Why Independence Matters: The Benefits of Self-Sufficiency

Achieving financial independence is a dream shared by many, and for good reason. Breaking free from the 9-to-5 grind can lead to a more fulfilling life, where individuals have the freedom to pursue their passions and interests without the burden of a traditional salary. By learning how to make money independently, individuals can experience reduced stress, increased job security, and a sense of self-sufficiency that is hard to find in a traditional employment setting.

One of the primary benefits of financial independence is the ability to create a lifestyle that is tailored to one’s individual needs and desires. Without the constraints of a traditional job, individuals can pursue opportunities that bring them joy and fulfillment, whether that means traveling, starting a business, or simply having more time to spend with loved ones. By taking control of their financial lives, individuals can create a sense of purpose and direction that is often lacking in a traditional employment setting.

In addition to the personal benefits, financial independence can also provide a sense of security and stability that is hard to find in today’s fast-paced and often unpredictable job market. By learning how to make money independently, individuals can reduce their reliance on a single income source and create a safety net that will protect them in the event of unexpected expenses or financial downturns. This can be especially important for individuals who are looking to start a family, retire early, or simply enjoy a more relaxed and stress-free lifestyle.

Furthermore, financial independence can also provide individuals with a sense of pride and accomplishment that comes from taking control of their financial lives. By learning how to make money independently, individuals can develop a sense of self-confidence and self-worth that is hard to find in a traditional employment setting. This can be especially important for individuals who are looking to break free from the constraints of a traditional job and create a lifestyle that is truly their own.

Overall, achieving financial independence is a goal that is within reach for anyone who is willing to put in the time and effort to learn how to make money independently. By taking control of their financial lives, individuals can create a more fulfilling, secure, and stress-free lifestyle that is tailored to their individual needs and desires.

Identifying Your Strengths: Uncovering Your Money-Making Potential

When it comes to making money independently, it’s essential to identify your strengths and talents that can be monetized. By understanding what you’re good at and what you enjoy doing, you can create a business or career that is both fulfilling and profitable. Many successful independent entrepreneurs have built their businesses around their unique value propositions, which are often rooted in their skills, talents, and interests.

For example, a skilled writer might start a freelance writing business, offering their services to clients who need high-quality content. A talented artist might sell their work online or at local galleries, while a skilled programmer might create and sell their own software or apps. By identifying your strengths and talents, you can create a business that is tailored to your unique abilities and interests.

One way to identify your strengths is to take an inventory of your skills and talents. Make a list of what you’re good at and what you enjoy doing. Consider your education, work experience, and hobbies. Ask yourself what you’re passionate about and what you’re willing to put in the time and effort to develop. By taking a close look at your strengths and talents, you can start to identify potential business ideas and opportunities.

Another way to identify your strengths is to seek feedback from others. Ask friends, family, and colleagues what they think you’re good at and what you’re passionate about. You might be surprised at the insights and ideas they can offer. Additionally, consider taking online courses or attending workshops and conferences to develop your skills and learn more about your industry.

Some successful independent entrepreneurs who have built their businesses around their unique value propositions include:

– Sara Blakely, founder of Spanx, who turned her idea for footless pantyhose into a multimillion-dollar business.

– Chris Gardner, founder of Gardner Rich & Co, who built a successful stock brokerage firm despite facing numerous challenges and setbacks.

– Lisa Stone, co-founder of BlogHer, who turned her passion for blogging into a successful business that connects women bloggers with brands and advertisers.

These entrepreneurs, and many others like them, have demonstrated that it’s possible to build a successful business around your strengths and talents. By identifying your unique value proposition and developing a business plan around it, you can start making money independently and achieving your financial goals.

Exploring Alternative Income Streams: Beyond the

Exploring Alternative Income Streams: Beyond the Paycheck

When it comes to making money independently, there are numerous alternative income streams to explore beyond the traditional paycheck. By diversifying your income streams, you can reduce your reliance on a single source of income and create a more stable financial foundation. In this section, we’ll explore various ways to make money independently, including freelancing, online businesses, affiliate marketing, and selling products or services.

Freelancing is a popular way to make money independently, as it allows you to offer your skills and services to clients on a project-by-project basis. Platforms like Upwork, Freelancer, and Fiverr make it easy to find freelance work in a variety of fields, from writing and design to programming and consulting. By freelancing, you can choose your own projects, set your own rates, and work on your own schedule.

Online businesses are another lucrative way to make money independently. By creating a website or blog, you can sell products or services, offer affiliate marketing, or monetize your content with advertising. Online businesses can be run from anywhere with an internet connection, making them a great option for those who want to work remotely or travel. Popular online business models include e-commerce, dropshipping, and affiliate marketing.

Affiliate marketing is a way to make money independently by promoting other people’s products or services. By joining affiliate programs, you can earn commissions on sales or referrals, without having to create your own products or services. Affiliate marketing can be done through a website, blog, or social media, and is a great way to monetize your online presence.

Selling products or services is another way to make money independently. By creating a product or service that solves a problem or meets a need, you can sell it online or offline, and earn a profit. Popular product-based businesses include handmade goods, print-on-demand products, and digital products like ebooks and courses.

When exploring alternative income streams, it’s essential to consider the pros and cons of each option. For example, freelancing offers flexibility and autonomy, but can be unpredictable and lacking in benefits. Online businesses offer scalability and potential for passive income, but require significant upfront effort and investment. Affiliate marketing offers low overhead and potential for high earnings, but requires significant marketing and promotion efforts.

Ultimately, the key to success in making money independently is to diversify your income streams and find what works best for you. By exploring alternative income streams and finding a combination that works, you can create a more stable financial foundation and achieve your goals.

Building a Personal Brand: Establishing Credibility and Trust

As an independent entrepreneur, building a personal brand is crucial for establishing credibility and trust with potential clients and customers. A strong personal brand can help you stand out in a crowded market, attract high-quality clients, and increase your earning potential. In this section, we’ll explore the importance of creating a professional online presence and offer tips on how to build a personal brand that attracts clients and customers.

A professional online presence is essential for building a personal brand. This includes having a website or blog, social media profiles, and networking with other professionals in your industry. Your website or blog should clearly communicate your unique value proposition, showcase your skills and expertise, and provide a way for potential clients to contact you. Social media profiles should be professional and consistent with your personal brand, and should be used to engage with your audience and share valuable content.

Networking is also a critical component of building a personal brand. Attend industry events, join online communities and forums, and connect with other professionals in your industry. This will help you build relationships, establish yourself as an expert in your field, and stay up-to-date on the latest industry trends and developments.

Consistency is key when it comes to building a personal brand. Ensure that your messaging, visual identity, and tone are consistent across all of your online platforms. This will help to establish trust and credibility with your audience, and make it easier for them to recognize and remember you.

Another important aspect of building a personal brand is to showcase your expertise and thought leadership. This can be done through creating valuable content, such as blog posts, videos, and podcasts, that demonstrate your knowledge and expertise in your industry. You can also use social media to share your thoughts and opinions on industry trends and developments, and to engage with your audience and build relationships.

Finally, building a personal brand takes time and effort. It’s essential to be patient, persistent, and authentic in your approach. Focus on providing value to your audience, and on building relationships with them. With time and effort, you can establish a strong personal brand that attracts clients and customers and helps you to achieve your goals.

Managing Finances: Budgeting and Investing for Success

As an independent entrepreneur, managing finances is crucial for achieving financial independence and long-term success. By creating a budget, saving, and investing, you can ensure that your business is financially stable and secure. In this section, we’ll explore the importance of financial planning and provide guidance on how to manage finances as an independent entrepreneur.

Creating a budget is the first step in managing finances. By tracking your income and expenses, you can identify areas where you can cut back and allocate your resources more effectively. Consider using a budgeting app or spreadsheet to make it easier to track your finances and stay on top of your spending.

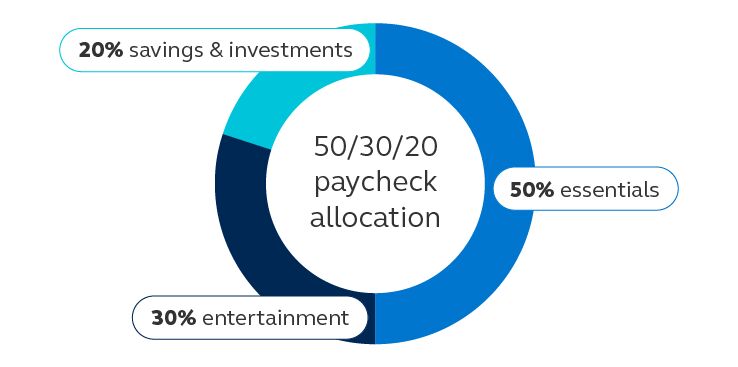

Saving is also essential for independent entrepreneurs. By setting aside a portion of your income each month, you can build an emergency fund and ensure that you have enough money to cover unexpected expenses. Consider setting up a separate savings account specifically for your business and aim to save at least 10% to 20% of your income each month.

Investing is another important aspect of financial planning. By investing in your business, you can increase your earning potential and achieve long-term financial success. Consider investing in assets such as stocks, real estate, or a retirement account, and seek the advice of a financial advisor to ensure that you’re making informed investment decisions.

In addition to budgeting, saving, and investing, it’s also important to manage your taxes effectively. As an independent entrepreneur, you’ll be responsible for paying your own taxes, so it’s essential to stay on top of your tax obligations and take advantage of any tax deductions or credits that you’re eligible for. Consider consulting with a tax professional to ensure that you’re in compliance with all tax laws and regulations.

Finally, it’s essential to stay organized and keep track of your finances. Consider using accounting software or a financial management tool to make it easier to track your income and expenses, and to stay on top of your financial obligations. By staying organized and managing your finances effectively, you can ensure that your business is financially stable and secure, and that you’re on track to achieving your long-term financial goals.

Some popular tools and resources for financial planning include:

– QuickBooks: A comprehensive accounting software that helps you track your income and expenses, and manage your finances.

– Mint: A personal finance app that helps you track your spending, create a budget, and set financial goals.

– TurboTax: A tax preparation software that helps you prepare and file your taxes, and ensures that you’re taking advantage of all tax deductions and credits that you’re eligible for.

By using these tools and resources, and by following the guidance outlined in this section, you can ensure that your finances are in order and that you’re on track to achieving your long-term financial goals.

Overcoming Obstacles: Staying Motivated and Focused

As an independent entrepreneur, it’s common to face obstacles and challenges that can make it difficult to stay motivated and focused. Self-doubt, procrastination, and burnout are just a few of the common challenges that can hold you back from achieving your goals. In this section, we’ll explore strategies for overcoming these obstacles and staying motivated and focused on your long-term goals.

One of the most effective ways to overcome self-doubt is to focus on your strengths and accomplishments. Rather than dwelling on your weaknesses and failures, try to focus on what you’re good at and what you’ve achieved. Celebrate your successes, no matter how small they may seem, and use them as motivation to keep moving forward.

Procrastination is another common obstacle that can hold you back from achieving your goals. To overcome procrastination, try breaking down large tasks into smaller, more manageable chunks. This will make it easier to stay focused and avoid feeling overwhelmed. Additionally, try setting deadlines for yourself and creating a schedule to help you stay on track.

Burnout is a common challenge that many independent entrepreneurs face. To avoid burnout, try taking regular breaks and practicing self-care. This can include activities such as exercise, meditation, or spending time with loved ones. Additionally, try to set realistic goals and prioritize your tasks to avoid feeling overwhelmed.

Another effective way to stay motivated and focused is to create a support network. This can include friends, family, or fellow entrepreneurs who can offer encouragement and support. Joining a community or networking group can also be a great way to connect with others who share similar goals and challenges.

Finally, try to stay positive and focused on your long-term goals. Remind yourself why you started your business in the first place, and what you hope to achieve. Celebrate your successes and don’t be too hard on yourself when you encounter setbacks. With persistence and determination, you can overcome any obstacle and achieve your goals.

Some popular strategies for staying motivated and focused include:

– Creating a vision board to help you stay focused on your goals

– Setting clear and achievable goals, and breaking them down into smaller tasks

– Creating a schedule and sticking to it

– Taking regular breaks and practicing self-care

– Surrounding yourself with a supportive network of friends, family, and fellow entrepreneurs

By incorporating these strategies into your daily routine, you can stay motivated and focused on your long-term goals, and overcome any obstacles that come your way.

Scaling Your Business: Strategies for Growth and Expansion

As an independent entrepreneur, scaling your business is crucial for achieving long-term success and financial independence. By expanding your product or service offerings, outsourcing tasks, and delegating responsibilities, you can increase your earning potential and build a sustainable business. In this section, we’ll explore strategies for scaling your business and provide tips on how to think big and aim for long-term success.

One of the most effective ways to scale your business is to expand your product or service offerings. This can include creating new products or services, or offering additional features and benefits to existing customers. By diversifying your offerings, you can attract new customers and increase revenue.

Outsourcing tasks is another effective way to scale your business. By delegating tasks to freelancers or contractors, you can free up time and focus on high-level tasks that drive growth and revenue. Consider outsourcing tasks such as content creation, social media management, and customer service.

Delegating responsibilities is also crucial for scaling your business. By hiring employees or contractors, you can delegate tasks and responsibilities, and focus on high-level tasks that drive growth and revenue. Consider hiring employees or contractors to handle tasks such as marketing, sales, and customer service.

Another effective way to scale your business is to leverage technology. By using tools and software, you can automate tasks, streamline processes, and increase efficiency. Consider using tools such as project management software, customer relationship management software, and marketing automation software.

Finally, it’s essential to think big and aim for long-term success. By setting ambitious goals and creating a strategic plan, you can achieve financial independence and build a sustainable business. Consider setting goals such as increasing revenue, expanding your customer base, and building a strong brand.

Some popular strategies for scaling a business include:

– Creating a minimum viable product (MVP) to test the market and gather feedback

– Using lean startup methodologies to iterate and improve products and services

– Leveraging social media and content marketing to build a strong brand and attract customers

– Outsourcing tasks and delegating responsibilities to free up time and focus on high-level tasks

– Using technology to automate tasks, streamline processes, and increase efficiency

By incorporating these strategies into your business, you can scale your business and achieve long-term success.