Understanding the Psychology of Spending and Giving

When it comes to managing finances, it’s essential to recognize the psychological factors that influence our spending and giving habits. Emotional triggers, social pressures, and personal values all play a significant role in shaping our financial decisions. By understanding these factors, individuals can make more intentional choices about how they spend and give their money.

Research has shown that emotional spending can be a significant obstacle to achieving financial stability. When individuals are feeling stressed, anxious, or bored, they may turn to retail therapy or impulse purchases as a way to cope. This can lead to a cycle of overspending and debt, which can be challenging to break. By recognizing the emotional triggers that drive spending habits, individuals can develop strategies to manage their emotions in healthier ways.

Social pressures also play a significant role in shaping our financial decisions. The desire to keep up with the latest trends, maintain a certain image, or fit in with a particular social group can lead to overspending and financial stress. By being aware of these social pressures, individuals can make more informed choices about how they spend their money and prioritize their financial goals.

Personal values are another critical factor in determining how we spend and give our money. When individuals align their spending habits with their values, they are more likely to feel fulfilled and satisfied with their financial decisions. For example, someone who values sustainability may prioritize spending on eco-friendly products or donating to environmental causes.

By understanding the psychological factors that influence our spending and giving habits, individuals can make more intentional choices about how they manage their finances. This can lead to a more balanced and fulfilling financial life, where individuals feel confident and in control of their money. Whether it’s developing strategies to manage emotional spending, resisting social pressures, or aligning spending habits with personal values, being aware of the psychological factors at play can help individuals achieve their financial goals.

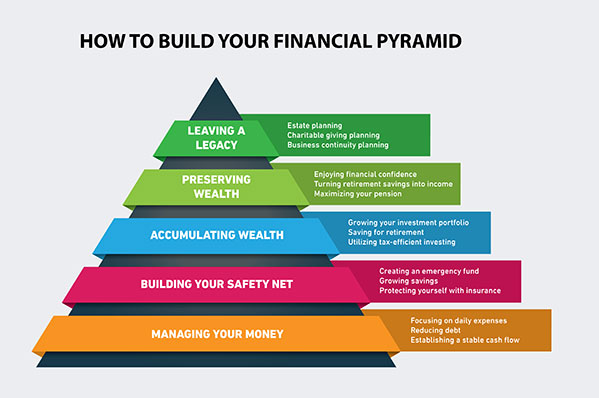

Assessing Your Financial Priorities: A Step-by-Step Guide

Assessing your financial priorities is a crucial step in managing your finances effectively. By understanding what you want to achieve with your money, you can make informed decisions about how you spend and give your money. Here’s a step-by-step guide to help you assess your financial priorities:

Step 1: Identify Your Financial Goals

Start by identifying your short-term and long-term financial goals. Do you want to save for a down payment on a house? Pay off debt? Build an emergency fund? Write down your goals and prioritize them. This will help you focus on what’s most important to you and allocate your money accordingly.

Step 2: Evaluate Your Income and Expenses

Next, evaluate your income and expenses to understand where your money is going. Make a list of your income sources and expenses, including fixed expenses like rent and utilities, and variable expenses like entertainment and hobbies. This will help you identify areas where you can cut back and allocate your money more efficiently.

Step 3: Determine Your Net Worth

Your net worth is the total value of your assets minus your liabilities. Calculate your net worth by adding up the value of your assets, such as your savings, investments, and retirement accounts, and subtracting your liabilities, such as your debts and loans. This will give you a clear picture of your financial situation and help you make informed decisions about how to manage your money.

Step 4: Create a Personalized Financial Plan

Based on your financial goals, income, expenses, and net worth, create a personalized financial plan. This plan should outline your financial objectives, strategies for achieving them, and a timeline for implementation. Be sure to review and update your plan regularly to ensure you’re on track to meet your financial goals.

By following these steps, you can assess your financial priorities and create a personalized financial plan that helps you achieve your goals. Remember to regularly review and update your plan to ensure you’re on track to financial success. By being mindful of how you spend and give your money, you can achieve a more balanced and fulfilling financial life.

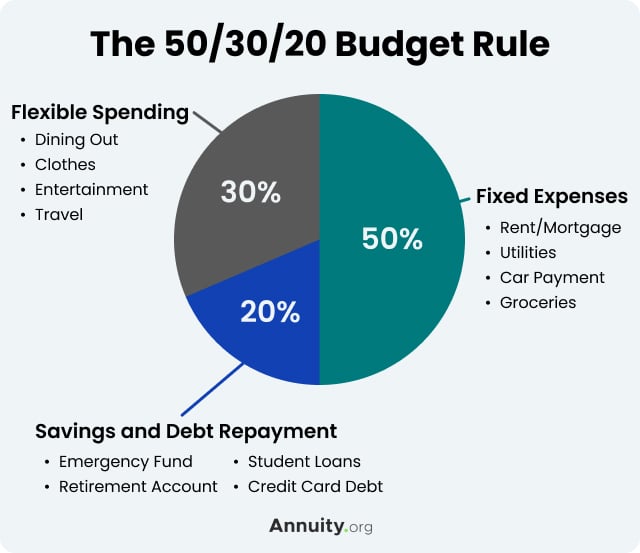

The 50/30/20 Rule: A Simple Framework for Allocating Your Money

The 50/30/20 rule is a simple and effective framework for allocating your money towards different expenses. This rule suggests that 50% of your income should go towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and giving. By following this rule, you can achieve a balanced financial life and make the most of your money.

Necessary expenses, which should account for 50% of your income, include essential costs such as rent, utilities, groceries, and transportation. These expenses are crucial for maintaining a basic standard of living and should be prioritized.

Discretionary spending, which should account for 30% of your income, includes expenses that are not essential but can improve your quality of life. Examples of discretionary spending include dining out, entertainment, hobbies, and travel. While these expenses can bring joy and fulfillment, they should be kept in check to avoid overspending.

Saving and giving, which should account for 20% of your income, is crucial for achieving long-term financial security and making a positive impact on the world. This includes saving for retirement, paying off debt, and donating to charity. By prioritizing saving and giving, you can build wealth, reduce financial stress, and make a difference in the lives of others.

By following the 50/30/20 rule, you can allocate your money in a way that aligns with your financial goals and values. This rule provides a simple and effective framework for managing your finances and achieving a balanced financial life. Remember, how you spend and give your money can have a significant impact on your financial well-being and overall quality of life.

It’s worth noting that the 50/30/20 rule is not a one-size-fits-all solution, and you may need to adjust the proportions based on your individual circumstances. For example, if you have high-interest debt, you may want to allocate a larger percentage of your income towards debt repayment. Similarly, if you’re saving for a specific goal, such as a down payment on a house, you may want to allocate a larger percentage of your income towards savings.

Ultimately, the key to achieving financial success is to find a balance that works for you and to be mindful of how you spend and give your money. By following the 50/30/20 rule and being intentional with your finances, you can achieve a more balanced and fulfilling financial life.

Strategies for Reducing Unnecessary Expenses and Increasing Savings

Reducing unnecessary expenses and increasing savings are crucial steps in achieving financial stability and security. By implementing a few simple strategies, you can make a significant impact on your financial well-being and achieve your long-term financial goals.

One effective way to reduce unnecessary expenses is to cut back on subscription services. Take a close look at your monthly subscriptions, such as streaming services, gym memberships, and magazine subscriptions. Cancel any services that you don’t use regularly or that don’t provide significant value to your life.

Cooking at home is another great way to reduce unnecessary expenses. Eating out can be expensive, and cooking at home can save you a significant amount of money. Try meal planning and batch cooking to make cooking at home easier and more efficient.

Canceling unwanted expenses is also an effective way to reduce unnecessary expenses. Take a close look at your bank statements and cancel any recurring payments that you don’t need or use. This can include things like unwanted subscription services, gym memberships, and insurance policies.

In addition to reducing unnecessary expenses, increasing savings is also crucial for achieving financial stability and security. One effective way to increase savings is to automate your savings. Set up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

Using cashback apps is another great way to increase savings. Cashback apps like Ibotta and Fetch Rewards offer cashback on certain purchases, which can be a great way to earn some extra money. Additionally, taking advantage of employer matching is also a great way to increase savings. If your employer offers a 401(k) or other retirement plan matching program, contribute enough to maximize the match.

By implementing these strategies, you can reduce unnecessary expenses and increase savings, which can have a significant impact on your financial well-being. Remember, how you spend and give your money can have a lasting impact on your financial stability and security. By being mindful of your spending habits and making intentional financial decisions, you can achieve your long-term financial goals and live a more fulfilling life.

The Power of Giving: How Donating to Charity Can Enrich Your Life

Donating to charity is a powerful way to make a positive impact on the world, and it can also have a profound effect on one’s own life. When considering how you spend and give your money, it’s essential to think about the role that charitable giving can play in your overall financial plan. Not only can donating to charity help those in need, but it can also bring numerous benefits to the giver.

Research has shown that charitable giving can have a positive impact on mental and emotional well-being. Acts of kindness and generosity have been shown to increase feelings of happiness and social connection, while also reducing stress and anxiety. Additionally, charitable giving can provide a sense of purpose and fulfillment, as individuals feel that they are making a meaningful contribution to their community.

Donating to charity can also have social benefits. When individuals give to charity, they are often brought into contact with like-minded people who share their values and passions. This can lead to new friendships and social connections, as well as a sense of belonging to a community that is working towards a common goal.

Furthermore, charitable giving can be an important part of personal growth and development. When individuals give to charity, they are forced to think critically about their values and priorities. This can lead to a greater sense of self-awareness and introspection, as individuals consider how they want to make a positive impact on the world.

So, how can you get started with charitable giving? Here are a few tips:

Start small: You don’t have to give a lot to make a difference. Consider starting with a small monthly donation to a charity that aligns with your values.

Research charities: Before giving to a charity, do your research to ensure that it is reputable and effective. Look for charities that are transparent about their finances and have a clear mission and goals.

Consider alternative forms of giving: In addition to monetary donations, consider volunteering your time or donating goods and services to charity.

Make it a habit: Consider setting up a regular donation to charity, either monthly or annually. This can help make giving a habit and ensure that you are consistently making a positive impact.

By incorporating charitable giving into your financial plan, you can experience the numerous benefits that it has to offer. Not only can donating to charity help those in need, but it can also bring a sense of purpose, fulfillment, and joy to your life. So, consider how you spend and give your money, and think about the role that charitable giving can play in your overall financial plan.

Investing in Yourself: The Importance of Personal Development and Education

Investing in oneself is a crucial aspect of achieving long-term financial success. By prioritizing personal development and education, individuals can increase their earning potential, improve their financial literacy, and lead a more fulfilling life. When considering how you spend and give your money, it’s essential to think about the role that investing in yourself can play in your overall financial plan.

Personal development and education can take many forms, from formal education and certifications to online courses and workshops. The key is to identify areas where you’d like to improve and invest in yourself accordingly. For example, if you’re looking to advance in your career, you may want to consider taking courses or earning certifications that align with your professional goals.

Investing in yourself can have a significant impact on your earning potential. According to the Bureau of Labor Statistics, workers with a bachelor’s degree typically earn about 50% more than those with only a high school diploma. Additionally, individuals with advanced degrees or certifications can earn even higher salaries.

Personal development and education can also improve your financial literacy. By learning about personal finance, investing, and money management, you can make more informed decisions about how you spend and give your money. This can lead to a more stable financial future and reduced financial stress.

Furthermore, investing in yourself can lead to a more fulfilling life. When you prioritize personal development and education, you’re investing in your own growth and well-being. This can lead to increased confidence, improved relationships, and a greater sense of purpose.

So, how can you start investing in yourself? Here are a few tips:

Identify your goals: Start by identifying areas where you’d like to improve. What are your career goals? What skills do you need to develop? What knowledge do you need to acquire?

Research options: Once you’ve identified your goals, research options for personal development and education. Look into online courses, workshops, and certifications that align with your goals.

Create a budget: Investing in yourself requires a budget. Set aside a portion of your income each month for personal development and education.

Take action: Finally, take action. Sign up for courses, attend workshops, and start learning. Remember, investing in yourself is a long-term process, and it’s essential to be patient and persistent.

By prioritizing personal development and education, you can take control of your financial future and lead a more fulfilling life. Remember to consider how you spend and give your money, and think about the role that investing in yourself can play in your overall financial plan.

Building Multiple Income Streams: A Key to Long-Term Financial Security

Having multiple income streams is a crucial aspect of achieving long-term financial security. By diversifying your income sources, you can reduce your financial risk, increase your financial flexibility, and improve your overall financial well-being. When considering how you spend and give your money, it’s essential to think about the role that multiple income streams can play in your overall financial plan.

There are several benefits to building multiple income streams. For one, it can reduce your financial risk by providing a safety net in case one of your income sources is disrupted. Additionally, having multiple income streams can increase your financial flexibility, allowing you to pursue new opportunities and make more intentional financial decisions.

So, how can you build multiple income streams? Here are a few strategies to consider:

Start a side hustle: A side hustle is a part-time business or freelance work that can provide an additional source of income. Consider starting a side hustle that aligns with your skills and interests, such as writing, designing, or consulting.

Invest in dividend-paying stocks: Dividend-paying stocks can provide a regular stream of income, which can help to diversify your income sources. Consider investing in established companies with a history of paying consistent dividends.

Create an online business: Creating an online business can provide a passive source of income, which can help to reduce your financial risk. Consider creating an online course, ebook, or membership site that aligns with your expertise and interests.

Rent out a spare room or property: If you have a spare room or property, consider renting it out on a short-term or long-term basis. This can provide a regular stream of income, which can help to diversify your income sources.

Participate in the gig economy: The gig economy is a growing trend that involves working on a freelance or contract basis. Consider participating in the gig economy by signing up with companies such as Uber, Lyft, or TaskRabbit.

By building multiple income streams, you can reduce your financial risk, increase your financial flexibility, and improve your overall financial well-being. Remember to consider how you spend and give your money, and think about the role that multiple income streams can play in your overall financial plan.

In addition to these strategies, it’s essential to have a solid understanding of personal finance and money management. This includes creating a budget, saving for retirement, and investing in a diversified portfolio. By combining these strategies with multiple income streams, you can achieve long-term financial security and live a more fulfilling life.

Ultimately, building multiple income streams requires patience, discipline, and persistence. It’s essential to stay focused on your long-term goals and to be willing to take calculated risks. By doing so, you can achieve financial freedom and live a more fulfilling life.

Cultivating a Mindful Money Mindset: Tips for Long-Term Success

Cultivating a mindful money mindset is essential for achieving long-term financial success. By being more intentional and aware of how you spend and give your money, you can make better financial decisions and achieve your financial goals. Here are some tips for cultivating a mindful money mindset:

Practice gratitude: Practicing gratitude can help you focus on what you already have, rather than what you don’t have. Take time each day to reflect on the things you’re thankful for, and consider keeping a gratitude journal to track your thoughts.

Avoid impulse purchases: Impulse purchases can be a major obstacle to achieving financial success. By avoiding impulse purchases, you can save money and make more intentional purchasing decisions. Consider implementing a 30-day waiting period before making non-essential purchases.

Stay informed about personal finance: Staying informed about personal finance can help you make better financial decisions and achieve your financial goals. Consider reading personal finance books, articles, and blogs, and following personal finance experts on social media.

Set clear financial goals: Setting clear financial goals can help you stay focused and motivated on your financial journey. Consider setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, and breaking them down into smaller, manageable steps.

Practice mindfulness: Practicing mindfulness can help you stay present and focused on your financial goals. Consider incorporating mindfulness practices, such as meditation or deep breathing, into your daily routine.

Seek support: Seeking support from friends, family, or a financial advisor can help you stay accountable and motivated on your financial journey. Consider joining a financial support group or seeking the advice of a financial professional.

Be patient and persistent: Achieving financial success takes time and effort. By being patient and persistent, you can stay focused on your financial goals and overcome obstacles along the way.

By incorporating these tips into your daily routine, you can cultivate a mindful money mindset and achieve long-term financial success. Remember to stay focused on your financial goals, and don’t be afraid to seek support when you need it.

In addition to these tips, it’s essential to have a solid understanding of personal finance and money management. This includes creating a budget, saving for retirement, and investing in a diversified portfolio. By combining these strategies with a mindful money mindset, you can achieve financial freedom and live a more fulfilling life.

Ultimately, cultivating a mindful money mindset requires a long-term commitment to financial awareness and responsibility. By staying focused on your financial goals and making intentional financial decisions, you can achieve financial success and live a more fulfilling life.