Understanding the Impact of Collections on Your Credit Score

Collections on a credit report can have a significant impact on an individual’s credit score, making it essential to understand the effects and take steps to remove them. A collection is a debt that has been sent to a third-party agency, typically after the original creditor has been unable to collect payment. These debts can include unpaid bills, credit card debt, and loans. When a collection appears on a credit report, it can lower the credit score, making it more challenging to obtain credit in the future.

The presence of collections on a credit report can also affect the credit utilization ratio, which is the percentage of available credit being used. A high credit utilization ratio can negatively impact the credit score, as it indicates to lenders that the individual may be overextending themselves. By removing collections from a credit report, individuals can improve their credit utilization ratio and overall credit score.

There are several types of collections that can appear on a credit report, including:

- Medical collections: Unpaid medical bills that have been sent to a collection agency.

- Credit card collections: Unpaid credit card debt that has been sent to a collection agency.

- Loan collections: Unpaid loans that have been sent to a collection agency.

- Public record collections: Unpaid debts that have been reported to the credit bureaus as public records, such as tax liens or court judgments.

Understanding the types of collections that can appear on a credit report is crucial in taking the necessary steps to remove them. By knowing the types of collections and their impact on the credit score, individuals can take proactive measures to improve their creditworthiness and increase their chances of obtaining credit in the future.

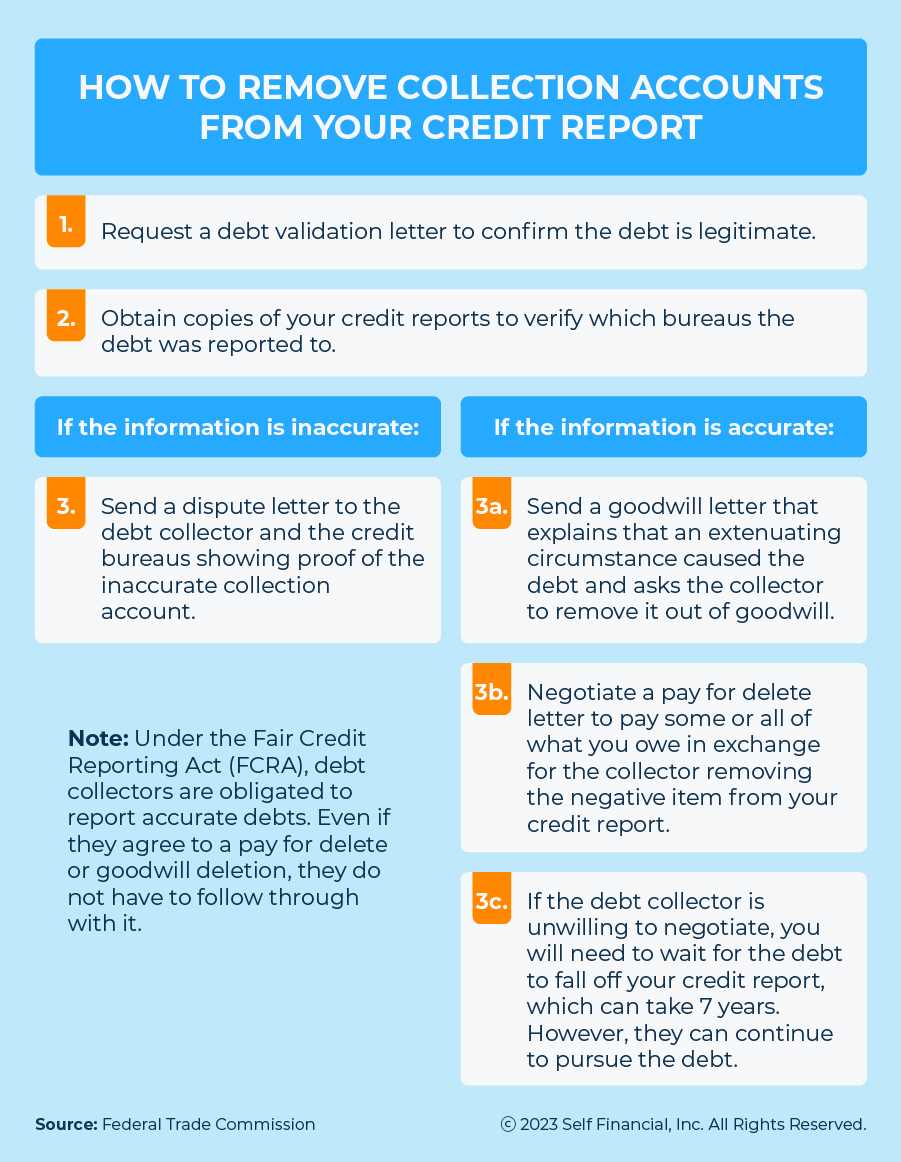

Removing collections from a credit report requires a strategic approach, including obtaining a credit report, identifying and verifying collections, and negotiating with creditors. By following these steps and understanding the impact of collections on the credit score, individuals can improve their credit report and increase their chances of achieving financial stability.

Learning how to remove collections from a credit report is a valuable skill that can benefit individuals in the long run. By taking the necessary steps to remove collections and improve their credit score, individuals can enjoy better financial health and increased access to credit.

How to Identify and Verify Collections on Your Credit Report

Obtaining a credit report is the first step in identifying and verifying collections. Consumers can request a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year from AnnualCreditReport.com. Reviewing the credit report carefully will help identify any collections that may be present.

When reviewing the credit report, look for the following information to identify collections:

- The name of the creditor or collection agency

- The amount of the debt

- The date the debt was incurred

- The date the debt was sent to collections

Verifying the accuracy of the collections is crucial in ensuring that the credit report is accurate. Consumers can dispute any errors or inaccuracies found on the credit report by contacting the credit reporting agency directly. The credit reporting agency will investigate the dispute and correct any errors found.

When disputing collections, it’s essential to provide documentation to support the dispute. This may include:

- Proof of payment or settlement of the debt

- Documentation showing that the debt is not valid or is past the statute of limitations

- Identification of any errors or inaccuracies on the credit report

The credit reporting agency will review the documentation and make any necessary corrections to the credit report. If the dispute is found to be valid, the collection will be removed from the credit report.

Learning how to remove collections from a credit report requires understanding the process of identifying and verifying collections. By obtaining a credit report, identifying collections, and verifying their accuracy, consumers can take the first step in removing unwanted marks from their credit report and improving their credit score.

Removing collections from a credit report can be a complex process, but it’s essential for maintaining good credit health. By following these steps and understanding the process of identifying and verifying collections, consumers can take control of their credit report and improve their financial well-being.

The Role of Credit Reporting Agencies in Removing Collections

Credit reporting agencies (CRAs) play a crucial role in maintaining accurate credit reports and removing collections. The three major CRAs, Equifax, Experian, and TransUnion, are responsible for collecting and maintaining credit data on individuals and businesses.

When it comes to removing collections, CRAs have a responsibility to ensure that the information on the credit report is accurate and up-to-date. If a consumer disputes a collection on their credit report, the CRA will investigate the dispute and correct any errors found.

The process of disputing a collection with a CRA typically involves the following steps:

- The consumer submits a dispute to the CRA, either online, by phone, or by mail.

- The CRA investigates the dispute and verifies the accuracy of the information.

- If the dispute is found to be valid, the CRA will correct the error and update the credit report.

CRAs are also responsible for ensuring that collections are reported accurately and in compliance with the Fair Credit Reporting Act (FCRA). The FCRA requires CRAs to maintain reasonable procedures to ensure the accuracy of the information on the credit report.

In addition to disputing collections, consumers can also request that CRAs delete collections from their credit report. This can be done by submitting a request to the CRA, along with documentation to support the request.

It’s essential to note that CRAs are not responsible for removing collections that are accurate and valid. If a collection is valid, the consumer will need to negotiate with the creditor or collection agency to have it removed.

Understanding the role of CRAs in removing collections is crucial in navigating the process of how to remove collections from a credit report. By knowing the responsibilities of CRAs and the process of disputing collections, consumers can take control of their credit report and improve their credit score.

CRAs provide a vital service in maintaining accurate credit reports, and their role in removing collections is an essential part of the process. By working with CRAs and understanding their responsibilities, consumers can achieve their goal of removing unwanted marks from their credit report.

Negotiating with Creditors to Remove Collections

Negotiating with creditors is a crucial step in removing collections from a credit report. When a creditor sends a debt to a collection agency, it can negatively impact the credit score. However, by negotiating with the creditor, it may be possible to remove the collection from the credit report.

Before negotiating with a creditor, it’s essential to understand the debt and the creditor’s policies. Review the credit report and verify the accuracy of the debt. If the debt is valid, consider the following strategies for negotiating with the creditor:

- Settlement: Offer to settle the debt for a lump sum payment. This can be a good option if the creditor is willing to accept a lower amount than the original debt.

- Goodwill deletion: Request that the creditor remove the collection from the credit report as a goodwill gesture. This can be a good option if the creditor is willing to work with the consumer to resolve the debt.

- Payment plan: Offer to make regular payments to the creditor in exchange for removing the collection from the credit report.

When negotiating with a creditor, it’s essential to be professional and respectful. Keep a record of all communication, including dates, times, and details of the conversation. This can help to ensure that the creditor follows through on any agreements made.

Some creditors may be more willing to negotiate than others. It’s essential to research the creditor’s policies and procedures before negotiating. Additionally, consider seeking the help of a credit counselor or debt management company if needed.

Removing collections from a credit report requires a strategic approach. By negotiating with creditors and using the right strategies, consumers can improve their credit score and achieve their financial goals.

Learning how to remove collections from a credit report is a valuable skill that can benefit consumers in the long run. By understanding the process of negotiating with creditors and using the right strategies, consumers can take control of their credit report and improve their financial well-being.

The Power of a Goodwill Letter in Removing Collections

A goodwill letter is a powerful tool that can be used to request the removal of collections from a credit report. A goodwill letter is a polite and respectful letter that is sent to a creditor or collection agency, requesting that they remove a collection from a credit report as a goodwill gesture.

Goodwill letters are often used when a consumer has paid a debt in full, but the creditor or collection agency has not updated the credit report to reflect the payment. In this case, a goodwill letter can be sent to request that the creditor or collection agency remove the collection from the credit report.

When writing a goodwill letter, it’s essential to be polite and respectful. The letter should include the following information:

- The consumer’s name and address

- The account number or reference number of the debt

- A statement explaining that the debt has been paid in full

- A request that the creditor or collection agency remove the collection from the credit report

Here is an example of a goodwill letter template:

Dear [Creditor or Collection Agency],

I am writing to request that you remove the collection for account number [account number] from my credit report. I have paid this debt in full, and I would appreciate it if you could update my credit report to reflect this.

Please let me know if there is any additional information you need from me to process this request.

Thank you for your time and consideration.

Sincerely,

[Consumer’s Name]

Goodwill letters can be an effective way to remove collections from a credit report. By being polite and respectful, consumers can increase their chances of having a collection removed from their credit report.

Learning how to write a goodwill letter is a valuable skill that can benefit consumers in the long run. By understanding the process of writing a goodwill letter and using the right strategies, consumers can take control of their credit report and improve their financial well-being.

Using the Fair Credit Reporting Act to Your Advantage

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the collection, use, and disclosure of consumer credit information. The FCRA provides consumers with certain rights and protections, including the right to dispute inaccurate information on their credit report.

When it comes to removing collections from a credit report, the FCRA can be a powerful tool. Under the FCRA, consumers have the right to dispute any information on their credit report that they believe is inaccurate or incomplete. This includes collections.

To dispute a collection under the FCRA, consumers can follow these steps:

- Obtain a copy of their credit report from the credit reporting agency

- Identify the collection that they wish to dispute

- Write a dispute letter to the credit reporting agency, explaining why they believe the collection is inaccurate or incomplete

- Provide supporting documentation to the credit reporting agency, such as proof of payment or a letter from the creditor

The credit reporting agency is then required to investigate the dispute and correct any errors or inaccuracies on the credit report. If the dispute is found to be valid, the collection will be removed from the credit report.

In addition to disputing collections, the FCRA also provides consumers with other rights and protections. For example, consumers have the right to request a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year.

Consumers also have the right to place a security freeze on their credit report, which can help to prevent identity theft. A security freeze prevents creditors from accessing a consumer’s credit report, making it more difficult for identity thieves to open new accounts in the consumer’s name.

By understanding the provisions of the FCRA and how to use them to their advantage, consumers can take control of their credit report and improve their financial well-being. Removing collections from a credit report can be a complex process, but with the right knowledge and tools, consumers can achieve their goal of a clean and accurate credit report.

Learning how to remove collections from a credit report using the FCRA is a valuable skill that can benefit consumers in the long run. By understanding the FCRA and how to use it to their advantage, consumers can take control of their credit report and improve their financial health.

Removing Public Records from Your Credit Report

Public records, such as bankruptcies and tax liens, can have a significant impact on a credit score. These records can remain on a credit report for up to 10 years, making it difficult to obtain credit or loans during that time.

Removing public records from a credit report can be a complex process, but it is possible. The first step is to obtain a copy of the credit report and identify the public record that needs to be removed. Next, the consumer should verify the accuracy of the public record and ensure that it is not still active.

If the public record is no longer active, the consumer can dispute it with the credit reporting agency. The credit reporting agency will then investigate the dispute and remove the public record from the credit report if it is found to be inaccurate or no longer active.

However, if the public record is still active, the consumer may need to take additional steps to have it removed. For example, if the public record is a bankruptcy, the consumer may need to provide documentation showing that the bankruptcy has been discharged. If the public record is a tax lien, the consumer may need to provide documentation showing that the tax lien has been paid in full.

It’s also important to note that removing public records from a credit report is different from removing collections. Public records are typically more difficult to remove, as they are a matter of public record and are often reported by government agencies or courts.

However, by understanding the process of removing public records from a credit report, consumers can take control of their credit report and improve their credit score. Removing public records can be a complex process, but with the right knowledge and tools, consumers can achieve their goal of a clean and accurate credit report.

Learning how to remove public records from a credit report is a valuable skill that can benefit consumers in the long run. By understanding the process of removing public records and how to use the Fair Credit Reporting Act to their advantage, consumers can take control of their credit report and improve their financial well-being.

Maintaining a Healthy Credit Report After Removing Collections

After removing collections from a credit report, it’s essential to maintain a healthy credit report to ensure good credit health. This can be achieved by following a few simple tips:

First, monitor your credit report regularly to ensure that no new collections or errors have been added. You can request a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year.

Second, keep your credit utilization ratio low. This means keeping your credit card balances low compared to your credit limits. Aim to use less than 30% of your available credit to show lenders that you can manage your debt responsibly.

Third, make on-time payments on all your debts. Payment history accounts for 35% of your credit score, so making timely payments is crucial to maintaining a good credit score.

Fourth, avoid applying for too many credit cards or loans in a short period. This can negatively affect your credit score, as it may indicate to lenders that you’re taking on too much debt.

Finally, consider working with a credit counselor or financial advisor to help you manage your debt and improve your credit score. They can provide personalized advice and help you develop a plan to achieve your financial goals.

By following these tips, you can maintain a healthy credit report and improve your credit score over time. Remember, removing collections from a credit report is just the first step in achieving good credit health. Ongoing maintenance and monitoring are essential to ensuring that your credit report remains accurate and healthy.

Learning how to maintain a healthy credit report is a valuable skill that can benefit you in the long run. By understanding the importance of credit monitoring, credit utilization, and credit score improvement, you can take control of your credit report and achieve your financial goals.