Understanding Your Credit Card Statement

When it comes to managing your credit card debt, understanding your credit card statement is crucial. Your statement provides a detailed breakdown of your account activity, including your balance, payment due date, and minimum payment requirements. To ensure you’re making timely payments and avoiding unnecessary fees, it’s essential to review your statement carefully each month.

Start by checking the billing cycle, which is the period between statements. This will help you understand when your payment is due and how much time you have to make a payment. Next, review the payment due date and make sure you understand the minimum payment requirements. Paying only the minimum payment can lead to a longer payoff period and more interest paid over time.

Take note of any fees associated with your account, such as late fees, foreign transaction fees, or balance transfer fees. These fees can add up quickly, so it’s essential to understand what you’re being charged for. Additionally, review your credit limit and available credit to ensure you’re not overspending.

By taking the time to review your credit card statement each month, you’ll be better equipped to manage your debt and make informed decisions about your payments. This is an essential step in learning how to pay the credit card bill effectively and avoiding unnecessary fees and charges.

Remember, understanding your credit card statement is just the first step in managing your debt. By combining this knowledge with a solid payment strategy, you’ll be well on your way to paying off your credit card balance and achieving financial freedom.

Choosing the Right Payment Method

When it comes to paying your credit card bill, you have several payment methods to choose from. Each method has its pros and cons, and understanding these can help you make an informed decision. In this section, we’ll explore the various payment methods available, including online payments, phone payments, mail payments, and in-person payments.

Online payments are a popular choice for many credit card holders. This method allows you to make payments from the comfort of your own home, 24/7. Simply log in to your credit card account, navigate to the payment section, and enter your payment details. Online payments are fast, convenient, and often free. However, be aware that some credit card issuers may charge a small fee for online payments.

Phone payments are another option for paying your credit card bill. This method involves calling your credit card issuer’s customer service number and providing your payment details over the phone. Phone payments are a good choice for those who prefer to speak with a live representative or need assistance with their payment. However, be aware that phone payments may incur a small fee, and you’ll need to have your payment details ready when you call.

Mail payments involve sending a check or money order to your credit card issuer’s mailing address. This method is a good choice for those who prefer to pay by check or need to make a payment when online or phone payments are not available. However, be aware that mail payments can take several days to process, and you’ll need to ensure that your payment is received by the due date to avoid late fees.

In-person payments involve visiting a bank branch or credit union to make a payment. This method is a good choice for those who prefer to make payments in person or need to make a payment when online or phone payments are not available. However, be aware that in-person payments may incur a small fee, and you’ll need to ensure that the bank branch or credit union accepts your credit card issuer’s payments.

When choosing a payment method, consider factors such as convenience, cost, and processing time. By selecting the right payment method for your needs, you can ensure that your credit card payments are made on time and in full, helping you to avoid late fees and penalties. By learning how to pay the credit card bill effectively, you can take control of your finances and achieve financial freedom.

Setting Up Automatic Payments

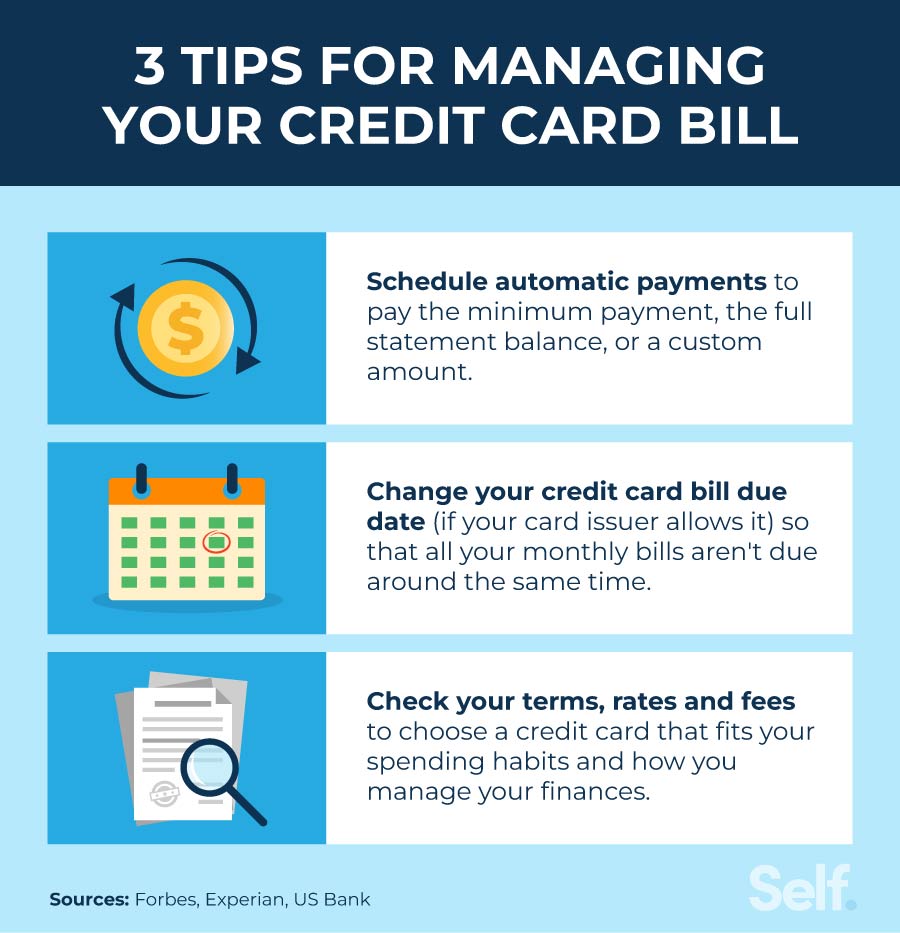

Setting up automatic payments is a convenient and efficient way to ensure that your credit card bill is paid on time, every time. By enrolling in autopay, you can avoid late fees and penalties, and make managing your credit card debt easier. In this section, we’ll provide a step-by-step guide on how to set up automatic payments.

Step 1: Log in to your credit card account online or through the mobile app. Navigate to the payment section and look for the autopay option. Some credit card issuers may call it “automatic payments” or “recurring payments.”

Step 2: Choose your payment frequency. You can usually choose to make payments monthly, bi-monthly, or weekly. Make sure to select a frequency that aligns with your pay schedule and financial goals.

Step 3: Select your payment amount. You can choose to pay the minimum payment, the full balance, or a fixed amount. Make sure to review your budget and financial goals before selecting a payment amount.

Step 4: Confirm your payment details. Review your payment information carefully to ensure that it is accurate and complete. Make sure to include your payment date, payment amount, and payment method.

Step 5: Enroll in autopay. Once you’ve confirmed your payment details, click the “enroll” or “submit” button to activate autopay. You’ll receive a confirmation email or notification once your enrollment is complete.

By following these steps, you can set up automatic payments and take control of your credit card debt. Remember to review your budget and financial goals regularly to ensure that your automatic payments are aligned with your needs. By learning how to pay the credit card bill effectively, you can avoid late fees and penalties, and achieve financial freedom.

Additionally, make sure to ensure sufficient funds in your account to avoid overdrafts or declined payments. You can also set up notifications to remind you of upcoming payments or low account balances. By taking these extra steps, you can ensure that your automatic payments are successful and stress-free.

Making Online Payments

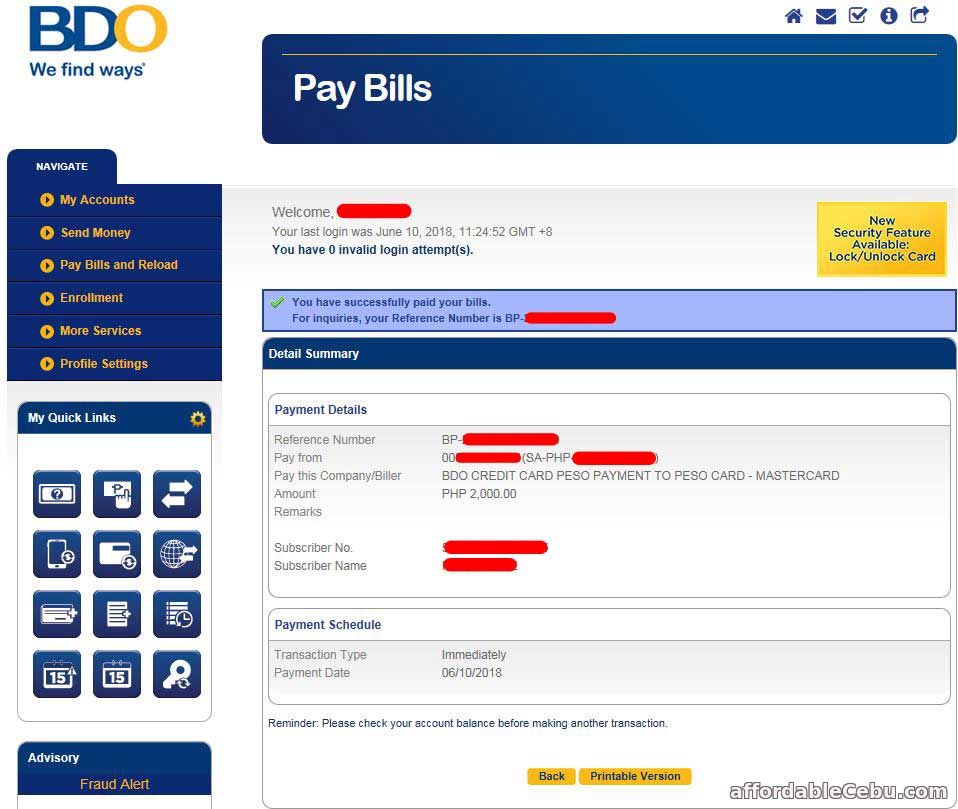

Making online payments is a convenient and efficient way to pay your credit card bill. With online payments, you can make payments from the comfort of your own home, 24/7. In this section, we’ll explain the process of making online payments, including how to log in to your credit card account, navigate to the payment section, and enter payment details.

Step 1: Log in to your credit card account online. Go to your credit card issuer’s website and click on the “login” or “account access” button. Enter your username and password to access your account.

Step 2: Navigate to the payment section. Once you’re logged in, click on the “payments” or “make a payment” tab. This will take you to the payment section of your account.

Step 3: Enter your payment details. In the payment section, you’ll need to enter your payment amount, payment date, and payment method. Make sure to review your payment details carefully to ensure that they are accurate and complete.

Step 4: Confirm your payment. Once you’ve entered your payment details, click the “submit” or “make payment” button to confirm your payment. You’ll receive a confirmation email or notification once your payment is processed.

By following these steps, you can make online payments and take control of your credit card debt. Remember to review your budget and financial goals regularly to ensure that your online payments are aligned with your needs. By learning how to pay the credit card bill effectively, you can avoid late fees and penalties, and achieve financial freedom.

Additionally, make sure to keep your account information and payment details secure. Use strong passwords and keep your account information confidential to avoid unauthorized access or identity theft. By taking these extra steps, you can ensure that your online payments are safe and secure.

Online payments are a convenient and efficient way to pay your credit card bill. By following the steps outlined above, you can make online payments and take control of your credit card debt. Remember to review your budget and financial goals regularly to ensure that your online payments are aligned with your needs.

Using Mobile Payments

Mobile payments are a convenient and secure way to pay your credit card bill. With mobile payments, you can make payments on the go, using your smartphone or tablet. In this section, we’ll discuss the option of using mobile payments, such as Apple Pay, Google Pay, or Samsung Pay, and how to set up and use these services.

Mobile payments use near-field communication (NFC) technology to transmit payment information to a payment terminal. To use mobile payments, you’ll need to have a compatible device and a mobile payment app. Some popular mobile payment apps include Apple Pay, Google Pay, and Samsung Pay.

To set up mobile payments, follow these steps:

Step 1: Download and install a mobile payment app on your device. You can find mobile payment apps in the app store or by searching online.

Step 2: Add your credit card information to the app. You’ll need to enter your credit card number, expiration date, and security code.

Step 3: Set up a payment method. You can choose to use a credit card, debit card, or other payment method.

Step 4: Use your mobile payment app to make payments. Simply hold your device near a payment terminal and authenticate the payment using a fingerprint, password, or other security method.

Mobile payments offer several benefits, including convenience, security, and ease of use. By using mobile payments, you can avoid carrying cash or credit cards, and make payments on the go. Additionally, mobile payments are often more secure than traditional payment methods, as they use tokenization and encryption to protect your payment information.

By learning how to pay the credit card bill using mobile payments, you can take advantage of these benefits and make managing your credit card debt easier. Remember to review your budget and financial goals regularly to ensure that your mobile payments are aligned with your needs.

Mobile payments are a convenient and secure way to pay your credit card bill. By following the steps outlined above, you can set up and use mobile payments to make managing your credit card debt easier.

Understanding Late Fees and Penalties

Missing a credit card payment can result in late fees and penalties, which can add up quickly and damage your credit score. In this section, we’ll explain the consequences of missing a payment, including late fees, penalties, and potential damage to credit scores.

Late fees are charges imposed by the credit card issuer for missing a payment. These fees can range from $25 to $38, depending on the credit card issuer and the state you live in. Late fees are typically added to your outstanding balance, which can increase the amount you owe and make it harder to pay off your debt.

Penalties are additional charges imposed by the credit card issuer for missing a payment. These penalties can include higher interest rates, fees for late payments, and fees for exceeding your credit limit. Penalties can add up quickly and make it harder to pay off your debt.

Missing a payment can also damage your credit score. Credit card issuers report late payments to the credit bureaus, which can lower your credit score and make it harder to get credit in the future. A lower credit score can also result in higher interest rates and fees, making it harder to pay off your debt.

To avoid late fees and penalties, it’s essential to make your credit card payments on time. Set up automatic payments or reminders to ensure you never miss a payment. If you’re having trouble making payments, contact your credit card issuer to discuss possible solutions, such as a payment plan or temporary hardship program.

By understanding the consequences of missing a payment, you can take steps to avoid late fees and penalties and maintain good credit habits. Remember, paying your credit card bill on time is crucial to avoiding debt and maintaining a good credit score.

Additionally, consider setting up a payment calendar or reminder system to ensure you never miss a payment. You can also set up automatic payments or use a budgeting app to track your expenses and stay on top of your payments.

By taking these steps, you can avoid late fees and penalties and maintain good credit habits. Remember, paying your credit card bill on time is crucial to avoiding debt and maintaining a good credit score.

Tips for Paying More Than the Minimum

Paying more than the minimum payment on your credit card bill can help you pay off your debt faster and reduce the amount of interest you owe. In this section, we’ll offer advice on how to pay more than the minimum payment, including strategies for paying off principal balances, reducing interest charges, and avoiding debt.

One way to pay more than the minimum payment is to pay a fixed amount each month. For example, you could pay $50 or $100 more than the minimum payment each month. This can help you pay off your principal balance faster and reduce the amount of interest you owe.

Another way to pay more than the minimum payment is to use the snowball method. This involves paying off your credit cards with the smallest balances first, while making minimum payments on your other credit cards. Once you’ve paid off the credit card with the smallest balance, you can use the money you were paying on that card to pay off the credit card with the next smallest balance.

You can also consider using the avalanche method, which involves paying off your credit cards with the highest interest rates first. This can help you save money on interest charges over time and pay off your debt faster.

Additionally, consider making bi-weekly payments instead of monthly payments. This can help you make 26 payments per year, instead of 12, which can help you pay off your debt faster.

By paying more than the minimum payment, you can avoid debt and save money on interest charges. Remember to review your budget and financial goals regularly to ensure that you’re making progress towards paying off your debt.

It’s also important to note that paying more than the minimum payment can help you avoid late fees and penalties. By making timely payments and paying more than the minimum, you can avoid these charges and save money over time.

By following these tips, you can pay more than the minimum payment and make progress towards paying off your debt. Remember to stay consistent and patient, and you’ll be on your way to financial freedom.

Monitoring Your Credit Score

Monitoring your credit score and report is essential to maintaining good credit habits and avoiding debt. In this section, we’ll emphasize the importance of monitoring your credit score and report, including how to check for errors, track changes, and maintain good credit habits.

Your credit score is a three-digit number that represents your creditworthiness. It’s calculated based on your payment history, credit utilization, and other factors. A good credit score can help you qualify for lower interest rates, better loan terms, and other financial benefits.

To monitor your credit score, you can check your credit report regularly. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. Review your report carefully to ensure that it’s accurate and up-to-date.

Check for errors on your credit report, such as incorrect payment history or credit accounts that don’t belong to you. Dispute any errors you find with the credit reporting agency. This can help improve your credit score and avoid debt.

Track changes to your credit score over time. You can use a credit monitoring service to track your credit score and receive alerts when changes occur. This can help you stay on top of your credit and make adjustments as needed.

Maintain good credit habits by making on-time payments, keeping credit utilization low, and avoiding debt. By following these tips, you can maintain a good credit score and avoid debt.

By monitoring your credit score and report, you can take control of your credit and avoid debt. Remember to check your credit report regularly, track changes to your credit score, and maintain good credit habits.

Additionally, consider using a credit monitoring service to track your credit score and receive alerts when changes occur. This can help you stay on top of your credit and make adjustments as needed.

By following these tips, you can maintain a good credit score and avoid debt. Remember to stay consistent and patient, and you’ll be on your way to financial freedom.