Understanding the Basics of Stock X and Its Potential for Returns

Investing in the stock market can be a lucrative venture, but it requires a thorough understanding of the underlying assets. Stock X, a prominent player in the industry, offers a unique opportunity for investors to capitalize on its growth potential. To maximize returns on Stock X, it is essential to grasp its fundamental characteristics, including its industry, market trends, and financial health.

Stock X operates in a rapidly evolving industry, marked by intense competition and innovation. The company’s ability to adapt to changing market conditions and capitalize on emerging trends is crucial to its success. Investors should closely monitor Stock X’s industry position, market share, and competitive landscape to gauge its potential for growth.

Market trends also play a significant role in shaping Stock X’s performance. Investors should stay informed about broader market trends, including economic indicators, regulatory changes, and shifts in consumer behavior. By understanding these trends, investors can better anticipate Stock X’s future prospects and make informed investment decisions.

Furthermore, Stock X’s financial health is a critical factor in determining its potential for returns. Investors should analyze the company’s income statement, balance sheet, and cash flow statement to assess its revenue growth, profitability, and liquidity. A thorough examination of Stock X’s financials can help investors identify potential risks and opportunities, enabling them to make more informed investment decisions.

By grasping the basics of Stock X, including its industry, market trends, and financial health, investors can lay the foundation for a successful investment strategy. This understanding is essential for developing a long-term approach to investing in Stock X, which can help investors navigate the complexities of the stock market and achieve consistent returns.

As investors seek to maximize their returns on Stock X, it is essential to remember that a thorough understanding of the underlying asset is crucial. By staying informed about Stock X’s industry, market trends, and financial health, investors can make more informed decisions and increase their potential for success. Whether you’re a seasoned investor or just starting out, understanding the basics of Stock X is a critical step in achieving your investment goals.

Now that you have a solid understanding of Stock X’s fundamentals, you can begin to develop a long-term strategy for investing in the stock. This may involve dollar-cost averaging, diversification, and regular portfolio rebalancing, all of which can help you achieve consistent returns on your investment. By combining a thorough understanding of Stock X with a well-crafted investment strategy, you can set yourself up for success in the stock market.

Conducting Thorough Research: Analyzing Stock X’s Financial Health

When it comes to investing in Stock X, conducting thorough research is crucial to making informed decisions. Analyzing the company’s financial health is a critical step in determining its potential for growth and returns. To do this, investors should examine Stock X’s income statement, balance sheet, and cash flow statement.

The income statement provides a snapshot of the company’s revenues, expenses, and profits over a specific period. Investors should look for trends in revenue growth, profit margins, and expense management. A company with increasing revenues and improving profit margins is generally a good sign.

The balance sheet offers a glimpse into the company’s financial position at a specific point in time. Investors should examine the company’s assets, liabilities, and equity to determine its financial health. A company with a strong balance sheet, characterized by low debt and high liquidity, is better equipped to weather financial storms.

The cash flow statement reveals the company’s ability to generate cash and pay its debts. Investors should look for positive cash flows from operations, as this indicates the company’s ability to generate cash from its core business. A company with strong cash flows is better positioned to invest in growth initiatives and return capital to shareholders.

In addition to analyzing these financial statements, investors should also evaluate Stock X’s financial ratios, such as the price-to-earnings (P/E) ratio, return on equity (ROE), and debt-to-equity ratio. These ratios provide valuable insights into the company’s financial performance and can help investors compare it to its peers.

By conducting thorough research and analyzing Stock X’s financial health, investors can gain a deeper understanding of the company’s potential for growth and returns. This information can be used to make informed investment decisions and develop a strategy for how to return on Stock X. Remember, thorough research is key to maximizing returns and minimizing risk.

Setting Realistic Expectations: Understanding the Risks and Rewards of Stock X

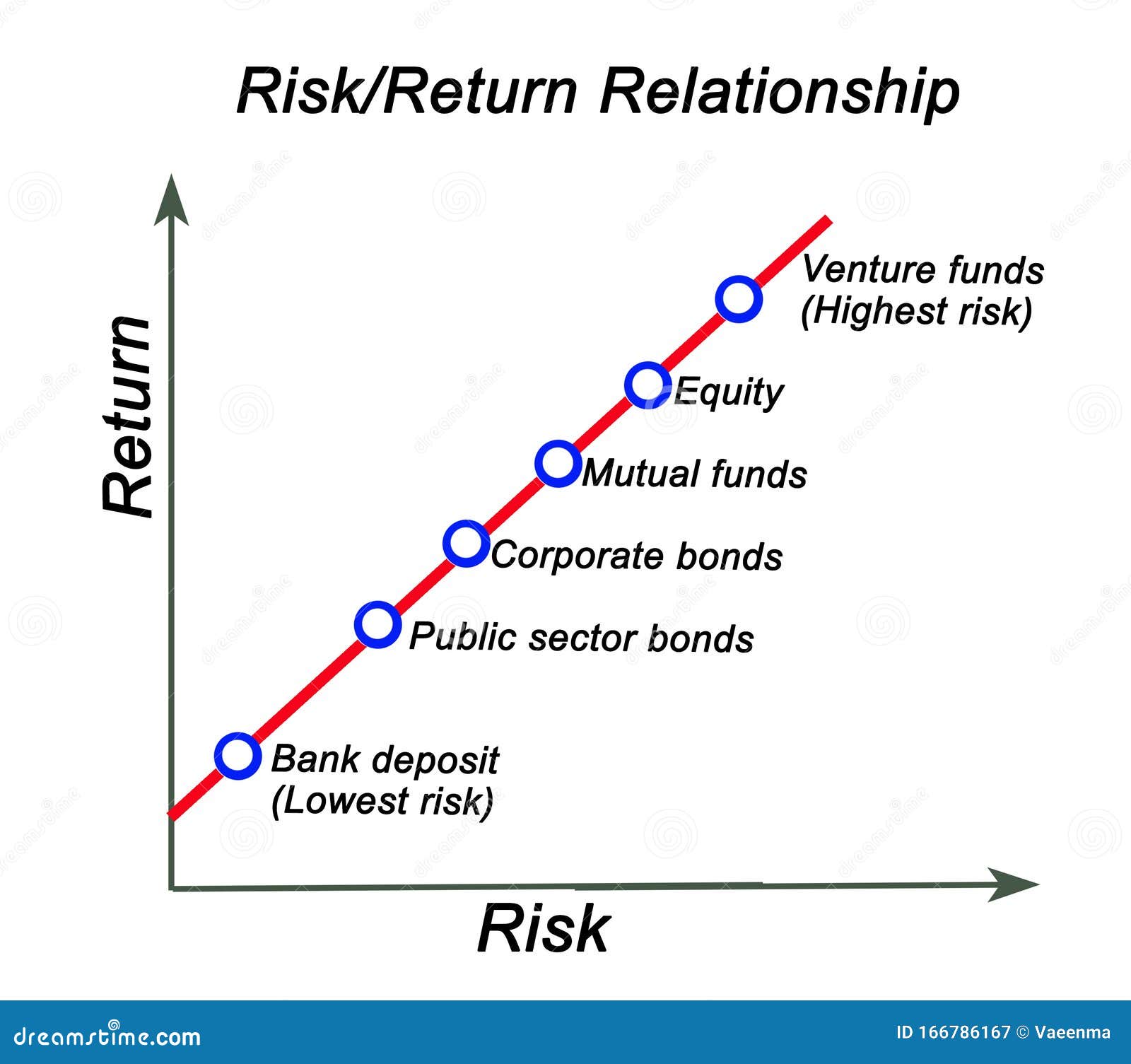

Investing in Stock X requires a clear understanding of the potential risks and rewards associated with the stock. Setting realistic expectations is crucial to achieving consistent returns and minimizing losses. It’s essential to recognize that Stock X, like any other investment, carries inherent risks that can impact its performance.

Market volatility is a significant risk factor that can affect Stock X’s performance. The stock market can be unpredictable, and prices can fluctuate rapidly in response to various market and economic factors. Investors should be prepared for potential losses and have a strategy in place to mitigate them.

On the other hand, Stock X also offers potential rewards for long-term investors. The company’s growth prospects, industry trends, and financial health can all contribute to its potential for long-term growth. Investors who are willing to take a long-term view and ride out market fluctuations may be rewarded with consistent returns.

To set realistic expectations, investors should consider the following factors:

Historical performance: Review Stock X’s historical performance to understand its volatility and potential for growth.

Industry trends: Stay up-to-date with industry trends and developments that may impact Stock X’s performance.

Financial health: Analyze Stock X’s financial health, including its income statement, balance sheet, and cash flow statement.

Market conditions: Monitor market conditions and adjust your investment strategy accordingly.

By understanding the potential risks and rewards associated with Stock X, investors can set realistic expectations and develop a strategy for how to return on Stock X. This includes being prepared for potential losses, staying informed about market trends, and having a long-term perspective.

Ultimately, setting realistic expectations is critical to achieving consistent returns on Stock X. By recognizing the potential risks and rewards, investors can make informed decisions and develop a strategy that aligns with their investment goals and risk tolerance.

Developing a Long-Term Strategy: How to Return on Stock X Consistently

Developing a long-term strategy is crucial to achieving consistent returns on Stock X. A well-thought-out strategy can help investors navigate market fluctuations and make informed decisions. Here are some tips on how to develop a long-term strategy for investing in Stock X:

Dollar-cost averaging: This involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This strategy can help reduce the impact of market volatility and timing risks.

Diversification: Spread your investments across different asset classes, sectors, and geographic regions to minimize risk. This can help you ride out market fluctuations and capture growth opportunities.

Regular portfolio rebalancing: Regularly review your portfolio and rebalance it to ensure that it remains aligned with your investment objectives. This can help you stay on track and avoid emotional decision-making.

Long-term perspective: Investing in Stock X requires a long-term perspective. Avoid making emotional decisions based on short-term market fluctuations. Instead, focus on the company’s fundamental strengths and growth prospects.

Patience and discipline: Consistent returns on Stock X require patience and discipline. Avoid the temptation to try to time the market or make quick profits. Instead, focus on steady, long-term growth.

By developing a long-term strategy and sticking to it, investors can increase their chances of achieving consistent returns on Stock X. Remember, investing in the stock market involves risks, but with a well-thought-out strategy, you can minimize those risks and maximize your returns.

When developing a long-term strategy for Stock X, consider the following:

Investment objectives: Clearly define your investment objectives and risk tolerance.

Risk management: Develop a risk management strategy to minimize potential losses.

Market trends: Stay informed about market trends and adjust your strategy accordingly.

Company performance: Monitor Stock X’s performance and adjust your strategy as needed.

By following these tips and developing a long-term strategy, investors can increase their chances of achieving consistent returns on Stock X and maximizing their investments.

Monitoring and Adjusting: Staying on Top of Stock X’s Performance

Regularly monitoring Stock X’s performance is crucial to achieving consistent returns. By staying informed about market trends and news that may impact the stock’s performance, investors can adjust their investment strategy as needed. Here are some tips on how to monitor and adjust:

Track key performance indicators (KPIs): Monitor Stock X’s KPIs, such as revenue growth, profit margins, and return on equity (ROE). This will help you understand the company’s financial health and identify potential areas for improvement.

Stay informed about market trends: Keep up-to-date with market trends and news that may impact Stock X’s performance. This includes industry trends, economic indicators, and regulatory changes.

Adjust your investment strategy: Based on your monitoring and analysis, adjust your investment strategy as needed. This may involve rebalancing your portfolio, adjusting your position size, or changing your investment horizon.

Use technical analysis: Technical analysis can help you identify trends and patterns in Stock X’s price movement. This can be useful in making informed investment decisions.

Stay disciplined: It’s essential to stay disciplined and avoid making emotional decisions based on short-term market fluctuations. Instead, focus on your long-term investment objectives and adjust your strategy accordingly.

By regularly monitoring Stock X’s performance and adjusting your investment strategy as needed, you can increase your chances of achieving consistent returns. Remember, investing in the stock market involves risks, but with a well-thought-out strategy and regular monitoring, you can minimize those risks and maximize your returns.

Some tools to help you monitor and adjust include:

Financial news websites: Websites such as Bloomberg, CNBC, and Reuters provide up-to-date financial news and analysis.

Stock screeners: Stock screeners such as Finviz and Yahoo Finance allow you to filter stocks based on specific criteria.

Technical analysis software: Software such as TradingView and MetaStock provide technical analysis tools and charts.

By using these tools and staying informed, you can make informed investment decisions and achieve consistent returns on Stock X.

Avoiding Common Mistakes: Pitfalls to Watch Out for When Investing in Stock X

When investing in Stock X, it’s essential to avoid common mistakes that can lead to significant losses. By being aware of these pitfalls, investors can take steps to mitigate risks and achieve consistent returns. Here are some common mistakes to watch out for:

Emotional decision-making: Investing in the stock market can be emotional, especially when market volatility is high. Avoid making impulsive decisions based on emotions, and instead, focus on your long-term investment objectives.

Lack of diversification: Diversification is key to minimizing risk and maximizing returns. Avoid putting all your eggs in one basket, and instead, spread your investments across different asset classes, sectors, and geographic regions.

Failure to monitor performance: Regularly monitoring Stock X’s performance is crucial to achieving consistent returns. Avoid neglecting your investments, and instead, stay informed about market trends and news that may impact the stock’s performance.

Over-leveraging: Using excessive leverage can amplify losses, especially during market downturns. Avoid over-leveraging your investments, and instead, focus on building a solid foundation of assets.

Not having a long-term strategy: Investing in Stock X requires a long-term perspective. Avoid making short-term decisions, and instead, focus on building a long-term strategy that aligns with your investment objectives.

By avoiding these common mistakes, investors can increase their chances of achieving consistent returns on Stock X. Remember, investing in the stock market involves risks, but with a well-thought-out strategy and regular monitoring, you can minimize those risks and maximize your returns.

To avoid these pitfalls, consider the following:

Develop a long-term strategy: Focus on building a long-term strategy that aligns with your investment objectives.

Diversify your portfolio: Spread your investments across different asset classes, sectors, and geographic regions.

Regularly monitor performance: Stay informed about market trends and news that may impact Stock X’s performance.

Avoid emotional decision-making: Focus on your long-term investment objectives, and avoid making impulsive decisions based on emotions.

By following these tips, investors can avoid common mistakes and achieve consistent returns on Stock X.

Staying Informed: Staying Up-to-Date on Stock X’s Latest Developments

Staying informed about Stock X’s latest developments is crucial to achieving consistent returns. By staying up-to-date on news, earnings reports, and industry trends, investors can adjust their investment strategy and make informed decisions. Here are some tips on how to stay informed:

Follow reputable news sources: Follow reputable news sources such as Bloomberg, CNBC, and Reuters to stay informed about Stock X’s latest developments.

Monitor earnings reports: Monitor Stock X’s earnings reports to understand the company’s financial performance and identify potential areas for growth.

Stay informed about industry trends: Stay informed about industry trends and developments that may impact Stock X’s performance.

Use social media: Use social media platforms such as Twitter and LinkedIn to stay informed about Stock X’s latest developments and connect with other investors.

Set up news alerts: Set up news alerts to receive notifications about Stock X’s latest developments and stay informed in real-time.

By staying informed about Stock X’s latest developments, investors can adjust their investment strategy and make informed decisions. Remember, staying informed is key to achieving consistent returns on Stock X.

Some tools to help you stay informed include:

Financial news websites: Websites such as Bloomberg and CNBC provide up-to-date financial news and analysis.

Stock screeners: Stock screeners such as Finviz and Yahoo Finance allow you to filter stocks based on specific criteria.

Social media platforms: Social media platforms such as Twitter and LinkedIn provide a platform to connect with other investors and stay informed about Stock X’s latest developments.

News alerts: News alerts allow you to receive notifications about Stock X’s latest developments and stay informed in real-time.

By using these tools and staying informed, investors can make informed decisions and achieve consistent returns on Stock X.

Conclusion: Achieving Consistent Returns on Stock X

In conclusion, achieving consistent returns on Stock X requires a combination of thorough research, a long-term strategy, and regular monitoring. By understanding the basics of the stock, conducting thorough research, and developing a long-term strategy, investors can increase their chances of achieving consistent returns.

It’s also important to stay informed about Stock X’s latest developments, including news, earnings reports, and industry trends. By staying informed, investors can adjust their investment strategy and make informed decisions.

Avoiding common mistakes, such as emotional decision-making, lack of diversification, and failure to monitor performance, is also crucial to achieving consistent returns. By avoiding these pitfalls, investors can minimize risks and maximize returns.

In summary, achieving consistent returns on Stock X requires:

Thorough research: Conduct thorough research on Stock X’s financial health, including analyzing its income statement, balance sheet, and cash flow statement.

Long-term strategy: Develop a long-term strategy for investing in Stock X, including dollar-cost averaging, diversification, and regular portfolio rebalancing.

Regular monitoring: Regularly monitor Stock X’s performance and adjust your investment strategy as needed.

Staying informed: Stay informed about Stock X’s latest developments, including news, earnings reports, and industry trends.

By following these tips, investors can increase their chances of achieving consistent returns on Stock X and maximizing their investments.

Remember, investing in the stock market involves risks, but with a well-thought-out strategy and regular monitoring, you can minimize those risks and achieve consistent returns on Stock X.