How to Determine When Your Check Will Clear

Check deposit processing times can vary depending on several factors, including the type of check, deposit method, and bank policies. Understanding these factors is crucial to determining when your check will clear. When you deposit a check, the bank verifies the check’s authenticity and ensures that the funds are available in the account of the check’s issuer. This process typically takes a few days, but it can be affected by weekends and holidays.

For instance, if you deposit a check on a Friday, the bank may not process it until the next business day, which is Monday. This means that the check may not clear until Tuesday or Wednesday, depending on the bank’s policies and the type of check. It’s essential to note that some banks may have different processing times for different types of checks, such as personal checks, business checks, or government checks.

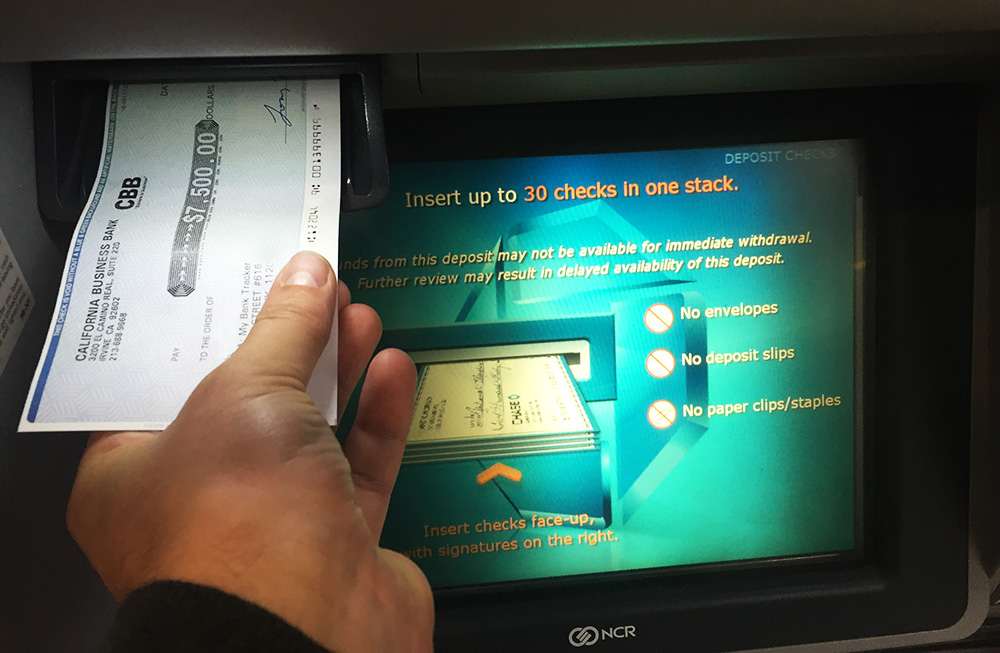

In addition to the type of check, the deposit method can also impact the clearing time. Depositing a check through an ATM or mobile banking app may take longer than depositing it in person at a bank branch. This is because the bank needs to verify the check’s authenticity and ensure that the funds are available before making them available to you.

Bank policies also play a significant role in determining when your check will clear. Some banks may have a same-day deposit policy, while others may take a few days to process checks. It’s essential to familiarize yourself with your bank’s check deposit policy to avoid any delays or issues.

By understanding the factors that affect check deposit processing times, you can better determine when your check will clear. If you’re unsure about the status of your deposited check, you can always contact your bank or check your account online to get an update.

The Impact of Weekends and Holidays on Check Clearing

Weekends and holidays can significantly impact the clearing time of a check. When you deposit a check on a Friday, it’s essential to understand how the bank’s processing schedule will affect the clearing time. Typically, banks process checks on business days, which are Monday through Friday, excluding federal holidays. If you deposit a check on a Friday, the bank may not process it until the next business day, which is Monday.

This means that if you deposit a check on a Friday, it may not clear until Tuesday or Wednesday, depending on the bank’s policies and the type of check. For example, if you deposit a check on a Friday at 5:00 PM, the bank may not process it until Monday morning, and the funds may not be available until Tuesday. This is because the bank needs to verify the check’s authenticity and ensure that the funds are available in the account of the check’s issuer.

Holidays can also impact the clearing time of a check. If a holiday falls on a Monday, for instance, the bank may not process checks until Tuesday. This can cause a delay in the clearing time of a check, especially if you deposit it on the Friday before the holiday. It’s essential to check with your bank to determine their holiday schedule and how it may affect the clearing time of your check.

In addition to weekends and holidays, the bank’s processing schedule can also impact the clearing time of a check. Some banks may have a same-day deposit policy, while others may take a few days to process checks. It’s essential to familiarize yourself with your bank’s check deposit policy to avoid any delays or issues.

By understanding how weekends and holidays can impact the clearing time of a check, you can better plan your finances and avoid any potential delays. If you’re unsure about the status of your deposited check, you can always contact your bank or check your account online to get an update.

What Happens When You Deposit a Check on a Friday

When you deposit a check on a Friday, it’s essential to understand what happens next. Typically, banks process checks on business days, which are Monday through Friday, excluding federal holidays. If you deposit a check on a Friday, the bank may not process it until the next business day, which is Monday.

Here’s a step-by-step explanation of what happens when you deposit a check on a Friday:

1. The bank receives the check and verifies its authenticity. This process typically takes a few hours, but it can take longer depending on the bank’s policies and the type of check.

2. Once the check is verified, the bank sends it to the Federal Reserve for processing. This can take a few hours to a few days, depending on the bank’s relationship with the Federal Reserve.

3. The Federal Reserve processes the check and sends it back to the bank. This can take a few hours to a few days, depending on the Federal Reserve’s processing schedule.

4. Once the bank receives the processed check, it updates your account and makes the funds available. This can take a few hours to a few days, depending on the bank’s policies and the type of check.

In general, if you deposit a check on a Friday, you can expect the funds to be available on Tuesday or Wednesday, depending on the bank’s policies and the type of check. However, this can vary depending on the bank’s processing schedule and the Federal Reserve’s processing schedule.

It’s essential to note that some banks may have different processing times for different types of checks. For example, some banks may process payroll checks faster than personal checks. It’s always best to check with your bank to determine their specific processing times and policies.

If you’re wondering “if I deposit a check Friday when will it clear,” the answer depends on the bank’s policies and the type of check. However, in general, you can expect the funds to be available on Tuesday or Wednesday, depending on the bank’s processing schedule.

Factors That Can Delay Check Clearing

While the typical processing time for a check deposited on a Friday is a few days, there are several factors that can delay the clearing of a check. Understanding these factors can help you avoid delays and ensure that your check clears in a timely manner.

One common factor that can delay check clearing is a hold on the check. A hold is a temporary delay in the processing of a check, usually due to a verification issue or a bank error. If a hold is placed on your check, it can take several days to resolve the issue and clear the check.

Verification issues are another common factor that can delay check clearing. If the bank is unable to verify the check’s authenticity or the account holder’s identity, the check may be delayed or returned. To avoid verification issues, make sure to endorse the check correctly and provide accurate account information.

Bank errors can also delay check clearing. If the bank makes an error in processing the check, it can take several days to correct the mistake and clear the check. To avoid bank errors, make sure to review your account statements regularly and report any discrepancies to the bank immediately.

In addition to holds, verification issues, and bank errors, other factors that can delay check clearing include:

• Insufficient funds in the account of the check’s issuer

• A stop payment order on the check

• A discrepancy in the check’s amount or account information

• A delay in the bank’s processing schedule

If your check is delayed, it’s essential to contact the bank to resolve the issue. The bank can provide you with information on the status of your check and help you resolve any issues that may be causing the delay.

In some cases, you may need to provide additional documentation or information to resolve the issue. Be prepared to provide this information to the bank to ensure that your check clears in a timely manner.

By understanding the factors that can delay check clearing, you can take steps to avoid delays and ensure that your check clears quickly and efficiently.

https://www.youtube.com/watch?v=QurTPU7b6QY

How to Check the Status of Your Deposited Check

Once you’ve deposited a check, it’s natural to wonder when the funds will become available. Fortunately, there are several ways to track the status of your deposited check and stay up-to-date on the clearing process.

One of the easiest ways to check the status of your deposited check is through online banking. Most banks offer online banking services that allow you to view your account activity, including deposited checks. Simply log in to your online banking account, navigate to the “Account Activity” or “Transaction History” section, and look for the deposited check. You should be able to see the status of the check, including whether it’s been processed, cleared, or returned.

Another way to check the status of your deposited check is through mobile banking apps. Many banks offer mobile banking apps that allow you to view your account activity, deposit checks, and transfer funds on the go. Simply download your bank’s mobile banking app, log in to your account, and navigate to the “Account Activity” or “Transaction History” section to view the status of your deposited check.

If you prefer to speak with a bank representative, you can also contact the bank directly to inquire about the status of your deposited check. Simply call the bank’s customer service number, provide your account information, and ask about the status of your deposited check. The bank representative should be able to provide you with an update on the clearing process and let you know when the funds will become available.

In addition to these methods, you can also check the status of your deposited check by visiting a bank branch in person. Simply visit a bank branch, provide your account information, and ask about the status of your deposited check. The bank representative should be able to provide you with an update on the clearing process and let you know when the funds will become available.

By using one or more of these methods, you can easily track the status of your deposited check and stay up-to-date on the clearing process. If you’re wondering “if I deposit a check Friday when will it clear,” you can use these methods to get an update on the status of your check and plan accordingly.

Understanding Your Bank’s Check Deposit Policy

When it comes to depositing checks, it’s essential to understand your bank’s check deposit policy. Each bank has its own set of rules and regulations regarding check clearing times, and familiarizing yourself with these policies can help you avoid delays and ensure that your checks clear in a timely manner.

One of the most important things to understand is your bank’s check clearing schedule. This schedule outlines when checks are processed and when funds become available. For example, if you deposit a check on a Friday, you may want to know when the funds will become available. By understanding your bank’s check clearing schedule, you can plan accordingly and avoid any potential delays.

In addition to the check clearing schedule, it’s also essential to understand your bank’s policies regarding check holds. A check hold is a temporary delay in the processing of a check, usually due to a verification issue or a bank error. If a check hold is placed on your deposit, you may need to wait several days for the funds to become available. By understanding your bank’s policies regarding check holds, you can plan accordingly and avoid any potential delays.

Another important aspect of your bank’s check deposit policy is their rules regarding check deposits made on weekends and holidays. As we discussed earlier, weekends and holidays can affect the clearing time of a check. By understanding your bank’s policies regarding weekend and holiday deposits, you can plan accordingly and avoid any potential delays.

Finally, it’s essential to understand your bank’s policies regarding check deposits made through different channels, such as online banking, mobile banking apps, or in-person deposits. Each channel may have its own set of rules and regulations regarding check clearing times, and familiarizing yourself with these policies can help you avoid delays and ensure that your checks clear in a timely manner.

By understanding your bank’s check deposit policy, you can avoid delays and ensure that your checks clear in a timely manner. If you’re wondering “if I deposit a check Friday when will it clear,” you can refer to your bank’s check clearing schedule and policies to get an answer.

What to Do If Your Check Doesn’t Clear on Time

If your check doesn’t clear on time, it can be frustrating and may cause delays in your financial plans. However, there are steps you can take to resolve the issue and get your check cleared as soon as possible.

First, contact the bank to inquire about the status of your check. The bank may be able to provide you with information on why the check hasn’t cleared and when you can expect the funds to become available. Be prepared to provide your account information and the check number to help the bank locate the check in their system.

If the bank is unable to provide you with a clear answer, you may want to ask to speak with a supervisor or someone who can provide more assistance. It’s also a good idea to ask about the bank’s check clearing policy and what steps you can take to avoid delays in the future.

In some cases, the bank may request additional documentation or information to verify the check. Be prepared to provide this information as soon as possible to avoid further delays.

If the issue is due to a bank error, the bank may be able to correct the issue and clear the check immediately. However, if the issue is due to a problem with the check itself, such as a missing signature or incorrect date, you may need to re-deposit the check or provide a new check to replace the original.

It’s also important to note that if your check doesn’t clear on time, you may be able to dispute the issue with the bank. However, this should be a last resort and only used in cases where the bank has made an error or failed to follow their own policies.

By following these steps, you can help resolve the issue and get your check cleared as soon as possible. If you’re wondering “if I deposit a check Friday when will it clear,” it’s always best to check with the bank directly to get the most up-to-date information.

Best Practices for Depositing Checks to Ensure Timely Clearing

To ensure that your checks clear in a timely manner, it’s essential to follow best practices when depositing checks. Here are some tips to help you avoid delays and ensure that your checks clear quickly:

1. Deposit checks early in the day: Depositing checks early in the day can help ensure that they are processed quickly and efficiently. This is because most banks process checks in batches, and depositing early in the day can help ensure that your check is included in the first batch of the day.

2. Use electronic deposit methods: Electronic deposit methods, such as online banking and mobile banking apps, can help speed up the check clearing process. These methods allow you to deposit checks remotely, which can help reduce the time it takes for the check to clear.

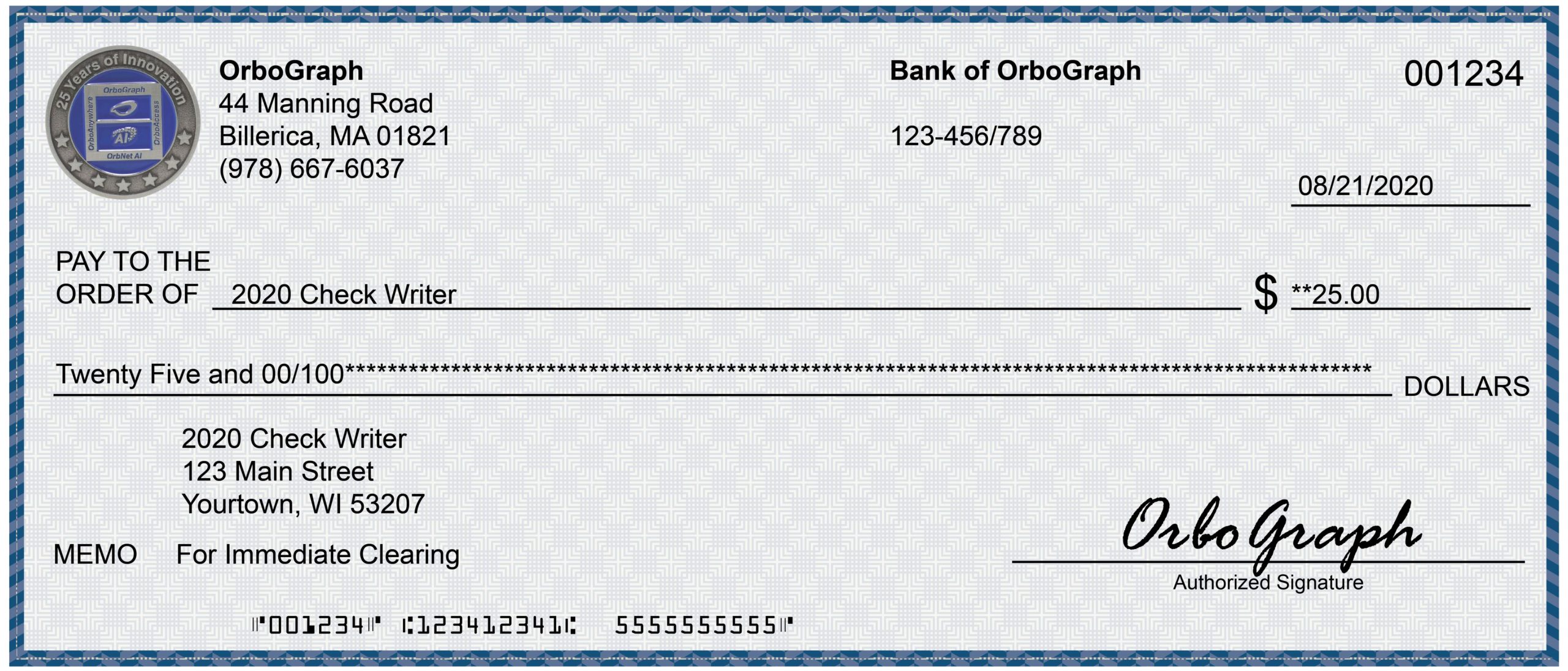

3. Verify check details: Before depositing a check, make sure to verify the check details, including the date, amount, and payee information. This can help ensure that the check is processed correctly and reduces the risk of errors or delays.

4. Use a deposit slip: Using a deposit slip can help ensure that your check is processed correctly and efficiently. A deposit slip provides a clear and concise record of the deposit, which can help reduce the risk of errors or delays.

5. Avoid depositing checks on weekends or holidays: Depositing checks on weekends or holidays can delay the clearing process. This is because most banks do not process checks on weekends or holidays, which can cause delays in the clearing process.

By following these best practices, you can help ensure that your checks clear in a timely manner and avoid delays. If you’re wondering “if I deposit a check Friday when will it clear,” following these best practices can help ensure that your check clears quickly and efficiently.

/how-to-write-a-check-4019395_FINAL-eec64c4ad9804b12b8098331b5e25809.jpg)

/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)