Why a Well-Written Business Plan is Crucial for Loan Approval

A well-written business plan is essential for securing a loan, as it demonstrates creditworthiness and showcases a clear vision for the business. Lenders and investors want to see a comprehensive plan that outlines the company’s goals, strategies, and financial projections. A business plan serves as a roadmap for the company, guiding decision-making and ensuring everyone is on the same page. By including a detailed business plan in a loan application, entrepreneurs can increase their chances of approval and secure the funding needed to grow their business.

When learning how to write a business plan for a loan, it’s essential to understand the lender’s perspective. Lenders want to mitigate risk and ensure that their investment will yield a return. A well-written business plan helps to alleviate concerns and demonstrates that the business is a viable investment opportunity. By providing a clear and concise plan, entrepreneurs can build trust with lenders and increase their chances of securing a loan.

A business plan should include an executive summary, company description, market analysis, product or service description, marketing and sales strategy, management team, financial projections, and funding request. Each section should be carefully crafted to provide a comprehensive overview of the business and its goals. By including all the necessary components, entrepreneurs can create a business plan that effectively communicates their vision and secures the funding needed to bring it to life.

When creating a business plan for a loan, it’s crucial to ensure that it is well-written, concise, and free of errors. A poorly written plan can lead to rejection, while a well-written plan can increase the chances of approval. By taking the time to craft a comprehensive and well-written business plan, entrepreneurs can demonstrate their commitment to their business and increase their chances of securing a loan.

Defining Your Business Model: Identifying Your Unique Value Proposition

Defining a clear business model is a crucial step in the process of how to write a business plan for a loan. A well-defined business model helps to identify the company’s unique value proposition, target market, and competitive advantage. This information is essential for lenders and investors, as it demonstrates the company’s potential for growth and profitability.

A business model should include a description of the company’s products or services, target market, marketing and sales strategy, and revenue streams. It should also identify the company’s unique value proposition, which is the unique benefit that the company offers to its customers. This could be a proprietary technology, a unique marketing approach, or a specialized service.

When defining a business model, it’s essential to conduct market research to understand the target market and competitive landscape. This includes analyzing industry trends, identifying competitors, and understanding customer needs and preferences. By conducting market research, companies can identify gaps in the market and develop a unique value proposition that sets them apart from their competitors.

A well-defined business model is essential for securing a loan, as it demonstrates the company’s potential for growth and profitability. Lenders and investors want to see a clear and concise business model that outlines the company’s goals and strategies. By including a well-defined business model in a business plan, companies can increase their chances of securing a loan and achieving their business goals.

Some common business models include the subscription-based model, the freemium model, and the advertising-based model. Each of these models has its own unique characteristics and advantages. By selecting the right business model, companies can increase their chances of success and achieve their business goals.

Conducting Market Research: Understanding Your Industry and Competition

Conducting market research is a critical step in the process of how to write a business plan for a loan. Market research helps to identify industry trends, competitors, and customer needs and preferences. This information is essential for developing a comprehensive business plan that outlines the company’s goals and strategies.

There are several types of market research, including primary research and secondary research. Primary research involves collecting original data through surveys, focus groups, and interviews. Secondary research involves analyzing existing data from sources such as industry reports, academic studies, and government statistics.

When conducting market research, it’s essential to identify the target market and analyze the competitive landscape. This includes identifying key competitors, their strengths and weaknesses, and their market share. By understanding the competitive landscape, companies can develop a unique value proposition that sets them apart from their competitors.

Market research also helps to identify customer needs and preferences. This includes understanding demographic characteristics, such as age, income, and education level, as well as psychographic characteristics, such as values, attitudes, and lifestyle. By understanding customer needs and preferences, companies can develop products and services that meet their needs and exceed their expectations.

Some common market research tools include SWOT analysis, Porter’s Five Forces analysis, and market segmentation analysis. SWOT analysis helps to identify the company’s strengths, weaknesses, opportunities, and threats. Porter’s Five Forces analysis helps to identify the competitive forces that shape the industry. Market segmentation analysis helps to identify specific segments of the market that the company can target.

By conducting market research, companies can gain a deeper understanding of their industry and competition. This information can be used to develop a comprehensive business plan that outlines the company’s goals and strategies. By including market research in a business plan, companies can increase their chances of securing a loan and achieving their business goals.

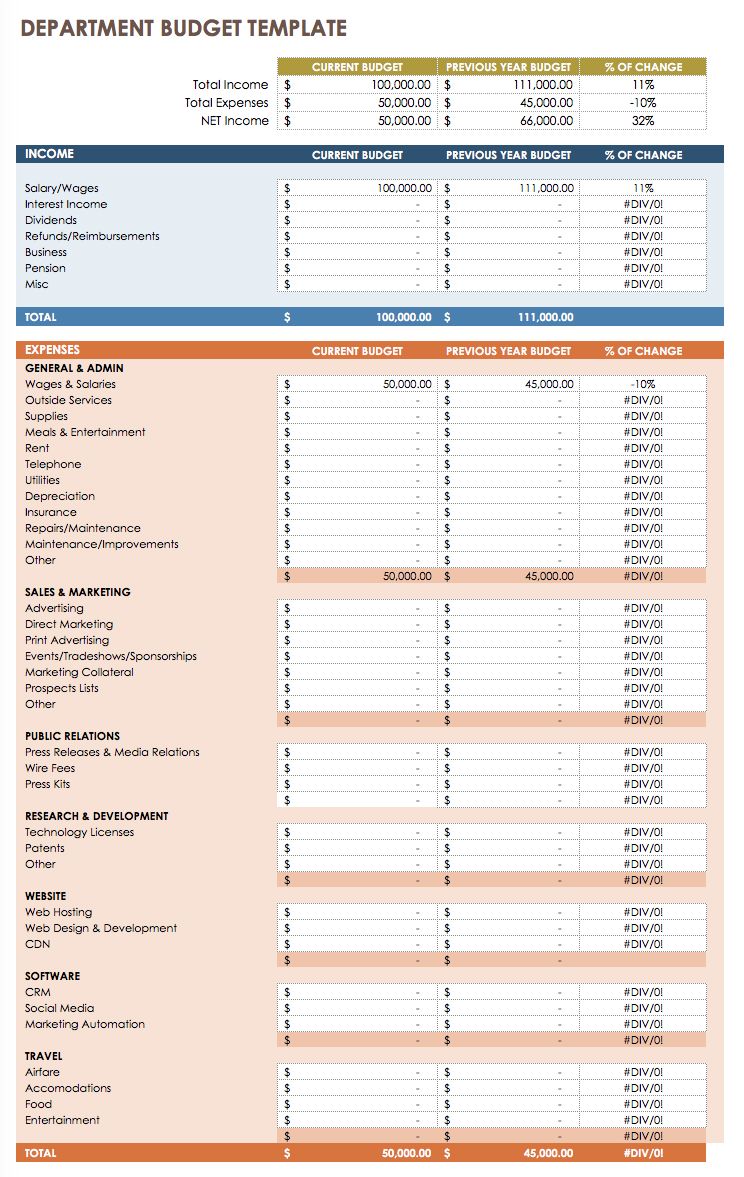

Creating a Realistic Financial Projections: Estimating Revenue and Expenses

Creating realistic financial projections is a critical step in the process of how to write a business plan for a loan. Financial projections help to estimate revenue, expenses, and cash flow, and provide a clear picture of the company’s financial health. This information is essential for lenders and investors, as it helps to determine the company’s creditworthiness and potential for growth.

When creating financial projections, it’s essential to estimate revenue accurately. This includes identifying the company’s revenue streams, estimating sales volume, and calculating revenue growth. Revenue projections should be based on historical data, market research, and industry trends.

Expenses should also be estimated accurately, including fixed costs, variable costs, and capital expenditures. This includes estimating costs such as salaries, rent, utilities, and equipment purchases. Expenses should be categorized and totaled to provide a clear picture of the company’s expense structure.

Cash flow projections are also critical, as they help to identify the company’s ability to generate cash and meet its financial obligations. Cash flow projections should include estimates of cash inflows and outflows, and provide a clear picture of the company’s cash position.

Break-even analysis is also an essential tool for creating realistic financial projections. Break-even analysis helps to identify the point at which the company’s revenue equals its expenses, and provides a clear picture of the company’s profitability.

Some common financial projection tools include financial statements, such as the income statement, balance sheet, and cash flow statement. These statements provide a clear picture of the company’s financial health and help to identify areas for improvement.

By creating realistic financial projections, companies can demonstrate their creditworthiness and potential for growth. This information is essential for lenders and investors, as it helps to determine the company’s ability to repay a loan or generate a return on investment.

When creating financial projections, it’s essential to use conservative estimates and avoid overestimating revenue or underestimating expenses. This helps to ensure that the company’s financial projections are realistic and achievable.

Developing a Comprehensive Marketing Strategy: Reaching Your Target Audience

Developing a comprehensive marketing strategy is a crucial step in the process of how to write a business plan for a loan. A well-crafted marketing strategy helps to identify the target audience, create a unique selling proposition, and establish a brand identity. This information is essential for lenders and investors, as it demonstrates the company’s ability to reach and engage with its target market.

A comprehensive marketing strategy should include a clear description of the target audience, including demographic characteristics, such as age, income, and education level, as well as psychographic characteristics, such as values, attitudes, and lifestyle. This information helps to create a unique selling proposition that resonates with the target audience.

The marketing strategy should also outline the marketing channels that will be used to reach the target audience, including social media, email marketing, content marketing, and paid advertising. Each marketing channel should be evaluated based on its effectiveness in reaching the target audience and achieving the company’s marketing goals.

Establishing a brand identity is also an essential component of a comprehensive marketing strategy. This includes creating a unique brand voice, visual identity, and messaging that resonates with the target audience. A strong brand identity helps to differentiate the company from its competitors and establish a loyal customer base.

Some common marketing strategy tools include the marketing mix, also known as the 4 Ps, which includes product, price, promotion, and place. This framework helps to evaluate the marketing strategy and ensure that it is aligned with the company’s overall business goals.

By developing a comprehensive marketing strategy, companies can demonstrate their ability to reach and engage with their target audience, establish a strong brand identity, and achieve their marketing goals. This information is essential for lenders and investors, as it helps to determine the company’s potential for growth and profitability.

When developing a marketing strategy, it’s essential to use data and analytics to inform decision-making and measure the effectiveness of the marketing efforts. This includes tracking website traffic, social media engagement, and conversion rates to ensure that the marketing strategy is achieving its intended goals.

Building a Strong Management Team: Highlighting Key Personnel and Roles

Building a strong management team is a crucial step in the process of how to write a business plan for a loan. A well-structured management team helps to demonstrate the company’s ability to execute its business plan and achieve its goals. This information is essential for lenders and investors, as it helps to determine the company’s potential for growth and profitability.

A strong management team should include key personnel with relevant skills and experience. This includes the CEO, CFO, and other senior executives who will be responsible for making strategic decisions and overseeing the company’s operations. Each member of the management team should have a clear role and responsibility, and their skills and experience should be highlighted in the business plan.

The management team should also have a clear organizational structure, including a clear chain of command and decision-making process. This helps to ensure that the company’s operations are efficient and effective, and that decisions are made in a timely and informed manner.

When building a management team, it’s essential to consider the company’s specific needs and goals. This includes identifying the key skills and experience required for each role, and recruiting personnel who can meet those needs. The management team should also be diverse and inclusive, with a range of perspectives and experiences that can help to drive innovation and growth.

Some common management team structures include the functional structure, the divisional structure, and the matrix structure. Each of these structures has its own advantages and disadvantages, and the best structure for the company will depend on its specific needs and goals.

By building a strong management team, companies can demonstrate their ability to execute their business plan and achieve their goals. This information is essential for lenders and investors, as it helps to determine the company’s potential for growth and profitability.

When highlighting key personnel and roles in the business plan, it’s essential to use clear and concise language, and to provide specific examples of each person’s skills and experience. This helps to ensure that the management team is presented in a clear and compelling way, and that the company’s potential for growth and profitability is demonstrated.

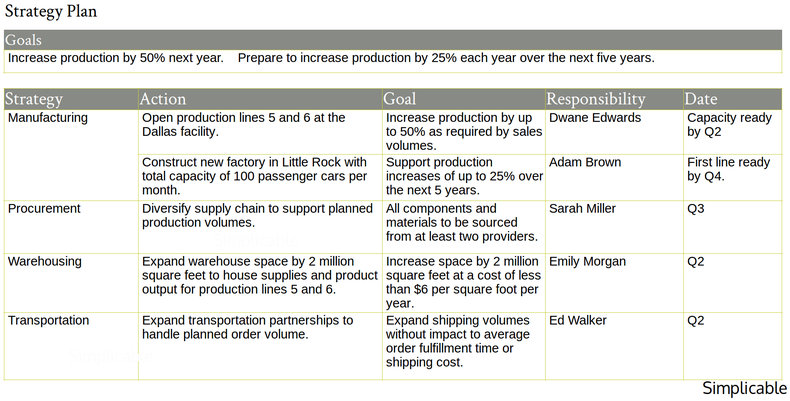

Outlining Operational and Logistics Plans: Ensuring Smooth Business Operations

Outlining operational and logistics plans is a crucial step in the process of how to write a business plan for a loan. A well-structured operational plan helps to ensure that the business runs smoothly and efficiently, and that all aspects of the business are well-coordinated. This information is essential for lenders and investors, as it helps to determine the company’s potential for growth and profitability.

An operational plan should include a description of the production process, including the materials and equipment needed, the manufacturing process, and the quality control measures in place. It should also include information on managing supply chains, including sourcing materials, managing inventory, and ensuring timely delivery of products or services.

Ensuring compliance with regulations is also an important aspect of operational planning. This includes obtaining necessary licenses and permits, meeting health and safety standards, and complying with environmental regulations. By outlining operational and logistics plans, companies can demonstrate their ability to manage the day-to-day operations of the business and ensure that all aspects of the business are well-coordinated.

Some common operational planning tools include the operational plan template, which helps to outline the key components of the operational plan, and the supply chain management template, which helps to manage the flow of goods and services. By using these tools, companies can create a comprehensive operational plan that helps to ensure smooth business operations.

When outlining operational and logistics plans, it’s essential to consider the company’s specific needs and goals. This includes identifying the key operational processes, such as production, logistics, and supply chain management, and outlining the steps needed to ensure that these processes are carried out efficiently and effectively.

By outlining operational and logistics plans, companies can demonstrate their ability to manage the day-to-day operations of the business and ensure that all aspects of the business are well-coordinated. This information is essential for lenders and investors, as it helps to determine the company’s potential for growth and profitability.

When creating an operational plan, it’s essential to use clear and concise language, and to provide specific examples of each operational process. This helps to ensure that the operational plan is presented in a clear and compelling way, and that the company’s potential for growth and profitability is demonstrated.

Finalizing Your Business Plan: Tips for Editing and Refining Your Document

Finalizing your business plan is a crucial step in the process of how to write a business plan for a loan. A well-written and polished business plan can make a significant difference in securing funding from lenders or investors. This article provides tips for editing and refining your business plan, ensuring consistency and clarity, and preparing for presentation to lenders or investors.

When editing and refining your business plan, it’s essential to review the document carefully, checking for grammar, spelling, and punctuation errors. Ensure that the language is clear and concise, and that the formatting is consistent throughout the document.

Consistency and clarity are key when it comes to presenting your business plan to lenders or investors. Ensure that the document is well-organized, with clear headings and subheadings, and that the information is presented in a logical and easy-to-follow manner.

When preparing for presentation, it’s essential to practice your pitch, ensuring that you can clearly and confidently communicate your business plan and vision to lenders or investors. Be prepared to answer questions and provide additional information as needed.

Some common editing and refining tools include grammar and spell checkers, such as Grammarly or ProWritingAid, and formatting guides, such as the AP Stylebook or the Chicago Manual of Style. By using these tools, you can ensure that your business plan is polished and professional.

When finalizing your business plan, it’s also essential to consider the audience and purpose of the document. Ensure that the language and tone are appropriate for the intended audience, and that the document is tailored to meet the specific needs and requirements of lenders or investors.

By following these tips, you can ensure that your business plan is well-written, polished, and effective in securing funding from lenders or investors. Remember to take the time to review and refine your document carefully, and to practice your pitch before presenting to lenders or investors.