Unlocking the Potential of a Small Investment

Making money from a small initial investment of $500 requires creativity, resourcefulness, and a solid understanding of the various opportunities available. With the right mindset and strategy, this amount can be a starting point for lucrative ventures that can generate significant returns. In today’s digital age, the possibilities for turning a small investment into a substantial profit are vast and varied.

One of the key factors to consider when exploring ways to make money from $500 is the concept of compounding. By investing wisely and allowing your money to grow over time, you can potentially earn significant returns. For example, investing in a high-yield savings account or a certificate of deposit (CD) can provide a steady stream of interest income. Alternatively, investing in the stock market or peer-to-peer lending can offer higher returns, but also come with higher risks.

Another important consideration is the concept of diversification. By spreading your investment across multiple asset classes and industries, you can minimize risk and maximize potential returns. This can involve investing in a mix of stocks, bonds, and alternative assets, such as real estate or cryptocurrencies.

For those looking to make money from $500, it’s also essential to consider the potential for passive income. This can involve investing in dividend-paying stocks, real estate investment trusts (REITs), or peer-to-peer lending platforms. By generating passive income, you can earn money without actively working for it, allowing you to focus on other pursuits.

Ultimately, making money from $500 requires a combination of creativity, resourcefulness, and a solid understanding of the various opportunities available. By exploring different investment options, diversifying your portfolio, and generating passive income, you can potentially turn a small investment into a substantial profit. Whether you’re looking to invest in the stock market, start a small online business, or participate in the gig economy, the key to success lies in finding the right opportunity and executing a well-thought-out strategy.

Exploring High-Yield Savings Options

High-yield savings accounts offer a low-risk way to grow your initial $500 investment. These accounts are designed to provide a higher interest rate than traditional savings accounts, allowing you to earn a steady stream of interest income. When considering high-yield savings options, it’s essential to research reputable banks and financial institutions that offer competitive interest rates.

Some popular high-yield savings accounts include those offered by Ally Bank, Marcus by Goldman Sachs, and Discover Bank. These accounts typically offer interest rates ranging from 1.5% to 2.5% APY, depending on the institution and market conditions. Additionally, many high-yield savings accounts come with low or no fees, making them an attractive option for those looking to make money from $500.

When selecting a high-yield savings account, consider the following factors: interest rate, fees, minimum balance requirements, and mobile banking capabilities. It’s also essential to ensure that the account is FDIC-insured, which protects your deposit up to $250,000. By choosing a high-yield savings account that meets your needs, you can earn a steady stream of interest income and make the most of your $500 investment.

Another benefit of high-yield savings accounts is their liquidity. You can access your money when needed, making it an excellent option for those who want to keep their investment liquid. Additionally, high-yield savings accounts can be used as a stepping stone for more significant investments, such as stocks or real estate.

While high-yield savings accounts may not offer the highest returns compared to other investment options, they provide a low-risk way to grow your money. By combining a high-yield savings account with other investment strategies, you can create a diversified portfolio that helps you achieve your financial goals. Whether you’re looking to make money from $500 or simply want to save for the future, high-yield savings accounts are an excellent option to consider.

Investing in the Stock Market: A Beginner’s Guide

Investing in the stock market can be a lucrative way to grow your $500 investment. With the right knowledge and strategy, you can potentially earn significant returns. However, it’s essential to understand the basics of the stock market and the risks involved.

Stocks, bonds, and ETFs are the most common investment options in the stock market. Stocks represent ownership in a company, while bonds are debt securities issued by companies or governments. ETFs, or exchange-traded funds, are a type of investment fund that tracks a particular index or sector. When investing in the stock market, it’s crucial to diversify your portfolio to minimize risk.

To get started with investing in the stock market, you’ll need to open a brokerage account. This can be done through a traditional brokerage firm or an online trading platform. Some popular online trading platforms include Robinhood, Fidelity, and Charles Schwab. These platforms offer low fees, user-friendly interfaces, and a wide range of investment options.

When investing with a small amount of money, such as $500, it’s essential to keep costs low. Look for brokerage accounts with low or no fees, and consider investing in index funds or ETFs. These investment options offer broad diversification and can be less expensive than actively managed funds.

Another key consideration when investing in the stock market is risk management. This involves setting a budget, diversifying your portfolio, and regularly reviewing your investments. It’s also essential to have a long-term perspective, as investing in the stock market can be volatile in the short term.

For those new to investing in the stock market, it’s essential to educate yourself on the basics of investing. This can involve reading books, articles, and online resources. Additionally, consider consulting with a financial advisor or using online investment tools to help you make informed investment decisions.

By following these tips and strategies, you can potentially turn your $500 investment into a lucrative opportunity. Remember to always keep costs low, diversify your portfolio, and have a long-term perspective. With the right knowledge and strategy, investing in the stock market can be a great way to grow your wealth over time.

Peer-to-Peer Lending: A Lucrative Alternative

Peer-to-peer lending is a rapidly growing industry that allows individuals to lend money to others, bypassing traditional financial institutions. This concept has gained popularity in recent years, with platforms like Lending Club and Prosper offering a lucrative alternative to traditional investments. By lending money to individuals or small businesses, you can earn interest on your investment, making it a viable option for those looking to make money from $500.

One of the primary benefits of peer-to-peer lending is the potential for high returns. By lending money to individuals or small businesses, you can earn interest rates ranging from 5% to 7% per annum, depending on the platform and the borrower’s creditworthiness. Additionally, peer-to-peer lending platforms often offer a diversified portfolio, allowing you to spread your investment across multiple loans and minimize risk.

However, peer-to-peer lending also comes with risks. Borrowers may default on their loans, which can result in a loss of principal. To mitigate this risk, it’s essential to choose a reputable platform that thoroughly vets borrowers and provides a robust credit scoring system. Lending Club and Prosper are two of the most popular peer-to-peer lending platforms, with a strong track record of managing risk and providing high returns.

When investing in peer-to-peer lending, it’s crucial to understand the fees associated with the platform. Most platforms charge a servicing fee, which can range from 1% to 2% of the loan amount. Additionally, you may be required to pay a small origination fee, which can range from 0.5% to 1% of the loan amount.

Despite the risks and fees, peer-to-peer lending can be a lucrative alternative to traditional investments. By lending money to individuals or small businesses, you can earn high returns and diversify your portfolio. However, it’s essential to approach peer-to-peer lending with caution, thoroughly researching the platform and the borrowers before investing.

For those looking to make money from $500, peer-to-peer lending can be an attractive option. By investing in a diversified portfolio of loans, you can potentially earn high returns and minimize risk. However, it’s essential to remember that peer-to-peer lending is a relatively new industry, and there may be risks associated with investing in this space.

Starting a Small Online Business

Starting a small online business can be a lucrative way to make money from a $500 investment. With the rise of e-commerce and digital marketing, it’s easier than ever to start a successful online business. Whether you’re interested in freelancing, affiliate marketing, or selling products on platforms like Amazon or Etsy, there are numerous opportunities to turn your $500 investment into a profitable venture.

One of the most popular ways to start a small online business is through freelancing. Platforms like Upwork, Fiverr, and Freelancer offer a range of opportunities for freelancers to offer their services, from writing and graphic design to web development and social media management. By creating a professional profile and showcasing your skills, you can attract clients and start earning money from your $500 investment.

Affiliate marketing is another lucrative way to make money online. By promoting products or services from established companies, you can earn a commission on each sale made through your unique referral link. With a $500 investment, you can create a professional website or social media presence and start promoting products to your audience.

Selling products on platforms like Amazon or Etsy is also a popular way to start a small online business. By creating a professional seller account and listing your products, you can reach a vast audience and start earning money from your $500 investment. Whether you’re selling handmade products, used books, or electronics, there are numerous opportunities to turn your $500 investment into a profitable venture.

When starting a small online business, it’s essential to have a solid business plan in place. This includes identifying your target audience, creating a marketing strategy, and setting clear financial goals. By doing your research and planning carefully, you can increase your chances of success and turn your $500 investment into a lucrative opportunity.

Additionally, it’s crucial to stay up-to-date with the latest trends and best practices in online business. This includes staying informed about changes in search engine algorithms, social media platforms, and e-commerce regulations. By continuously learning and adapting, you can stay ahead of the competition and maximize your earnings from your $500 investment.

Starting a small online business requires creativity, resourcefulness, and a willingness to take calculated risks. By investing $500 in a well-planned online business, you can potentially earn significant returns and achieve long-term financial success.

Creating and Selling Digital Products

Creating and selling digital products is a lucrative way to make money from a $500 investment. With the rise of online learning and digital content, there is a growing demand for high-quality digital products such as ebooks, courses, and software. By creating a valuable digital product, you can sell it online and earn passive income from your $500 investment.

One of the most popular types of digital products is ebooks. With the rise of self-publishing, it’s easier than ever to create and sell ebooks on platforms like Amazon Kindle Direct Publishing or Apple Books. By writing a high-quality ebook on a topic you’re knowledgeable about, you can sell it online and earn passive income from your $500 investment.

Another popular type of digital product is online courses. With the rise of online learning, there is a growing demand for high-quality online courses on topics such as marketing, entrepreneurship, and technology. By creating a comprehensive online course, you can sell it on platforms like Udemy or Skillshare and earn passive income from your $500 investment.

Software is another type of digital product that can be created and sold online. With the rise of software as a service (SaaS), there is a growing demand for high-quality software solutions that solve real-world problems. By creating a valuable software solution, you can sell it online and earn passive income from your $500 investment.

When creating and selling digital products, it’s essential to focus on providing value to your customers. This means creating high-quality products that solve real-world problems or meet a specific need. By doing so, you can build a loyal customer base and earn passive income from your $500 investment.

Marketing and sales are also crucial when creating and selling digital products. This means having a solid understanding of your target audience and creating effective marketing campaigns to reach them. By using platforms like social media, email marketing, and paid advertising, you can reach a large audience and sell your digital products online.

Additionally, it’s essential to stay up-to-date with the latest trends and best practices in digital product creation and sales. This means continuously learning and adapting to changes in the market and staying ahead of the competition. By doing so, you can maximize your earnings from your $500 investment and achieve long-term financial success.

Participating in the Gig Economy

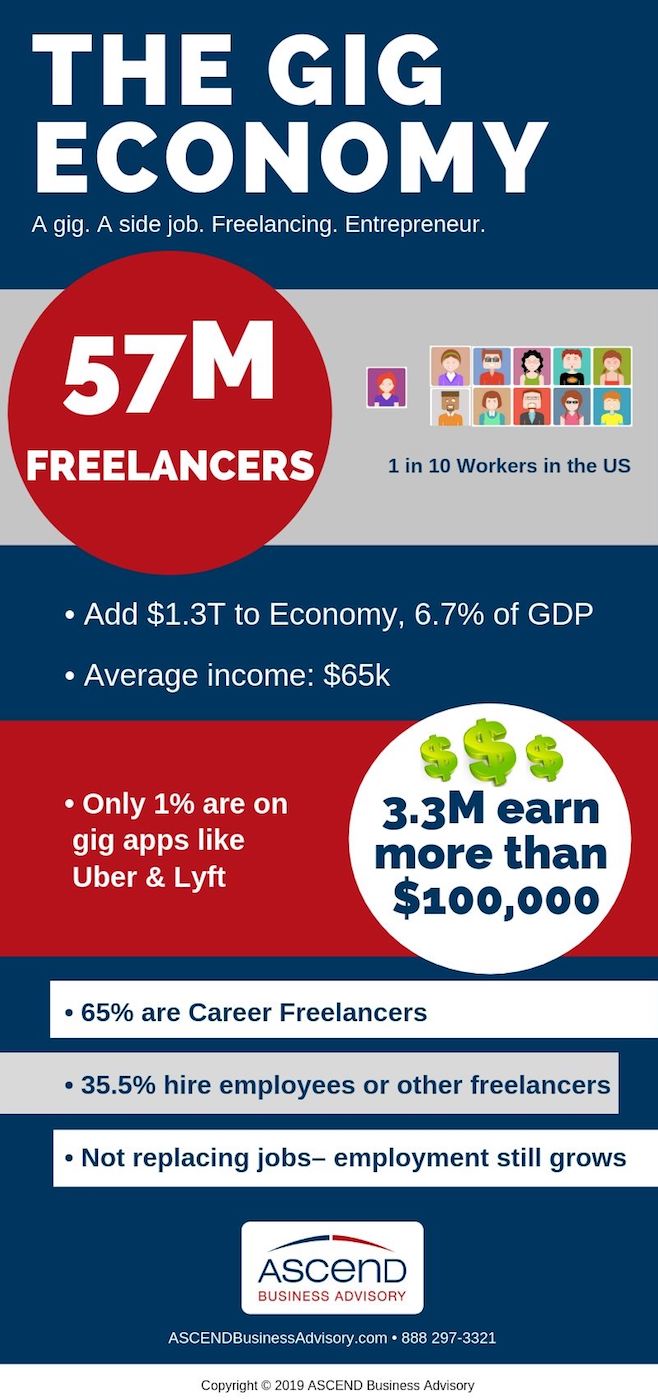

Participating in the gig economy is a flexible and lucrative way to make money from a $500 investment. With the rise of platforms like Uber, Lyft, and TaskRabbit, it’s easier than ever to find gig work that fits your schedule and skills. By investing $500 in a gig economy platform, you can potentially earn significant returns and achieve financial success.

One of the most popular gig economy platforms is Uber. By becoming an Uber driver, you can earn money by transporting passengers in your area. With a $500 investment, you can potentially earn up to $1,000 per month, depending on your location and the number of hours you work.

Another popular gig economy platform is TaskRabbit. By becoming a TaskRabbit tasker, you can earn money by completing tasks and errands for people in your area. With a $500 investment, you can potentially earn up to $500 per month, depending on the number of tasks you complete and the fees you charge.

Lyft is another gig economy platform that allows you to earn money by driving passengers in your area. With a $500 investment, you can potentially earn up to $1,000 per month, depending on your location and the number of hours you work.

When participating in the gig economy, it’s essential to be flexible and adaptable. This means being available to work at different times and being willing to take on different types of tasks. By being flexible and adaptable, you can increase your earnings and achieve financial success.

Additionally, it’s essential to have a solid understanding of the gig economy platform you’re using. This means understanding the fees, rules, and regulations of the platform, as well as the expectations of the clients you’re working with. By having a solid understanding of the platform, you can increase your earnings and achieve financial success.

Marketing and sales are also crucial when participating in the gig economy. This means promoting your services to potential clients and negotiating fair rates for your work. By using platforms like social media and online advertising, you can reach a large audience and increase your earnings.

By participating in the gig economy, you can potentially earn significant returns from a $500 investment. With the flexibility and adaptability to take on different types of tasks, you can increase your earnings and achieve financial success.

Maximizing Your Earnings: Tips and Strategies

Maximizing your earnings from a $500 investment requires patience, persistence, and continuous learning. By following these tips and strategies, you can increase your chances of achieving long-term financial success.

First, it’s essential to have a solid understanding of the investment options available to you. This means researching and comparing different investment opportunities, such as high-yield savings accounts, stocks, bonds, and peer-to-peer lending. By understanding the benefits and risks of each option, you can make informed decisions and maximize your earnings.

Second, it’s crucial to diversify your portfolio. This means spreading your investment across multiple asset classes and industries to minimize risk. By diversifying your portfolio, you can reduce your exposure to market fluctuations and increase your potential for long-term growth.

Third, it’s essential to stay informed and adapt to changes in the market. This means staying up-to-date with the latest news and trends, and adjusting your investment strategy accordingly. By staying informed and adapting to changes, you can stay ahead of the competition and maximize your earnings.

Fourth, it’s crucial to be patient and persistent. Investing is a long-term game, and it’s essential to have a time horizon of at least five years. By being patient and persistent, you can ride out market fluctuations and achieve long-term financial success.

Fifth, it’s essential to continuously learn and improve. This means seeking out new knowledge and skills, and applying them to your investment strategy. By continuously learning and improving, you can stay ahead of the competition and maximize your earnings.

Finally, it’s crucial to have a solid understanding of tax implications and fees associated with your investment. This means understanding how taxes and fees can impact your earnings, and adjusting your investment strategy accordingly. By understanding tax implications and fees, you can minimize your expenses and maximize your earnings.

By following these tips and strategies, you can maximize your earnings from a $500 investment and achieve long-term financial success. Remember to stay informed, adapt to changes, and continuously learn and improve. With patience, persistence, and the right investment strategy, you can turn your $500 investment into a lucrative opportunity.