Unlocking the Secrets of Successful Stock Trading

Stock trading has long been a popular way to build wealth and achieve financial freedom. With the potential for high returns and the ability to trade from anywhere in the world, it’s no wonder that millions of people are drawn to the stock market every year. However, successful stock trading requires more than just luck or intuition. It demands a deep understanding of the markets, a solid trading strategy, and the discipline to stick to your plan. In this article, we’ll take a closer look at how to trade in stocks effectively, providing you with a step-by-step guide to help you get started on your trading journey.

Whether you’re a seasoned investor or just starting out, learning how to trade in stocks can seem overwhelming at first. With so many different types of stocks, trading platforms, and strategies to choose from, it’s easy to feel like you’re in over your head. But with the right knowledge and tools, you can navigate the stock market with confidence and start building the wealth you deserve. In the following sections, we’ll break down the basics of stock trading, discuss the importance of developing a trading strategy, and explore the different types of analysis you can use to make informed trading decisions.

By the end of this article, you’ll have a solid understanding of how to trade in stocks and be well on your way to achieving your financial goals. So let’s get started and explore the world of stock trading together.

Understanding the Basics: What You Need to Know Before You Start

Before diving into the world of stock trading, it’s essential to understand the fundamental concepts that govern the markets. This knowledge will serve as the foundation for developing a solid trading strategy and making informed investment decisions. In this section, we’ll explore the basics of stock trading, including the different types of stocks, trading platforms, and basic trading terminology.

Stocks, also known as equities, represent ownership in companies. There are two primary types of stocks: common stocks and preferred stocks. Common stocks give shareholders voting rights and the potential to receive dividends, while preferred stocks have a higher claim on assets and earnings but typically don’t come with voting rights.

Trading platforms are the software systems used to buy and sell stocks. These platforms can be online, mobile, or desktop-based and offer various features such as real-time market data, charting tools, and order execution. Popular trading platforms include Robinhood, Fidelity, and TD Ameritrade.

Basic trading terminology is also crucial to understand. Some key terms include:

- Bull market: A market trending upward, characterized by rising stock prices.

- Bear market: A market trending downward, characterized by falling stock prices.

- Portfolio: A collection of stocks, bonds, and other investment instruments held by an individual or institution.

- Broker: An intermediary who facilitates buying and selling transactions between buyers and sellers.

- Exchange: A platform where stocks are traded, such as the New York Stock Exchange (NYSE) or NASDAQ.

Understanding these basic concepts is vital for anyone looking to learn how to trade in stocks effectively. By grasping these fundamentals, traders can make informed decisions and develop a solid foundation for their investment strategies.

Setting Up Your Trading Environment: Choosing the Right Tools and Resources

Once you have a solid understanding of the basics of stock trading, it’s essential to set up a trading environment that supports your activities. This includes selecting the right trading platform, broker, and other tools to help you make informed investment decisions and execute trades efficiently.

A trading platform is the software system used to buy and sell stocks. When choosing a trading platform, consider the following factors:

- Fees and commissions: Look for platforms with competitive fees and commissions.

- User interface: Choose a platform with an intuitive and user-friendly interface.

- Trading tools: Consider platforms that offer advanced trading tools, such as charting software and technical indicators.

- Mobile access: Ensure the platform offers mobile access to trade on-the-go.

- Customer support: Look for platforms with reliable customer support.

Popular trading platforms include:

- Robinhood: Known for its commission-free trading and simple interface.

- Fidelity: Offers a range of trading tools and research resources.

- TD Ameritrade: Provides advanced trading tools and a user-friendly interface.

In addition to a trading platform, you’ll also need to choose a broker. A broker is an intermediary who facilitates buying and selling transactions between buyers and sellers. When selecting a broker, consider the following factors:

- Reputation: Research the broker’s reputation and read reviews from other traders.

- Fees and commissions: Compare fees and commissions among different brokers.

- Trading tools: Consider brokers that offer advanced trading tools and research resources.

- Customer support: Look for brokers with reliable customer support.

Other tools and resources to consider when setting up your trading environment include:

- Charting software: Helps you analyze charts and identify trends.

- Technical indicators: Provides additional data points to inform your trading decisions.

- News and research resources: Stay up-to-date with market news and analysis.

- Trading communities: Connect with other traders to share knowledge and ideas.

By choosing the right trading platform, broker, and other tools, you’ll be well-equipped to learn how to trade in stocks effectively and make informed investment decisions.

Developing a Trading Strategy: Identifying Your Goals and Risk Tolerance

Developing a trading strategy is a crucial step in learning how to trade in stocks effectively. A well-defined strategy helps traders make informed decisions, manage risk, and achieve their financial goals. In this section, we’ll discuss the importance of identifying your goals and risk tolerance, and explore different types of trading strategies.

Before developing a trading strategy, it’s essential to identify your financial goals and risk tolerance. What are you trying to achieve through stock trading? Are you looking for short-term gains or long-term wealth creation? How much risk are you willing to take on? Answering these questions will help you determine the type of trading strategy that suits you best.

There are several types of trading strategies, including:

- Day Trading: Involves buying and selling stocks within a single trading day, with the aim of profiting from intraday price movements.

- Swing Trading: Involves holding stocks for a shorter period, typically a few days or weeks, to profit from medium-term price movements.

- Long-term Investing: Involves holding stocks for an extended period, typically months or years, to profit from long-term growth and dividend income.

Each trading strategy has its unique characteristics, advantages, and disadvantages. For example, day trading requires a high level of market analysis and quick decision-making, while long-term investing requires patience and a long-term perspective.

When developing a trading strategy, consider the following factors:

- Market analysis: Use technical and fundamental analysis to identify potential trading opportunities.

- Risk management: Set stop-loss orders and position sizing to manage risk.

- Trade planning: Plan your trades in advance, including entry and exit points.

- Trade execution: Execute your trades efficiently, using the right trading tools and platforms.

By identifying your goals and risk tolerance, and developing a trading strategy that suits your needs, you’ll be well on your way to learning how to trade in stocks effectively and achieving your financial objectives.

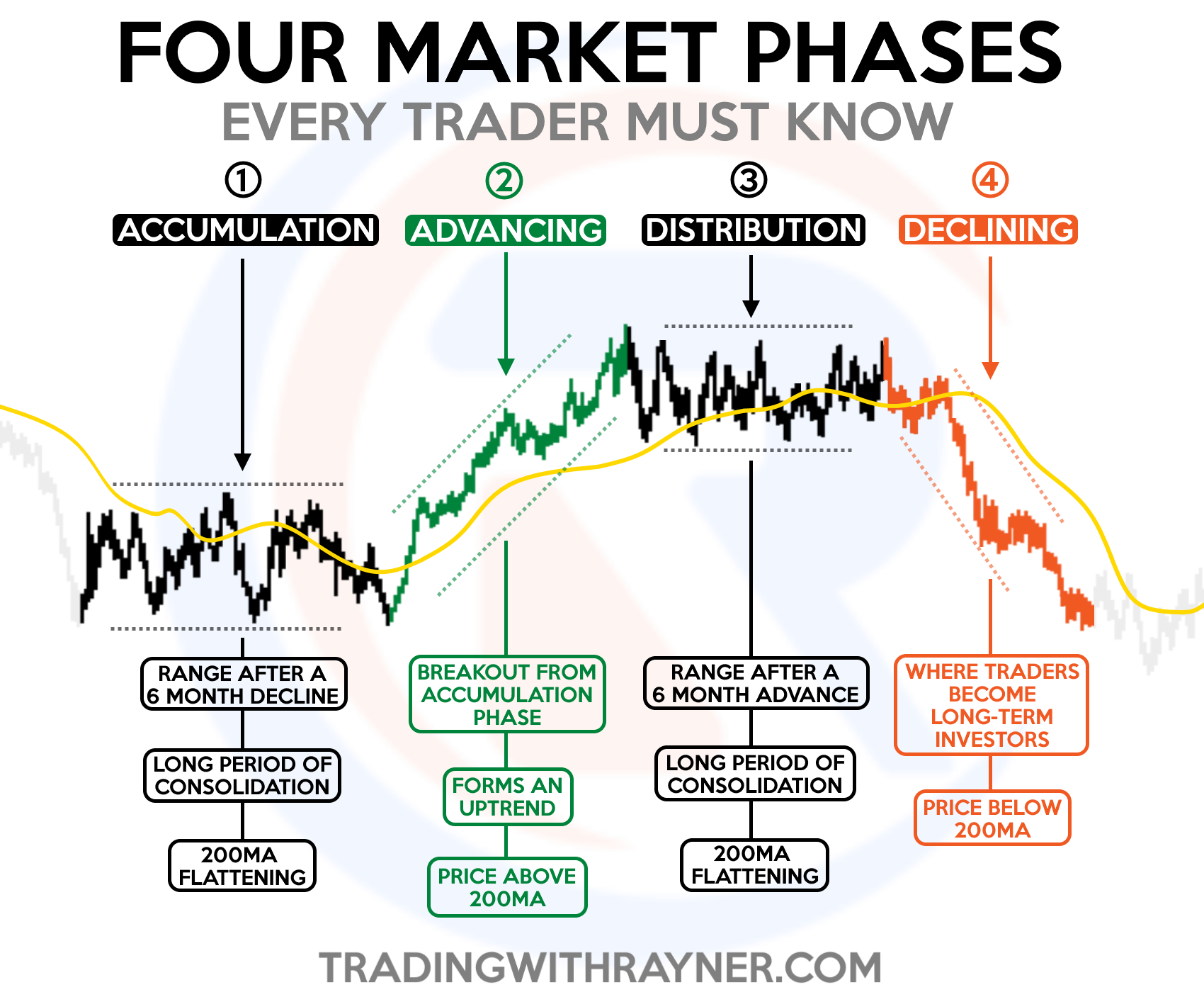

Technical Analysis 101: Reading Charts and Identifying Trends

Technical analysis is a crucial tool for stock traders, providing insights into market trends and potential trading opportunities. By learning how to read charts and identify trends, traders can make informed decisions and improve their chances of success. In this section, we’ll introduce the basics of technical analysis and explore how to use it to trade in stocks effectively.

Technical analysis involves studying charts and patterns to identify trends and predict future price movements. There are several types of charts used in technical analysis, including:

- Line charts: Show the closing price of a stock over time.

- Bar charts: Show the high, low, and closing prices of a stock over time.

- Candlestick charts: Show the high, low, and closing prices of a stock over time, with additional information about market sentiment.

Chart patterns are also an essential part of technical analysis. Common patterns include:

- Trend lines: Show the direction and strength of a trend.

- Support and resistance levels: Identify areas where the price of a stock is likely to bounce or break through.

- Reversal patterns: Indicate a potential change in trend, such as a head and shoulders or inverse head and shoulders pattern.

Indicators are also used in technical analysis to provide additional insights into market trends. Common indicators include:

- Moving averages: Show the average price of a stock over a certain period.

- Relative strength index (RSI): Measures the strength of a trend and identifies potential overbought or oversold conditions.

- Bollinger Bands: Show the volatility of a stock and identify potential breakouts or breakdowns.

By learning how to read charts and identify trends, traders can use technical analysis to identify potential trading opportunities and make informed decisions. For example, a trader might use a trend line to identify a strong uptrend and then use indicators to confirm the trend and identify potential entry points.

Technical analysis is a powerful tool for stock traders, but it’s essential to remember that it’s not a guarantee of success. Traders should always combine technical analysis with fundamental analysis and risk management techniques to maximize their chances of success.

Fundamental Analysis: Evaluating Stocks Based on Company Performance

Fundamental analysis is a crucial aspect of stock trading, as it helps traders evaluate the financial health and performance of a company. By analyzing a company’s financial statements, management team, and industry trends, traders can gain valuable insights into the company’s potential for growth and profitability.

Financial statements are a key component of fundamental analysis. Traders should review a company’s income statement, balance sheet, and cash flow statement to understand its revenue, expenses, assets, liabilities, and cash flow. This information can help traders identify trends and patterns in a company’s financial performance.

The management team is also an essential aspect of fundamental analysis. Traders should research the company’s management team, including their experience, track record, and leadership style. A strong management team can be a key driver of a company’s success.

Industry trends are also important to consider when evaluating a company’s stock. Traders should research the company’s industry, including its growth prospects, competitive landscape, and regulatory environment. This information can help traders understand the company’s potential for growth and profitability.

Some key metrics to consider when evaluating a company’s stock include:

- Price-to-earnings (P/E) ratio: Compares the company’s stock price to its earnings per share.

- Return on equity (ROE): Measures the company’s profitability by comparing its net income to its shareholder equity.

- Debt-to-equity ratio: Compares the company’s debt to its shareholder equity.

- Dividend yield: Measures the company’s dividend payments as a percentage of its stock price.

By analyzing these metrics and considering the company’s financial statements, management team, and industry trends, traders can gain a comprehensive understanding of the company’s stock and make informed trading decisions.

Fundamental analysis is a powerful tool for stock traders, as it helps them evaluate the financial health and performance of a company. By combining fundamental analysis with technical analysis and risk management techniques, traders can develop a comprehensive trading strategy that incorporates multiple perspectives and approaches.

Managing Risk and Emotions: The Key to Successful Stock Trading

Managing risk and emotions is a crucial aspect of stock trading, as it can help traders avoid significant losses and achieve their financial goals. In this section, we’ll discuss the importance of managing risk and emotions, and provide guidance on how to do so effectively.

Risk management is a critical component of stock trading, as it helps traders protect their capital and avoid significant losses. There are several risk management strategies that traders can use, including:

- Stop-loss orders: Automatically sell a stock when it falls to a certain price, limiting potential losses.

- Position sizing: Manage the size of trades to limit potential losses.

- Diversification: Spread investments across different asset classes and industries to reduce risk.

Emotional management is also essential in stock trading, as emotions can cloud judgment and lead to impulsive decisions. Traders should strive to maintain a disciplined approach, avoiding emotional decisions and staying focused on their trading strategy.

Some common emotional pitfalls in stock trading include:

- Fear and greed: Fear can lead to selling too early, while greed can lead to holding onto a stock for too long.

- Overconfidence: Overconfidence can lead to taking on too much risk and ignoring potential losses.

- Loss aversion: Loss aversion can lead to holding onto a losing stock, hoping it will rebound.

To manage emotions effectively, traders can use several strategies, including:

- Meditation and mindfulness: Practice mindfulness and meditation to stay calm and focused.

- Journaling: Keep a trading journal to track progress and identify areas for improvement.

- Support groups: Join a trading community or support group to connect with other traders and share experiences.

By managing risk and emotions effectively, traders can develop a disciplined approach to stock trading and achieve their financial goals. Remember, successful stock trading requires a combination of technical analysis, fundamental analysis, and risk management, as well as emotional control and discipline.

Putting it All Together: Creating a Winning Stock Trading Plan

Creating a comprehensive stock trading plan is essential for achieving success in the markets. By incorporating the strategies and techniques discussed throughout this article, traders can develop a winning plan that helps them navigate the markets with confidence.

A successful stock trading plan should include the following components:

- Clear financial goals: Define your financial objectives and risk tolerance.

- Trading strategy: Choose a trading strategy that aligns with your goals and risk tolerance.

- Risk management: Implement risk management techniques, such as stop-loss orders and diversification.

- Technical analysis: Use technical analysis to identify potential trading opportunities.

- Fundamental analysis: Evaluate stocks based on company performance and industry trends.

- Emotional management: Develop a disciplined approach to managing emotions and avoiding impulsive decisions.

By incorporating these components into a comprehensive trading plan, traders can increase their chances of success and achieve their financial goals.

Remember, learning how to trade in stocks effectively takes time and practice. It’s essential to stay disciplined, patient, and informed to achieve success in the markets.

By following the guidance provided in this article, traders can develop a solid foundation for successful stock trading and create a winning trading plan that helps them achieve their financial objectives.