Understanding the Housing Market: A Key to Making an Informed Decision

When considering whether it’s a good time to buy a house, understanding the current state of the housing market is crucial. The housing market is influenced by a complex array of factors, including interest rates, supply and demand, and economic trends. These factors can have a significant impact on the decision to buy a house, and it’s essential to understand how they interact and affect the market.

Interest rates, for example, play a critical role in determining the affordability of homes. When interest rates are low, it can be a good time to buy a house, as mortgage payments are more manageable. On the other hand, high interest rates can make buying a house more expensive, and may deter potential buyers. Supply and demand also have a significant impact on the housing market. When demand is high, and supply is low, prices tend to rise, making it a seller’s market. Conversely, when demand is low, and supply is high, prices tend to fall, making it a buyer’s market.

Economic trends, such as GDP growth, inflation, and employment rates, also influence the housing market. A strong economy can lead to increased demand for housing, driving up prices, while a weak economy can lead to decreased demand, causing prices to fall. Understanding these factors and how they interact is essential for making an informed decision about whether it’s a good time to buy a house.

Furthermore, the housing market can be affected by seasonal fluctuations. For instance, the spring and summer months tend to be the busiest times for home buying, while the winter months tend to be slower. Understanding these seasonal fluctuations can help potential buyers make a more informed decision about when to buy a house.

In addition to these factors, it’s also essential to consider the local housing market. Different regions and cities have unique characteristics that can affect the housing market. For example, areas with growing industries and populations tend to have a higher demand for housing, driving up prices. On the other hand, areas with declining industries and populations tend to have a lower demand for housing, causing prices to fall.

By understanding the current state of the housing market, including interest rates, supply and demand, economic trends, and local market conditions, potential buyers can make a more informed decision about whether it’s a good time to buy a house. This knowledge can help buyers navigate the complex housing market and make a decision that’s right for them.

Assessing Your Finances: Are You Ready for Homeownership?

Before deciding whether it’s a good time to buy a house, it’s essential to assess your financial situation. Evaluating your finances will help you determine whether you’re ready for homeownership and can afford the costs associated with buying and owning a home.

One of the first steps in assessing your finances is to check your credit score. Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a mortgage. A good credit score can help you qualify for better interest rates and terms, while a poor credit score can make it more challenging to get approved for a mortgage.

In addition to checking your credit score, it’s also essential to calculate your affordability. This involves determining how much home you can afford based on your income, expenses, and debt. A general rule of thumb is to spend no more than 30% of your gross income on housing costs, including mortgage payments, property taxes, and insurance.

Another critical aspect of assessing your finances is preparing for ongoing expenses. As a homeowner, you’ll be responsible for paying mortgage payments, property taxes, insurance, and maintenance costs. It’s essential to factor these costs into your budget and ensure you have enough savings to cover them.

Some of the ongoing expenses you’ll need to consider include:

- Mortgage payments: This includes the principal and interest on your mortgage, as well as any private mortgage insurance (PMI) you may be required to pay.

- Property taxes: These vary by location and can be a significant expense.

- Insurance: This includes homeowners insurance, which protects you against damage to your home and liability.

- Maintenance costs: These include repairs, replacements, and upgrades to your home.

By carefully assessing your finances and preparing for ongoing expenses, you can make an informed decision about whether it’s a good time to buy a house. Remember to consider all the costs associated with homeownership and ensure you have enough savings to cover them.

How to Determine if It’s a Buyer’s or Seller’s Market

When deciding whether it’s a good time to buy a house, it’s essential to understand the current state of the market. The real estate market can be broadly classified into two types: a buyer’s market and a seller’s market. Understanding the differences between these two markets can help you make an informed decision about whether to buy a house.

A buyer’s market is characterized by a surplus of homes for sale, giving buyers more negotiating power and flexibility. In a buyer’s market, prices tend to be lower, and sellers may be more willing to compromise on price and terms. This type of market is ideal for buyers who are looking for a good deal and are willing to negotiate.

On the other hand, a seller’s market is characterized by a shortage of homes for sale, giving sellers more control and power. In a seller’s market, prices tend to be higher, and buyers may face more competition for available homes. This type of market is ideal for sellers who are looking to get the best possible price for their home.

So, how can you determine whether it’s a buyer’s or seller’s market? Here are some key indicators to look out for:

- Inventory levels: If there are many homes for sale in your area, it may be a buyer’s market. If there are few homes for sale, it may be a seller’s market.

- Price trends: If prices are falling or stable, it may be a buyer’s market. If prices are rising, it may be a seller’s market.

- Days on market: If homes are selling quickly, it may be a seller’s market. If homes are taking longer to sell, it may be a buyer’s market.

- Number of offers: If there are many offers on a home, it may be a seller’s market. If there are few offers, it may be a buyer’s market.

By understanding the current state of the market and whether it’s a buyer’s or seller’s market, you can make a more informed decision about whether it’s a good time to buy a house. Remember to consider all the factors that affect the market and adjust your strategy accordingly.

The Role of Interest Rates in Your Homebuying Decision

When deciding whether it’s a good time to buy a house, interest rates play a crucial role in determining the cost of buying a home. Interest rates can significantly impact the affordability of a home, and changes in interest rates can affect mortgage payments and overall affordability.

Interest rates are essentially the cost of borrowing money to purchase a home. When interest rates are low, it can be a good time to buy a house, as mortgage payments are more manageable. On the other hand, high interest rates can make buying a house more expensive, and may deter potential buyers.

For example, let’s say you’re considering buying a $300,000 home with a 20% down payment and a 30-year mortgage. If the interest rate is 4%, your monthly mortgage payment would be approximately $1,194. However, if the interest rate increases to 5%, your monthly mortgage payment would increase to approximately $1,342. This represents a $148 increase in monthly mortgage payments, which can add up over time.

Changes in interest rates can also affect the overall affordability of a home. When interest rates rise, the cost of buying a home increases, which can make it more difficult for potential buyers to qualify for a mortgage. On the other hand, when interest rates fall, the cost of buying a home decreases, which can make it easier for potential buyers to qualify for a mortgage.

It’s essential to consider the current interest rate environment when deciding whether it’s a good time to buy a house. If interest rates are low, it may be a good time to buy a house, as mortgage payments are more manageable. However, if interest rates are high, it may be more challenging to qualify for a mortgage, and the cost of buying a home may be more expensive.

In addition to considering the current interest rate environment, it’s also essential to consider the potential for future interest rate changes. If interest rates are expected to rise in the future, it may be more challenging to qualify for a mortgage, and the cost of buying a home may increase. On the other hand, if interest rates are expected to fall, it may be easier to qualify for a mortgage, and the cost of buying a home may decrease.

Considering Your Long-Term Goals: How Long Do You Plan to Stay?

When deciding whether it’s a good time to buy a house, it’s essential to consider your long-term goals. The length of time you plan to stay in the home can significantly impact your decision, including factors such as appreciation, rental yields, and selling costs.

If you plan to stay in the home for an extended period, it may be a good time to buy a house. Over time, the value of the home is likely to appreciate, providing a potential long-term investment. Additionally, the longer you stay in the home, the more likely you are to build equity, which can be used to secure future loans or finance other investments.

On the other hand, if you plan to stay in the home for a short period, it may not be the best time to buy a house. In this scenario, the costs associated with buying and selling a home, such as closing costs and real estate agent fees, may outweigh any potential benefits. Additionally, the home may not have time to appreciate in value, which could result in a loss if you sell the home too quickly.

Rental yields are another important consideration when deciding whether it’s a good time to buy a house. If you plan to rent out the home, you’ll need to consider the potential rental income and whether it will cover the costs associated with owning the home, such as mortgage payments, property taxes, and maintenance costs.

Selling costs are also an essential factor to consider when deciding whether it’s a good time to buy a house. If you plan to sell the home in the near future, you’ll need to factor in the costs associated with selling, such as real estate agent fees and closing costs. These costs can add up quickly, and may impact your decision to buy a house.

Ultimately, the length of time you plan to stay in the home will depend on your individual circumstances and goals. It’s essential to carefully consider your long-term goals and how they may impact your decision to buy a house. By doing so, you can make an informed decision that’s right for you and your financial situation.

Additional Costs to Consider: Beyond the Purchase Price

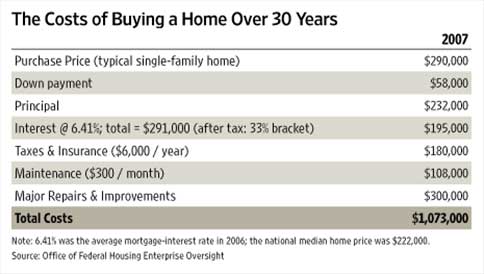

When deciding whether it’s a good time to buy a house, it’s essential to consider the additional costs associated with buying a home. These costs can add up quickly and impact your overall budget, making it crucial to factor them into your decision-making process.

Closing costs are one of the most significant additional costs associated with buying a house. These costs can range from 2% to 5% of the purchase price and include fees such as title insurance, appraisal fees, and attorney fees. It’s essential to factor these costs into your budget and consider them when determining how much home you can afford.

Inspections and appraisals are also important additional costs to consider. A home inspection can cost anywhere from $300 to $1,000, depending on the location and type of property. An appraisal can cost anywhere from $300 to $1,500, depending on the location and type of property. These costs can provide valuable insights into the condition and value of the property, but they can also add up quickly.

Other additional costs to consider include property taxes, insurance, and maintenance costs. Property taxes can vary significantly depending on the location and value of the property. Insurance costs can also vary depending on the location and value of the property, as well as the level of coverage desired. Maintenance costs can include expenses such as repairs, replacements, and upgrades, and can vary significantly depending on the age and condition of the property.

It’s essential to consider all of these additional costs when deciding whether it’s a good time to buy a house. By factoring these costs into your budget and decision-making process, you can make a more informed decision that’s right for you and your financial situation.

In addition to these costs, it’s also essential to consider the ongoing expenses associated with homeownership. These expenses can include mortgage payments, property taxes, insurance, and maintenance costs, and can vary significantly depending on the location and value of the property.

By considering all of these additional costs and ongoing expenses, you can make a more informed decision about whether it’s a good time to buy a house. Remember to factor these costs into your budget and decision-making process, and don’t hesitate to seek professional advice if needed.

Seeking Professional Advice: Working with a Real Estate Agent

When navigating the complex process of buying a house, it’s essential to have a trusted guide by your side. A real estate agent can provide invaluable expertise and support to help you make an informed decision. But what exactly can a real estate agent do for you, and how can they help you determine if it’s a good time to buy a house?

A real estate agent can offer a wealth of knowledge about the local market, including current trends, prices, and the quality of schools and neighborhoods. They can also help you identify your needs and priorities, and match you with properties that fit your criteria. Additionally, an agent can provide guidance on the homebuying process, from securing financing to closing the deal.

One of the most significant benefits of working with a real estate agent is their ability to provide objective advice. Unlike friends or family members, an agent has no personal stake in the outcome of your homebuying journey. They can offer unbiased opinions and help you weigh the pros and cons of different properties and neighborhoods.

When selecting a real estate agent, look for someone with extensive experience in your local market. They should be knowledgeable about the current state of the market, including interest rates, supply and demand, and economic trends. A good agent will also be able to provide you with data and statistics to support their recommendations.

Some key questions to ask a potential real estate agent include: What experience do you have in this market? What’s your approach to working with clients? How will you communicate with me throughout the homebuying process? What services do you offer, and what are your fees?

By working with a reputable and experienced real estate agent, you can gain a deeper understanding of the market and make a more informed decision about whether it’s a good time to buy a house. They can help you navigate the complexities of the homebuying process and ensure that you find the right property for your needs and budget.

Ultimately, a real estate agent can be a valuable ally in your homebuying journey. By seeking their professional advice and guidance, you can make a more informed decision and achieve your goal of owning a home.

Making an Informed Decision: Weighing the Pros and Cons

Deciding whether it’s a good time to buy a house can be a daunting task, especially for first-time homebuyers. With so many factors to consider, it’s essential to take a step back and weigh the pros and cons of purchasing a home. By carefully evaluating the current state of the housing market, your financial situation, and your long-term goals, you can make an informed decision that’s right for you.

One of the most critical factors to consider is the current state of the housing market. Is it a buyer’s or seller’s market? What are the current interest rates, and how will they impact your mortgage payments? Understanding the market trends and conditions can help you determine whether it’s a good time to buy a house.

In addition to market conditions, it’s essential to assess your financial situation. Can you afford the monthly mortgage payments, property taxes, and maintenance costs? Do you have a stable income and a good credit score? Evaluating your financial readiness for homeownership can help you avoid costly mistakes and ensure that you’re making a sustainable decision.

Another crucial factor to consider is your long-term goals. How long do you plan to stay in the home? Are you looking for a short-term investment or a long-term residence? Understanding your goals can help you determine whether buying a house is the right decision for you.

It’s also essential to consider the additional costs associated with buying a house, including closing costs, inspections, and appraisals. These costs can add up quickly, and it’s crucial to factor them into your overall budget.

Ultimately, deciding whether it’s a good time to buy a house requires careful consideration of multiple factors. By weighing the pros and cons, evaluating the market conditions, assessing your financial situation, and considering your long-term goals, you can make an informed decision that’s right for you.

Some key questions to ask yourself when making a decision include: What are my long-term goals, and how will buying a house align with them? What is my current financial situation, and can I afford the costs associated with homeownership? What are the current market conditions, and how will they impact my decision? By answering these questions and carefully evaluating the pros and cons, you can make a decision that’s right for you and sets you up for success in the world of homeownership.

Remember, buying a house is a significant investment, and it’s essential to approach the decision with caution and careful consideration. By taking the time to weigh the pros and cons, you can ensure that you’re making an informed decision that will benefit you for years to come.