Why Digital Real Estate is the Future of Investing

Digital real estate is rapidly becoming a viable investment option for those looking to diversify their portfolios and capitalize on the growing demand for online properties. The benefits of investing in digital real estate are numerous, including low overhead costs, passive income potential, and scalability. Unlike traditional real estate, digital real estate requires little to no physical maintenance, reducing the need for costly repairs and renovations. Additionally, digital real estate can be easily managed and monitored remotely, making it an attractive option for investors who value flexibility and convenience.

One of the primary advantages of digital real estate is its potential for passive income generation. Through strategic investments in online properties such as websites, e-commerce stores, and affiliate marketing platforms, investors can earn recurring revenue streams without requiring direct involvement in the day-to-day operations. This allows investors to focus on other aspects of their business or personal lives while still generating income. Furthermore, digital real estate investments can be easily scaled up or down depending on market conditions, providing investors with a high degree of control over their investments.

Investing in digital real estate also offers a unique opportunity for investors to capitalize on emerging trends and technologies. As the digital landscape continues to evolve, new opportunities for investment and growth are emerging. For example, the rise of e-commerce has created a high demand for online stores and digital marketplaces, while the growth of online education has created opportunities for investors to develop and sell online courses. By investing in digital real estate, investors can position themselves at the forefront of these emerging trends and capitalize on the potential for long-term growth and returns.

For those looking to invest in digital real estate, it is essential to conduct thorough research and due diligence to ensure that investments are sound and well-positioned for growth. This includes evaluating the potential returns on investment, assessing the competitive landscape, and understanding the target market and audience. By taking a strategic and informed approach to investing in digital real estate, investors can maximize their returns and achieve long-term success in this exciting and rapidly evolving field.

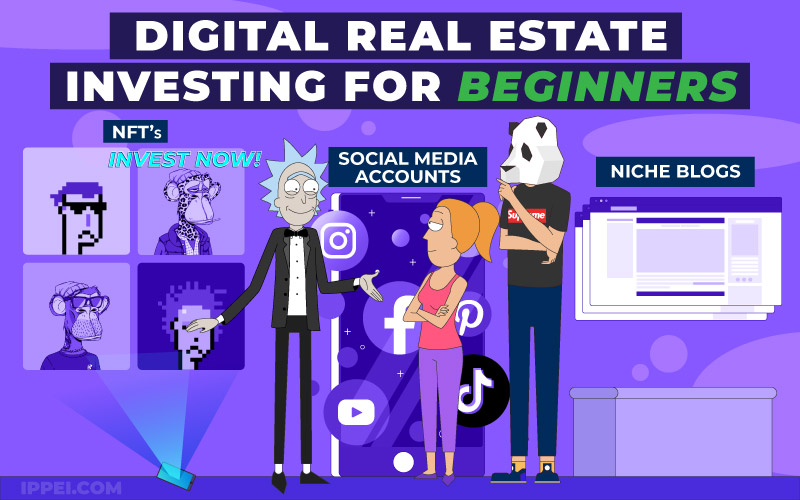

Understanding the Different Types of Digital Real Estate

Digital real estate encompasses a wide range of online properties, each with its unique characteristics, benefits, and investment potential. Understanding the different types of digital real estate is crucial for investors looking to diversify their portfolios and capitalize on emerging trends. Some of the most popular types of digital real estate include:

Websites: Investing in websites can be a lucrative opportunity, especially if the site has a strong online presence, high-quality content, and a loyal audience. Websites can be monetized through advertising, affiliate marketing, and sponsored content, providing a steady stream of passive income.

E-commerce stores: E-commerce stores are online platforms that allow businesses to sell products and services directly to customers. Investing in e-commerce stores can be a profitable venture, especially if the store has a strong brand, high-quality products, and effective marketing strategies.

Online courses: Online courses are digital educational resources that teach students a particular skill or subject. Investing in online courses can be a lucrative opportunity, especially if the course is high-quality, in-demand, and has a strong marketing strategy.

Affiliate marketing platforms: Affiliate marketing platforms connect businesses with affiliates who promote their products or services in exchange for a commission. Investing in affiliate marketing platforms can be a profitable venture, especially if the platform has a strong network of affiliates, high-quality products, and effective marketing strategies.

Other types of digital real estate include mobile apps, online communities, and digital marketplaces. Each of these types of digital real estate has its unique benefits and investment potential, and understanding the differences between them is crucial for investors looking to succeed in this space.

Successful digital real estate investments require a deep understanding of the online landscape, including the latest trends, technologies, and consumer behaviors. By staying informed and adapting to changes in the market, investors can maximize their returns and achieve long-term success in the digital real estate space.

For example, investors who invested in online education platforms during the COVID-19 pandemic saw significant returns as demand for online learning increased. Similarly, investors who invested in e-commerce stores during the holiday season saw increased sales and revenue. By understanding the different types of digital real estate and staying informed about market trends, investors can make informed decisions and achieve their investment goals.

How to Get Started with Investing in Digital Real Estate

Investing in digital real estate can seem daunting, especially for those new to the space. However, with a step-by-step approach, anyone can get started with investing in digital real estate. Here’s a comprehensive guide to help you get started:

Step 1: Research Opportunities

Start by researching different types of digital real estate, such as websites, e-commerce stores, online courses, and affiliate marketing platforms. Look for opportunities that align with your investment goals and risk tolerance. Utilize online resources, such as industry reports, blogs, and forums, to stay informed about market trends and emerging opportunities.

Step 2: Evaluate Potential Returns

Once you’ve identified potential investment opportunities, evaluate their potential returns. Consider factors such as revenue streams, growth potential, and competition. Use tools such as financial statements, market analysis, and industry benchmarks to estimate potential returns.

Step 3: Manage Risk

Investing in digital real estate carries inherent risks, such as market volatility, competition, and technological changes. To manage risk, diversify your portfolio by investing in multiple assets, and consider hedging strategies, such as options or futures contracts.

Step 4: Develop a Investment Strategy

Develop a comprehensive investment strategy that outlines your goals, risk tolerance, and investment approach. Consider factors such as investment horizon, liquidity needs, and tax implications. Regularly review and update your strategy to ensure it remains aligned with your goals.

Step 5: Execute Your Investment Plan

Once you’ve developed a comprehensive investment strategy, execute your plan by investing in digital real estate assets. Consider working with a financial advisor or investment professional to ensure you’re making informed investment decisions.

Additional Tips for Investing in Digital Real Estate

Stay informed about market trends and emerging opportunities by attending industry conferences, reading industry publications, and participating in online forums. Consider investing in digital real estate investment trusts (REITs) or crowdfunding platforms to gain exposure to a diversified portfolio of digital real estate assets.

By following these steps and tips, you can get started with investing in digital real estate and potentially earn attractive returns. Remember to stay informed, manage risk, and adapt to changes in the market to ensure long-term success.

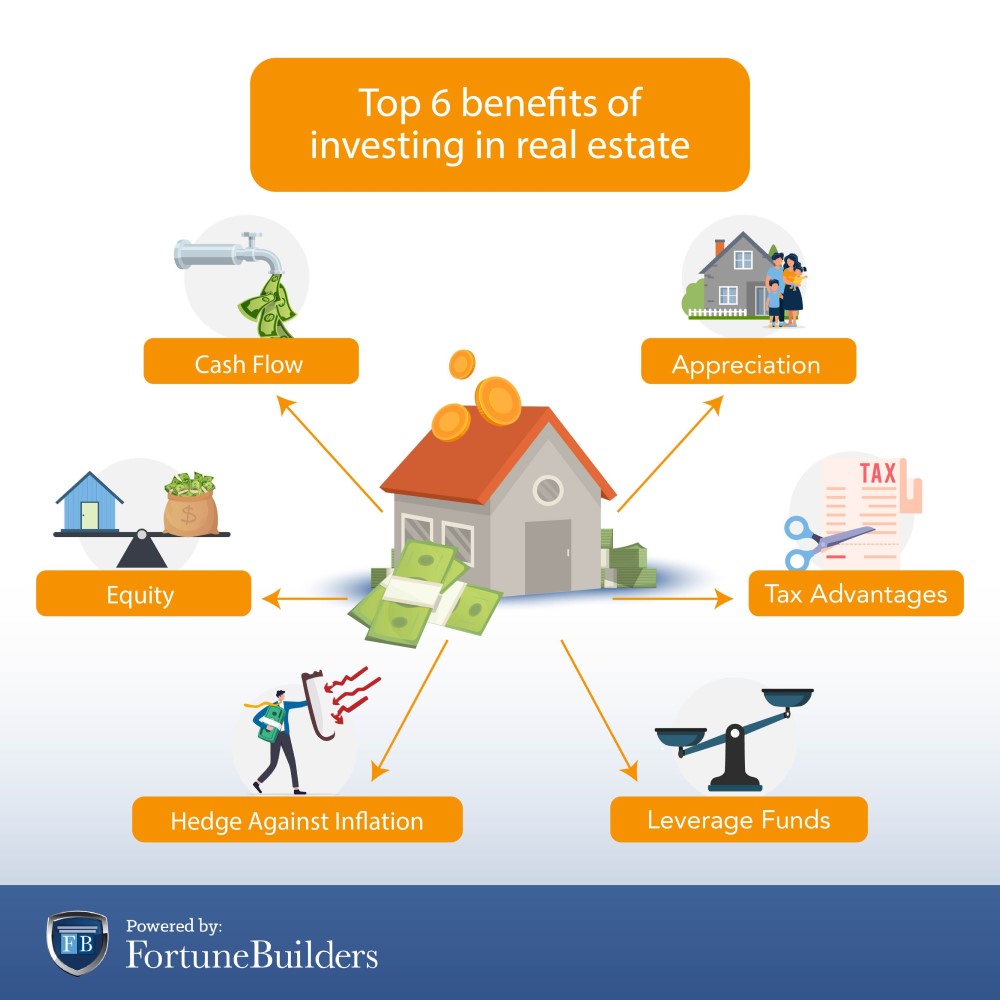

The Benefits of Investing in Digital Real Estate vs Traditional Real Estate

When it comes to investing in real estate, there are two primary options: traditional real estate and digital real estate. While traditional real estate has been a popular investment option for decades, digital real estate is rapidly gaining popularity due to its numerous benefits. In this article, we’ll compare and contrast the benefits of investing in digital real estate versus traditional real estate.

Lower Upfront Costs

One of the primary benefits of investing in digital real estate is the lower upfront costs. Unlike traditional real estate, which requires a significant amount of capital to purchase a property, digital real estate can be invested in with relatively little capital. This makes it an attractive option for investors who are just starting out or who have limited funds.

Greater Flexibility

Digital real estate also offers greater flexibility than traditional real estate. With digital real estate, investors can easily diversify their portfolios by investing in multiple assets, such as websites, e-commerce stores, and online courses. This allows investors to spread their risk and increase their potential returns.

Faster Returns

Digital real estate also offers faster returns than traditional real estate. With digital real estate, investors can earn passive income through advertising, affiliate marketing, and sponsored content. This allows investors to earn returns on their investment much faster than with traditional real estate, which can take years to generate returns.

Scalability

Digital real estate is also highly scalable, meaning that investors can easily increase their investment and earn higher returns. With traditional real estate, investors are limited by the physical location and size of the property, making it difficult to scale their investment.

Passive Income Potential

Digital real estate also offers passive income potential, meaning that investors can earn income without actively working for it. With traditional real estate, investors must actively manage the property, including finding tenants, handling maintenance, and dealing with paperwork.

In conclusion, investing in digital real estate offers numerous benefits over traditional real estate, including lower upfront costs, greater flexibility, faster returns, scalability, and passive income potential. Whether you’re a seasoned investor or just starting out, digital real estate is definitely worth considering as a viable investment option.

Success Stories: Real-Life Examples of Digital Real Estate Investing

Digital real estate investing has created numerous success stories for individuals who have taken the leap and invested in online properties. Here are a few inspiring examples of real-life digital real estate investing success stories:

Example 1: Website Flipping

John, a digital entrepreneur, invested in a website that was generating $1,000 per month in revenue. He spent $10,000 to acquire the website and then spent another $5,000 to improve its design and content. After six months, the website was generating $5,000 per month in revenue, and John was able to sell it for $50,000, earning a 400% return on his investment.

Example 2: E-commerce Store

Jane, an e-commerce enthusiast, invested in an e-commerce store that was selling products on Amazon. She spent $5,000 to acquire the store and then spent another $2,000 to improve its marketing and operations. After three months, the store was generating $10,000 per month in revenue, and Jane was able to sell it for $30,000, earning a 500% return on her investment.

Example 3: Online Course Creation

Bob, an online educator, invested in creating an online course on a topic he was passionate about. He spent $2,000 to create the course and then spent another $1,000 to market it. After six months, the course was generating $5,000 per month in revenue, and Bob was able to sell it for $20,000, earning a 900% return on his investment.

These success stories demonstrate the potential for digital real estate investing to generate significant returns on investment. However, it’s essential to note that these success stories are not typical and require a lot of hard work, dedication, and expertise.

Key Takeaways

Investing in digital real estate requires a deep understanding of the online landscape, including the latest trends, technologies, and consumer behaviors. It’s essential to conduct thorough research, evaluate potential returns, and manage risk to ensure success in digital real estate investing.

By learning from the success stories of others and applying the key takeaways, you can increase your chances of success in digital real estate investing and build wealth in the digital age.

Common Mistakes to Avoid When Investing in Digital Real Estate

Investing in digital real estate can be a lucrative opportunity, but it’s not without its risks. To ensure success, it’s essential to avoid common pitfalls that can lead to financial losses. Here are some common mistakes to avoid when investing in digital real estate:

Lack of Research

One of the most significant mistakes investors make is not conducting thorough research before investing in digital real estate. This includes failing to evaluate the market, assess the competition, and understand the target audience. Without proper research, investors may end up investing in a digital property that is not viable or profitable.

Poor Due Diligence

Due diligence is critical when investing in digital real estate. This includes evaluating the financials, assessing the technology, and understanding the operational processes. Without proper due diligence, investors may end up investing in a digital property that is not well-managed or has significant technical issues.

Unrealistic Expectations

Investors often have unrealistic expectations when it comes to investing in digital real estate. This includes expecting overnight success, unrealistic returns on investment, or assuming that the digital property will manage itself. Unrealistic expectations can lead to disappointment and financial losses.

Failure to Diversify

Investors often make the mistake of putting all their eggs in one basket when it comes to investing in digital real estate. This includes investing in a single digital property or a single niche. Failure to diversify can lead to significant financial losses if the digital property or niche experiences a downturn.

Not Staying Up-to-Date with Industry Trends

The digital real estate industry is constantly evolving, and investors need to stay up-to-date with the latest trends and technologies. This includes understanding the impact of artificial intelligence, blockchain, and the Internet of Things (IoT) on the digital real estate industry. Failure to stay informed can lead to missed opportunities and financial losses.

By avoiding these common mistakes, investors can increase their chances of success when investing in digital real estate. It’s essential to conduct thorough research, perform proper due diligence, and have realistic expectations. Additionally, investors should diversify their portfolio and stay informed about industry trends to ensure long-term success.

Maximizing Your Returns: Tips for Managing and Growing Your Digital Real Estate Portfolio

Managing and growing a digital real estate portfolio requires a strategic approach to maximize returns. Here are some expert tips to help you optimize and grow your digital real estate portfolio:

Increasing Traffic

One of the most critical factors in maximizing returns on digital real estate is increasing traffic to your online properties. This can be achieved through search engine optimization (SEO), pay-per-click (PPC) advertising, social media marketing, and content marketing. By increasing traffic, you can increase the potential for revenue generation and maximize returns.

Improving Conversion Rates

Improving conversion rates is another crucial factor in maximizing returns on digital real estate. This can be achieved by optimizing the user experience, improving the design and layout of your online properties, and streamlining the checkout process. By improving conversion rates, you can increase the potential for revenue generation and maximize returns.

Diversifying Investments

Diversifying investments is essential in maximizing returns on digital real estate. This can be achieved by investing in multiple online properties, such as websites, e-commerce stores, online courses, and affiliate marketing platforms. By diversifying investments, you can reduce risk and increase the potential for revenue generation.

Monitoring and Analyzing Performance

Monitoring and analyzing performance is critical in maximizing returns on digital real estate. This can be achieved by tracking key performance indicators (KPIs), such as website traffic, conversion rates, and revenue generation. By monitoring and analyzing performance, you can identify areas for improvement and make data-driven decisions to optimize and grow your digital real estate portfolio.

Staying Up-to-Date with Industry Trends

Staying up-to-date with industry trends is essential in maximizing returns on digital real estate. This can be achieved by attending industry conferences, reading industry publications, and participating in online forums. By staying informed about the latest trends and technologies, you can stay ahead of the competition and maximize returns on your digital real estate investments.

By following these expert tips, you can maximize your returns on digital real estate and achieve long-term success in the digital real estate space.

The Future of Digital Real Estate: Trends and Opportunities to Watch

The digital real estate space is rapidly evolving, with emerging trends and technologies transforming the way we invest in online properties. Here are some trends and opportunities to watch in the digital real estate space:

Artificial Intelligence (AI)

AI is revolutionizing the digital real estate space, enabling investors to make data-driven decisions and automate tasks. AI-powered tools can help investors analyze market trends, identify potential investments, and optimize their portfolios.

Blockchain

Blockchain technology is transforming the digital real estate space, enabling secure and transparent transactions. Blockchain-based platforms can help investors buy, sell, and manage digital properties with ease and confidence.

Internet of Things (IoT)

The IoT is transforming the digital real estate space, enabling investors to create smart and connected online properties. IoT-powered devices can help investors monitor and manage their digital properties remotely, improving efficiency and reducing costs.

Virtual and Augmented Reality

Virtual and augmented reality technologies are transforming the digital real estate space, enabling investors to create immersive and interactive online experiences. Virtual and augmented reality-powered platforms can help investors showcase their digital properties in a more engaging and interactive way.

5G Networks

5G networks are transforming the digital real estate space, enabling investors to create faster and more reliable online connections. 5G-powered networks can help investors improve the performance and speed of their digital properties, enhancing the user experience and increasing revenue potential.

By staying informed about these emerging trends and technologies, investors can stay ahead of the competition and capitalize on new opportunities in the digital real estate space.

The future of digital real estate is exciting and full of possibilities. As the digital landscape continues to evolve, investors can expect new and innovative opportunities to emerge. By staying informed and adapting to change, investors can build wealth and achieve long-term success in the digital real estate space.

:max_bytes(150000):strip_icc()/most-important-factors-investing-real-estate.asp-ADD-FINALjpg-32950329a30d4500b6d7e0fd0ba95189.jpg)