Understanding the Significance of a $5,000 Monthly Salary

Earning a $5,000 monthly salary can have a profound impact on one’s lifestyle and financial stability. For many, it represents a significant milestone in their career, offering a sense of security and freedom. But what does it really mean to earn $5,000 per month? Is it a good income, and how does it compare to other benchmarks?

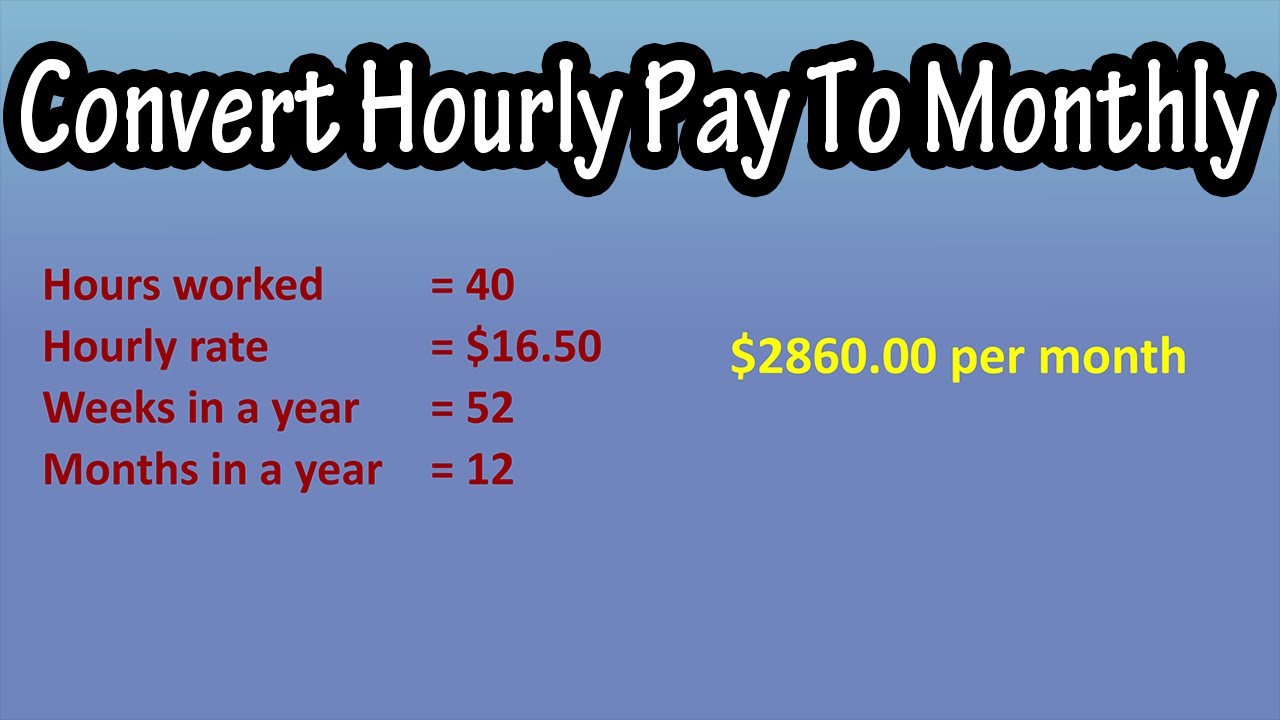

For starters, a $5,000 monthly salary translates to an annual income of $60,000. This is significantly higher than the median household income in many countries, which can range from $30,000 to $50,000 per year. As such, earning $5,000 per month can provide a comfortable lifestyle, allowing individuals to afford luxuries and invest in their future.

Moreover, a $5,000 monthly salary can offer a range of benefits, including increased financial security, reduced stress, and improved work-life balance. With a steady income, individuals can plan for the future, pay off debts, and build wealth. They can also enjoy a better quality of life, with the means to travel, pursue hobbies, and spend time with loved ones.

However, it’s essential to consider the context in which a $5,000 monthly salary is earned. For instance, the cost of living in certain cities or countries can be extremely high, making it challenging to maintain a comfortable lifestyle on this income. Additionally, taxes, healthcare costs, and other expenses can eat into one’s earnings, reducing the overall value of a $5,000 monthly salary.

Ultimately, whether a $5,000 monthly salary is “good” depends on individual circumstances. For some, it may represent a significant achievement, while for others, it may be a modest income. As we explore the pros and cons of earning $5,000 per month, it’s crucial to consider the broader context and how this income can impact one’s life.

How to Determine if a $5,000 Monthly Income is Good for You

To determine whether a $5,000 monthly income is sufficient for your individual circumstances, it’s essential to consider several factors. One of the most critical factors is location. The cost of living in different cities or countries can vary significantly, and a $5,000 monthly income may be considered high in some areas but low in others.

For example, in cities like New York or San Francisco, a $5,000 monthly income may be considered modest due to the high cost of living. In contrast, in cities like Des Moines or Omaha, a $5,000 monthly income may be considered relatively high. Therefore, it’s crucial to research the cost of living in your area and adjust your expectations accordingly.

Another factor to consider is family size. A $5,000 monthly income may be sufficient for a single person or a couple, but it may not be enough for a family with multiple children. Additionally, personal spending habits can also impact whether a $5,000 monthly income is good for you. If you have a tendency to overspend or have high expenses, a $5,000 monthly income may not be enough to cover your costs.

To assess whether a $5,000 monthly income is good for you, consider the 50/30/20 rule. Allocate 50% of your income towards necessary expenses like rent, utilities, and groceries. Use 30% for discretionary spending like entertainment, hobbies, and travel. And, put 20% towards saving and debt repayment. If you can comfortably allocate your income according to this rule, a $5,000 monthly income may be sufficient for your needs.

Ultimately, whether a $5,000 monthly income is good for you depends on your individual circumstances and financial goals. By considering factors like location, family size, and personal spending habits, you can determine whether a $5,000 monthly income is a realistic and desirable target for your financial aspirations.

The Pros and Cons of Earning $5,000 per Month

Earning a $5,000 monthly income can have a significant impact on one’s life, offering a range of benefits and drawbacks. On the one hand, a $5,000 monthly income can provide increased financial security, reduced stress, and improved work-life balance. With a steady income, individuals can plan for the future, pay off debts, and build wealth.

Additionally, a $5,000 monthly income can offer greater freedom and flexibility, allowing individuals to pursue their passions and interests. Whether it’s traveling, starting a business, or pursuing a hobby, a $5,000 monthly income can provide the means to live a more fulfilling life.

However, earning a $5,000 monthly income also comes with its drawbacks. For one, it can lead to increased taxes, which can eat into one’s earnings. Additionally, a $5,000 monthly income can also lead to social pressures and lifestyle inflation, where individuals feel pressure to keep up with their peers and maintain a certain lifestyle.

Furthermore, a $5,000 monthly income can also lead to a sense of complacency, where individuals become too comfortable and stop striving for more. This can lead to stagnation and a lack of personal growth, which can be detrimental to one’s long-term success.

Ultimately, whether a $5,000 monthly income is good for you depends on your individual circumstances and financial goals. While it can offer many benefits, it’s essential to be aware of the potential drawbacks and take steps to mitigate them. By being mindful of your spending habits, saving and investing wisely, and continuing to strive for personal growth, you can make the most of a $5,000 monthly income and achieve long-term financial success.

So, is $5,000 a month a good income? It depends on your individual circumstances and financial goals. However, with the right mindset and strategies, a $5,000 monthly income can be a stepping stone to achieving financial freedom and living a more fulfilling life.

Comparing $5,000 per Month to Other Income Benchmarks

To put a $5,000 monthly income into perspective, it’s helpful to compare it to other common income benchmarks. For example, the median household income in the United States is around $67,000 per year, or approximately $5,583 per month. This means that a $5,000 monthly income is slightly below the median household income.

In contrast, the poverty line for a single person in the United States is around $1,063 per month. This means that a $5,000 monthly income is significantly higher than the poverty line, and would be considered a relatively high income.

Another way to look at it is to compare a $5,000 monthly income to other notable income thresholds. For example, the average income for a software engineer in the United States is around $124,000 per year, or approximately $10,333 per month. This means that a $5,000 monthly income is roughly half of what a software engineer might earn.

On the other hand, the average income for a freelance writer in the United States is around $40,000 per year, or approximately $3,333 per month. This means that a $5,000 monthly income is significantly higher than what a freelance writer might earn.

Ultimately, whether a $5,000 monthly income is good for you depends on your individual circumstances and financial goals. By comparing it to other income benchmarks, you can get a better sense of whether it’s a realistic and desirable target for your financial aspirations.

So, is $5,000 a month a good income? It depends on your individual circumstances and financial goals. However, by comparing it to other income benchmarks, you can get a better sense of whether it’s a realistic and desirable target for your financial aspirations.

How to Achieve a $5,000 Monthly Income: Career and Business Strategies

Achieving a $5,000 monthly income requires a combination of career development, entrepreneurship, and smart financial planning. Here are some actionable strategies to help you increase your income to $5,000 per month:

1. Develop in-demand skills: Focus on acquiring skills that are in high demand in the job market, such as coding, digital marketing, or data analysis. This will increase your earning potential and make you more attractive to potential employers.

2. Start a side hustle: Consider starting a side business or freelancing in a field you’re passionate about. This can help you earn extra income and potentially lead to a full-time business opportunity.

3. Invest in real estate: Real estate investing can provide a steady stream of passive income, which can help you achieve a $5,000 monthly income. Consider investing in rental properties or real estate investment trusts (REITs).

4. Build a online business: Building an online business can provide a scalable and passive income stream. Consider creating and selling online courses, ebooks, or software products.

5. Network and build relationships: Building relationships with successful people in your industry can lead to new opportunities and increased earning potential. Attend networking events, join online communities, and connect with people on LinkedIn.

6. Create and sell a product or service: Creating and selling a product or service can provide a steady stream of income. Consider creating a product or service that solves a problem or meets a need in the market.

7. Invest in stocks or mutual funds: Investing in stocks or mutual funds can provide a steady stream of passive income. Consider investing in a diversified portfolio of stocks or mutual funds.

By implementing these strategies, you can increase your income to $5,000 per month and achieve financial freedom. Remember to always stay focused, work hard, and be patient, as achieving a high income takes time and effort.

Managing a $5,000 Monthly Income: Budgeting and Financial Planning

Once the milestone of earning $5,000 per month is achieved, effective management of this income becomes crucial to maximize financial stability and growth. A well-structured budget is essential to allocate funds towards necessary expenses, savings, and investments. The 50/30/20 rule can serve as a starting point, where 50% of the income is dedicated to essential expenses like rent, utilities, and groceries, 30% towards discretionary spending, and 20% towards saving and debt repayment.

It is also vital to prioritize needs over wants, avoiding lifestyle inflation and ensuring that increased income translates to increased savings and investments. A $5,000 monthly income provides an opportunity to build a substantial emergency fund, pay off high-interest debts, and invest in a diversified portfolio of stocks, real estate, or retirement accounts.

Tax planning is another critical aspect of managing a $5,000 monthly income. Depending on the individual’s tax bracket and location, tax liabilities may increase with higher income. It is essential to consult with a tax professional to optimize tax deductions, credits, and exemptions, minimizing tax liabilities and maximizing take-home pay.

In addition to budgeting and tax planning, individuals earning $5,000 per month should focus on building multiple income streams to reduce financial risk. This could include investing in dividend-paying stocks, real estate investment trusts (REITs), or peer-to-peer lending platforms. By diversifying income sources, individuals can create a more stable financial foundation and increase their overall wealth.

Ultimately, managing a $5,000 monthly income requires discipline, patience, and a long-term perspective. By prioritizing needs over wants, building an emergency fund, investing in a diversified portfolio, and minimizing tax liabilities, individuals can unlock the full potential of their increased income and achieve financial freedom. As the question “is 5k a month good” is often asked, the answer lies in effective management and a well-structured financial plan.

Real-Life Examples of People Earning $5,000 per Month

While earning $5,000 per month may seem like an unattainable goal, many individuals have successfully achieved this milestone through various career paths and business ventures. Here are a few inspiring stories of people who have reached this income level:

Alex, a software engineer, was able to increase his income to $5,000 per month by developing a mobile app that gained popularity on the app store. He invested his time and skills in creating a unique solution that met the needs of his target audience, and his hard work paid off. Alex’s story highlights the potential for tech-savvy individuals to create lucrative income streams through innovative products and services.

Sarah, a freelance writer, built a successful business by offering high-quality content creation services to clients. She leveraged her writing skills and industry expertise to attract high-paying clients and increase her earnings. Sarah’s experience demonstrates the potential for freelancers to earn a good income by offering specialized services to clients.

Mark, an entrepreneur, started an e-commerce business that generated $5,000 per month in revenue. He identified a niche market and created a successful online store that catered to the needs of his target audience. Mark’s story showcases the potential for entrepreneurs to create successful businesses that generate significant income.

These examples illustrate that earning $5,000 per month is achievable through various means. Whether it’s through a traditional career path, freelancing, or entrepreneurship, individuals can increase their income by developing valuable skills, creating innovative products or services, and meeting the needs of their target audience. As the question “is 5k a month good” is often asked, these real-life examples demonstrate that it is indeed possible to achieve this income level with hard work, dedication, and a well-thought-out strategy.

These stories also highlight the importance of financial planning and management in achieving long-term financial stability. By creating a budget, saving, and investing, individuals can make the most of their increased income and achieve their financial goals. Whether it’s paying off debt, building an emergency fund, or investing in a retirement account, effective financial management is crucial to achieving financial freedom.

Conclusion: Is $5,000 a Month a Good Income for You?

In conclusion, earning a $5,000 monthly income can be a life-changing experience, offering financial freedom, career opportunities, and a improved work-life balance. However, whether or not $5,000 a month is a good income for you depends on various factors, including your location, family size, and personal spending habits.

As discussed throughout this article, a $5,000 monthly income can provide a comfortable lifestyle, but it’s essential to consider the pros and cons, including increased taxes, social pressures, and lifestyle inflation. By understanding the significance of a $5,000 monthly salary and how to determine if it’s sufficient for your individual circumstances, you can make informed decisions about your financial goals and aspirations.

The real-life examples of people earning $5,000 per month demonstrate that it’s achievable through various career paths and business ventures. By following the actionable advice and strategies outlined in this article, you can increase your income to $5,000 per month and achieve financial stability and growth.

Ultimately, whether or not $5,000 a month is a good income for you depends on your individual circumstances and financial goals. By reflecting on your own financial aspirations and considering the information presented in this article, you can determine if a $5,000 monthly income is a realistic and desirable target for you. As the question “is 5k a month good” is often asked, the answer lies in understanding your own financial needs and goals.

By taking control of your finances, creating a budget, saving, and investing, you can make the most of your increased income and achieve financial freedom. Remember, earning a $5,000 monthly income is just the first step; managing your finances effectively is crucial to achieving long-term financial stability and growth.