Unlocking the Secrets of Successful Investors

Studying the stock market is a crucial step in making informed investment decisions. By understanding the intricacies of the stock market, individuals can gain a competitive edge in achieving their financial goals. Whether it’s saving for retirement, funding a down payment on a house, or simply building wealth, a well-informed investment strategy is essential. To develop a successful investment plan, it’s essential to learn how to study the stock market effectively.

Investors who take the time to educate themselves on the stock market are better equipped to navigate the complexities of the financial world. By learning how to analyze market trends, identify potential investment opportunities, and manage risk, individuals can make more informed decisions about their investments. This, in turn, can lead to increased confidence and a greater sense of control over their financial futures.

So, how do you get started? The first step is to develop a solid understanding of the stock market fundamentals. This includes learning about the different types of investment products, such as stocks, bonds, and ETFs, as well as key terms like bulls, bears, and market trends. From there, you can begin to explore more advanced topics, such as technical analysis and fundamental analysis.

Technical analysis involves studying charts and patterns to identify potential investment opportunities. This can be a powerful tool for investors, as it allows them to make more informed decisions about when to buy or sell. Fundamental analysis, on the other hand, involves evaluating a company’s financial performance, management team, and industry trends to determine its potential for growth.

By combining these two approaches, investors can gain a more complete understanding of the stock market and make more informed investment decisions. Of course, studying the stock market is an ongoing process, and there’s always more to learn. But by taking the time to educate yourself and develop a solid investment strategy, you can set yourself up for success and achieve your long-term financial goals.

Setting Your Investment Goals: A Roadmap to Success

Before diving into the world of stock market analysis, it’s essential to define your investment goals. This will serve as a roadmap to guide your decisions and help you stay focused on what you want to achieve. Setting clear investment goals is a critical step in developing a successful investment strategy, and it’s a key component of learning how to study the stock market.

So, how do you set investment goals? Start by considering your risk tolerance. Are you comfortable with the possibility of losing some or all of your investment in pursuit of higher returns, or do you prefer more conservative investments with lower potential returns? Your risk tolerance will help determine the types of investments that are suitable for you.

Next, consider your investment horizon. Are you saving for a short-term goal, such as a down payment on a house, or a long-term goal, such as retirement? Your investment horizon will help determine the time frame for your investments and the level of risk you’re willing to take on.

Finally, define your financial objectives. What do you want to achieve through your investments? Are you looking to generate income, grow your wealth, or preserve your capital? Your financial objectives will help guide your investment decisions and ensure that you’re on track to meet your goals.

By setting clear investment goals, you’ll be able to develop a personalized investment strategy that aligns with your risk tolerance, investment horizon, and financial objectives. This will help you make more informed investment decisions and increase your chances of success in the stock market.

For example, if your investment goal is to save for retirement, you may want to consider a long-term investment strategy that includes a mix of low-risk investments, such as bonds and dividend-paying stocks, and higher-risk investments, such as growth stocks and real estate investment trusts (REITs). By diversifying your portfolio and taking a long-term approach, you can help ensure that you’ll have the funds you need to support your retirement goals.

Understanding Stock Market Fundamentals: A Beginner’s Guide

When it comes to studying the stock market, it’s essential to start with the basics. Understanding the fundamentals of the stock market will provide a solid foundation for making informed investment decisions and learning how to study the stock market effectively.

So, what are the basics of the stock market? Let’s start with the different types of investment products. Stocks, also known as equities, represent ownership in a company. Bonds, on the other hand, are debt securities issued by companies or governments to raise capital. Exchange-traded funds (ETFs) are a type of investment fund that is traded on a stock exchange, like stocks.

In addition to these investment products, it’s essential to understand key terms such as bulls, bears, and market trends. A bull market is a prolonged period of time when the market is rising, while a bear market is a prolonged period of time when the market is falling. Market trends refer to the direction in which the market is moving, either up or down.

Other essential concepts to understand include market capitalization, dividend yield, and price-to-earnings ratio. Market capitalization refers to the total value of a company’s outstanding shares. Dividend yield is the ratio of the annual dividend payment to the stock’s current price. Price-to-earnings ratio is the ratio of a stock’s current price to its earnings per share.

By understanding these fundamental concepts, investors can make more informed decisions about their investments and develop a successful investment strategy. It’s also essential to stay up-to-date with market news and trends, as this will help investors make informed decisions and adjust their strategy as needed.

For example, if an investor is interested in investing in a particular company, they should research the company’s financial statements, management team, and industry trends. They should also consider the company’s market capitalization, dividend yield, and price-to-earnings ratio to determine if it’s a good investment opportunity.

By taking the time to understand the fundamentals of the stock market, investors can develop a solid foundation for making informed investment decisions and achieving their financial goals. Whether you’re a beginner or an experienced investor, understanding the basics of the stock market is essential for success.

Technical Analysis: Reading Charts and Patterns

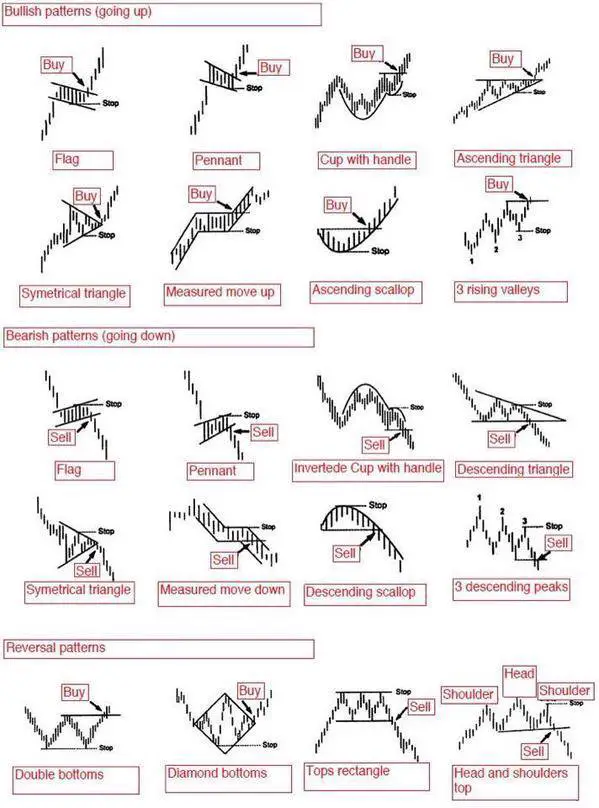

Technical analysis is a crucial aspect of stock market study, as it helps investors identify trends and patterns in the market. By learning how to read charts and use technical indicators, investors can make more informed decisions about their investments and develop a successful investment strategy.

So, what is technical analysis? Technical analysis is the study of past market data, primarily price and volume, to identify patterns and trends. It’s based on the idea that market prices reflect all available information, and that by analyzing past price movements, investors can gain insights into future market trends.

There are several types of charts used in technical analysis, including line charts, bar charts, and candlestick charts. Each type of chart provides a different perspective on market data, and by combining multiple charts, investors can gain a more complete understanding of market trends.

Technical indicators are also a key component of technical analysis. These indicators, such as moving averages and relative strength index (RSI), help investors identify trends and patterns in the market. By using technical indicators, investors can gain insights into market momentum, trend direction, and potential reversal points.

One of the most popular technical indicators is the moving average. A moving average is a trend-following indicator that helps investors identify the direction of the market trend. By plotting a moving average on a chart, investors can see the average price of a security over a certain period of time, which can help identify trends and patterns.

Another important technical indicator is the relative strength index (RSI). The RSI is a momentum indicator that helps investors identify overbought and oversold conditions in the market. By using the RSI, investors can gain insights into market momentum and potential reversal points.

By learning how to read charts and use technical indicators, investors can develop a successful investment strategy and make more informed decisions about their investments. Whether you’re a beginner or an experienced investor, technical analysis is an essential tool for achieving success in the stock market.

For example, if an investor is interested in buying a particular stock, they can use technical analysis to identify trends and patterns in the market. By analyzing charts and using technical indicators, the investor can gain insights into market momentum and potential reversal points, which can help them make a more informed decision about their investment.

Fundamental Analysis: Evaluating Company Performance

Fundamental analysis is a crucial aspect of stock market study, as it helps investors evaluate the performance of a company and make informed investment decisions. By analyzing a company’s financial statements, management team, industry trends, and competitive analysis, investors can gain a deeper understanding of the company’s strengths and weaknesses.

Financial statements are a key component of fundamental analysis. Investors should review a company’s income statement, balance sheet, and cash flow statement to gain insights into its revenue, expenses, assets, liabilities, and cash flow. By analyzing these statements, investors can identify trends and patterns in a company’s financial performance.

The management team is also an important aspect of fundamental analysis. Investors should research the company’s management team, including their experience, track record, and leadership style. A strong management team can make a significant difference in a company’s success.

Industry trends and competitive analysis are also essential components of fundamental analysis. Investors should research the company’s industry, including its size, growth rate, and trends. They should also analyze the company’s competitors, including their market share, products, and pricing strategy.

By combining these components of fundamental analysis, investors can gain a comprehensive understanding of a company’s performance and make informed investment decisions. Fundamental analysis is a valuable tool for investors, as it helps them identify companies with strong financials, a solid management team, and a competitive advantage.

For example, if an investor is considering investing in a company, they can use fundamental analysis to evaluate its performance. By reviewing the company’s financial statements, researching its management team, and analyzing its industry trends and competitive analysis, the investor can gain a deeper understanding of the company’s strengths and weaknesses.

By using fundamental analysis, investors can make more informed investment decisions and avoid costly mistakes. Whether you’re a beginner or an experienced investor, fundamental analysis is an essential tool for achieving success in the stock market.

In addition to fundamental analysis, investors should also consider other factors, such as the company’s products, services, and business model. By taking a comprehensive approach to evaluating a company’s performance, investors can make more informed investment decisions and achieve their financial goals.

Staying Up-to-Date: News, Trends, and Market Analysis

To effectively study the stock market and make informed investment decisions, it is crucial to stay informed about market news, trends, and analysis. This involves following reputable sources, setting up news alerts, and leveraging social media to stay up-to-date. By doing so, investors can gain valuable insights into market movements, identify potential opportunities, and mitigate risks.

One effective way to stay informed is to follow reputable financial news sources, such as Bloomberg, CNBC, and The Wall Street Journal. These sources provide in-depth coverage of market news, trends, and analysis, helping investors stay ahead of the curve. Additionally, setting up news alerts can help investors receive real-time updates on market movements, allowing them to respond quickly to changing market conditions.

Social media platforms, such as Twitter and LinkedIn, can also be valuable resources for staying informed about market news and trends. Many financial experts, analysts, and investors share their insights and analysis on these platforms, providing a wealth of information for those looking to study the stock market. By following these experts and engaging with their content, investors can gain a deeper understanding of market trends and make more informed investment decisions.

Furthermore, investors can also leverage online resources, such as financial websites and blogs, to stay informed about market news and trends. Websites like Seeking Alpha, The Motley Fool, and Investopedia provide a wealth of information on stock market analysis, investment strategies, and market trends. By regularly visiting these websites and staying up-to-date with the latest news and analysis, investors can develop a more nuanced understanding of the stock market and make more informed investment decisions.

When it comes to how to study stock market news and trends, it is essential to be selective and discerning. With so much information available, it can be challenging to separate signal from noise. Investors should focus on following reputable sources, setting up news alerts, and leveraging social media to stay informed. By doing so, they can gain valuable insights into market movements and make more informed investment decisions.

Ultimately, staying up-to-date with market news, trends, and analysis is critical for anyone looking to study the stock market and make informed investment decisions. By following reputable sources, setting up news alerts, and leveraging social media, investors can gain a deeper understanding of market trends and make more informed investment decisions. By incorporating these strategies into their study routine, investors can develop a more nuanced understanding of the stock market and achieve their financial goals.

Developing a Study Routine: Tips for Consistency

Consistency is key when it comes to studying the stock market. Developing a regular study routine can help individuals stay on track, retain information, and make progress towards their investment goals. In this section, we will provide tips on how to create a consistent study routine, including setting aside dedicated time, creating a study schedule, and using online resources and tools.

Setting aside dedicated time is crucial for developing a consistent study routine. This can be as simple as allocating 30 minutes each day or 2 hours each week to study the stock market. It’s essential to choose a time that works best for your schedule and lifestyle, ensuring that you can commit to it regularly. By doing so, you can create a habit of studying the stock market, making it easier to stay on track.

Creating a study schedule is another vital aspect of developing a consistent study routine. This can be done by breaking down your study material into manageable chunks, setting specific goals for each study session, and tracking your progress. A study schedule can help you stay organized, focused, and motivated, ensuring that you cover all the necessary material to achieve your investment goals.

Using online resources and tools can also enhance your study routine. There are numerous websites, apps, and software programs available that can provide valuable information, analysis, and insights on the stock market. Some popular resources include Investopedia, Seeking Alpha, and Yahoo Finance. By leveraging these resources, you can access a wealth of information, stay up-to-date with market news, and gain a deeper understanding of the stock market.

In addition to online resources, there are also various study tools and techniques that can aid in your learning. Flashcards, for example, can be an effective way to memorize key terms and concepts. Mind maps and diagrams can help visualize complex information, making it easier to understand and retain. By incorporating these tools and techniques into your study routine, you can optimize your learning and make the most of your study time.

When it comes to how to study stock market, consistency is key. By developing a regular study routine, you can stay on track, retain information, and make progress towards your investment goals. By setting aside dedicated time, creating a study schedule, and using online resources and tools, you can create a study routine that works best for you. Remember, studying the stock market is a long-term process, and consistency is essential for achieving success.

Ultimately, the key to developing a consistent study routine is to find a approach that works best for you. Experiment with different study techniques, tools, and resources until you find what works best for your learning style and schedule. By doing so, you can create a study routine that is both effective and sustainable, helping you achieve your investment goals and succeed in the stock market.

Putting it All Together: Creating a Personalized Study Plan

Now that we have covered the essential components of studying the stock market, it’s time to put it all together and create a personalized study plan. A well-structured study plan can help individuals stay focused, motivated, and on track to achieving their investment goals. In this section, we will provide a template and example to help readers create a personalized study plan that incorporates their investment goals, risk tolerance, and learning style.

To create a personalized study plan, start by identifying your investment goals and risk tolerance. What are you trying to achieve through your investments? Are you looking for long-term growth or short-term gains? What is your risk tolerance? Are you comfortable with high-risk investments or do you prefer more conservative options? Once you have a clear understanding of your investment goals and risk tolerance, you can begin to develop a study plan that meets your needs.

Next, consider your learning style. Do you prefer hands-on learning or do you learn better through reading and research? Do you have a busy schedule or do you have dedicated time to study? By understanding your learning style, you can create a study plan that is tailored to your needs and preferences.

A personalized study plan should include the following components:

- Investment goals and risk tolerance

- Learning style and preferences

- Study schedule and routine

- Resources and materials

- Progress tracking and evaluation

Here is an example of a personalized study plan:

**Investment Goals:** Long-term growth and income generation

**Risk Tolerance:** Moderate

**Learning Style:** Hands-on learning and reading

**Study Schedule:** 2 hours per week, dedicated to studying the stock market

**Resources and Materials:** Investopedia, Seeking Alpha, and Yahoo Finance

**Progress Tracking and Evaluation:** Quarterly review of investment portfolio and study progress

By creating a personalized study plan, individuals can take control of their learning and stay focused on their investment goals. Remember, studying the stock market is a long-term process, and consistency is key. By following a well-structured study plan, individuals can develop the knowledge and skills needed to succeed in the stock market.

When it comes to how to study stock market, a personalized study plan is essential. By incorporating your investment goals, risk tolerance, and learning style into your study plan, you can create a tailored approach that meets your needs and helps you achieve your investment objectives. By following the template and example provided, you can create a personalized study plan that sets you up for success in the stock market.