Understanding Amazon’s Monthly Payment Plans

Amazon’s monthly payment plans offer customers a flexible and convenient way to make purchases on the platform. By providing various payment options, Amazon caters to different customer needs, allowing them to budget and manage their expenses more effectively. For instance, customers can opt for a monthly payment plan when purchasing large items, such as electronics or furniture, which can help spread the cost over several months. This option is particularly useful for those who want to avoid paying the full amount upfront. Additionally, Amazon’s monthly payment plans can help customers avoid overspending, as they can set a budget and stick to it. To take advantage of this feature, customers can simply select the “Monthly Payments” option at checkout and choose a payment plan that suits their needs.

Amazon’s monthly payment plans are designed to be user-friendly, with clear and transparent terms and conditions. Customers can easily track their payments and adjust their payment schedules as needed. Furthermore, Amazon’s monthly payment plans can help customers build credit, as payments are reported to the credit bureaus. This can be particularly beneficial for customers who are looking to establish or improve their credit score. Overall, Amazon’s monthly payment plans provide customers with a convenient and flexible way to make purchases on the platform, while also helping them manage their finances more effectively.

When considering how to pay monthly on Amazon, customers should be aware of the various payment options available. Amazon offers a range of payment plans, including financing options and credit cards. Customers can choose the payment plan that best suits their needs, whether it’s a short-term or long-term plan. By understanding the different payment options available, customers can make informed decisions about their purchases and manage their finances more effectively.

How to Set Up a Monthly Payment Plan on Amazon

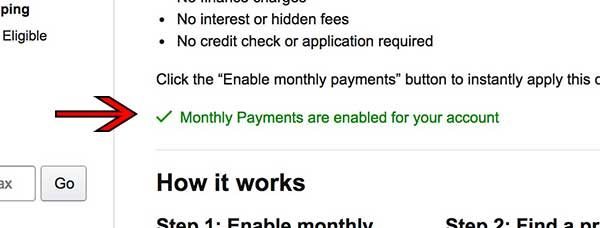

Setting up a monthly payment plan on Amazon is a straightforward process that can be completed in a few steps. To get started, customers need to navigate to the payment options page, which can be accessed by clicking on the “Payment Options” link at the top of the Amazon homepage. From there, customers can select the “Monthly Payments” option and choose the desired payment plan.

Amazon offers a range of payment plans, including financing options and credit cards. Customers can choose the payment plan that best suits their needs, whether it’s a short-term or long-term plan. When selecting a payment plan, customers should consider factors such as interest rates, fees, and repayment terms. By understanding the different payment options available, customers can make informed decisions about their purchases and manage their finances more effectively.

To confirm the payment method, customers will need to enter their payment information, including their credit card number, expiration date, and security code. Customers can also choose to save their payment information for future purchases, making it easier to checkout and manage their payments.

Once the payment method is confirmed, customers can review and agree to the terms and conditions of the payment plan. This includes understanding the payment schedule, interest rates, and fees associated with the plan. By carefully reviewing the terms and conditions, customers can ensure that they understand their obligations and can manage their payments effectively.

After completing the setup process, customers can start making purchases on Amazon using their monthly payment plan. Customers can track their payments and adjust their payment schedules as needed, making it easy to manage their finances and stay on top of their payments.

Amazon Financing Options: What You Need to Know

Amazon offers several financing options to help customers pay for their purchases over time. These options include the Amazon Credit Card, Amazon Store Card, and Amazon Financing. Each of these options has its own interest rates, fees, and repayment terms, so it’s essential to understand the details before choosing a financing option.

The Amazon Credit Card is a popular financing option that offers 0% interest for 6, 12, or 24 months on purchases over $149. This card also offers rewards, such as 3% cashback on Amazon purchases and 1% cashback on all other purchases. However, the card has an annual fee of $95, and interest rates can range from 14.49% to 22.49% variable APR.

The Amazon Store Card is another financing option that offers 0% interest for 6 months on purchases over $149. This card also offers rewards, such as 5% cashback on Amazon purchases. However, the card has a higher interest rate than the Amazon Credit Card, ranging from 25.99% to 29.99% variable APR.

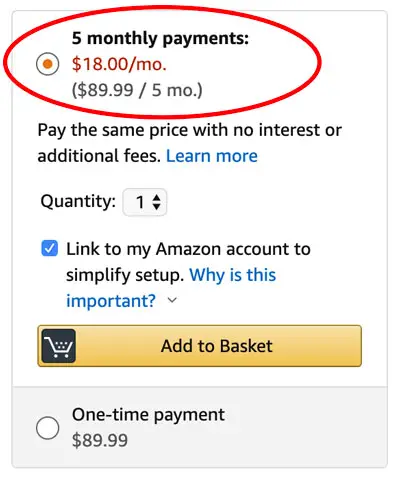

Amazon Financing is a financing option that allows customers to pay for their purchases over time with fixed monthly payments. This option is available on select purchases over $149 and offers 0% interest for 3, 6, or 12 months. However, interest rates can range from 10.99% to 29.99% APR, and late fees may apply.

When considering Amazon’s financing options, customers should carefully review the terms and conditions, including interest rates, fees, and repayment terms. By understanding the details of each financing option, customers can make informed decisions about their purchases and manage their finances more effectively.

It’s also essential to note that Amazon’s financing options are subject to credit approval, and not all customers may qualify. Additionally, customers should be aware of the potential risks of accumulating debt and make timely payments to avoid late fees and interest charges.

Using Amazon’s Monthly Payment Plan for Large Purchases

Amazon’s monthly payment plan is a great option for customers who want to make large purchases, such as electronics, furniture, or appliances, without breaking the bank. By spreading the cost of the purchase over several months, customers can budget and manage their expenses more effectively.

For example, if a customer wants to purchase a new TV that costs $1,000, they can use Amazon’s monthly payment plan to pay for it over 6 months. This would break down to approximately $167 per month, making it more manageable for the customer to pay for the TV without having to pay the full amount upfront.

Using Amazon’s monthly payment plan for large purchases also helps customers avoid overspending. By setting a budget and sticking to it, customers can avoid accumulating debt and make timely payments. Additionally, Amazon’s monthly payment plan can help customers build credit, as payments are reported to the credit bureaus.

Another benefit of using Amazon’s monthly payment plan for large purchases is that it allows customers to take advantage of sales and discounts. If a customer sees a sale on a large item they want to purchase, they can use Amazon’s monthly payment plan to pay for it over time, rather than having to pay the full amount upfront.

It’s also worth noting that Amazon’s monthly payment plan can be used in conjunction with other financing options, such as the Amazon Credit Card or Amazon Store Card. This can provide customers with even more flexibility and options for paying for their purchases.

Overall, Amazon’s monthly payment plan is a great option for customers who want to make large purchases without breaking the bank. By spreading the cost of the purchase over several months, customers can budget and manage their expenses more effectively, and take advantage of sales and discounts.

Managing Your Amazon Monthly Payments

Once you’ve set up a monthly payment plan on Amazon, it’s essential to manage your payments effectively to avoid late fees and interest charges. Here are some tips to help you manage your Amazon monthly payments:

Set up automatic payments: Amazon allows you to set up automatic payments, which can help ensure that your payments are made on time. You can set up automatic payments by going to the “Payment Options” page and selecting the “Automatic Payments” option.

Track your payment history: Amazon provides a payment history page where you can view all your past payments, including the payment amount, payment date, and payment method. You can access this page by going to the “Payment Options” page and selecting the “Payment History” option.

Adjust your payment schedule: If you need to adjust your payment schedule, you can do so by going to the “Payment Options” page and selecting the “Payment Schedule” option. You can adjust the payment amount, payment date, and payment frequency to suit your needs.

Make extra payments: If you want to pay off your balance faster, you can make extra payments by going to the “Payment Options” page and selecting the “Make a Payment” option. You can make a one-time payment or set up a recurring payment schedule.

Monitor your account activity: It’s essential to monitor your account activity regularly to ensure that your payments are being processed correctly. You can view your account activity by going to the “Payment Options” page and selecting the “Account Activity” option.

By following these tips, you can manage your Amazon monthly payments effectively and avoid late fees and interest charges. Remember to always review your payment terms and conditions before making a purchase, and don’t hesitate to contact Amazon customer support if you have any questions or concerns.

Common Questions About Amazon Monthly Payments

Amazon’s monthly payment options can be a bit complex, and customers often have questions and concerns about how they work. Here are some common questions and answers to help clarify things:

What happens if I miss a payment? If you miss a payment, Amazon will send you a reminder email and may charge a late fee. You can avoid late fees by setting up automatic payments or making a payment as soon as possible.

Can I change my payment method? Yes, you can change your payment method at any time by going to the “Payment Options” page and selecting the “Change Payment Method” option.

Can I cancel my monthly payment plan? Yes, you can cancel your monthly payment plan at any time by going to the “Payment Options” page and selecting the “Cancel Payment Plan” option. However, keep in mind that you will still be responsible for paying off any outstanding balance.

What is the interest rate on Amazon’s monthly payment plans? The interest rate on Amazon’s monthly payment plans varies depending on the plan you choose. Some plans may have a 0% interest rate for a promotional period, while others may have a higher interest rate.

Can I use Amazon’s monthly payment plans for all purchases? No, Amazon’s monthly payment plans are only available for certain purchases, such as those over $149. Additionally, some sellers may not offer monthly payment plans, so it’s always a good idea to check the product page before making a purchase.

How do I know if I’m eligible for Amazon’s monthly payment plans? To be eligible for Amazon’s monthly payment plans, you must have a valid Amazon account and meet certain creditworthiness requirements. You can check your eligibility by going to the “Payment Options” page and selecting the “Check Eligibility” option.

Alternatives to Amazon’s Monthly Payment Plan

While Amazon’s monthly payment plan is a great option for many customers, it may not be the best fit for everyone. Fortunately, there are several alternative payment options available on Amazon that can provide similar benefits and flexibility. Here are a few options to consider:

Amazon Pay: Amazon Pay is a payment service that allows customers to pay for purchases using their Amazon account. It’s a convenient and secure way to make payments, and it can be used for both online and in-store purchases.

Amazon Cash: Amazon Cash is a payment option that allows customers to add cash to their Amazon account at participating retailers. It’s a great option for customers who prefer to use cash or who don’t have a credit or debit card.

Third-party financing options: Amazon also offers third-party financing options through partners like Affirm and Klarna. These options allow customers to pay for purchases over time, often with interest-free financing options.

Benefits of alternative payment options: Alternative payment options can provide several benefits, including flexibility, convenience, and budgeting. They can also help customers avoid overspending and make more informed purchasing decisions.

Drawbacks of alternative payment options: While alternative payment options can be beneficial, they may also have some drawbacks. For example, some options may have interest rates or fees associated with them, and others may require a credit check.

Choosing the right payment option: When choosing a payment option on Amazon, it’s essential to consider your individual needs and financial situation. Take the time to review the terms and conditions of each option, and choose the one that best fits your budget and preferences.

Conclusion: Making the Most of Amazon’s Monthly Payment Options

Amazon’s monthly payment options offer a flexible and convenient way to make purchases on the platform. By understanding the benefits and flexibility of these options, customers can make informed decisions about their payment plans and manage their finances more effectively.

Whether you’re looking to make a large purchase or simply want to spread out the cost of a smaller item, Amazon’s monthly payment options can help. With a range of financing options available, including the Amazon Credit Card, Amazon Store Card, and Amazon Financing, customers can choose the option that best fits their needs.

In addition to Amazon’s monthly payment options, customers can also explore alternative payment options, such as Amazon Pay, Amazon Cash, and third-party financing options. These alternatives can provide similar benefits and flexibility, and can be a great option for customers who want to avoid interest rates or fees.

By taking the time to understand Amazon’s monthly payment options and alternatives, customers can make the most of their purchasing power and manage their finances more effectively. Whether you’re a seasoned Amazon shopper or just starting out, exploring these options can help you make informed decisions and achieve your financial goals.

Remember, Amazon’s monthly payment options are designed to be flexible and convenient, so don’t be afraid to explore and find the option that works best for you. With a little bit of planning and research, you can make the most of Amazon’s monthly payment options and achieve your financial goals.