What is Upstart and How Does it Work?

Upstart is a financial technology company that provides personal loans and credit cards to individuals. Founded in 2012 by a group of ex-Google employees, Upstart uses artificial intelligence (AI) to evaluate borrowers’ creditworthiness and provide more accurate interest rates. The company’s mission is to make credit more accessible and affordable for people who may not have a traditional credit history.

Upstart’s AI-powered platform assesses a borrower’s creditworthiness by analyzing a range of factors, including their education, employment history, and income. This approach allows Upstart to provide loans to individuals who may not qualify for traditional credit products. The company offers personal loans ranging from $1,000 to $50,000, with interest rates starting at 6.95% APR.

Upstart’s loan application process is designed to be quick and easy, with most applicants receiving a decision within minutes. The company also offers a range of repayment terms, including 3-year and 5-year loans, to help borrowers manage their debt.

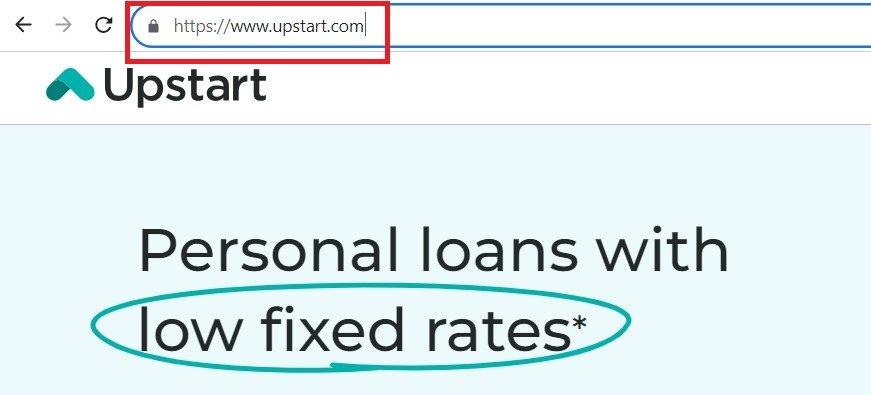

As a legitimate loan company, Upstart is committed to transparency and fairness in its lending practices. The company is licensed to operate in all 50 states and is a member of the Online Lenders Alliance (OLA), a trade association that promotes best practices in online lending.

While Upstart is a relatively new player in the lending industry, the company has already made a significant impact. With over $10 billion in loans originated to date, Upstart has established itself as a major player in the fintech space.

However, as with any loan company, it’s essential to do your research and carefully review the terms and conditions before applying for a loan. In the next section, we’ll explore how to determine if a loan company is legitimate and what red flags to watch out for.

How to Determine if a Loan Company is Legitimate: Red Flags to Watch Out For

When searching for a loan company, it’s essential to do your research and ensure that you’re working with a legitimate lender. A legitimate loan company will be transparent about its fees, interest rates, and repayment terms. Here are some red flags to watch out for when evaluating a loan company:

Unusually high interest rates or fees: Be wary of loan companies that charge exorbitant interest rates or fees. Legitimate lenders will clearly disclose their rates and fees, and they will be competitive with other lenders in the industry.

Lack of licenses or certifications: A legitimate loan company will be licensed to operate in your state and will have certifications from reputable organizations, such as the Better Business Bureau (BBB) or the Online Lenders Alliance (OLA).

Poor online reviews: Check online reviews from multiple sources, including the BBB, Trustpilot, and Google Reviews. If a loan company has a pattern of negative reviews, it may be a sign of a larger issue.

Unclear or misleading advertising: Be cautious of loan companies that use misleading or deceptive advertising practices. Legitimate lenders will clearly disclose their terms and conditions, and they will not make false promises.

No physical address or contact information: A legitimate loan company will have a physical address and contact information, including a phone number and email address.

Pressure to act quickly: Be wary of loan companies that pressure you to act quickly or make a decision without fully understanding the terms and conditions.

By watching out for these red flags, you can increase your chances of working with a legitimate loan company. In the next section, we’ll take a closer look at Upstart’s business model and evaluate whether it’s a scam or a genuine opportunity.

Upstart’s Business Model: Is it a Scam or a Genuine Opportunity?

Upstart’s business model is built around providing personal loans and credit cards to individuals using artificial intelligence (AI) to evaluate creditworthiness. The company’s revenue streams come from interest payments on loans and fees associated with credit card transactions.

Upstart has partnered with several banks and financial institutions to provide loans and credit cards to its customers. The company’s customer acquisition strategy involves using online marketing channels, such as social media and search engine optimization (SEO), to reach potential borrowers.

Upstart’s business model is designed to be sustainable and transparent. The company provides clear and concise information about its loan terms, interest rates, and fees. Upstart also offers a range of repayment options, including fixed-rate loans and credit cards with variable interest rates.

However, some critics have raised concerns about Upstart’s business model, arguing that the company’s use of AI to evaluate creditworthiness may be biased against certain groups of people. Additionally, some borrowers have reported difficulty in getting approved for loans or credit cards through Upstart’s platform.

Despite these concerns, Upstart’s business model has been praised for its innovation and potential to disrupt the traditional lending industry. The company’s use of AI to evaluate creditworthiness has been shown to be more accurate than traditional credit scoring methods, and its online platform has made it easier for borrowers to access credit.

Overall, Upstart’s business model appears to be a genuine opportunity for borrowers who are looking for alternative credit options. However, as with any loan company, it’s essential to carefully review the terms and conditions before applying for a loan or credit card.

In the next section, we’ll take a closer look at what real customers have to say about Upstart’s services, including both positive and negative experiences.

Real Customer Reviews: What Borrowers Say About Upstart

To get a better understanding of Upstart’s services, we’ve compiled a selection of real customer reviews and testimonials. These reviews highlight both positive and negative experiences, providing a well-rounded view of the company’s strengths and weaknesses.

Many customers have praised Upstart for its ease of use and fast application process. One borrower noted, “I was able to apply for a loan and get approved in just a few minutes. The process was so easy and straightforward.”

Others have praised Upstart’s customer support team, citing their helpfulness and responsiveness. A borrower wrote, “I had some questions about my loan, and the customer support team was very helpful and knowledgeable. They answered all my questions and helped me resolve my issue quickly.”

However, not all reviews have been positive. Some borrowers have reported difficulty in getting approved for loans or credit cards, citing strict credit requirements and high interest rates. One borrower noted, “I was disappointed to find out that I didn’t qualify for a loan with Upstart. The interest rates were also much higher than I expected.”

Another borrower reported issues with the company’s communication, stating, “I had to call multiple times to get an update on my loan application. The communication was not very clear, and I felt like I was left in the dark.”

Despite these negative reviews, many customers have reported positive experiences with Upstart. A borrower wrote, “I was able to get a loan with Upstart when other lenders turned me down. The interest rate was competitive, and the repayment terms were flexible.”

Overall, Upstart’s customer reviews suggest that the company is a legitimate loan provider with a user-friendly platform and helpful customer support. However, as with any loan company, it’s essential to carefully review the terms and conditions before applying for a loan or credit card.

In the next section, we’ll take a closer look at Upstart’s interest rates and fees, comparing them to those of other loan companies to determine whether they are competitive and transparent.

Upstart’s Interest Rates and Fees: Are They Competitive?

When considering a loan company, one of the most important factors to consider is the interest rate and fees associated with the loan. Upstart’s interest rates and fees are competitive with other online lenders, but may be higher than those offered by traditional banks.

Upstart’s interest rates range from 6.95% to 35.99% APR, depending on the borrower’s creditworthiness and loan terms. The company also charges an origination fee, which ranges from 0.25% to 8% of the loan amount.

In comparison, traditional banks may offer lower interest rates, but often have stricter credit requirements and may require collateral. Other online lenders, such as LendingClub and Prosper, may offer similar interest rates and fees to Upstart.

It’s essential to carefully review the interest rates and fees associated with any loan before applying. Borrowers should also consider the loan terms, including the repayment period and any prepayment penalties.

Upstart’s transparency regarding its interest rates and fees is a positive aspect of the company’s services. The company clearly discloses its rates and fees on its website, making it easier for borrowers to make informed decisions.

However, some borrowers may find Upstart’s interest rates and fees to be higher than expected. It’s crucial to carefully review the loan terms and consider alternative options before applying.

In the next section, we’ll provide tips and tricks on how to get the best loan terms from Upstart, including improving credit scores, providing accurate financial information, and negotiating rates.

How to Get the Best Loan Terms from Upstart: Tips and Tricks

To get the best loan terms from Upstart, it’s essential to understand the company’s lending criteria and to be prepared to provide accurate financial information. Here are some tips and tricks to help you get the best loan terms from Upstart:

Improve your credit score: Upstart uses credit scores to determine interest rates and loan terms. Improving your credit score can help you qualify for better loan terms and lower interest rates.

Provide accurate financial information: Upstart requires borrowers to provide accurate financial information, including income, employment history, and credit reports. Providing accurate information can help you qualify for better loan terms and avoid delays in the application process.

Negotiate rates: Upstart offers competitive interest rates, but borrowers may be able to negotiate better rates by providing additional financial information or by comparing rates with other lenders.

Consider a co-signer: If you have a limited credit history or a low credit score, consider applying for a loan with a co-signer. A co-signer with a good credit score can help you qualify for better loan terms and lower interest rates.

Be prepared to provide additional documentation: Upstart may require additional documentation, such as pay stubs or bank statements, to verify your financial information. Being prepared to provide this documentation can help you avoid delays in the application process.

By following these tips and tricks, you can increase your chances of getting the best loan terms from Upstart. Remember to carefully review the loan terms and conditions before applying, and to consider alternative options if you’re not satisfied with the terms offered.

In the next section, we’ll evaluate Upstart’s customer support, including its availability, responsiveness, and helpfulness. We’ll discuss whether the company’s support team is knowledgeable and empathetic, and provide recommendations for potential borrowers.

Upstart’s Customer Support: Is it Reliable and Responsive?

Upstart’s customer support is an essential aspect of its services, as it provides borrowers with assistance and guidance throughout the loan application and repayment process. In this section, we’ll evaluate Upstart’s customer support, including its availability, responsiveness, and helpfulness.

Upstart offers customer support through various channels, including phone, email, and live chat. The company’s support team is available Monday through Friday, from 9am to 5pm EST, and Saturday from 10am to 5pm EST.

According to customer reviews, Upstart’s customer support team is knowledgeable and empathetic. Borrowers have praised the team for its responsiveness and helpfulness, with many reporting that their issues were resolved quickly and efficiently.

However, some borrowers have reported difficulty in getting in touch with Upstart’s customer support team, citing long wait times and unresponsive emails. These issues may be due to the company’s high volume of customer inquiries, but they can still be frustrating for borrowers who need assistance.

Overall, Upstart’s customer support is reliable and responsive, but it may not be perfect. Borrowers should be aware of the potential for delays in getting assistance, but they can also expect a knowledgeable and empathetic support team.

In the next section, we’ll summarize our findings and provide a final verdict on whether Upstart is a legitimate loan company. We’ll discuss the company’s strengths and weaknesses, and offer recommendations for potential borrowers.

Conclusion: Is Upstart a Legitimate Loan Company?

After conducting a thorough review of Upstart, we can conclude that it is a legitimate loan company. Upstart’s business model is transparent, and its use of AI to provide personal loans and credit cards is innovative and effective.

While Upstart’s interest rates and fees may be higher than those of traditional banks, they are competitive with other online lenders. The company’s customer support is also reliable and responsive, with a knowledgeable and empathetic support team.

However, as with any loan company, there are some potential drawbacks to consider. Upstart’s credit requirements may be stricter than those of other lenders, and the company’s origination fees can be high.

Overall, we recommend Upstart to potential borrowers who are looking for a legitimate and innovative loan company. Upstart’s use of AI and its commitment to transparency make it a great option for those who want a hassle-free and efficient loan application process.

If you’re considering applying for a loan with Upstart, we recommend carefully reviewing the company’s terms and conditions, including its interest rates and fees. We also recommend checking your credit score and history to ensure that you meet Upstart’s credit requirements.

By following these tips and doing your research, you can make an informed decision about whether Upstart is the right loan company for you.

:max_bytes(150000):strip_icc()/Upstart-2b749b7c65fb4d85aad11712eadbfb94.jpg)