Choosing the Right Type of CD Account for Your Needs

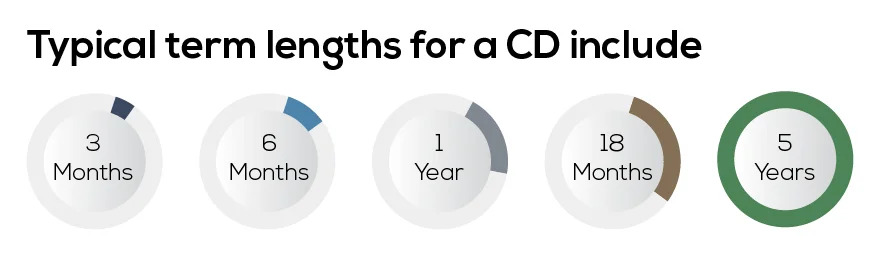

When it comes to opening a CD account, one of the most important decisions is choosing the right type of CD that aligns with your financial goals and time horizon. There are several types of CD accounts available, each with its own unique characteristics and benefits. Traditional CDs, for example, offer a fixed interest rate for a specified term, typically ranging from a few months to several years. Jumbo CDs, on the other hand, require a higher minimum deposit, but often offer higher interest rates and more favorable terms.

No-penalty CDs, also known as liquid CDs, offer more flexibility than traditional CDs, allowing you to withdraw your money before the end of the term without incurring a penalty. However, these CDs often come with lower interest rates and more restrictive terms. Step-up CDs, also known as tiered CDs, offer multiple interest rates, with higher rates for larger deposits. Zero-coupon CDs, also known as discount CDs, are sold at a discount to their face value and do not pay interest until maturity.

When selecting a CD account, it’s essential to consider your financial goals, risk tolerance, and time horizon. If you’re looking for a low-risk investment with a fixed return, a traditional CD may be the best option. However, if you need more flexibility or are willing to take on more risk, a no-penalty or step-up CD may be a better fit. By understanding the different types of CD accounts available, you can make an informed decision and choose the one that best meets your needs.

Meeting the Eligibility Requirements for a CD Account

To open a CD account, you’ll need to meet certain eligibility requirements, which may vary depending on the bank or financial institution. Typically, you’ll need to be at least 18 years old and a U.S. citizen or resident alien to qualify for a CD account. You may also need to provide proof of identity, such as a driver’s license or passport, and proof of address, such as a utility bill or lease agreement.

In addition to these basic requirements, some banks may have additional eligibility criteria, such as a minimum deposit requirement or a minimum balance requirement. It’s essential to review the eligibility requirements for the specific CD account you’re interested in before applying. This will help you avoid any potential issues or delays in the application process.

When researching how to open a CD account, it’s crucial to understand the eligibility requirements and ensure you meet them before applying. This will save you time and effort in the long run and help you avoid any potential disappointment. By meeting the eligibility requirements, you can take the first step towards opening a CD account and starting to earn a higher interest rate on your savings.

Researching and Comparing CD Account Offers from Top Banks

When considering how to open a CD account, it’s essential to research and compare CD account offers from top banks to find the best option for your needs. With so many banks offering CD accounts, it can be overwhelming to navigate the different options. However, by taking the time to research and compare, you can find a CD account that meets your financial goals and provides a competitive interest rate.

One of the key factors to consider when researching CD account offers is the interest rate. Look for banks that offer competitive interest rates, and be sure to understand the terms and conditions of the account. Some banks may offer higher interest rates for longer terms or larger deposits, so be sure to consider these factors when making your decision.

In addition to interest rates, it’s also important to consider fees and minimum deposit requirements. Some banks may charge fees for early withdrawal or maintenance, so be sure to understand these fees before opening an account. Minimum deposit requirements can also vary, so be sure to choose a bank that meets your needs.

Another factor to consider is the bank’s reputation and stability. Look for banks that are FDIC-insured or NCUA-insured, which means that your deposits are insured up to $250,000. You can also check the bank’s rating with the Better Business Bureau or other consumer protection agencies to ensure that you’re working with a reputable institution.

By taking the time to research and compare CD account offers from top banks, you can find a CD account that meets your financial goals and provides a competitive interest rate. Remember to consider factors such as interest rates, fees, and minimum deposit requirements, as well as the bank’s reputation and stability. With the right CD account, you can start earning a higher interest rate on your savings and achieving your financial goals.

Opening a CD Account: A Step-by-Step Process

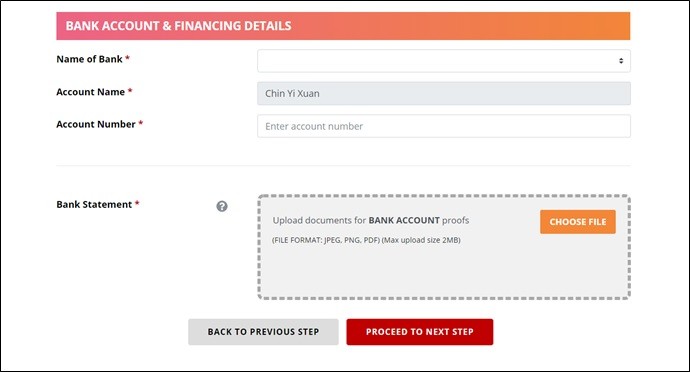

Opening a CD account is a straightforward process that can be completed online, by phone, or in person at a bank branch. To get started, you’ll need to gather the required documents and information, which may include your social security number, driver’s license, and proof of address.

Once you have the necessary documents, you can begin the application process. This typically involves filling out an online application or visiting a bank branch in person. Be sure to carefully review the terms and conditions of the CD account before submitting your application.

After your application is approved, you’ll need to fund your CD account. This can be done by transferring money from an existing bank account, mailing a check, or making a deposit in person. Be sure to understand any deposit limits or requirements that may apply.

Once your CD account is funded, you can start earning interest on your deposit. Be sure to review your account terms and conditions to understand how interest is calculated and compounded. You can also set up automatic transfers from your checking account to your CD account to make saving easier.

Throughout the process of opening a CD account, it’s essential to carefully review the terms and conditions to ensure you understand the agreement. This includes understanding the interest rate, fees, and minimum deposit requirements. By taking the time to review the terms and conditions, you can avoid any potential issues or surprises down the line.

By following these steps, you can successfully open a CD account and start earning a higher interest rate on your savings. Remember to carefully review the terms and conditions, understand the deposit requirements, and set up automatic transfers to make saving easier.

Funding Your CD Account: Understanding Deposit Options and Limits

Once you’ve opened a CD account, you’ll need to fund it to start earning interest. There are several deposit options available, including online transfers, wire transfers, and mail deposits. Each option has its own benefits and limitations, so it’s essential to understand the details before making a deposit.

Online transfers are a convenient way to fund your CD account. You can transfer money from an existing bank account or from another financial institution. This option is usually free and can be completed quickly. However, there may be limits on the amount you can transfer online, so be sure to check with your bank before making a deposit.

Wire transfers are another option for funding your CD account. This method is typically faster than online transfers, but it may come with a fee. Wire transfers can be initiated online or by phone, and the funds are usually available in your CD account within a few hours.

Mail deposits are a more traditional way to fund your CD account. You can mail a check or money order to the bank, and the funds will be deposited into your account. This option may take longer than online or wire transfers, but it’s a good option if you prefer to use a physical check.

It’s essential to understand the deposit limits and requirements for your CD account. Some banks may have minimum deposit requirements, while others may have maximum deposit limits. Be sure to review the terms and conditions of your CD account to understand the deposit requirements and any potential fees.

By understanding the deposit options and limits for your CD account, you can make informed decisions about how to fund your account and start earning interest. Remember to review the terms and conditions of your CD account to ensure you understand the deposit requirements and any potential fees.

Managing Your CD Account: Understanding Interest Rates, Compounding, and Maturity

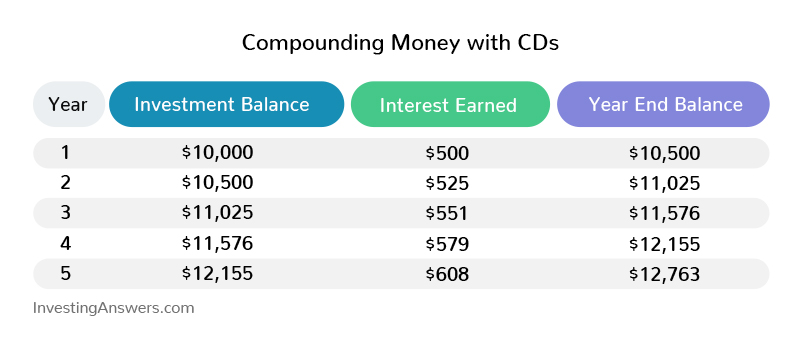

Once you’ve opened a CD account, it’s essential to understand how it works, including how interest is calculated and compounded. A CD account earns interest on a fixed rate, which is typically higher than a traditional savings account. The interest rate is usually expressed as an annual percentage yield (APY), which takes into account the compounding of interest.

Compounding is the process of earning interest on both the principal deposit and any accrued interest. This means that the interest earned on your CD account is added to the principal, and then the interest rate is applied to the new balance. Compounding can occur daily, monthly, or quarterly, depending on the terms of your CD account.

The maturity date of a CD account is the date when the term ends, and you can access your money without penalty. On the maturity date, you can choose to withdraw your money, roll it over into a new CD account, or let it automatically renew. It’s essential to understand the maturity date and the options available to you to make the most of your CD account.

When considering how to open a CD account, it’s crucial to understand the interest rates, compounding, and maturity. By understanding these factors, you can make informed decisions about your CD account and maximize your earnings. Remember to review the terms and conditions of your CD account to ensure you understand the interest rates, compounding, and maturity.

In addition to understanding the interest rates, compounding, and maturity, it’s also essential to keep track of your CD account’s performance. You can do this by regularly reviewing your account statements and monitoring your interest earnings. By staying on top of your CD account’s performance, you can make adjustments as needed to ensure you’re getting the most out of your investment.

Common Mistakes to Avoid When Opening a CD Account

When opening a CD account, it’s essential to avoid common mistakes that can cost you money or lead to frustration. One of the most significant mistakes is not reading the fine print. Before signing any agreement, make sure you understand the terms and conditions, including the interest rate, fees, and minimum deposit requirements.

Another mistake is not understanding the fees associated with the CD account. Some banks may charge fees for early withdrawal, maintenance, or other services. Make sure you understand what fees are associated with the account and how they can impact your earnings.

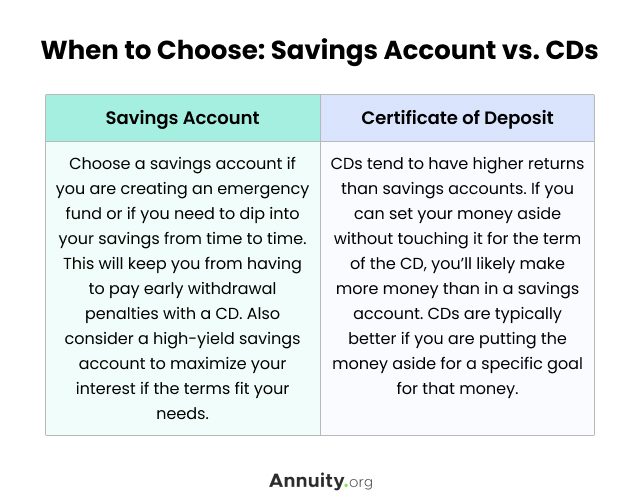

Not considering alternative savings options is also a common mistake. CDs are just one type of savings account, and there may be other options that better fit your financial goals and time horizon. Consider other savings accounts, such as high-yield savings accounts or money market accounts, before opening a CD account.

Not monitoring your CD account’s performance is another mistake to avoid. Regularly review your account statements and monitor your interest earnings to ensure you’re getting the most out of your investment. If you notice any discrepancies or issues, contact your bank immediately to resolve the problem.

Finally, not considering the tax implications of a CD account is a mistake to avoid. CDs are subject to taxes, and the interest earned may be taxable. Consider the tax implications of a CD account before opening one, and consult with a tax professional if necessary.

By avoiding these common mistakes, you can make the most of your CD account and achieve your financial goals. Remember to always read the fine print, understand the fees, consider alternative savings options, monitor your account’s performance, and consider the tax implications before opening a CD account.

Common Mistakes to Avoid When Opening a CD Account

Opening a CD account can be a great way to save money and earn a higher interest rate than a traditional savings account. However, there are some common mistakes to avoid when opening a CD account. By understanding these mistakes, you can make the most of your CD account and achieve your financial goals.

One of the most common mistakes is not reading the fine print. Before signing any agreement, make sure you understand the terms and conditions, including the interest rate, fees, and minimum deposit requirements. Don’t assume that all CD accounts are the same, and take the time to review the details of the account you’re interested in.

Another mistake is not understanding the fees associated with the CD account. Some banks may charge fees for early withdrawal, maintenance, or other services. Make sure you understand what fees are associated with the account and how they can impact your earnings.

Not considering alternative savings options is also a common mistake. CDs are just one type of savings account, and there may be other options that better fit your financial goals and time horizon. Consider other savings accounts, such as high-yield savings accounts or money market accounts, before opening a CD account.

Not monitoring your CD account’s performance is another mistake to avoid. Regularly review your account statements and monitor your interest earnings to ensure you’re getting the most out of your investment. If you notice any discrepancies or issues, contact your bank immediately to resolve the problem.

Finally, not considering the tax implications of a CD account is a mistake to avoid. CDs are subject to taxes, and the interest earned may be taxable. Consider the tax implications of a CD account before opening one, and consult with a tax professional if necessary.

By avoiding these common mistakes, you can make the most of your CD account and achieve your financial goals. Remember to always read the fine print, understand the fees, consider alternative savings options, monitor your account’s performance, and consider the tax implications before opening a CD account.