To avoid this mistake, make sure to carefully review the state regulations and ensure that your business is in compliance with all requirements.

Additionally, failing to pay the required fees or submitting the application too late can also delay or prevent approval. To avoid this mistake, make sure to carefully review the application and ensure that all required fees are paid and the application is submitted on time.

By avoiding these common mistakes, you can ensure that your application for a wholesale license in Texas is approved and you can start operating your business as a licensed wholesaler in Texas.

Remember, getting a wholesale license in Texas requires careful attention to detail and compliance with state regulations. By following the steps outlined above and avoiding common mistakes, you can ensure that your business is successful and compliant with all state regulations.