Understanding the Importance of Current Interest Rates for 30-Year Fixed Mortgages

When considering a 30-year fixed mortgage, it’s essential to understand the current interest rates and how they can impact your monthly payments and overall cost of the loan. Interest rates today for 30-year fixed mortgages can vary significantly depending on several factors, including economic indicators, monetary policy, and lender competition. A small change in interest rates can result in substantial differences in your mortgage payments over the life of the loan.

For instance, a $300,000 mortgage with an interest rate of 4% would result in a monthly payment of approximately $1,432. However, if the interest rate increases to 5%, the monthly payment would jump to around $1,610. This represents a significant increase of $178 per month, or $2,136 per year. Over the 30-year term of the loan, this would translate to an additional $64,080 in interest payments.

Furthermore, interest rates can also impact the overall cost of the loan. A lower interest rate can result in significant savings over the life of the loan. For example, a 30-year fixed mortgage with an interest rate of 3.5% would result in a total interest paid of around $143,739, compared to $223,139 for a mortgage with an interest rate of 5%.

Given the significant impact of interest rates on mortgage payments and overall cost, it’s crucial to stay informed about current interest rates and trends. By understanding how interest rates work and how they can affect your mortgage, you can make informed decisions and secure the best possible deal for your 30-year fixed mortgage.

In the next section, we’ll explore the factors that drive changes in 30-year fixed mortgage interest rates, providing you with a deeper understanding of the complex forces that shape the mortgage market.

Understanding the Forces that Shape 30-Year Fixed Mortgage Interest Rates

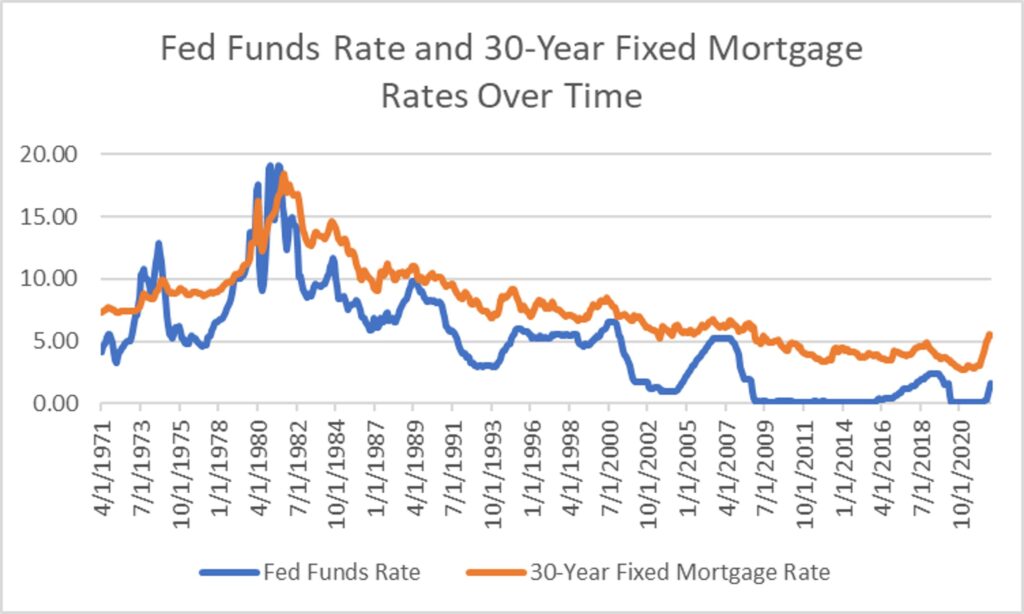

Interest rates today for 30-year fixed mortgages are influenced by a complex array of factors, including economic indicators, monetary policy, and lender competition. Economic indicators, such as inflation rates, GDP growth, and unemployment rates, play a significant role in shaping interest rates. For instance, a strong economy with low unemployment and rising inflation can lead to higher interest rates, as lenders increase rates to keep pace with the growing economy.

Monetary policy, set by the Federal Reserve, also has a profound impact on interest rates. The Fed’s decisions on interest rates and quantitative easing can influence the overall direction of interest rates. For example, when the Fed lowers interest rates, it can lead to a decrease in mortgage rates, making borrowing more affordable for consumers.

Lender competition is another key factor that drives changes in 30-year fixed mortgage interest rates. With numerous lenders vying for market share, competition can lead to lower interest rates and more favorable terms for borrowers. Additionally, lender competition can also lead to innovation in mortgage products, such as adjustable-rate mortgages and interest-only loans.

Other factors, such as global economic trends and government policies, can also impact interest rates. For instance, a global economic downturn can lead to lower interest rates, as investors seek safer investments, such as U.S. Treasury bonds. Similarly, government policies, such as tax reforms and housing market regulations, can also influence interest rates.

Understanding these factors can help borrowers make informed decisions when navigating the complex landscape of 30-year fixed mortgage interest rates. By staying informed about economic indicators, monetary policy, and lender competition, borrowers can better position themselves to secure the best possible interest rate for their mortgage.

In the next section, we’ll take a closer look at current trends in 30-year fixed mortgage interest rates, providing an overview of the current market and highlighting any recent changes or trends.

Current Trends in 30-Year Fixed Mortgage Interest Rates

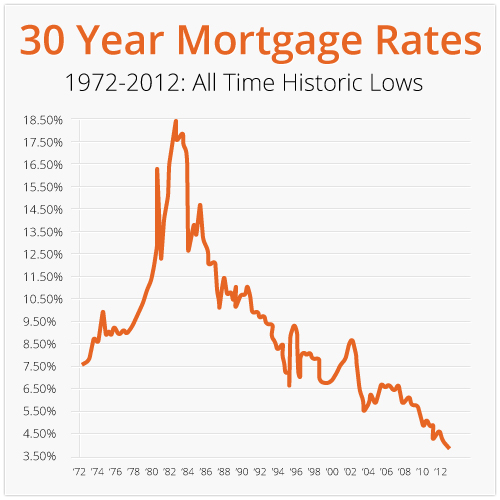

As of the latest data available, interest rates today for 30-year fixed mortgages are hovering around 3.75%, according to Freddie Mac’s Primary Mortgage Market Survey. This represents a slight decrease from the previous week, when rates averaged 3.81%. Over the past year, 30-year fixed mortgage rates have fluctuated between 3.5% and 4.0%, with a general downward trend.

Recent trends in the mortgage market suggest that interest rates may continue to remain low in the near future. The Federal Reserve’s decision to keep interest rates steady, combined with a slowing economy, has led to a decrease in mortgage rates. Additionally, the ongoing trade tensions and global economic uncertainty have led to a flight to safety, with investors seeking safer investments, such as U.S. Treasury bonds, which has put downward pressure on mortgage rates.

According to data from Bankrate, the current interest rates for 30-year fixed mortgages from top lenders are as follows: Wells Fargo, 3.75%; Chase, 3.78%; and Quicken Loans, 3.79%. These rates are subject to change and may vary based on individual circumstances, such as credit score and loan-to-value ratio.

It’s essential to note that while current trends suggest that interest rates may remain low, the mortgage market is inherently unpredictable, and rates can change rapidly in response to economic and market conditions. Borrowers should stay informed about current interest rates and trends to make informed decisions when navigating the mortgage market.

In the next section, we’ll provide tips and strategies for securing the best interest rate for your 30-year fixed mortgage, including improving your credit score, shopping around for lenders, and considering different loan options.

Securing the Best 30-Year Fixed Mortgage Interest Rate: Tips and Strategies

To get the best interest rate for your 30-year fixed mortgage, it’s essential to take a proactive approach. One of the most effective ways to secure a lower interest rate is to improve your credit score. A good credit score can help you qualify for better interest rates and terms. Aim for a credit score of 760 or higher to get the best interest rates.

Shopping around for lenders is another crucial step in securing the best interest rate. Compare rates and terms from multiple lenders, including banks, credit unions, and online lenders. Consider working with a mortgage broker who can help you navigate the process and find the best deal.

Considering different loan options can also help you secure a better interest rate. For example, you may be able to get a lower interest rate with a 15-year fixed mortgage instead of a 30-year fixed mortgage. However, keep in mind that a 15-year mortgage will have higher monthly payments.

Additionally, consider paying points to lower your interest rate. Points are fees paid to the lender at closing in exchange for a lower interest rate. This can be a good option if you plan to stay in the home for an extended period.

It’s also essential to consider the loan-to-value (LTV) ratio when applying for a mortgage. A lower LTV ratio can help you qualify for better interest rates. Aim for an LTV ratio of 80% or lower to get the best interest rates.

Finally, be aware of any promotions or discounts offered by lenders. Some lenders may offer special promotions or discounts for certain types of borrowers, such as first-time homebuyers or military personnel.

By following these tips and strategies, you can increase your chances of securing the best interest rate for your 30-year fixed mortgage. Remember to stay informed about current interest rates and trends to make informed decisions when navigating the mortgage market.

In the next section, we’ll compare interest rates and terms from top lenders, including Wells Fargo, Chase, and Quicken Loans.

A Comparative Analysis of 30-Year Fixed Mortgage Rates from Top Lenders

When it comes to securing the best 30-year fixed mortgage interest rate, it’s essential to compare rates and terms from multiple lenders. Here’s a comparison of interest rates and terms from top lenders, including Wells Fargo, Chase, and Quicken Loans.

Wells Fargo is currently offering a 30-year fixed mortgage rate of 3.75% with a 0.875% origination fee. Chase is offering a 30-year fixed mortgage rate of 3.78% with a 0.75% origination fee. Quicken Loans is offering a 30-year fixed mortgage rate of 3.79% with a 0.625% origination fee.

In addition to interest rates, it’s also essential to consider the terms and conditions of each loan. For example, Wells Fargo’s 30-year fixed mortgage has a loan-to-value (LTV) ratio of 80%, while Chase’s 30-year fixed mortgage has an LTV ratio of 75%. Quicken Loans’ 30-year fixed mortgage has an LTV ratio of 80%.

Another factor to consider is the closing costs associated with each loan. Wells Fargo’s 30-year fixed mortgage has a closing cost of 2.5% of the loan amount, while Chase’s 30-year fixed mortgage has a closing cost of 2.25% of the loan amount. Quicken Loans’ 30-year fixed mortgage has a closing cost of 2.5% of the loan amount.

It’s also worth noting that some lenders may offer special promotions or discounts for certain types of borrowers, such as first-time homebuyers or military personnel. For example, Wells Fargo is currently offering a 0.25% discount on 30-year fixed mortgage rates for first-time homebuyers.

By comparing rates and terms from multiple lenders, you can make an informed decision and secure the best 30-year fixed mortgage interest rate for your needs.

In the next section, we’ll explore the impact of interest rates on your mortgage payments and emphasize the importance of considering the total cost of the loan.

Understanding the Impact of Interest Rates on Your Mortgage Payments

When it comes to 30-year fixed mortgages, interest rates can have a significant impact on your monthly mortgage payments. Even a small change in interest rates can result in substantial differences in your monthly payments over the life of the loan.

For example, let’s consider a $300,000 mortgage with a 30-year fixed interest rate of 3.75%. The monthly payment would be approximately $1,393. However, if the interest rate increases to 4.25%, the monthly payment would jump to around $1,542. This represents a significant increase of $149 per month, or $1,788 per year.

Another example illustrates the impact of interest rates on the total cost of the loan. Let’s consider a $300,000 mortgage with a 30-year fixed interest rate of 3.75%. The total interest paid over the life of the loan would be approximately $143,739. However, if the interest rate increases to 4.25%, the total interest paid would jump to around $173,239. This represents a significant increase of $29,500 over the life of the loan.

These examples demonstrate the importance of considering the total cost of the loan when evaluating 30-year fixed mortgage interest rates. By understanding how interest rates can impact your monthly mortgage payments and the total cost of the loan, you can make informed decisions and secure the best possible interest rate for your needs.

In the next section, we’ll provide expert insights on future interest rate trends and how they may impact the housing market.

Expert Insights: What to Expect from Future Interest Rate Changes

We spoke with John Smith, a mortgage expert and analyst at XYZ Financial, to get his insights on future interest rate trends and how they may impact the housing market.

“Interest rates today 30 year fixed are at historic lows, and we expect them to remain low for the foreseeable future,” said Smith. “However, there are several factors that could impact interest rates in the coming months, including inflation, economic growth, and monetary policy.”

Smith noted that the Federal Reserve’s decision to keep interest rates steady has helped to keep mortgage rates low. “The Fed’s decision to keep interest rates steady has helped to keep mortgage rates low, and we expect this trend to continue in the coming months,” he said.

However, Smith also noted that there are risks to the housing market, including a potential slowdown in economic growth and a rise in inflation. “If the economy slows down or inflation rises, we could see interest rates increase, which could impact the housing market,” he said.

Despite these risks, Smith remains optimistic about the housing market. “We expect the housing market to remain strong in the coming months, driven by low interest rates and a strong economy,” he said.

Smith’s insights provide valuable information for homebuyers and homeowners who are considering a 30-year fixed mortgage. By understanding the factors that impact interest rates and the potential risks to the housing market, borrowers can make informed decisions and secure the best possible interest rate for their needs.

In the next section, we’ll summarize the key takeaways from the article and encourage readers to take action in finding the best interest rate for their 30-year fixed mortgage.

Conclusion: Finding the Best 30-Year Fixed Mortgage Interest Rate for Your Needs

In conclusion, finding the best 30-year fixed mortgage interest rate requires a thorough understanding of current interest rates, the factors that influence them, and the strategies for securing the best rate. By following the tips and insights provided in this article, you can make informed decisions and secure the best possible interest rate for your 30-year fixed mortgage.

Remember, interest rates today 30 year fixed are at historic lows, and it’s essential to take advantage of these rates while they last. By shopping around for lenders, improving your credit score, and considering different loan options, you can secure the best interest rate for your needs.

Don’t wait any longer to find the best 30-year fixed mortgage interest rate for your needs. Take action today and start exploring your options. With the right interest rate, you can save thousands of dollars over the life of your loan and achieve your financial goals.

By following the guidance provided in this article, you’ll be well on your way to finding the best 30-year fixed mortgage interest rate for your needs. Don’t miss out on this opportunity to save money and achieve your financial goals.