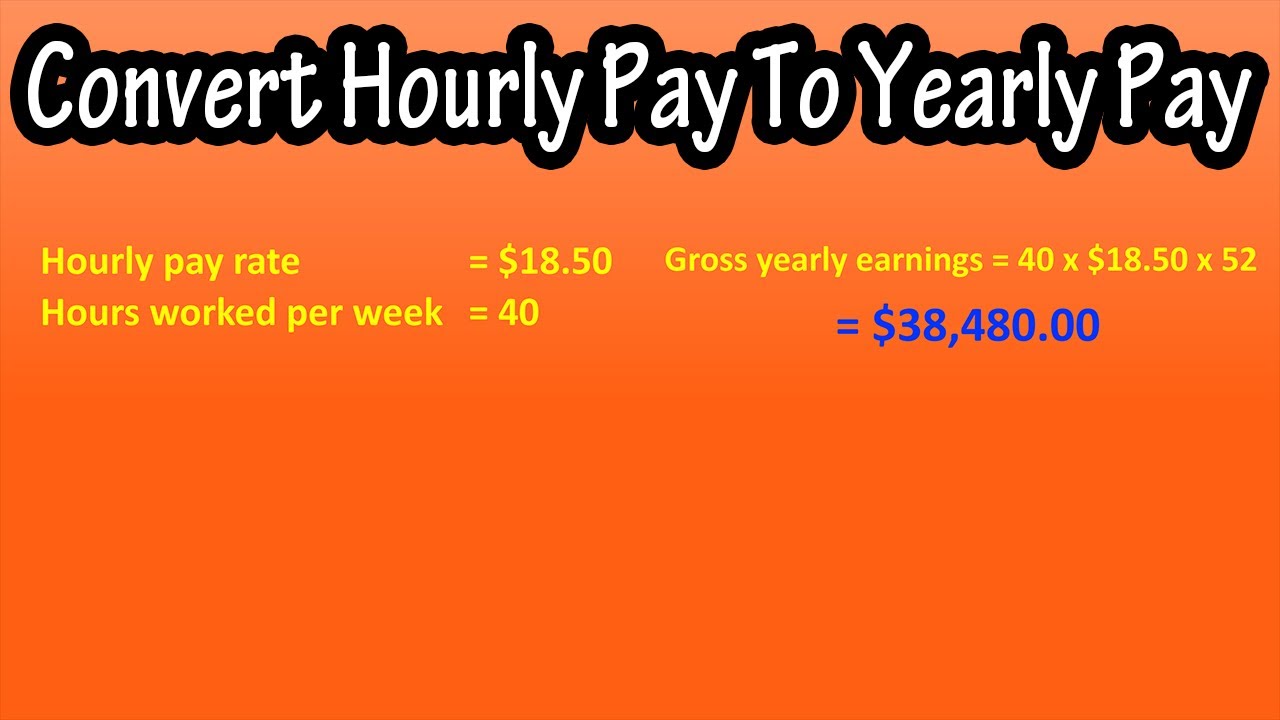

Understanding the Value of $15 an Hour

The $15 an hour wage has become a widely discussed topic in recent years, with many advocating for it as a minimum wage to ensure a decent standard of living. But what exactly does this wage represent, and how does it impact individuals and the broader economy? To answer this, it’s essential to consider the significance of $15 an hour in today’s economy.

In the United States, the federal minimum wage has been stagnant at $7.25 an hour since 2009. Meanwhile, the cost of living has continued to rise, making it increasingly difficult for low-wage workers to make ends meet. The $15 an hour wage is often seen as a benchmark for a decent income, as it is higher than the poverty line for a single person and allows for a more comfortable standard of living.

Research has shown that a higher minimum wage can have numerous benefits, including reduced poverty rates, improved health outcomes, and increased economic growth. For instance, a study by the Economic Policy Institute found that raising the minimum wage to $15 an hour would lift millions of Americans out of poverty and generate billions of dollars in economic activity.

However, some argue that a $15 an hour wage could have negative consequences, such as increased unemployment and reduced hiring. While these concerns are valid, many experts believe that the benefits of a higher minimum wage outweigh the potential drawbacks.

So, is $15 an hour a good wage? The answer depends on various factors, including location, industry, and individual circumstances. In some parts of the country, $15 an hour may be considered a high wage, while in others, it may be barely enough to get by. Ultimately, the value of $15 an hour lies in its potential to provide a decent standard of living and promote economic growth.

How to Determine if $15 an Hour is a Good Wage for You

Evaluating whether $15 an hour is a good wage requires considering various factors that affect an individual’s financial situation. To determine if this wage is sufficient, it’s essential to assess personal circumstances, including location, industry, experience, and job requirements.

Location plays a significant role in determining the value of $15 an hour. In areas with a high cost of living, such as major cities, $15 an hour may not be enough to cover basic expenses. In contrast, in regions with a lower cost of living, $15 an hour may provide a more comfortable standard of living.

Industry is another crucial factor to consider. Certain industries, such as healthcare and technology, tend to offer higher wages than others, such as retail and food service. If you’re working in a low-paying industry, $15 an hour may be a good wage. However, if you’re in a high-paying industry, you may expect a higher wage.

Experience and job requirements also impact the value of $15 an hour. If you have specialized skills or experience, you may be able to command a higher wage. Additionally, if your job requires specific certifications, education, or training, you may expect a higher wage.

To determine if $15 an hour is a good wage for you, consider the following steps:

1. Calculate your monthly expenses, including rent, utilities, food, and transportation.

2. Research the average wage for your industry and location.

3. Evaluate your skills, experience, and job requirements.

4. Compare your calculated expenses to the average wage and your individual circumstances.

By following these steps, you can determine if $15 an hour is a good wage for you and make informed decisions about your career and financial situation.

Ultimately, whether $15 an hour is a good wage depends on individual circumstances. By considering the factors mentioned above, you can make a more informed decision about your financial situation and determine if $15 an hour is sufficient for your needs.

The Pros and Cons of Earning $15 an Hour

Earning $15 an hour can have both positive and negative effects on an individual’s financial situation and career prospects. On the one hand, a higher wage can provide financial stability, job security, and opportunities for advancement. On the other hand, it may also lead to limited career progression and stagnant wages.

One of the primary advantages of earning $15 an hour is financial stability. A higher wage can provide a sense of security and allow individuals to better manage their finances, pay off debt, and build savings. Additionally, a higher wage can also lead to increased job satisfaction, as individuals feel more valued and respected in their roles.

Another benefit of earning $15 an hour is job security. A higher wage can make individuals more attractive to potential employers, as they are seen as more valuable and skilled. This can lead to increased job security and a lower risk of layoffs or terminations.

However, earning $15 an hour may also have some drawbacks. One of the primary concerns is limited career progression. If an individual is earning a higher wage, they may feel less motivated to pursue additional education or training, which can limit their career advancement opportunities.

Another potential drawback of earning $15 an hour is stagnant wages. If an individual is earning a higher wage, they may not see significant increases in their salary over time, which can lead to feelings of frustration and dissatisfaction.

Despite these potential drawbacks, many experts believe that the benefits of earning $15 an hour outweigh the costs. A higher wage can provide financial stability, job security, and opportunities for advancement, which can lead to increased job satisfaction and overall well-being.

Ultimately, whether $15 an hour is a good wage depends on individual circumstances. While it may have some drawbacks, the benefits of earning a higher wage can be significant. By weighing the pros and cons, individuals can make informed decisions about their career and financial situation.

Comparing $15 an Hour to the National Average Wage

The national average wage is a benchmark that provides insight into the overall wage landscape in the United States. According to data from the Bureau of Labor Statistics, the median hourly earnings for all occupations in May 2020 was $25.72. This means that $15 an hour is below the national average wage.

However, it’s essential to note that wages can vary significantly depending on the industry, location, and occupation. For example, in the retail industry, the median hourly earnings was $12.67 in May 2020, while in the software development industry, the median hourly earnings was $43.41.

Earning a wage above or below the national average can have implications for individuals and the broader economy. For instance, earning a wage above the national average can lead to increased financial stability and job satisfaction, while earning a wage below the national average can lead to financial stress and decreased job satisfaction.

Income inequality is another critical aspect to consider when evaluating the national average wage. The United States has experienced rising income inequality in recent decades, with the top 10% of earners holding a disproportionate share of the national income. Earning a wage above or below the national average can exacerbate or mitigate income inequality, depending on the individual’s circumstances.

Wage growth is also an essential factor to consider when evaluating the national average wage. The United States has experienced slow wage growth in recent years, with wages increasing at a rate of 2-3% per year. Earning a wage above or below the national average can impact an individual’s ability to keep pace with inflation and maintain their standard of living.

In conclusion, comparing $15 an hour to the national average wage provides valuable insights into the wage landscape in the United States. While $15 an hour is below the national average wage, it’s essential to consider the industry, location, and occupation when evaluating the adequacy of this wage. Additionally, income inequality and wage growth are critical factors to consider when evaluating the national average wage.

How to Negotiate a Higher Wage if $15 an Hour is Not Enough

If you feel that $15 an hour is not sufficient, it’s essential to know how to negotiate a higher wage. Negotiating a higher wage can be a challenging task, but with the right strategies and preparation, you can increase your chances of success.

The first step in negotiating a higher wage is to research market rates. Look at salary data from reputable sources such as the Bureau of Labor Statistics, Glassdoor, or Payscale to determine the average salary for your position in your area. This will give you a solid foundation for your negotiation.

Next, prepare your case for a higher wage. Make a list of your skills, qualifications, and achievements, and be prepared to explain how they contribute to the company’s success. Focus on the value you bring to the company, rather than just asking for a higher wage.

When negotiating, be confident and assertive, but also respectful and professional. Avoid making demands or threats, and instead, focus on finding a mutually beneficial solution. Be open to compromise and creative solutions, such as additional benefits or a performance-based raise.

Some specific tips for negotiating a higher wage include:

1. Do your research: Know the market rate for your position and be prepared to make a strong case for why you deserve a higher wage.

2. Focus on value: Emphasize the value you bring to the company, rather than just asking for a higher wage.

3. Be confident: Be assertive and confident in your negotiation, but also respectful and professional.

4. Be open to compromise: Be willing to consider alternative solutions, such as additional benefits or a performance-based raise.

5. Follow up: After the negotiation, be sure to follow up on any agreements or next steps that were discussed.

By following these tips and being prepared, you can increase your chances of successfully negotiating a higher wage if $15 an hour is not enough.

Exploring Alternative Income Streams to Supplement $15 an Hour

While $15 an hour may be a decent wage for some, it may not be enough to cover all expenses or achieve financial stability. Fortunately, there are several alternative income streams that can supplement a $15 an hour wage and increase overall income.

One popular alternative income stream is freelancing. Freelancing platforms such as Upwork, Fiverr, and Freelancer offer a range of opportunities for individuals to offer their skills and services on a project-by-project basis. Freelancing can be a great way to earn extra income, as it allows individuals to work on their own schedule and choose projects that align with their interests and skills.

Another alternative income stream is entrepreneurship. Starting a small business or side hustle can be a great way to earn extra income and achieve financial stability. Some popular side hustles include selling products online, offering pet-sitting or house-sitting services, and providing tutoring or lessons.

Side hustles can be a great way to earn extra income, as they allow individuals to monetize their skills and interests. Some popular side hustles include:

1. Selling products online: Utilize platforms such as eBay, Amazon, or Etsy to sell products that align with your interests and skills.

2. Pet-sitting or house-sitting: Offer pet-sitting or house-sitting services to neighbors, friends, or family members.

3. Tutoring or lessons: Offer tutoring or lessons in a subject area that you are knowledgeable in.

4. Affiliate marketing: Promote products or services of other companies and earn a commission on sales.

5. Selling handmade goods: Utilize platforms such as Redbubble or Zazzle to sell handmade goods such as jewelry, crafts, or artwork.

By exploring alternative income streams, individuals can increase their overall income and achieve financial stability. Whether it’s freelancing, entrepreneurship, or a side hustle, there are many opportunities to earn extra income and improve one’s financial situation.

The Impact of $15 an Hour on Career Advancement and Job Satisfaction

Earning $15 an hour can have a significant impact on career advancement and job satisfaction. A higher wage can provide individuals with the financial stability and security they need to pursue their career goals and advance in their profession.

One of the primary ways that $15 an hour can impact career advancement is by providing individuals with the financial resources they need to invest in their education and training. With a higher wage, individuals can afford to take courses, attend workshops, and pursue certifications that can help them advance in their career.

In addition to providing financial resources, $15 an hour can also impact job satisfaction. A higher wage can provide individuals with a sense of pride and self-worth, which can lead to increased job satisfaction and motivation. When individuals feel that they are being fairly compensated for their work, they are more likely to be engaged and motivated in their job.

Furthermore, $15 an hour can also impact career advancement by providing individuals with the opportunity to take on more responsibility and pursue leadership roles. With a higher wage, individuals can afford to take on more responsibility and pursue leadership roles, which can lead to increased career advancement and job satisfaction.

Some of the ways that $15 an hour can impact career advancement and job satisfaction include:

1. Increased financial resources: A higher wage can provide individuals with the financial resources they need to invest in their education and training.

2. Increased job satisfaction: A higher wage can provide individuals with a sense of pride and self-worth, which can lead to increased job satisfaction and motivation.

3. Increased opportunities for advancement: A higher wage can provide individuals with the opportunity to take on more responsibility and pursue leadership roles.

4. Increased motivation: A higher wage can provide individuals with the motivation they need to pursue their career goals and advance in their profession.

In conclusion, $15 an hour can have a significant impact on career advancement and job satisfaction. By providing individuals with the financial resources they need to invest in their education and training, $15 an hour can help individuals advance in their career and achieve their career goals.

Conclusion: Is $15 an Hour a Good Wage in Today’s Economy

In conclusion, whether $15 an hour is a good wage in today’s economy depends on various factors, including location, industry, experience, and job requirements. While $15 an hour may be a decent wage for some, it may not be enough for others to cover their living expenses and achieve financial stability.

As discussed in this article, $15 an hour can have a significant impact on living standards, poverty rates, and economic growth. It can also provide individuals with financial stability, job security, and opportunities for advancement. However, it may also have some drawbacks, such as limited career progression and stagnant wages.

Ultimately, whether $15 an hour is a good wage depends on individual circumstances. For those who feel that $15 an hour is not sufficient, there are various strategies that can be employed to increase their income, such as negotiating a higher wage, exploring alternative income streams, and pursuing additional education and training.

For readers who are seeking to improve their financial situation, we recommend the following:

1. Evaluate your individual circumstances: Consider your location, industry, experience, and job requirements to determine whether $15 an hour is a good wage for you.

2. Research market rates: Look at salary data from reputable sources to determine the average salary for your position in your area.

3. Negotiate a higher wage: If you feel that $15 an hour is not sufficient, prepare a strong case for a higher wage and negotiate with your employer.

4. Explore alternative income streams: Consider side hustles, freelancing, and entrepreneurship as ways to increase your overall income.

5. Pursue additional education and training: Invest in your education and training to increase your earning potential and advance in your career.

By following these recommendations, readers can take steps to improve their financial situation and achieve a better standard of living.