Understanding Your Financial Emergency

When unexpected expenses arise, it’s not uncommon for individuals to find themselves in need of thousands of dollars quickly. Whether it’s a sudden medical bill, car repair, or losing a job, financial emergencies can be overwhelming and stressful. In such situations, it’s essential to understand the root cause of the problem and explore reliable solutions to avoid further financial strain.

Research suggests that nearly 60% of Americans struggle to cover unexpected expenses, often relying on credit cards or high-interest loans to get by. However, these short-term fixes can lead to a cycle of debt and financial instability. It’s crucial to address the underlying issue and seek a more sustainable solution.

For those who need thousands of dollars now, it’s vital to take a step back and assess the situation. Ask yourself: What is the root cause of this financial emergency? Is it a one-time expense or an ongoing issue? What are my financial goals, and how can I achieve them? By understanding the nature of the problem, you can begin to explore alternative solutions that align with your financial objectives.

In the next section, we’ll delve into the pros and cons of short-term loan options, including payday loans, title loans, and cash advances. We’ll also discuss alternative solutions for making money quickly, such as selling unwanted items, freelancing, or participating in gig economy jobs.

Exploring Short-Term Loan Options

When faced with a financial emergency, some individuals may consider short-term loan options to get the money they need quickly. Payday loans, title loans, and cash advances are popular choices, but it’s essential to understand the pros and cons of these loans before making a decision.

Payday loans, for example, offer quick access to cash, often with minimal credit checks. However, they come with extremely high interest rates, typically ranging from 300% to 700% APR. This can lead to a cycle of debt, making it challenging to pay off the loan. Additionally, payday lenders often charge exorbitant fees, which can add up quickly.

Title loans, on the other hand, require collateral, usually in the form of a vehicle. While they may offer lower interest rates than payday loans, they still come with significant risks. If the borrower fails to repay the loan, the lender can repossess the vehicle, leaving the individual without a means of transportation.

Cash advances, often offered by credit card companies, provide quick access to cash, but at a steep price. Interest rates can be high, and fees can add up quickly. Furthermore, cash advances often come with stricter repayment terms, making it challenging to pay off the loan.

While short-term loan options may seem like a quick fix for those who need thousands of dollars now, it’s crucial to carefully consider the potential risks and consequences. High interest rates, exorbitant fees, and strict repayment terms can lead to a cycle of debt, making it challenging to achieve financial stability.

In the next section, we’ll explore alternative solutions for making money quickly, such as selling unwanted items, freelancing, or participating in gig economy jobs. These options may offer a more sustainable solution for those facing financial emergencies.

Alternative Solutions: How to Make Money Quickly

For those who need thousands of dollars now, exploring alternative solutions can be a more sustainable and reliable option. One approach is to sell unwanted items, which can be done through online marketplaces like eBay, Craigslist, or Facebook Marketplace. This can be a quick way to generate cash, especially if you have items of value that you no longer need.

Freelancing is another option for making money quickly. Platforms like Upwork, Fiverr, or Freelancer offer a range of opportunities for individuals to offer their skills and services. Whether you’re a writer, graphic designer, or web developer, freelancing can be a flexible and lucrative way to earn money.

Participating in gig economy jobs is another alternative solution. Companies like Uber, Lyft, or DoorDash offer opportunities for individuals to make money by delivering food or providing transportation. While these jobs may not make you rich, they can provide a quick influx of cash when you need it.

Other alternative solutions include participating in online surveys, renting out a spare room on Airbnb, or selling handmade goods on Etsy. These options may not make you thousands of dollars immediately, but they can provide a steady stream of income and help you build a financial safety net.

When exploring alternative solutions, it’s essential to be realistic about the potential earnings and the time required to generate income. However, with the right mindset and strategy, these options can provide a more sustainable and reliable way to make money quickly.

In the next section, we’ll explore crowdfunding as a community-driven approach to raising money for emergency funding. We’ll discuss the benefits and potential drawbacks of this approach and provide tips on how to get started.

Crowdfunding: A Community-Driven Approach

Crowdfunding is a community-driven approach to raising money for emergency funding. Platforms like GoFundMe, Kickstarter, or Indiegogo allow individuals to create a campaign and share it with their network, seeking donations to support their cause. This approach can be particularly useful for those who need thousands of dollars now, as it allows them to tap into their community’s resources and support.

One of the benefits of crowdfunding is that it allows individuals to share their story and connect with others who may be able to offer support. This can be a powerful way to build a community around a cause and raise money quickly. Additionally, crowdfunding platforms often have a low barrier to entry, making it easy for individuals to create a campaign and start raising money.

However, crowdfunding also has its drawbacks. For example, there are often fees associated with creating a campaign, and there is no guarantee that the campaign will be successful. Additionally, crowdfunding can be a time-consuming process, requiring individuals to promote their campaign and engage with their network.

Despite these challenges, crowdfunding can be a viable option for those who need emergency funding. By sharing their story and connecting with others, individuals can raise the money they need to cover unexpected expenses or achieve their goals.

Some popular crowdfunding platforms for emergency funding include:

- GoFundMe: A platform that allows individuals to create a campaign and raise money for emergency funding, medical expenses, or other causes.

- Kickstarter: A platform that allows individuals to create a campaign and raise money for creative projects or business ventures.

- Indiegogo: A platform that allows individuals to create a campaign and raise money for a wide range of causes, including emergency funding and business ventures.

In the next section, we’ll discuss government assistance programs that can provide financial aid in times of need, such as Medicaid, food stamps, or temporary cash assistance.

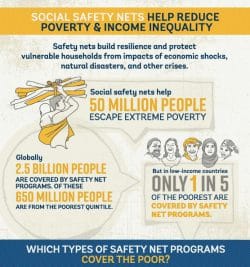

Government Assistance Programs: A Safety Net

Government assistance programs can provide a vital safety net for individuals who need thousands of dollars now. These programs are designed to help people in times of need, and can offer financial aid for a variety of expenses, including medical bills, housing costs, and food.

Medicaid is one example of a government assistance program that can provide financial aid for medical expenses. This program is designed for low-income individuals and families, and can help cover the cost of doctor visits, hospital stays, and prescription medications.

Food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), is another government assistance program that can provide financial aid for food expenses. This program is designed for low-income individuals and families, and can help cover the cost of groceries and other food expenses.

Temporary cash assistance programs, such as the Temporary Assistance for Needy Families (TANF) program, can also provide financial aid for individuals who need thousands of dollars now. These programs are designed to help people in times of need, and can offer financial aid for a variety of expenses, including housing costs, food, and medical expenses.

To be eligible for these government assistance programs, individuals typically need to meet certain income and resource requirements. For example, Medicaid eligibility is typically based on income and family size, while food stamp eligibility is based on income and expenses.

The application process for these programs can vary depending on the state and the specific program. However, most programs require individuals to submit an application and provide documentation of their income and expenses.

Government assistance programs can provide a vital safety net for individuals who need thousands of dollars now. By understanding the eligibility requirements and application process for these programs, individuals can get the financial aid they need to cover unexpected expenses and achieve financial stability.

In the next section, we’ll discuss the importance of long-term financial planning to avoid future financial emergencies.

Long-Term Financial Planning: Avoiding Future Emergencies

While emergency funding solutions can provide a temporary fix for financial emergencies, it’s essential to focus on long-term financial planning to avoid future emergencies. By creating a budget, building an emergency fund, and investing in a retirement plan, individuals can reduce their reliance on emergency funding solutions and achieve financial stability.

Creating a budget is the first step towards long-term financial planning. By tracking income and expenses, individuals can identify areas where they can cut back and allocate funds towards savings and investments. A budget should include a plan for emergency funding, as well as a strategy for paying off high-interest debt and building credit.

Building an emergency fund is also crucial for avoiding future financial emergencies. This fund should cover 3-6 months of living expenses and be easily accessible in case of an emergency. By having a cushion of savings, individuals can avoid going into debt when unexpected expenses arise.

Investing in a retirement plan is another important aspect of long-term financial planning. By starting early and contributing regularly, individuals can build a nest egg that will provide financial security in retirement. This can include employer-sponsored plans, such as 401(k) or IRA, or individual retirement accounts.

Additionally, individuals can consider other long-term financial planning strategies, such as investing in a diversified portfolio of stocks and bonds, or purchasing a life insurance policy. By taking a proactive approach to financial planning, individuals can reduce their reliance on emergency funding solutions and achieve financial stability.

By focusing on long-term financial planning, individuals can avoid future financial emergencies and achieve financial stability. In the next section, we’ll discuss the importance of managing debt and introduce strategies for paying off high-interest loans and credit cards.

Managing Debt: A Crucial Step Towards Financial Stability

Managing debt is a crucial step towards achieving financial stability, especially for those who need thousands of dollars now. High-interest loans and credit cards can quickly spiral out of control, leading to financial strain and stress. However, by implementing effective debt management strategies, individuals can pay off their debts and achieve financial stability.

One effective strategy for managing debt is to prioritize high-interest loans and credit cards. By focusing on paying off these debts first, individuals can save money on interest payments and reduce their overall debt burden. Additionally, individuals can consider debt consolidation options, such as balance transfer credit cards or personal loans, to simplify their debt payments and reduce interest rates.

Another important aspect of managing debt is to create a budget and track expenses. By understanding where their money is going, individuals can identify areas where they can cut back and allocate funds towards debt repayment. Additionally, individuals can consider credit counseling services, which can provide personalized advice and support for managing debt.

It’s also important to note that debt management is not a one-time task, but rather an ongoing process. By regularly reviewing and adjusting their debt management plan, individuals can ensure that they are on track to achieving financial stability. Additionally, individuals can consider automating their debt payments to ensure that they never miss a payment.

By managing debt effectively, individuals can reduce their financial stress and achieve financial stability. In the next section, we’ll summarize the various options discussed in the article and encourage readers to carefully evaluate their financial situation before choosing a solution.

Conclusion: Finding the Right Solution for Your Financial Emergency

When faced with a financial emergency, it’s essential to carefully evaluate your options and choose a solution that meets your needs. Whether you need thousands of dollars now to cover unexpected medical bills, car repairs, or losing a job, there are various options available to help you get back on your feet.

In this article, we’ve discussed various emergency funding solutions, including short-term loan options, alternative solutions for making money quickly, crowdfunding, government assistance programs, long-term financial planning, and managing debt. Each of these options has its pros and cons, and it’s crucial to understand the potential risks and benefits before making a decision.

Before choosing a solution, take the time to carefully evaluate your financial situation and consider your options. If you’re unsure about which solution is best for you, consider seeking professional advice from a financial advisor or credit counselor.

Remember, finding the right solution for your financial emergency requires careful consideration and planning. By taking the time to evaluate your options and choose a solution that meets your needs, you can get back on your feet and achieve financial stability.

Don’t let financial emergencies hold you back. Take control of your finances today and find the right solution for your needs.