Defining the Basics: What is an LLC?

A Limited Liability Company (LLC) is a popular business structure that offers liability protection and tax benefits to its owners, also known as members. An LLC is often considered a hybrid entity, combining the liability protection of a corporation with the tax benefits and flexibility of a partnership or sole proprietorship. To understand whether an LLC is a corporation or sole proprietorship, it’s essential to delve into its history and purpose.

The concept of an LLC originated in the 1970s, with Wyoming being the first state to enact LLC legislation in 1977. The primary goal of creating an LLC was to provide business owners with a structure that would shield their personal assets from business liabilities, while also offering pass-through taxation. This means that the LLC itself is not taxed on its profits; instead, the members report their share of the profits and losses on their personal tax returns.

One of the key benefits of an LLC is its flexibility in terms of ownership and management. An LLC can have any number of owners (members), and these members can be individuals, corporations, or other LLCs. Additionally, an LLC can be managed by its members (member-managed) or by appointed managers (manager-managed). This flexibility makes an LLC an attractive option for businesses of all sizes and structures.

When considering whether an LLC is a corporation or sole proprietorship, it’s essential to understand that an LLC is a distinct business entity. While it shares some characteristics with corporations, such as liability protection, it is not a corporation in the classical sense. Similarly, an LLC is not a sole proprietorship, as it provides liability protection and tax benefits that are not available to sole proprietors.

In summary, an LLC is a unique business structure that offers liability protection, tax benefits, and flexibility in terms of ownership and management. Understanding the basics of an LLC is crucial for business owners who are considering this structure for their venture.

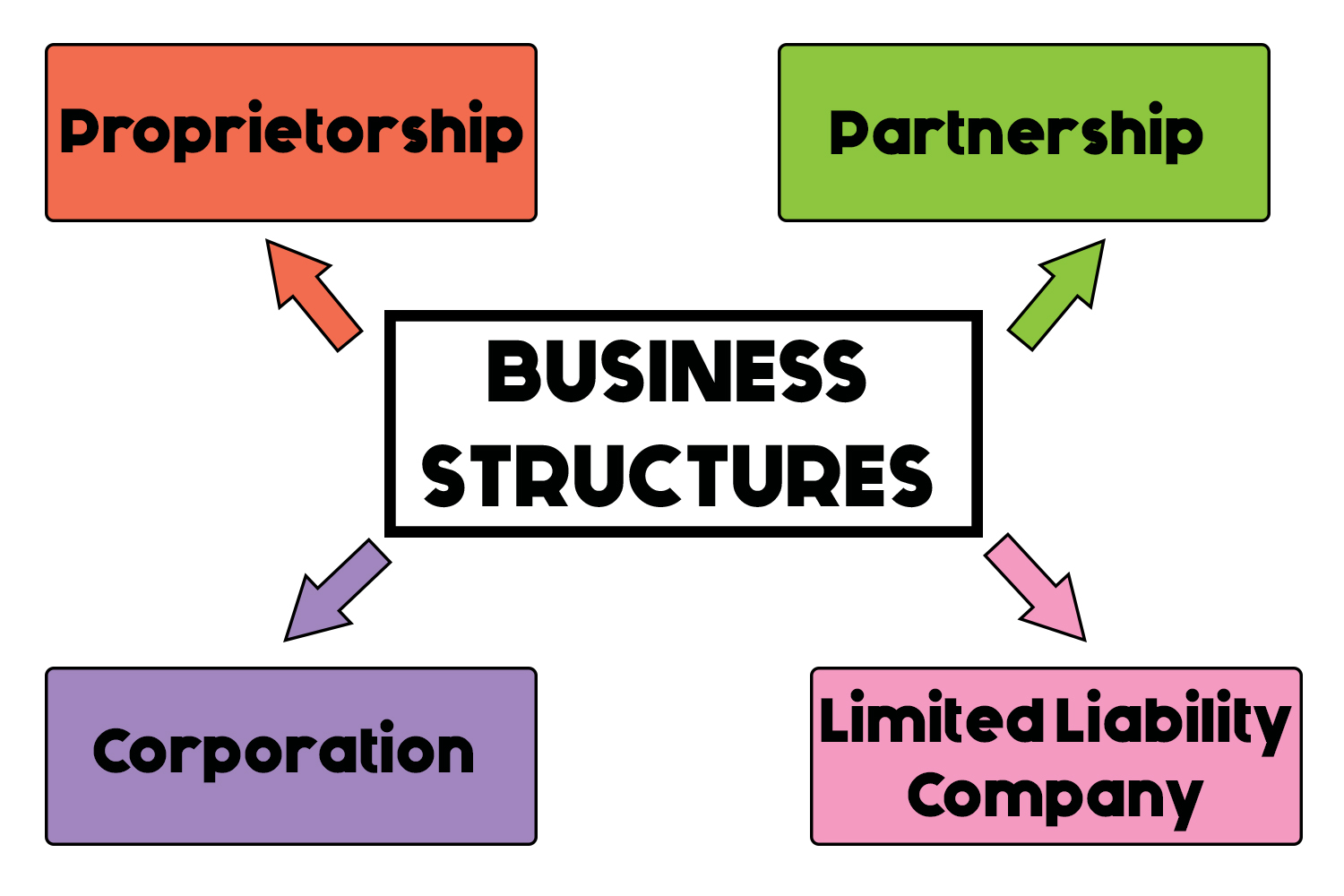

How to Choose the Right Business Structure for Your Venture

Selecting the right business structure is a crucial decision that can impact the success and longevity of your company. With various options available, including corporations, LLCs, and sole proprietorships, it’s essential to consider several factors before making a decision. When evaluating whether an LLC is a corporation or sole proprietorship, it’s vital to understand the key differences between these structures and how they align with your business goals.

Liability protection is a critical consideration when choosing a business structure. Corporations and LLCs offer limited liability protection, which shields owners’ personal assets from business liabilities. In contrast, sole proprietorships do not provide liability protection, leaving owners’ personal assets at risk. If liability protection is a top priority, an LLC or corporation may be the better choice.

Tax implications are another essential factor to consider. Corporations are subject to double taxation, meaning that the corporation is taxed on its profits, and shareholders are taxed on dividends received. LLCs, on the other hand, are typically taxed as pass-through entities, meaning that the LLC itself is not taxed on its profits. Instead, members report their share of the profits and losses on their personal tax returns. Sole proprietorships are also taxed as pass-through entities, but they do not offer the same level of liability protection as LLCs.

Management flexibility is also an important consideration. Corporations have a rigid management structure, with a board of directors and shareholders. LLCs, on the other hand, offer more flexibility in terms of management, allowing members to manage the business themselves or appoint managers. Sole proprietorships are typically managed by the owner, who has complete control over the business.

When deciding between an LLC, corporation, or sole proprietorship, it’s essential to consider your business goals, risk tolerance, and management style. By evaluating these factors, you can make an informed decision about which business structure is right for your venture. Remember, the right business structure can provide a solid foundation for your company’s success and help you achieve your goals.

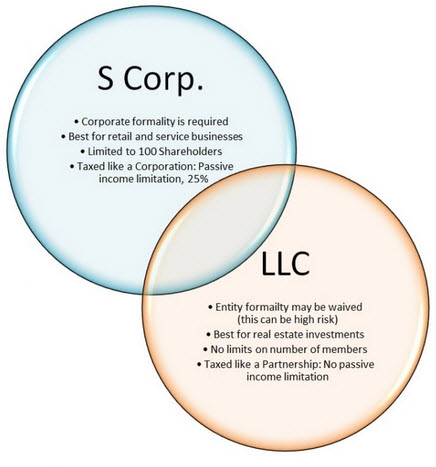

Corporation vs LLC: Key Differences and Similarities

When considering the question “is an LLC a corporation or sole proprietorship?”, it’s essential to understand the key differences and similarities between corporations and LLCs. Both structures offer liability protection and tax benefits, but they have distinct characteristics that set them apart.

One of the primary differences between corporations and LLCs is their ownership structure. Corporations are owned by shareholders who elect a board of directors to manage the company. LLCs, on the other hand, are owned by members who can manage the business themselves or appoint managers. This difference in ownership structure can impact the level of control and decision-making authority within the company.

Another significant difference between corporations and LLCs is their tax treatment. Corporations are subject to double taxation, meaning that the corporation is taxed on its profits, and shareholders are taxed on dividends received. LLCs, as mentioned earlier, are typically taxed as pass-through entities, meaning that the LLC itself is not taxed on its profits. Instead, members report their share of the profits and losses on their personal tax returns.

Despite these differences, corporations and LLCs share some similarities. Both structures offer liability protection, which shields owners’ personal assets from business liabilities. Both structures also require formal documentation, such as articles of incorporation or articles of organization, to establish the business.

When deciding between a corporation and an LLC, it’s essential to consider your business goals, risk tolerance, and management style. If you prefer a more formal management structure and are willing to accept double taxation, a corporation may be the better choice. If you prefer a more flexible management structure and want to avoid double taxation, an LLC may be the better choice.

In summary, while corporations and LLCs share some similarities, they have distinct differences in terms of ownership structure, tax treatment, and management flexibility. By understanding these differences, you can make an informed decision about which structure is right for your business.

Sole Proprietorship vs LLC: Which is Right for You?

When considering the question “is an LLC a corporation or sole proprietorship?”, it’s essential to understand the differences between sole proprietorships and LLCs. Both structures have their advantages and disadvantages, and choosing the right one depends on your business goals, risk tolerance, and management style.

A sole proprietorship is a business owned and operated by one individual. It is the simplest and most common business structure, requiring minimal paperwork and formalities. However, sole proprietorships offer no liability protection, meaning that the owner’s personal assets are at risk in case of business debts or lawsuits.

An LLC, on the other hand, offers liability protection, which shields the owner’s personal assets from business liabilities. LLCs also offer tax benefits, as they are typically taxed as pass-through entities. However, LLCs require more formalities than sole proprietorships, including filing articles of organization and obtaining necessary licenses and permits.

When deciding between a sole proprietorship and an LLC, consider the level of risk involved in your business. If your business is high-risk or has significant assets, an LLC may be the better choice due to its liability protection. However, if your business is low-risk and has minimal assets, a sole proprietorship may be sufficient.

Another factor to consider is tax treatment. Sole proprietorships are taxed as pass-through entities, meaning that the owner reports business income and expenses on their personal tax return. LLCs are also taxed as pass-through entities, but they offer more flexibility in terms of tax classification. LLCs can elect to be taxed as corporations, which may provide tax benefits for certain businesses.

In terms of management responsibilities, sole proprietorships are typically managed by the owner, who has complete control over the business. LLCs, on the other hand, can be managed by the owners (members) or by appointed managers. This difference in management structure can impact the level of control and decision-making authority within the company.

In summary, sole proprietorships and LLCs have distinct differences in terms of liability protection, tax treatment, and management responsibilities. By understanding these differences, you can make an informed decision about which structure is right for your business.

LLC Taxation: How it Differs from Corporations and Sole Proprietorships

When considering the question “is an LLC a corporation or sole proprietorship?”, it’s essential to understand the tax implications of each structure. LLCs, corporations, and sole proprietorships have distinct tax treatments that can impact a business’s bottom line.

LLCs are typically taxed as pass-through entities, meaning that the LLC itself is not taxed on its profits. Instead, the LLC’s profits and losses are passed through to the owners (members), who report their share of the profits and losses on their personal tax returns. This tax treatment is similar to that of sole proprietorships, which are also taxed as pass-through entities.

Corporations, on the other hand, are taxed as separate entities from their owners (shareholders). Corporations are subject to double taxation, meaning that the corporation is taxed on its profits, and shareholders are taxed on dividends received. This can result in a higher overall tax burden for corporations compared to LLCs and sole proprietorships.

Another key difference in tax treatment between LLCs and corporations is the ability to elect a different tax classification. LLCs can elect to be taxed as corporations, which may provide tax benefits for certain businesses. For example, an LLC may elect to be taxed as an S corporation, which can provide tax benefits for businesses with a large number of shareholders.

In contrast, sole proprietorships do not have the option to elect a different tax classification. Sole proprietorships are always taxed as pass-through entities, and the owner reports business income and expenses on their personal tax return.

When deciding between an LLC, corporation, or sole proprietorship, it’s essential to consider the tax implications of each structure. By understanding the tax treatment of each structure, you can make an informed decision about which structure is right for your business.

In summary, LLCs are typically taxed as pass-through entities, while corporations are taxed as separate entities from their owners. Sole proprietorships are also taxed as pass-through entities, but do not have the option to elect a different tax classification. By understanding these differences, you can make an informed decision about which structure is right for your business.

Forming an LLC: A Step-by-Step Guide

Forming an LLC can be a straightforward process if you follow the necessary steps. Here’s a step-by-step guide to help you form an LLC:

Step 1: Choose a Business Name

The first step in forming an LLC is to choose a business name. The name must be unique and comply with the naming requirements of your state. You can check the availability of your desired name by searching the database of your state’s business registration office.

Step 2: File Articles of Organization

Once you’ve chosen a business name, you’ll need to file articles of organization with your state’s business registration office. The articles of organization must include the name and address of your LLC, the name and address of the registered agent, and the purpose of your LLC.

Step 3: Obtain Necessary Licenses and Permits

Depending on the type of business you’re operating, you may need to obtain licenses and permits from your state or local government. These licenses and permits can include sales tax permits, employer identification numbers, and zoning permits.

Step 4: Create an Operating Agreement

An operating agreement is a document that outlines the ownership and management structure of your LLC. It should include the names and addresses of the owners, the percentage of ownership, and the roles and responsibilities of each owner.

Step 5: Obtain an Employer Identification Number (EIN)

An EIN is a unique number assigned to your LLC by the IRS. You’ll need an EIN to open a business bank account, file taxes, and hire employees.

Step 6: Open a Business Bank Account

Opening a business bank account is essential for separating your personal and business finances. You’ll need to provide your EIN and articles of organization to open a business bank account.

By following these steps, you can form an LLC and start operating your business. Remember to consult with a professional if you need help with the formation process.

Converting to an LLC: Is it Right for Your Business?

Converting an existing business to an LLC can be a strategic decision that offers several benefits, including liability protection, tax advantages, and increased credibility. However, it’s essential to evaluate whether conversion is the best decision for your company.

Benefits of Converting to an LLC

Converting to an LLC can provide several benefits, including:

Liability Protection: An LLC provides personal liability protection for its owners, which means that their personal assets are protected in case of business debts or lawsuits.

Tax Advantages: LLCs are typically taxed as pass-through entities, which means that the business income is only taxed at the individual level, avoiding double taxation.

Increased Credibility: Forming an LLC can increase your business’s credibility and professionalism, making it more attractive to customers, investors, and partners.

Potential Drawbacks of Converting to an LLC

While converting to an LLC can offer several benefits, there are also potential drawbacks to consider:

Complexity: Forming an LLC can be a complex process, requiring significant paperwork and formalities.

Cost: Converting to an LLC can involve significant costs, including filing fees, attorney fees, and other expenses.

Changes in Ownership Structure: Converting to an LLC may require changes in ownership structure, which can impact the control and decision-making authority within the company.

Evaluating Whether Conversion is Right for Your Business

To determine whether converting to an LLC is right for your business, consider the following factors:

Business Goals: Evaluate whether an LLC aligns with your business goals and objectives.

Risk Tolerance: Consider your risk tolerance and whether an LLC provides the necessary liability protection.

Management Structure: Evaluate whether an LLC’s management structure aligns with your business needs.

By carefully evaluating these factors, you can make an informed decision about whether converting to an LLC is right for your business.

Conclusion: Making an Informed Decision About Your Business Structure

In conclusion, understanding the differences between LLCs, corporations, and sole proprietorships is crucial for making an informed decision about your business structure. By carefully considering factors such as liability protection, tax implications, and management flexibility, you can choose the structure that best aligns with your business goals and objectives.

Remember, an LLC is not a corporation or sole proprietorship, but rather a unique business structure that offers a combination of liability protection, tax benefits, and management flexibility. By understanding the benefits and drawbacks of each structure, you can make an informed decision about which one is right for your business.

If you’re still unsure about which business structure is right for you, consider consulting with a professional, such as an attorney or accountant, who can provide personalized guidance and advice. By taking the time to carefully consider your business structure, you can ensure that your business is set up for success and that you’re protected from potential risks and liabilities.

In the end, the key to making an informed decision about your business structure is to educate yourself and seek professional advice when needed. By doing so, you can ensure that your business is structured in a way that aligns with your goals and objectives, and that you’re well on your way to achieving success.