Understanding the Context of a $2000 Monthly Salary

When evaluating whether $2000 a month is a good income, it’s essential to consider the various factors that influence this perception. Location, lifestyle, and personal expectations all play a significant role in determining whether this amount is sufficient or modest. For instance, in areas with a high cost of living, such as major cities, $2000 a month may be considered a relatively low income. In contrast, in regions with a lower cost of living, this amount may be deemed sufficient for a comfortable lifestyle.

Additionally, individual circumstances, such as family size, education level, and occupation, can also impact the perception of a $2000 monthly salary. For example, a single person with a modest lifestyle may find $2000 a month to be a comfortable income, while a family of four with two working parents may struggle to make ends meet on this amount.

It’s also important to note that personal expectations and priorities can greatly influence the perception of a $2000 monthly salary. Some individuals may prioritize financial stability and security, while others may value lifestyle freedom and flexibility. Ultimately, whether $2000 a month is considered “good” depends on individual circumstances, priorities, and financial goals.

In the United States, the median household income is around $67,000 per year, which translates to approximately $5,583 per month. In this context, $2000 a month is significantly lower than the national average. However, it’s essential to remember that income is just one aspect of overall financial health, and other factors, such as expenses, debt, and savings, also play a crucial role in determining financial stability.

When considering whether $2000 a month is a good income, it’s also important to think about the potential for growth and advancement. While $2000 a month may be a modest income in some areas, it can also provide a foundation for future financial growth and stability. By prioritizing saving, investing, and debt reduction, individuals can create a solid financial foundation and improve their overall financial well-being.

Breaking Down the Costs: Expenses to Consider on a $2000 Monthly Budget

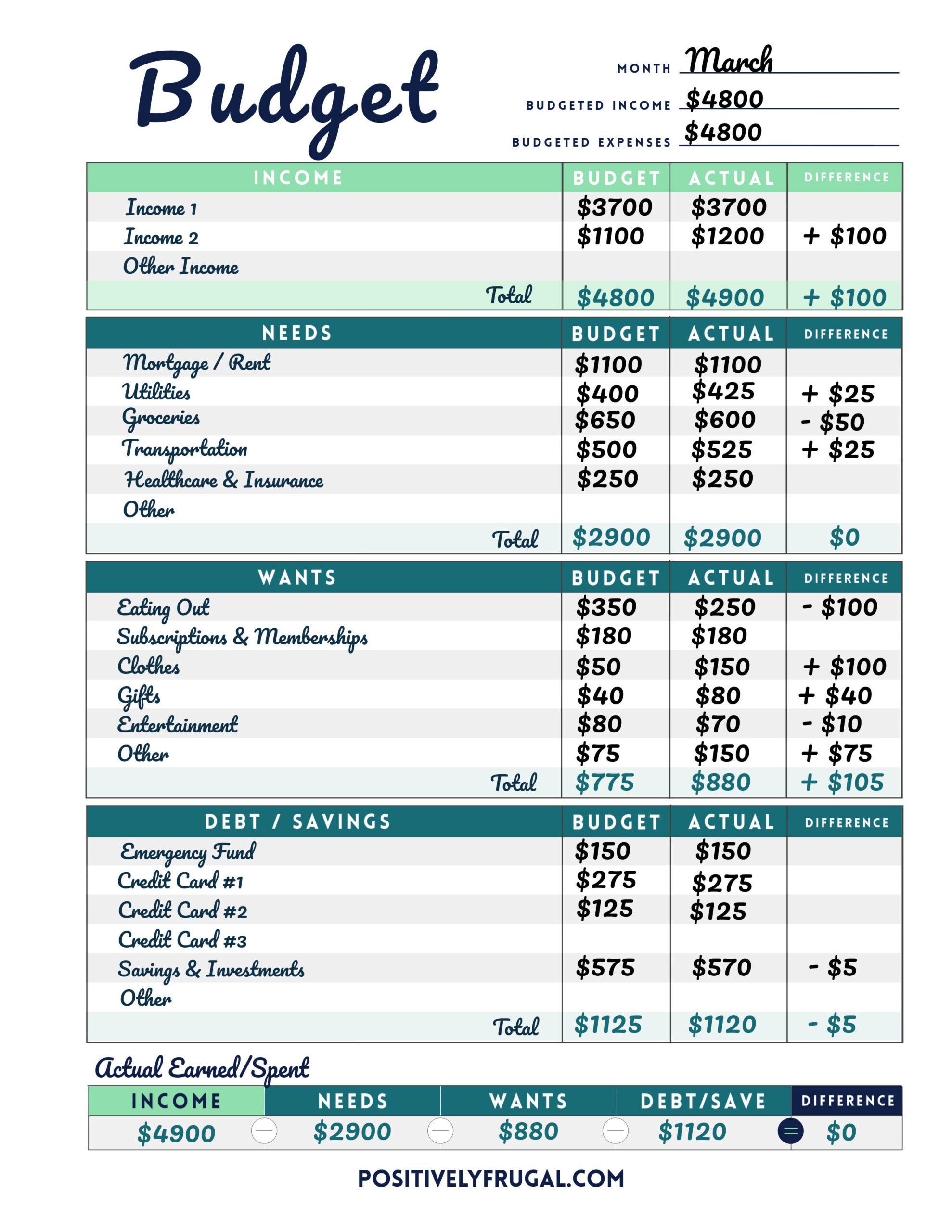

When evaluating whether $2000 a month is a good income, it’s essential to consider the various expenses that can impact an individual’s financial stability. Housing, food, transportation, and entertainment are just a few of the typical monthly expenses that can vary greatly depending on individual circumstances.

Housing costs, for example, can range from 30% to 50% of the monthly budget, depending on the location, size, and type of accommodation. In areas with high housing costs, such as major cities, $2000 a month may not be enough to cover rent or mortgage payments, let alone other expenses. In contrast, in regions with lower housing costs, this amount may be sufficient to cover housing expenses and still leave room for other necessities.

Food expenses are another significant consideration, with the average American spending around 10% to 15% of their income on groceries and dining out. On a $2000 monthly budget, this translates to around $200 to $300 per month for food expenses. However, this amount can vary greatly depending on individual circumstances, such as dietary preferences, cooking habits, and eating out frequency.

Transportation costs, including car payments, insurance, gas, and maintenance, can also be a significant expense for many individuals. On a $2000 monthly budget, it’s essential to prioritize transportation costs and consider ways to reduce expenses, such as carpooling, using public transportation, or finding ways to lower car insurance premiums.

Entertainment expenses, including hobbies, travel, and leisure activities, can also impact an individual’s financial stability. While it’s essential to prioritize needs over wants, it’s also important to leave room for enjoyment and relaxation. On a $2000 monthly budget, it’s essential to find ways to reduce entertainment expenses, such as finding free or low-cost activities, cooking at home instead of eating out, and canceling subscription services.

Other expenses, such as healthcare, insurance, and debt payments, can also impact an individual’s financial stability. On a $2000 monthly budget, it’s essential to prioritize these expenses and consider ways to reduce costs, such as negotiating with service providers, finding ways to lower insurance premiums, and consolidating debt.

By breaking down the costs and considering the various expenses that can impact an individual’s financial stability, it’s possible to determine whether $2000 a month is a good income. While this amount may be sufficient for some individuals, it may not be enough for others, depending on their individual circumstances and priorities.

How to Make the Most of a $2000 Monthly Income

Managing finances effectively on a modest income requires discipline, patience, and a solid understanding of personal financial management. For individuals earning $2000 a month, it’s essential to prioritize needs over wants, create a budget, and develop a long-term financial plan.

One of the most effective ways to make the most of a $2000 monthly income is to create a budget that accounts for all expenses, including housing, food, transportation, and entertainment. By categorizing expenses and allocating funds accordingly, individuals can ensure that they’re making the most of their income and avoiding unnecessary expenses.

Another key strategy for managing finances on a modest income is to prioritize saving and investing. By setting aside a portion of each month’s income, individuals can build an emergency fund, pay off debt, and invest in their future. Consider automating savings by setting up automatic transfers from a checking account to a savings or investment account.

Investing in a retirement account, such as a 401(k) or IRA, is also an excellent way to make the most of a $2000 monthly income. By contributing to a retirement account, individuals can take advantage of compound interest and build a nest egg for the future.

Additionally, individuals earning $2000 a month can benefit from developing multiple income streams. This can include starting a side business, freelancing, or pursuing alternative sources of income. By diversifying income streams, individuals can reduce their reliance on a single income source and increase their overall financial stability.

Finally, it’s essential to avoid lifestyle inflation, which can occur when individuals increase their spending habits as their income increases. By maintaining a modest lifestyle and avoiding unnecessary expenses, individuals can make the most of their $2000 monthly income and achieve long-term financial stability.

By following these strategies, individuals earning $2000 a month can make the most of their income and achieve financial stability. Whether $2000 a month is considered “good” ultimately depends on individual circumstances, priorities, and financial goals. However, with the right mindset and financial management strategies, individuals can thrive on a modest income and achieve long-term financial success.

Comparing $2000 a Month to the National Average: Is it Above or Below?

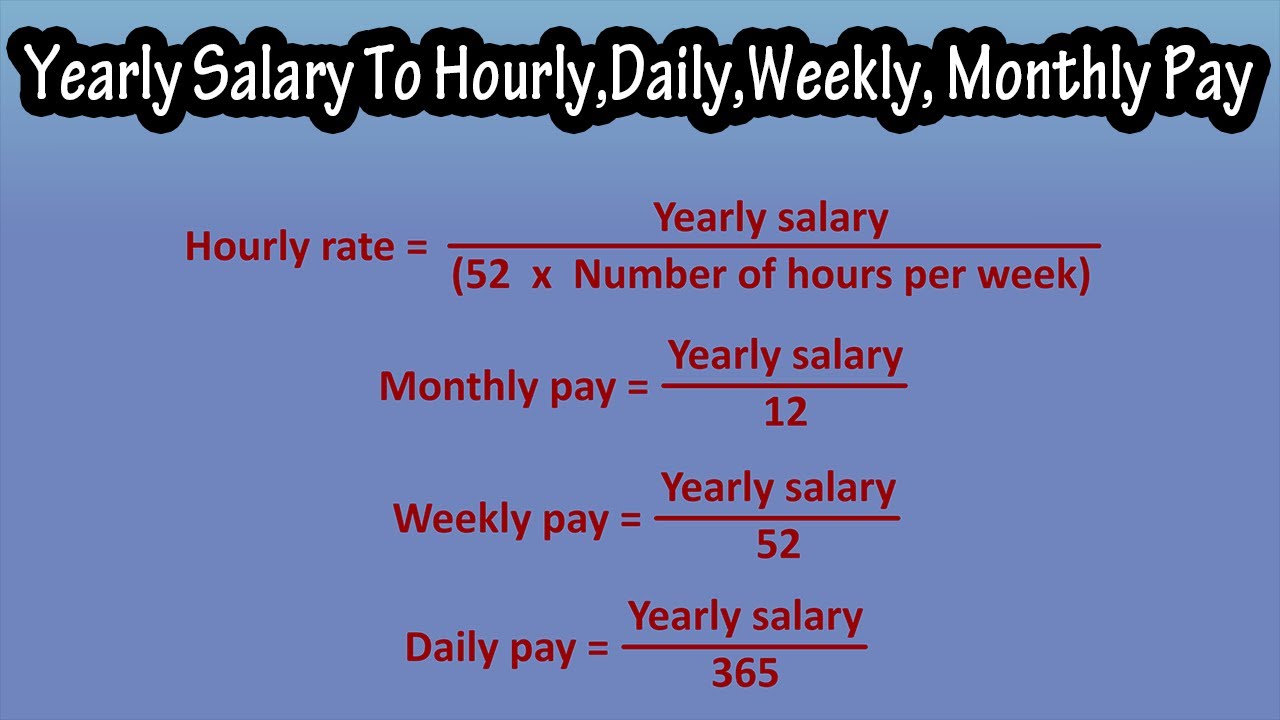

When evaluating whether $2000 a month is a good income, it’s essential to consider the national average salary in the United States. According to data from the U.S. Bureau of Labor Statistics, the median annual salary for all occupations is around $47,000, which translates to approximately $3,917 per month.

In comparison, $2000 a month is significantly lower than the national average. However, it’s essential to note that the cost of living varies greatly depending on the region, city, and even neighborhood. For example, in cities like New York or San Francisco, $2000 a month may be considered a relatively low income, while in smaller towns or rural areas, it may be considered a decent income.

Additionally, the national average salary can vary depending on the industry, occupation, and level of experience. For example, in the tech industry, the average salary is around $114,000 per year, while in the non-profit sector, the average salary is around $43,000 per year.

It’s also worth noting that the national average salary is not the only factor to consider when evaluating whether $2000 a month is a good income. Other factors, such as the cost of living, job security, and opportunities for advancement, should also be taken into account.

For example, in some regions, $2000 a month may be sufficient to cover the cost of living, while in other regions, it may not be enough. Similarly, in some industries, $2000 a month may be considered a good income, while in other industries, it may be considered low.

Ultimately, whether $2000 a month is considered “good” depends on individual circumstances, priorities, and financial goals. By considering the national average salary and other factors, individuals can make a more informed decision about whether $2000 a month is a good income for them.

It’s also important to note that $2000 a month can be a good income for individuals who are just starting their careers, or for those who are in a low-cost-of-living area. Additionally, $2000 a month can be a good income for individuals who are able to save and invest their money wisely, and who have a solid financial plan in place.

The Pros and Cons of a $2000 Monthly Salary: Weighing the Advantages and Disadvantages

Earning $2000 a month can have both positive and negative effects on an individual’s financial stability and lifestyle. On the one hand, a $2000 monthly salary can provide a sense of financial security and stability, allowing individuals to cover their basic needs and enjoy some discretionary income.

One of the main advantages of earning $2000 a month is the potential for financial stability. With a steady income, individuals can budget and plan for the future, knowing that they have a reliable source of income to fall back on. This can be especially beneficial for individuals who are trying to pay off debt, build an emergency fund, or save for long-term goals.

Another advantage of earning $2000 a month is the ability to enjoy some discretionary income. While $2000 a month may not be a lot of money in some areas, it can still provide individuals with the means to enjoy some luxuries and pursue their interests. Whether it’s traveling, dining out, or pursuing hobbies, a $2000 monthly salary can provide individuals with the freedom to enjoy life and pursue their passions.

However, there are also some potential drawbacks to earning $2000 a month. One of the main disadvantages is the limited disposable income. With a modest income, individuals may have to make sacrifices and prioritize their spending in order to make ends meet. This can be especially challenging for individuals who are trying to save for long-term goals or pay off debt.

Another potential drawback of earning $2000 a month is the impact on lifestyle choices. With a modest income, individuals may have to make compromises on their lifestyle, such as living in a smaller apartment or driving an older car. While these sacrifices may be necessary in the short-term, they can still have a significant impact on an individual’s quality of life and overall happiness.

Ultimately, whether $2000 a month is considered “good” depends on individual circumstances, priorities, and financial goals. While a $2000 monthly salary can provide financial stability and some discretionary income, it may also require individuals to make sacrifices and prioritize their spending. By weighing the pros and cons of earning $2000 a month, individuals can make a more informed decision about whether this income is right for them.

Real-Life Examples: How People Make the Most of a $2000 Monthly Income

While earning $2000 a month may present some financial challenges, many individuals have successfully managed on this income and achieved their financial goals. Here are a few examples of how people make the most of a $2000 monthly income:

Meet Sarah, a 28-year-old marketing specialist who earns $2000 a month. Despite her modest income, Sarah has managed to save $10,000 in the past year by prioritizing her spending and creating a budget. She allocates 50% of her income towards necessary expenses like rent, utilities, and food, and uses the remaining 50% for discretionary spending and saving.

Another example is John, a 35-year-old freelance writer who earns $2000 a month. John has managed to make the most of his income by investing in a retirement account and taking advantage of tax-advantaged savings options. He also prioritizes his spending and avoids unnecessary expenses, allowing him to save $500 a month.

Emily, a 25-year-old graphic designer, earns $2000 a month and has managed to pay off $10,000 in student loans in the past two years. She achieved this by creating a budget and prioritizing her debt payments, and by taking advantage of income-driven repayment plans.

These examples illustrate that earning $2000 a month does not have to limit one’s financial potential. By prioritizing spending, creating a budget, and taking advantage of savings options, individuals can make the most of their income and achieve their financial goals.

It’s also worth noting that these individuals have made lifestyle adjustments to accommodate their modest income. For example, Sarah shares an apartment with a roommate to reduce her housing costs, while John cooks at home instead of eating out to save money. Emily has also made adjustments to her lifestyle, such as canceling subscription services and finding free entertainment options.

By making these adjustments and prioritizing their spending, these individuals have been able to make the most of their $2000 monthly income and achieve financial stability.

Long-Term Implications: How a $2000 Monthly Income Affects Future Financial Goals

Earning $2000 a month can have significant long-term implications for future financial goals, such as retirement savings, buying a home, or funding education expenses. While a $2000 monthly income may provide a sense of financial stability in the short-term, it may not be enough to support long-term financial goals.

For example, saving for retirement is a critical long-term financial goal. However, with a $2000 monthly income, it may be challenging to save enough for retirement, especially if other financial priorities, such as paying off debt or saving for a down payment on a home, take precedence.

Similarly, buying a home is a significant long-term financial goal for many individuals. However, with a $2000 monthly income, it may be difficult to save for a down payment, closing costs, and other expenses associated with buying a home.

Funding education expenses is another long-term financial goal that may be impacted by a $2000 monthly income. While it may be possible to save for education expenses, such as college tuition or student loans, it may be challenging to save enough to cover the full cost of education.

However, it’s not all doom and gloom. With careful planning, budgeting, and prioritization, it’s possible to make progress towards long-term financial goals, even on a $2000 monthly income. For example, taking advantage of tax-advantaged savings options, such as 401(k) or IRA accounts, can help individuals save for retirement and other long-term financial goals.

Additionally, exploring alternative options, such as shared housing or community land trusts, can help individuals achieve their goal of buying a home. And, by prioritizing education expenses and taking advantage of financial aid options, individuals can make progress towards funding their education goals.

Ultimately, whether a $2000 monthly income is enough to support long-term financial goals depends on individual circumstances, priorities, and financial goals. By carefully considering these factors and developing a comprehensive financial plan, individuals can make progress towards their long-term financial goals, even on a modest income.

Conclusion: Is $2000 a Month Good? It Depends on Your Perspective

In conclusion, whether $2000 a month is considered “good” ultimately depends on individual circumstances, priorities, and financial goals. While a $2000 monthly income may provide a sense of financial stability and security, it may not be enough to support long-term financial goals or provide a high level of disposable income.

However, with careful planning, budgeting, and prioritization, it’s possible to make the most of a $2000 monthly income and achieve financial stability. By understanding the factors that influence the perception of a $2000 monthly salary, breaking down the costs of typical monthly expenses, and making the most of a modest income, individuals can make progress towards their financial goals.

Ultimately, the answer to the question “Is $2000 a month good?” depends on individual perspectives and priorities. While some individuals may find that a $2000 monthly income is sufficient to meet their needs and achieve their financial goals, others may find that it’s not enough.

By considering the pros and cons of a $2000 monthly salary, exploring real-life examples of individuals who have successfully managed on this income, and understanding the long-term implications of earning $2000 a month, individuals can make a more informed decision about whether this income is right for them.

In the end, whether $2000 a month is considered “good” is a matter of personal perspective and financial goals. By taking a comprehensive and nuanced approach to evaluating this income, individuals can make a more informed decision about whether it’s enough to support their financial stability and security.