Understanding Venmo’s Social Payment Network

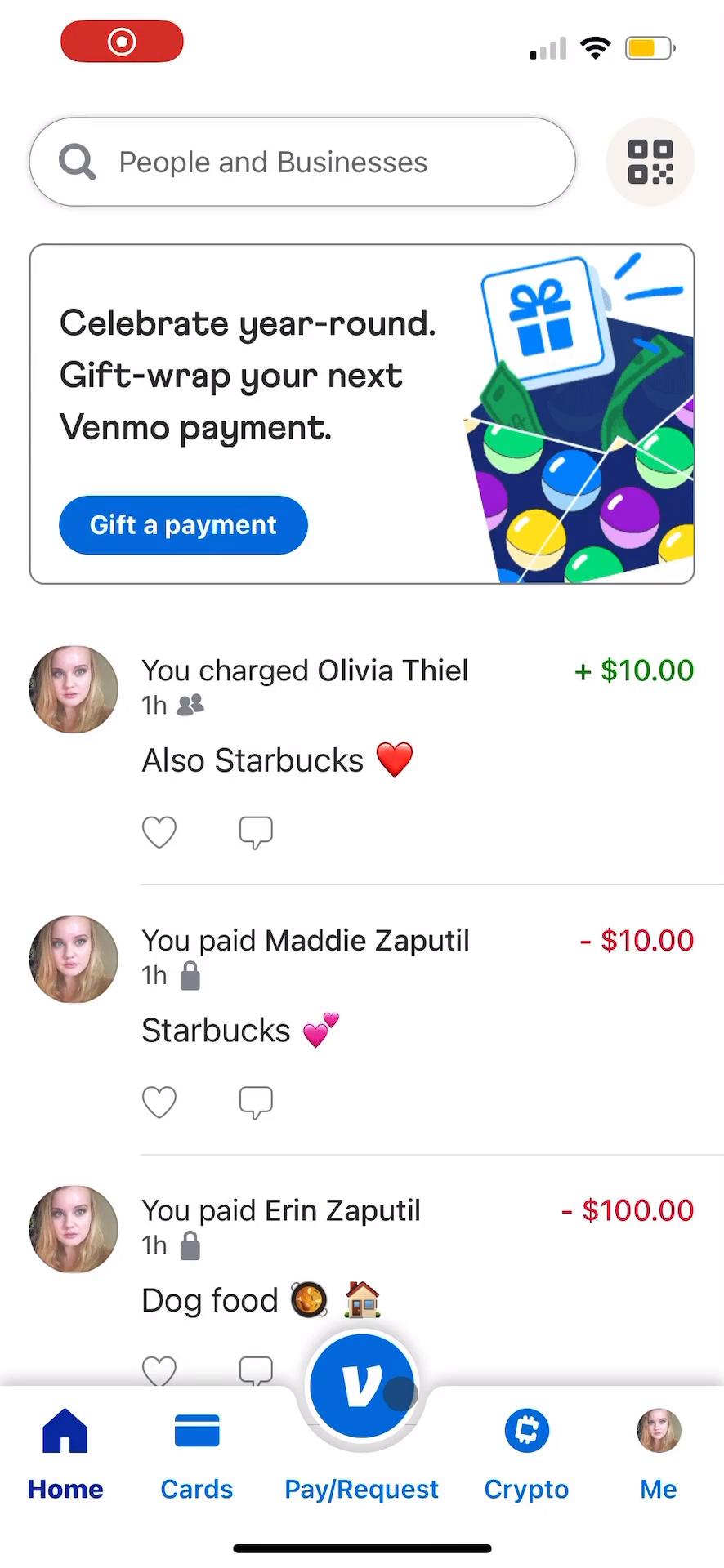

Venmo, a peer-to-peer payment service owned by PayPal, has evolved into a social payment network that allows users to send and receive money, as well as share their transactions on a social feed. This unique feature has made Venmo a popular platform for individuals to make money, with many users leveraging the network to buy, sell, and trade goods and services. As the popularity of Venmo continues to grow, so does its potential for monetization. With over 40 million active users, Venmo provides a vast market for individuals to earn extra cash. By understanding how to navigate Venmo’s social payment network, users can unlock new opportunities to make money and achieve financial freedom.

One of the key features that sets Venmo apart from other payment services is its social aspect. The platform allows users to share their transactions on a social feed, which can be seen by their friends and followers. This feature has given rise to a new form of social commerce, where users can buy and sell goods and services with ease. By leveraging this feature, users can increase their visibility, build their personal brand, and attract new customers. For example, a user can share a transaction for a product they are selling, and their friends and followers can see the post and make a purchase. This feature has made Venmo an attractive platform for entrepreneurs, small business owners, and individuals looking to make money online.

In addition to its social features, Venmo also provides a range of tools and services that make it easy to send and receive money. The platform allows users to link their debit card, credit card, or bank account, making it easy to transfer funds. Venmo also offers a range of payment features, including invoicing and payment requests, which can be used to get paid by clients or customers. By utilizing these features, users can streamline their payment process, reduce fees, and increase their earnings. For example, a freelancer can use Venmo’s invoicing feature to send a bill to a client, and the client can pay the invoice directly through the platform.

Overall, Venmo’s social payment network provides a unique opportunity for individuals to make money and achieve financial freedom. By understanding how to navigate the platform, users can unlock new opportunities to earn extra cash, build their personal brand, and attract new customers. Whether you’re an entrepreneur, small business owner, or individual looking to make money online, Venmo is definitely worth considering. With its social features, payment tools, and vast user base, Venmo has the potential to become a major player in the world of online commerce.

Setting Up Your Venmo Account for Success

Setting up a Venmo account is a straightforward process that requires some basic information and a few minutes of your time. To get started, download the Venmo app on your mobile device and tap “Sign up” to create a new account. You will be asked to provide some basic information, such as your name, email address, and phone number. You will also need to create a username and password for your account.

Choosing a username is an important part of setting up your Venmo account. Your username will be used to identify you on the platform, so choose something that is unique and memorable. It’s also a good idea to choose a username that reflects your personal brand or business. For example, if you’re a freelancer, you might choose a username that includes your name and profession.

In addition to choosing a username, you will also need to add a profile picture and bio to your Venmo account. Your profile picture should be a clear and recent photo of yourself, and your bio should include a brief description of who you are and what you do. This information will be visible to other Venmo users, so make sure it’s accurate and professional.

Once you’ve set up your Venmo account, you’ll need to verify it by linking a payment method. You can link a debit card, credit card, or bank account to your Venmo account, which will allow you to send and receive money. Verifying your account is an important step in setting up your Venmo account, as it will help to prevent fraud and ensure that your transactions are secure.

Linking a payment method to your Venmo account is a simple process that requires just a few minutes of your time. To link a debit card or credit card, simply tap “Add a payment method” and follow the prompts to enter your card information. To link a bank account, you will need to provide your bank account information and verify your account through a series of test transactions.

By following these steps, you can set up a Venmo account that is secure, professional, and ready to use. Remember to choose a unique and memorable username, add a profile picture and bio, and verify your account by linking a payment method. With a Venmo account, you can start making money and achieving your financial goals.

Ways to Make Money on Venmo: Selling Products and Services

Venmo offers a range of opportunities for users to make money, from selling products and services to participating in the online gig economy. One of the most popular ways to make money on Venmo is by selling products. Users can sell physical goods, such as clothing, accessories, and electronics, or digital products, such as ebooks, courses, and software. To get started, users can create a post on their Venmo feed showcasing the product they want to sell, including a description, price, and photos.

Another way to make money on Venmo is by offering services. Users can offer services such as freelance writing, graphic design, pet-sitting, or house cleaning. To get started, users can create a post on their Venmo feed showcasing their services, including a description, pricing, and examples of their work. Venmo’s social features make it easy to promote services and connect with potential clients.

Participating in the online gig economy is another way to make money on Venmo. Users can offer their skills and services on platforms such as Fiverr, TaskRabbit, or Uber, and get paid through Venmo. This is a great way to monetize skills and expertise, and Venmo’s payment features make it easy to get paid quickly and securely.

Successful Venmo users have monetized their accounts through these methods. For example, some users have sold products such as handmade jewelry, artwork, or clothing, while others have offered services such as freelance writing, graphic design, or pet-sitting. By leveraging Venmo’s social features and payment tools, users can turn their passions into profitable ventures.

One of the benefits of making money on Venmo is the low transaction fees. Venmo charges a small fee for transactions, but it’s often lower than other payment platforms. This means that users can keep more of their earnings, and Venmo’s payment features make it easy to track and manage transactions.

Overall, Venmo offers a range of opportunities for users to make money, from selling products and services to participating in the online gig economy. By leveraging Venmo’s social features and payment tools, users can turn their passions into profitable ventures and achieve their financial goals.

Utilizing Venmo’s Payment Features to Get Paid

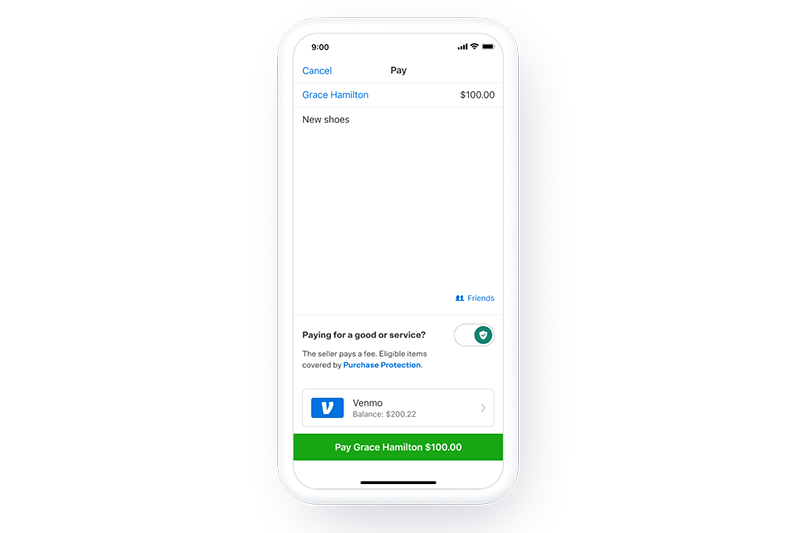

Venmo’s payment features make it easy to get paid by clients or customers. One of the most useful features is the ability to send invoices and payment requests. This feature allows users to create and send professional-looking invoices to clients, making it easy to get paid for services or products. To use this feature, simply tap the “Request” button on the Venmo app, enter the amount and description of the payment, and send the request to the client’s Venmo account.

Another useful feature is the ability to receive payments from clients or customers. Venmo’s payment features make it easy to receive payments, and users can track their payments in real-time. To receive a payment, simply provide the client with your Venmo username or QR code, and they can send the payment directly to your account.

Venmo’s payment features also include the ability to split bills and payments with friends or colleagues. This feature is useful for splitting restaurant bills, rent, or other expenses. To split a bill, simply tap the “Split” button on the Venmo app, enter the amount and description of the payment, and select the friends or colleagues you want to split the bill with.

Using Venmo’s payment features can help users get paid quickly and securely. Venmo’s payment features are designed to make it easy to send and receive payments, and users can track their payments in real-time. Additionally, Venmo’s payment features are secure, and users can rest assured that their payments are protected.

One of the benefits of using Venmo’s payment features is the low transaction fees. Venmo charges a small fee for transactions, but it’s often lower than other payment platforms. This means that users can keep more of their earnings, and Venmo’s payment features make it easy to track and manage transactions.

Overall, Venmo’s payment features make it easy to get paid by clients or customers. By using Venmo’s payment features, users can streamline their payment process, reduce fees, and increase their earnings. Whether you’re a freelancer, small business owner, or individual looking to make money online, Venmo’s payment features can help you achieve your financial goals.

Building a Personal Brand on Venmo

Building a personal brand on Venmo is crucial for increasing earning potential on the platform. A strong personal brand can help you establish credibility, build trust with your audience, and differentiate yourself from others. To build a personal brand on Venmo, start by creating engaging content that showcases your personality, skills, and expertise.

Use relevant hashtags to make your content more discoverable, and interact with other users by commenting, liking, and sharing their posts. This will help you build relationships and establish yourself as an authority in your niche. Additionally, use Venmo’s social features to share your content, such as posting updates, sharing photos, and participating in discussions.

Consistency is key when it comes to building a personal brand on Venmo. Post content regularly, and make sure it’s high-quality and engaging. Use a consistent tone and voice, and make sure your content is aligned with your personal brand. This will help you build a loyal following and increase your earning potential on the platform.

Another important aspect of building a personal brand on Venmo is to be authentic and transparent. Be honest and open with your audience, and make sure you’re providing value to them. This will help you build trust and credibility, and increase your earning potential on the platform.

Some successful Venmo users have built a personal brand by showcasing their expertise and skills. For example, a freelance writer might share their writing portfolio, while a graphic designer might share their design work. By showcasing their expertise and skills, these users have established themselves as authorities in their niche and increased their earning potential on the platform.

Overall, building a personal brand on Venmo is crucial for increasing earning potential on the platform. By creating engaging content, using relevant hashtags, interacting with other users, and being authentic and transparent, you can establish yourself as an authority in your niche and increase your earning potential on Venmo.

Monetizing Your Venmo Account through Affiliate Marketing

Affiliate marketing is a popular way to monetize a Venmo account, and it can be a lucrative way to earn extra cash. By promoting products or services of other companies and earning a commission on sales, you can turn your Venmo account into a profitable venture. To get started with affiliate marketing on Venmo, you’ll need to find affiliate programs that align with your niche or interests.

There are many affiliate programs available, and you can find them by searching online or through affiliate networks such as Commission Junction or ShareASale. Once you’ve found a program that interests you, you’ll need to create an affiliate link or code to track your referrals. You can then share this link with your Venmo followers, either by posting it directly to your feed or by including it in a message or comment.

When promoting products or services through affiliate marketing, it’s essential to be transparent with your followers. Make sure to disclose that you’re earning a commission on sales, and only promote products that you believe in and use yourself. This will help you build trust with your audience and increase your chances of success.

Some successful Venmo users have monetized their accounts through affiliate marketing by promoting products such as fashion items, electronics, or home goods. By leveraging their influence and reach on the platform, they’ve been able to earn significant commissions and increase their earnings.

The potential earnings from affiliate marketing on Venmo can vary widely, depending on the products you promote, the size of your audience, and the commission rates offered by the affiliate program. However, with the right strategy and a bit of effort, it’s possible to earn hundreds or even thousands of dollars per month through affiliate marketing on Venmo.

Overall, affiliate marketing is a powerful way to monetize a Venmo account and earn extra cash. By finding the right affiliate programs, creating engaging content, and promoting products to your followers, you can turn your Venmo account into a profitable venture and achieve your financial goals.

Staying Safe and Secure on Venmo

As with any online platform, it’s essential to prioritize safety and security when using Venmo. To avoid scams and protect your personal and financial information, follow these tips:

First, be cautious when receiving payments from unknown senders. Verify the sender’s identity and ensure that you’re receiving payment for a legitimate transaction. Never send money to someone you don’t know, and be wary of requests for payment from unfamiliar senders.

Second, protect your personal and financial information by using strong passwords and keeping your account information up-to-date. Avoid using public computers or public Wi-Fi to access your Venmo account, and make sure to log out of your account when you’re finished using it.

Third, report any suspicious activity to Venmo’s customer support team. If you notice any unusual transactions or receive a suspicious payment request, don’t hesitate to reach out to Venmo’s support team for assistance.

Venmo also offers several security measures to help protect your account. For example, you can enable two-factor authentication to add an extra layer of security to your account. You can also set up notifications to alert you of any suspicious activity on your account.

By following these tips and using Venmo’s security measures, you can help protect your account and ensure a safe and secure experience on the platform.

Additionally, Venmo has a number of policies in place to help prevent scams and protect users. For example, Venmo has a strict policy against phishing and other forms of scams, and the company works closely with law enforcement to investigate and prosecute scammers.

Overall, staying safe and secure on Venmo requires a combination of common sense, caution, and awareness of the platform’s security measures. By following these tips and using Venmo’s security features, you can help protect your account and ensure a safe and secure experience on the platform.

Maximizing Your Earnings on Venmo: Tips and Strategies

To maximize your earnings on Venmo, it’s essential to stay up-to-date with the latest platform changes and trends. One way to do this is by participating in online communities related to Venmo and personal finance. These communities can provide valuable insights and tips on how to make the most of your Venmo account.

Another way to maximize your earnings on Venmo is by using the platform’s rewards program. Venmo offers a rewards program that allows users to earn cash back and other rewards on certain purchases. By using this program, you can earn extra money on top of your regular earnings.

In addition to using the rewards program, you can also maximize your earnings on Venmo by experimenting with different monetization strategies. For example, you can try selling products or services, offering affiliate marketing, or participating in online gig economy. By trying out different strategies, you can find what works best for you and maximize your earnings.

Finally, it’s essential to stay organized and keep track of your earnings on Venmo. You can use a spreadsheet or a budgeting app to track your income and expenses, and make sure you’re meeting your financial goals. By staying organized and focused, you can maximize your earnings on Venmo and achieve financial success.

By following these tips and strategies, you can maximize your earnings on Venmo and achieve financial success. Remember to stay up-to-date with the latest platform changes and trends, use the rewards program, experiment with different monetization strategies, and stay organized and focused. With the right approach, you can make the most of your Venmo account and earn extra money.

Overall, maximizing your earnings on Venmo requires a combination of creativity, experimentation, and organization. By trying out different strategies and staying focused, you can achieve financial success and make the most of your Venmo account.