Understanding Your Options for International Money Transfers

When it comes to sending money to Mexico, there are several options available. Each method has its pros and cons, and understanding these differences is crucial to making an informed decision. In this section, we will explore the various ways to send money to Mexico, including bank transfers, online money transfer services, and cash-based services.

Bank transfers are a traditional method for sending money to Mexico. This option involves transferring funds from your bank account to the recipient’s bank account in Mexico. While bank transfers can be reliable, they often come with higher fees and less competitive exchange rates compared to other options. Additionally, bank transfers can take several days to process, which may not be ideal for urgent transactions.

Online money transfer services, on the other hand, offer a faster and more convenient way to send money to Mexico. These services, such as Xoom, TransferWise, and PayPal, allow you to transfer funds online or through a mobile app. Online money transfer services often provide better exchange rates and lower fees compared to bank transfers. However, some services may charge additional fees for certain payment methods or transfer amounts.

Cash-based services, such as Western Union or MoneyGram, enable you to send cash to Mexico. These services typically involve visiting a physical location, filling out a form, and paying the transfer amount in cash. The recipient can then collect the cash at a designated location in Mexico. While cash-based services can be convenient for those without access to online banking, they often come with higher fees and less competitive exchange rates.

When considering how to send money to Mexico, it’s essential to weigh the pros and cons of each option. Factors such as transfer fees, exchange rates, transfer speed, and security should be taken into account. By understanding the different methods available, you can make an informed decision that suits your needs and budget.

For those looking to send money to Mexico regularly, online money transfer services may be the most convenient option. These services often provide a user-friendly interface, competitive exchange rates, and lower fees. Additionally, online money transfer services can be accessed from anywhere with an internet connection, making it easier to send money to Mexico at any time.

Ultimately, the best option for sending money to Mexico depends on your individual needs and preferences. By considering the pros and cons of each method, you can choose the most suitable option for your transactions.

Choosing the Best Service for Your Needs: Factors to Consider

When it comes to sending money to Mexico, selecting the right service can make a significant difference in the overall cost, speed, and security of the transaction. With numerous options available, it’s essential to consider several key factors to ensure you choose the best service for your needs. Here are some crucial aspects to evaluate when selecting a money transfer service for sending money to Mexico.

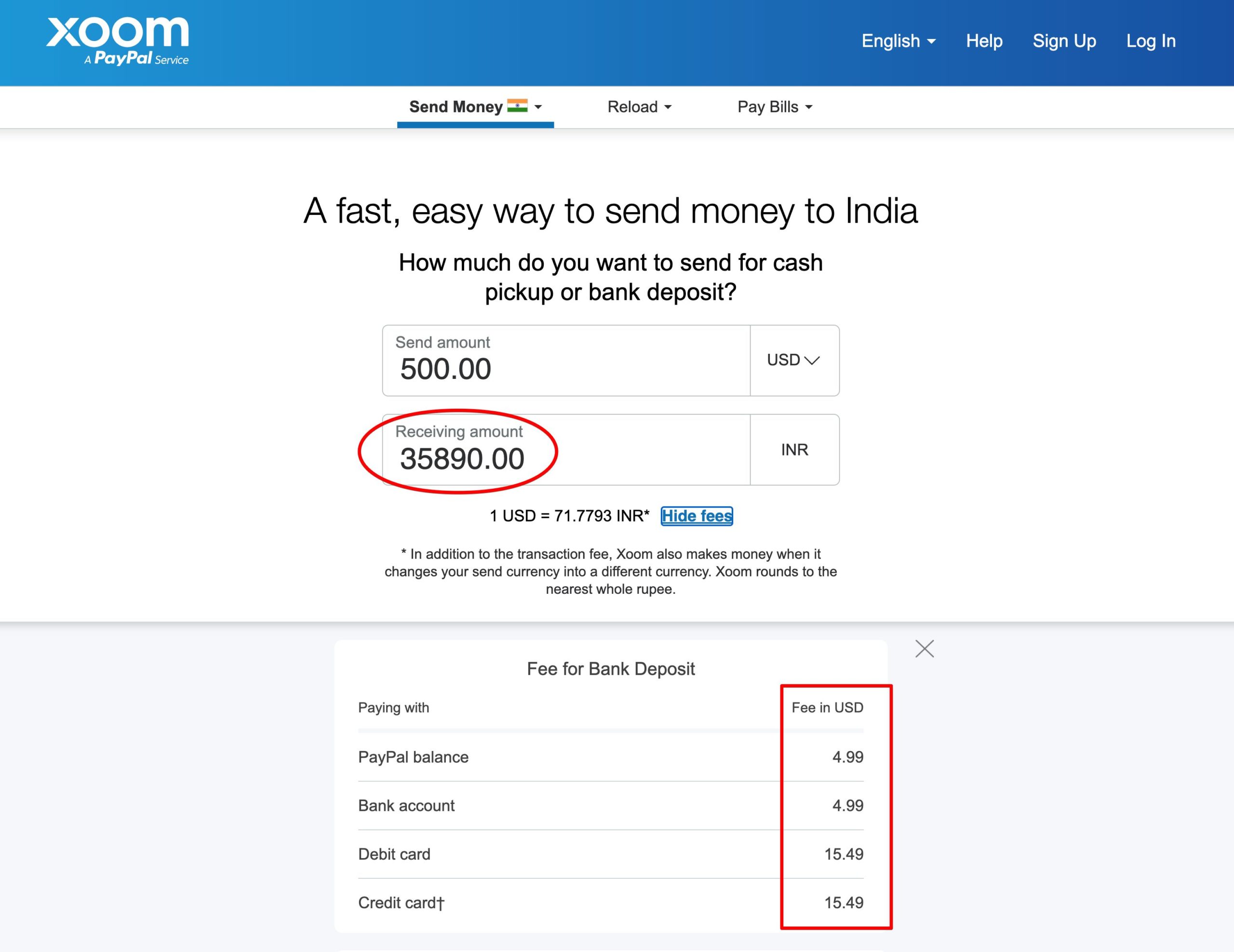

Transfer fees are a critical consideration, as they can add up quickly. Look for services that offer competitive fees, and be aware of any additional charges for things like expedited transfers or cash pickups. Exchange rates also play a significant role in the overall cost of the transfer. A service with a favorable exchange rate can help you save money in the long run.

Transfer speed is another essential factor to consider. If you need to send money to Mexico quickly, look for services that offer fast transfer times, such as same-day or next-day delivery. Some services, like Xoom and TransferWise, offer fast and secure transfers, while others, like Western Union, may take longer.

Security is also a top priority when sending money to Mexico. Look for services that use robust security measures, such as encryption and two-factor authentication, to protect your transactions. Additionally, consider services that offer tracking and monitoring tools, so you can stay up-to-date on the status of your transfer.

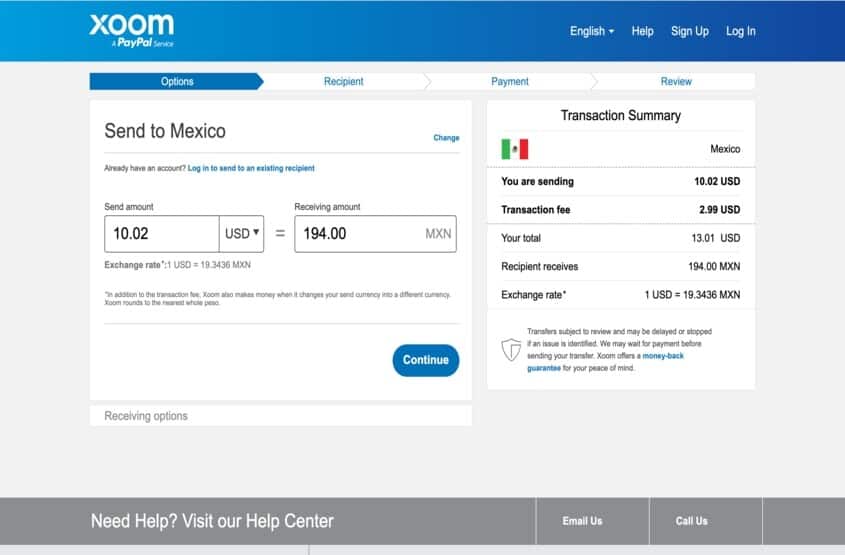

Popular services like Xoom, TransferWise, and Western Union offer a range of benefits and drawbacks. Xoom, for example, offers fast and secure transfers, but may charge higher fees for certain services. TransferWise, on the other hand, offers competitive exchange rates and low fees, but may have slower transfer times. Western Union offers a wide range of services, including cash pickups and bank transfers, but may charge higher fees and have less favorable exchange rates.

When evaluating services, consider your specific needs and priorities. If you need to send money to Mexico quickly and securely, Xoom or TransferWise may be a good option. If you prefer to send cash or use a service with a wide range of options, Western Union may be a better choice. By carefully evaluating these factors, you can choose the best service for your needs and ensure a smooth and cost-effective transaction.

How to Send Money to Mexico Online: A Step-by-Step Guide

Sending money to Mexico online is a convenient and efficient way to transfer funds across the border. With the rise of online money transfer services, it’s now easier than ever to send money to Mexico from the comfort of your own home. Here’s a step-by-step guide on how to send money to Mexico online:

Step 1: Choose a Reputable Online Money Transfer Service

Research and select a reputable online money transfer service that offers transfers to Mexico. Some popular options include Xoom, TransferWise, and Western Union. Make sure to read reviews and compare fees, exchange rates, and transfer times before making a decision.

Step 2: Create an Account

Once you’ve chosen a service, create an account on their website or mobile app. You’ll typically need to provide some personal and financial information, such as your name, address, and bank account details.

Step 3: Add a Recipient

Add the recipient’s information, including their name, address, and bank account details (if applicable). Make sure to double-check the recipient’s information to avoid any errors or delays.

Step 4: Initiate the Transfer

Enter the amount you want to send and select the transfer method (e.g., bank transfer, cash pickup, or debit card). Review the transfer details, including the exchange rate, fees, and transfer time, before confirming the transaction.

Step 5: Pay for the Transfer

Pay for the transfer using a debit card, credit card, or bank account. Some services may also offer alternative payment methods, such as PayPal or Apple Pay.

Step 6: Track the Transfer

Once the transfer is initiated, track the status of the transfer using the service’s online tracking tool or mobile app. This will help you stay up-to-date on the transfer’s progress and ensure that the funds are delivered to the recipient safely and efficiently.

Tips and Reminders:

When sending money to Mexico online, make sure to:

- Verify the recipient’s information to avoid errors or delays.

- Use a secure and reputable online money transfer service.

- Monitor the transfer status to ensure safe and efficient delivery.

- Take advantage of competitive exchange rates and low fees.

By following these steps and tips, you can easily send money to Mexico online and ensure that your funds are delivered safely and efficiently. Whether you’re sending money to family, friends, or business associates, online money transfer services make it easy to transfer funds across the border.

Using Bank Transfers to Send Money to Mexico: What You Need to Know

Bank transfers are a popular method for sending money to Mexico, offering a secure and reliable way to transfer funds across the border. However, the process can be complex, and it’s essential to understand the requirements, transfer times, and potential fees involved. Here’s what you need to know when using bank transfers to send money to Mexico:

Required Information

To initiate a bank transfer to Mexico, you’ll need to provide the following information:

- The recipient’s name and address

- The recipient’s bank account details, including the bank name, branch, and account number

- The amount you want to send

- Your own bank account details, including the account number and routing number

Transfer Times

Bank transfers to Mexico can take several days to process, depending on the banks involved and the transfer method used. Typically, transfers can take anywhere from 2 to 5 business days to complete. However, some banks may offer expedited transfer options, which can reduce the transfer time to as little as 1 business day.

Potential Fees

Bank transfers to Mexico often involve fees, which can vary depending on the banks involved and the transfer method used. These fees can include:

- Transfer fees: These fees are charged by the sending bank and can range from $10 to $30 per transfer.

- Receiving fees: These fees are charged by the recipient’s bank and can range from $10 to $20 per transfer.

- Exchange rate fees: These fees are charged by the banks involved and can range from 1% to 3% of the transfer amount.

Benefits and Drawbacks

Bank transfers to Mexico offer several benefits, including:

- Security: Bank transfers are a secure way to transfer funds, as they are processed through a network of banks and financial institutions.

- Reliability: Bank transfers are a reliable way to transfer funds, as they are less prone to errors and delays.

- Convenience: Bank transfers can be initiated online or in-person, making it easy to send money to Mexico from anywhere.

However, bank transfers also have some drawbacks, including:

- Complexity: The process of initiating a bank transfer can be complex, requiring multiple steps and pieces of information.

- Fees: Bank transfers often involve fees, which can add up quickly.

- Transfer times: Bank transfers can take several days to process, which may not be suitable for urgent transfers.

Alternatives to Bank Transfers

If you’re looking for alternative methods to send money to Mexico, consider using online money transfer services or cash-based services. These methods can offer faster transfer times, lower fees, and greater convenience. However, it’s essential to research and compare the different options to find the best method for your needs.

Cash-Based Services: How to Send Money to Mexico with Cash

Cash-based services are a popular method for sending money to Mexico, offering a convenient and accessible way to transfer funds across the border. Western Union and MoneyGram are two of the most well-known cash-based services, with a wide network of locations in Mexico and around the world. Here’s how to send money to Mexico using cash-based services:

Step 1: Find a Location

To send money to Mexico using a cash-based service, you’ll need to find a location near you. Western Union and MoneyGram have thousands of locations worldwide, including in Mexico. You can use their websites or mobile apps to find a location near you.

Step 2: Provide the Required Information

When you arrive at the location, you’ll need to provide the required information to initiate the transfer. This typically includes:

- The recipient’s name and address

- The amount you want to send

- Your own identification and contact information

Step 3: Pay for the Transfer

Once you’ve provided the required information, you’ll need to pay for the transfer using cash. The fees for cash-based services can vary depending on the amount you’re sending and the location you’re sending from.

Step 4: Receive the Transfer

The recipient can pick up the cash at a Western Union or MoneyGram location in Mexico. They’ll need to provide their identification and the transfer control number (TCN) to receive the cash.

Benefits and Drawbacks

Cash-based services offer several benefits, including:

- Convenience: Cash-based services have a wide network of locations, making it easy to send money to Mexico.

- Accessibility: Cash-based services are a good option for those who don’t have access to a bank account or online services.

- Speed: Cash-based services can provide fast transfer times, with some transfers available in as little as 10 minutes.

However, cash-based services also have some drawbacks, including:

- Fees: Cash-based services can be more expensive than other methods, with fees ranging from 1% to 5% of the transfer amount.

- Security: Cash-based services can be vulnerable to scams and theft, so it’s essential to use a reputable service and follow the necessary security protocols.

- Limits: Cash-based services may have limits on the amount you can send, which can range from $500 to $5,000.

Alternatives to Cash-Based Services

If you’re looking for alternative methods to send money to Mexico, consider using online money transfer services or bank transfers. These methods can offer lower fees, faster transfer times, and greater convenience. However, it’s essential to research and compare the different options to find the best method for your needs.

Security and Safety: Protecting Your Transactions When Sending Money to Mexico

When sending money to Mexico, security and safety are top priorities. With the rise of online money transfer services, it’s easier than ever to send money across the border. However, this also increases the risk of scams, theft, and other security threats. In this article, we’ll discuss the importance of security and safety when sending money to Mexico and provide tips on how to protect your transactions.

Why Security and Safety Matter

When sending money to Mexico, you’re entrusting a third-party service with your financial information and funds. This makes it essential to choose a reputable and secure service that can protect your transactions. Failure to do so can result in:

- Financial loss: Scammers and thieves can steal your money, leaving you with significant financial losses.

- Identity theft: Your personal and financial information can be compromised, putting you at risk of identity theft.

- Reputation damage: A security breach can damage your reputation and erode trust in the money transfer service.

Tips for Protecting Your Transactions

To ensure the security and safety of your transactions when sending money to Mexico, follow these tips:

- Verify recipient information: Double-check the recipient’s name, address, and bank account details to ensure accuracy.

- Use a secure service: Choose a reputable and secure money transfer service that uses encryption and other security measures to protect your transactions.

- Monitor transfer status: Track the status of your transfer to ensure it’s delivered safely and efficiently.

- Keep records: Keep a record of your transfer, including the transfer amount, recipient information, and transfer status.

- Avoid public computers: Avoid using public computers or public Wi-Fi to initiate transfers, as these can be vulnerable to hacking and other security threats.

Best Practices for Secure Money Transfers

In addition to the tips above, follow these best practices for secure money transfers:

- Use strong passwords: Use strong and unique passwords for your money transfer account and avoid sharing them with others.

- Enable two-factor authentication: Enable two-factor authentication to add an extra layer of security to your account.

- Keep software up-to-date: Keep your computer and mobile device software up-to-date to ensure you have the latest security patches and updates.

- Be cautious of scams: Be cautious of scams and phishing attempts, and never provide sensitive information to unknown parties.

Conclusion

Security and safety are critical when sending money to Mexico. By following the tips and best practices outlined above, you can protect your transactions and ensure a safe and efficient transfer process. Remember to always choose a reputable and secure money transfer service, verify recipient information, and monitor transfer status to ensure a successful transfer.

Taxes and Regulations: What You Need to Know When Sending Money to Mexico

When sending money to Mexico, it’s essential to understand the tax implications and regulations surrounding international money transfers. Mexico has specific laws and regulations that govern the transfer of funds across the border, and failure to comply can result in penalties and fines. In this article, we’ll discuss the tax implications and regulations you need to know when sending money to Mexico.

Tax Implications

When sending money to Mexico, you may be subject to taxes on the transfer amount. The Mexican government imposes a tax on international money transfers, known as the “impuesto sobre la transferencia de divisas” (ITD). The ITD is a 2% tax on the transfer amount, which is typically deducted from the recipient’s account.

Regulations

Mexico has several regulations that govern international money transfers, including:

- The “Ley de Instituciones de Crédito” (LIC), which regulates the activities of banks and other financial institutions in Mexico.

- The “Ley de la Moneda”, which governs the exchange of foreign currency in Mexico.

- The “Reglamento de la Ley de la Moneda”, which sets out the rules and regulations for international money transfers in Mexico.

Restrictions

There are also restrictions on the amount of money that can be sent to Mexico, including:

- The “límite de transferencia”, which sets a limit on the amount of money that can be transferred to Mexico in a single transaction.

- The “límite de acumulación”, which sets a limit on the total amount of money that can be transferred to Mexico in a calendar year.

Compliance

To ensure compliance with Mexican regulations, it’s essential to:

- Use a reputable and licensed money transfer service.

- Provide accurate and complete information about the transfer, including the recipient’s name, address, and bank account details.

- Comply with all applicable taxes and regulations, including the ITD.

Penalties for Non-Compliance

Failure to comply with Mexican regulations can result in penalties and fines, including:

- A fine of up to 10% of the transfer amount for non-compliance with the ITD.

- A fine of up to 20% of the transfer amount for non-compliance with other regulations.

Conclusion

When sending money to Mexico, it’s essential to understand the tax implications and regulations surrounding international money transfers. By complying with Mexican regulations and using a reputable and licensed money transfer service, you can ensure a safe and efficient transfer process.

Common Issues and Solutions: Troubleshooting Your Money Transfer to Mexico

When sending money to Mexico, issues can arise that may delay or prevent the transfer from being completed. In this article, we’ll address common issues that may arise when sending money to Mexico and provide solutions and troubleshooting tips to help you resolve them.

Delayed Transfers

One of the most common issues when sending money to Mexico is delayed transfers. This can occur due to a variety of reasons, including:

- Incorrect recipient information

- Insufficient funds

- Technical issues with the transfer service

Solution:

To resolve delayed transfers, check the recipient’s information to ensure it is accurate and complete. Verify that you have sufficient funds in your account to cover the transfer amount. If the issue persists, contact the transfer service’s customer support for assistance.

Incorrect Recipient Information

Incorrect recipient information is another common issue that can cause delays or prevent the transfer from being completed. This can include:

- Incorrect name or address

- Incorrect bank account details

Solution:

To resolve incorrect recipient information, verify the recipient’s details to ensure they are accurate and complete. Update the recipient’s information in your account and re-initiate the transfer.

Transfer Limits

Transfer limits are another common issue that can prevent the transfer from being completed. This can include:

- Daily transfer limits

- Monthly transfer limits

Solution:

To resolve transfer limits, check the transfer service’s website or contact their customer support to determine the transfer limits. If you need to send a larger amount, consider using a different transfer service or splitting the transfer into smaller amounts.

Technical Issues

Technical issues can also cause delays or prevent the transfer from being completed. This can include:

- Website or app issues

- Server errors

Solution:

To resolve technical issues, try restarting the transfer process or contacting the transfer service’s customer support for assistance.

Additional Tips

To avoid common issues when sending money to Mexico, follow these additional tips:

- Verify the recipient’s information before initiating the transfer

- Use a reputable and licensed transfer service

- Monitor the transfer status to ensure it is completed successfully

Conclusion

By following these troubleshooting tips and solutions, you can resolve common issues that may arise when sending money to Mexico. Remember to always verify the recipient’s information, use a reputable transfer service, and monitor the transfer status to ensure a successful transfer.