What is a Brokerage Account and How Does it Work?

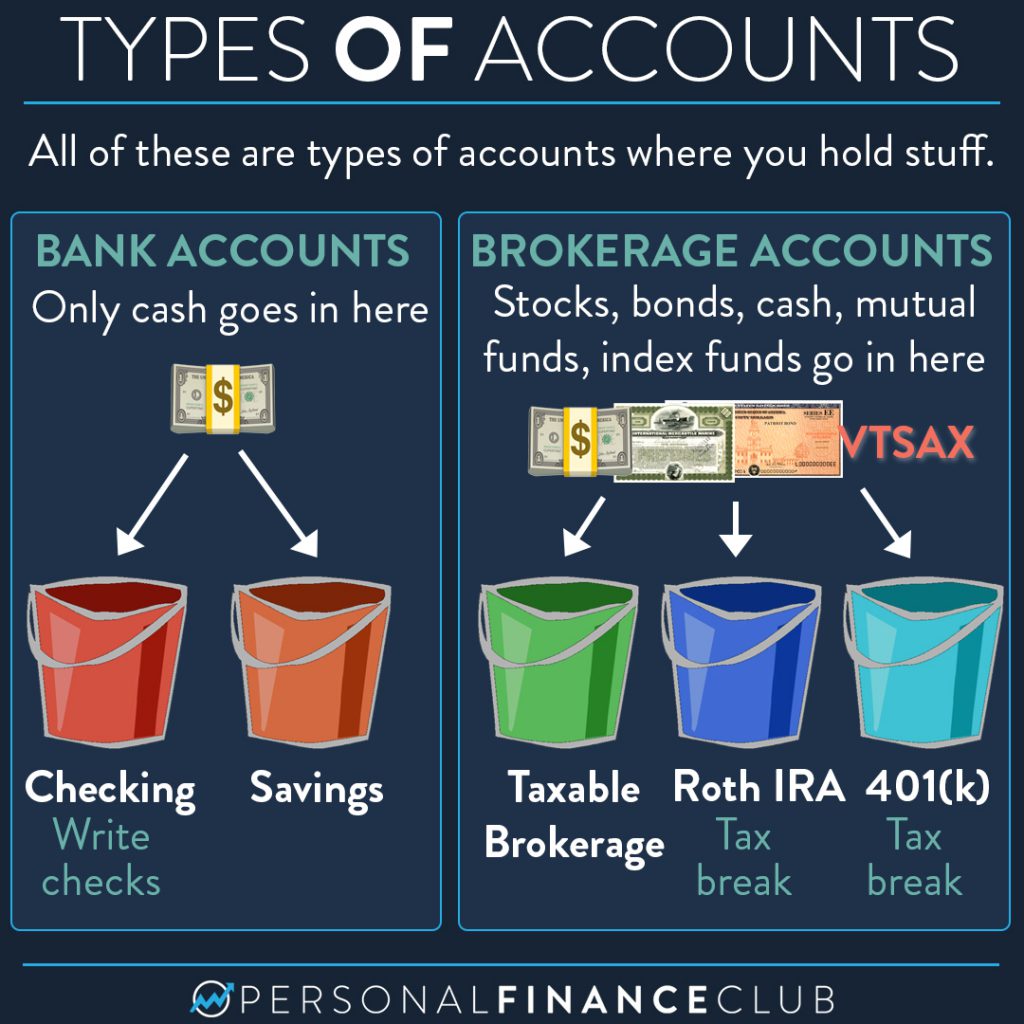

A brokerage account is a financial account that allows individuals to buy and sell securities, such as stocks, bonds, and mutual funds. It serves as a platform for investors to manage their investments, track their portfolio’s performance, and make informed decisions about their financial future. Brokerage firms, like Fidelity, Charles Schwab, and Robinhood, facilitate the buying and selling of securities by providing a marketplace for investors to trade.

When an investor opens a brokerage account, they typically deposit funds into the account, which are then used to purchase securities. The brokerage firm acts as an intermediary, executing trades on behalf of the investor and providing access to various investment products. In exchange for these services, brokerage firms charge fees, which can include management fees, trading fees, and other expenses.

Brokerage accounts can be tailored to meet the specific needs of investors, offering a range of features and benefits. For example, some brokerage accounts may offer research tools, investment advice, and tax optimization strategies. Others may provide access to margin trading, options trading, or other advanced investment products.

As the financial landscape continues to evolve, new types of brokerage accounts have emerged, catering to diverse investor needs. For instance, robo-advisors, like Betterment and Wealthfront, offer automated investment management services, while micro-investing platforms, like Stash, provide a more accessible and user-friendly experience for beginners.

Understanding the concept of a brokerage account and how it works is essential for investors looking to navigate the complex world of finance. By grasping the basics of brokerage accounts, investors can make informed decisions about their financial future and choose the right investment platform to suit their needs. This is particularly relevant when considering the question, “Is Stash a brokerage account?” and evaluating its features and benefits in comparison to traditional brokerage accounts.

Unpacking Stash: A Micro-Investing Platform

Stash is a micro-investing platform that allows users to invest small amounts of money into a variety of assets, including ETFs, stocks, and other securities. Founded in 2015, Stash aims to make investing more accessible and user-friendly, particularly for beginners or those with limited financial resources. By providing a mobile app and website, Stash enables users to invest as little as $5 into a range of investment options, making it an attractive option for those who may not have the means to invest larger sums.

One of the key features of Stash is its simplicity and ease of use. The platform offers a range of pre-built investment portfolios, known as “themes,” which cater to different investment goals and risk tolerance levels. Users can choose from a variety of themes, such as “Conservative” or “Aggressive,” and Stash will automatically allocate their investments accordingly. This approach makes it easy for users to get started with investing, even if they have limited knowledge of the financial markets.

Stash also offers a range of educational resources and tools to help users learn more about investing and personal finance. The platform provides access to news articles, videos, and other educational content, which can help users make more informed investment decisions. Additionally, Stash offers a range of features, such as automatic investment and dividend reinvestment, which can help users grow their investments over time.

While Stash is often referred to as a micro-investing platform, it is worth considering whether it can be classified as a brokerage account. After all, Stash does allow users to buy and sell securities, which is a key feature of traditional brokerage accounts. However, Stash differs from traditional brokerage accounts in several ways, including its focus on micro-investing and its simplified investment approach. As we explore the features and benefits of Stash in more detail, we will examine whether it can be considered a viable alternative to traditional brokerage accounts.

Key Features of Stash: Investment Options and Fees

Stash offers a range of investment options, including ETFs, stocks, and other securities. The platform provides access to over 150 ETFs, which cover a variety of asset classes, sectors, and geographic regions. Stash also offers a selection of individual stocks, allowing users to invest in specific companies they believe in. Additionally, Stash provides a range of other investment options, such as real estate investment trusts (REITs) and cryptocurrencies.

One of the key benefits of Stash is its low-cost investment options. The platform offers a range of low-cost ETFs, which have lower fees compared to actively managed funds. Stash also offers a range of no-fee ETFs, which means users can invest without paying any management fees. However, it’s worth noting that Stash does charge a small management fee for some of its investment options, which ranges from 0.25% to 0.50% per year.

In addition to management fees, Stash also charges a small trading fee for some investment options. The trading fee ranges from $0.50 to $2.00 per trade, depending on the type of investment and the user’s account balance. However, Stash does offer a range of commission-free trades, which means users can buy and sell certain investments without paying any trading fees.

It’s worth noting that Stash’s fee structure is designed to be transparent and easy to understand. The platform provides a clear breakdown of its fees and charges, which makes it easy for users to understand how much they’re paying for their investments. This transparency is an important factor to consider when evaluating whether Stash is a brokerage account, as it provides users with a clear understanding of the costs associated with using the platform.

Overall, Stash’s investment options and fee structure make it an attractive option for investors who are looking for a low-cost and user-friendly investment platform. However, it’s essential to carefully evaluate the fees and charges associated with using Stash, as well as its investment options and features, to determine whether it’s a suitable option for your investment needs.

How to Use Stash: A Step-by-Step Guide

Using Stash is a straightforward process that can be completed in a few simple steps. Here’s a step-by-step guide to help you get started:

Step 1: Download the Stash App or Visit the Website

Start by downloading the Stash app on your mobile device or visiting the Stash website. The app is available for both iOS and Android devices, and the website can be accessed through any web browser.

Step 2: Create an Account

Once you’ve downloaded the app or visited the website, create an account by providing some basic information, such as your name, email address, and password. You’ll also need to provide some personal and financial information, such as your social security number and employment status.

Step 3: Fund Your Account

After creating your account, you’ll need to fund it with money to start investing. You can do this by linking a bank account or using a credit/debit card. Stash accepts a variety of payment methods, including Apple Pay and Google Pay.

Step 4: Choose Your Investment Options

Once your account is funded, you can start choosing your investment options. Stash offers a range of ETFs, stocks, and other securities to choose from. You can browse through the available options and select the ones that align with your investment goals and risk tolerance.

Step 5: Set Up Your Investment Portfolio

After selecting your investment options, you’ll need to set up your investment portfolio. Stash offers a range of pre-built portfolios that cater to different investment goals and risk tolerance levels. You can choose from these portfolios or create your own custom portfolio.

Step 6: Monitor and Adjust Your Portfolio

Once your portfolio is set up, you’ll need to monitor it regularly and make adjustments as needed. Stash provides a range of tools and resources to help you track your portfolio’s performance and make informed investment decisions.

By following these steps, you can start using Stash to invest in a variety of assets and achieve your financial goals. Whether you’re a beginner or an experienced investor, Stash provides a user-friendly and accessible platform for investing in the stock market.

Is Stash a Brokerage Account? A Comparison with Traditional Brokerages

When considering whether Stash is a brokerage account, it’s essential to compare it with traditional brokerage accounts. While Stash offers many features and benefits similar to traditional brokerages, there are also some key differences.

Similarities between Stash and traditional brokerages include:

- Both offer a range of investment options, including stocks, ETFs, and other securities.

- Both provide a platform for buying and selling securities.

- Both offer some level of customer support and education.

However, there are also some significant differences between Stash and traditional brokerages:

- Stash is a micro-investing platform, which means it allows users to invest small amounts of money into a variety of assets. Traditional brokerages typically require larger minimum investment amounts.

- Stash offers a more streamlined and user-friendly interface, making it easier for beginners to get started with investing. Traditional brokerages often have more complex interfaces and may require more investment knowledge.

- Stash charges lower fees compared to traditional brokerages, making it a more affordable option for investors.

The implications of Stash’s micro-investing approach on investment strategies and outcomes are significant. By allowing users to invest small amounts of money, Stash makes it possible for more people to start investing and building wealth over time. Additionally, Stash’s lower fees mean that investors can keep more of their returns, rather than paying high fees to a traditional brokerage.

However, it’s also important to consider the potential drawbacks of Stash’s micro-investing approach. For example, investing small amounts of money may not be enough to achieve significant returns, and the platform’s limited investment options may not be suitable for all investors.

Ultimately, whether Stash is a brokerage account or not is a matter of interpretation. While it offers many features and benefits similar to traditional brokerages, its micro-investing approach and lower fees set it apart from traditional brokerages. As the investment landscape continues to evolve, it will be interesting to see how Stash and other micro-investing platforms continue to innovate and disrupt the traditional brokerage model.

Regulatory Framework: Is Stash a Registered Broker-Dealer?

Stash is a registered broker-dealer with the Securities and Exchange Commission (SEC) and a member of the Financial Industry Regulatory Authority (FINRA). This means that Stash is subject to the same regulatory requirements and oversight as traditional brokerage firms.

As a registered broker-dealer, Stash is required to comply with a range of regulations and rules, including those related to customer protection, trading practices, and financial reporting. Stash is also subject to regular audits and examinations by the SEC and FINRA to ensure that it is operating in compliance with these regulations.

Stash’s registration with the SEC and membership with FINRA provides investors with an added layer of protection and confidence in the platform. It also demonstrates Stash’s commitment to operating in a transparent and compliant manner.

In addition to its registration with the SEC and membership with FINRA, Stash is also a member of the Securities Investor Protection Corporation (SIPC). This provides investors with additional protection in the event of a brokerage firm failure, up to $500,000, including a $250,000 limit for cash claims.

Overall, Stash’s regulatory framework is designed to provide investors with a safe and secure platform for investing. By registering with the SEC and becoming a member of FINRA and SIPC, Stash has demonstrated its commitment to operating in a compliant and transparent manner.

When considering whether Stash is a brokerage account, it’s essential to examine its regulatory framework and ensure that it meets the necessary requirements. By doing so, investors can have confidence in the platform and its ability to provide a safe and secure investing experience.

Risk Management: Understanding the Risks of Investing with Stash

As with any investment platform, there are risks associated with investing with Stash. It’s essential to understand these risks and take steps to manage them effectively.

Market Volatility: One of the primary risks associated with investing with Stash is market volatility. The value of your investments can fluctuate rapidly, and there is a risk that you could lose some or all of your investment.

Liquidity Risks: Another risk associated with investing with Stash is liquidity risk. This refers to the risk that you may not be able to sell your investments quickly enough or at a fair price.

Regulatory Risks: Stash is a registered broker-dealer with the SEC and a member of FINRA, which provides some level of protection for investors. However, there is still a risk that regulatory changes or enforcement actions could impact the platform and your investments.

To manage these risks effectively, it’s essential to:

- Diversify your portfolio: Spread your investments across a range of asset classes and industries to reduce your exposure to any one particular market or sector.

- Set clear investment goals: Define your investment goals and risk tolerance to ensure that you’re investing in a way that aligns with your objectives.

- Monitor your investments: Keep a close eye on your investments and be prepared to adjust your portfolio as market conditions change.

- Understand the fees: Make sure you understand the fees associated with investing with Stash, including management fees, trading fees, and other expenses.

By understanding the risks associated with investing with Stash and taking steps to manage them effectively, you can help to minimize your exposure to potential losses and maximize your returns.

When considering whether Stash is a brokerage account, it’s essential to weigh the pros and cons of using the platform, including the risks associated with investing. By doing so, you can make an informed decision about whether Stash is a suitable option for your investment needs.

Conclusion: Is Stash a Viable Alternative to Traditional Brokerage Accounts?

After examining the features, benefits, and risks associated with Stash, it’s clear that the platform offers a unique and innovative approach to investing. While Stash is not a traditional brokerage account, it provides many of the same benefits and services, including access to a range of investment options, low fees, and a user-friendly interface.

One of the primary advantages of Stash is its micro-investing approach, which allows users to invest small amounts of money into a variety of assets. This makes it an attractive option for beginners or those with limited financial resources. Additionally, Stash’s low fees and lack of minimum balance requirements make it an accessible option for investors who may not have been able to invest through traditional brokerage accounts.

However, it’s also important to consider the potential drawbacks of using Stash. For example, the platform’s limited investment options and lack of advanced trading features may not be suitable for more experienced investors. Additionally, the risks associated with investing, including market volatility and liquidity risks, are still present when using Stash.

Ultimately, whether Stash is a viable alternative to traditional brokerage accounts depends on the individual investor’s needs and goals. For those who are looking for a low-cost, user-friendly platform for investing small amounts of money, Stash may be an excellent option. However, for more experienced investors or those who require more advanced trading features, traditional brokerage accounts may still be the better choice.

In conclusion, Stash is a unique and innovative investment platform that offers many benefits and services to investors. While it may not be a traditional brokerage account, it provides a viable alternative for those who are looking for a low-cost, user-friendly platform for investing. By understanding the features, benefits, and risks associated with Stash, investors can make an informed decision about whether it is a suitable option for their investment needs.