Understanding the Basics of Gift Tax Exclusion

The lifetime gift tax exclusion is a valuable tool for individuals seeking to transfer wealth to their loved ones while minimizing tax liabilities. In 2023, the lifetime gift tax exclusion allows individuals to gift up to $12.92 million during their lifetime without incurring federal gift taxes. This exclusion is a key component of estate planning, enabling individuals to reduce their taxable estate and ultimately lower their estate tax burden.

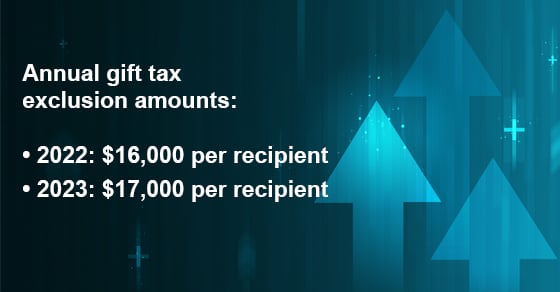

Gift tax exclusion is a complex topic, and understanding its intricacies is crucial for effective estate planning. The Internal Revenue Service (IRS) sets the annual gift tax exclusion, which is the amount an individual can gift to another person without incurring gift taxes. In 2023, the annual gift tax exclusion is $17,000 per recipient. This means that an individual can gift up to $17,000 to any number of recipients without using their lifetime gift tax exclusion.

The lifetime gift tax exclusion is a cumulative total, meaning that it encompasses all gifts made during an individual’s lifetime. If an individual exceeds the annual gift tax exclusion, they must file a gift tax return (Form 709) and report the excess amount. This excess amount will then reduce their lifetime gift tax exclusion. For example, if an individual gifts $20,000 to a single recipient in 2023, they will use $3,000 of their lifetime gift tax exclusion ($20,000 – $17,000 annual exclusion).

It is essential to note that the lifetime gift tax exclusion is not the same as the estate tax exemption. While the lifetime gift tax exclusion is used to calculate gift taxes during an individual’s lifetime, the estate tax exemption is used to calculate estate taxes after an individual’s passing. In 2023, the estate tax exemption is also $12.92 million. Understanding the distinction between these two concepts is vital for effective estate planning.

In conclusion, the lifetime gift tax exclusion is a powerful tool for transferring wealth while minimizing tax liabilities. By understanding the basics of gift tax exclusion, individuals can make informed decisions about their estate planning and ensure that their loved ones receive the maximum benefit from their gifts.

How to Make the Most of Your Lifetime Gift Tax Exclusion

To maximize the benefits of the lifetime gift tax exclusion, it’s essential to plan ahead and make strategic gifts throughout the year. One effective strategy is to make annual gifts to recipients, taking advantage of the annual gift tax exclusion of $17,000 per recipient. This approach can help reduce the amount of gift tax owed and minimize the impact on the lifetime gift tax exclusion.

Another way to make the most of the lifetime gift tax exclusion is to leverage trusts and other estate planning tools. For example, a grantor retained annuity trust (GRAT) can be used to transfer wealth to beneficiaries while minimizing gift taxes. Similarly, a qualified personal residence trust (QPRT) can be used to transfer a primary residence or vacation home to beneficiaries while reducing gift taxes.

It’s also important to consider the use of family limited partnerships (FLPs) and limited liability companies (LLCs) to transfer wealth and minimize taxes. These entities can be used to hold and manage assets, such as real estate or investments, and can provide a level of protection and flexibility in estate planning.

In addition to these strategies, it’s essential to keep accurate records of all gifts made, including the date, amount, and recipient of each gift. This documentation will be necessary when filing gift tax returns and can help ensure that the lifetime gift tax exclusion is used effectively.

Finally, it’s crucial to review and update the lifetime gift tax exclusion strategy regularly to ensure it remains aligned with changing financial situations and goals. This may involve adjusting the amount and frequency of gifts, as well as revising estate planning documents to reflect changes in the law or personal circumstances.

By following these tips and strategies, individuals can make the most of their lifetime gift tax exclusion and minimize their tax liability. It’s essential to consult with a qualified tax professional or estate planning attorney to ensure that the lifetime gift tax exclusion is used effectively and in compliance with all applicable laws and regulations.

The Impact of Inflation on Your Lifetime Gift Tax Exclusion

Inflation can have a significant impact on the lifetime gift tax exclusion, as it can erode the purchasing power of the exclusion amount over time. As inflation rises, the value of the lifetime gift tax exclusion decreases, making it more challenging to transfer wealth to beneficiaries without incurring gift taxes.

To illustrate the impact of inflation, consider the following example: if the lifetime gift tax exclusion is $12.92 million in 2023, and inflation rises by 2% per year, the purchasing power of the exclusion amount will decrease by approximately $258,400 per year. This means that if an individual waits five years to make a gift, the value of the exclusion amount will have decreased by approximately $1.29 million.

To adjust for inflation, individuals can consider making gifts earlier rather than later. This can help to reduce the impact of inflation on the lifetime gift tax exclusion and ensure that the maximum amount is transferred to beneficiaries. Additionally, individuals can consider using inflation-indexed gifts, such as gifts of securities or real estate, which can increase in value over time and help to keep pace with inflation.

Another strategy to consider is to use a grantor retained annuity trust (GRAT) or a qualified personal residence trust (QPRT) to transfer wealth to beneficiaries. These trusts can provide a level of protection against inflation, as they allow the grantor to retain an annuity or a residence while transferring the remainder to beneficiaries.

It’s also essential to review and update the lifetime gift tax exclusion strategy regularly to ensure it remains aligned with changing financial situations and goals. This may involve adjusting the amount and frequency of gifts, as well as revising estate planning documents to reflect changes in the law or personal circumstances.

By understanding the impact of inflation on the lifetime gift tax exclusion and adjusting the gifting strategy accordingly, individuals can make the most of this valuable tax benefit and transfer wealth to their beneficiaries in a tax-efficient manner.

Common Mistakes to Avoid When Using Your Lifetime Gift Tax Exclusion

When using the lifetime gift tax exclusion, it’s essential to avoid common mistakes that can result in unnecessary taxes, penalties, and complications. One of the most common mistakes is failing to document gifts properly. This can lead to disputes with the IRS and result in the loss of the gift tax exclusion.

Another mistake is not considering state taxes when making gifts. While the federal government provides a lifetime gift tax exclusion, some states impose their own gift taxes or have different exemption amounts. Failing to consider state taxes can result in unexpected tax liabilities.

Not updating estate planning documents is another common mistake. As the lifetime gift tax exclusion changes over time, it’s essential to review and update estate planning documents, such as wills and trusts, to ensure they remain aligned with the current tax laws and regulations.

Additionally, failing to consider the impact of the lifetime gift tax exclusion on other estate planning strategies can lead to unintended consequences. For example, making large gifts during life can reduce the amount of the estate tax exemption available at death, potentially resulting in higher estate taxes.

Not seeking professional advice is another mistake to avoid. The lifetime gift tax exclusion is a complex topic, and navigating the rules and regulations can be challenging. Seeking the advice of a qualified tax professional or estate planning attorney can help ensure that the lifetime gift tax exclusion is used effectively and in compliance with all applicable laws and regulations.

Finally, not reviewing and updating the lifetime gift tax exclusion strategy regularly can result in missed opportunities and unnecessary taxes. As the tax laws and regulations change, it’s essential to review and update the strategy to ensure it remains aligned with changing financial situations and goals.

By avoiding these common mistakes, individuals can make the most of the lifetime gift tax exclusion and transfer wealth to their beneficiaries in a tax-efficient manner.

How to Coordinate Your Lifetime Gift Tax Exclusion with Other Estate Planning Strategies

Coordinating the lifetime gift tax exclusion with other estate planning strategies is crucial to ensure that the overall estate plan is effective and efficient. One of the key strategies to consider is the use of wills and trusts. A will can be used to distribute assets that are not subject to the lifetime gift tax exclusion, while a trust can be used to manage and distribute assets that are subject to the exclusion.

Another strategy to consider is the use of powers of attorney. A power of attorney can be used to appoint an agent to manage the estate and make decisions on behalf of the grantor. This can be particularly useful if the grantor becomes incapacitated or unable to manage their own affairs.

It’s also important to consider the use of other estate planning tools, such as irrevocable life insurance trusts (ILITs) and qualified personal residence trusts (QPRTs). These trusts can be used to transfer wealth to beneficiaries while minimizing taxes and ensuring that the lifetime gift tax exclusion is used effectively.

When coordinating the lifetime gift tax exclusion with other estate planning strategies, it’s essential to consider the overall goals and objectives of the estate plan. This may include minimizing taxes, ensuring that assets are distributed according to the grantor’s wishes, and providing for the well-being of beneficiaries.

It’s also important to review and update the estate plan regularly to ensure that it remains aligned with changing financial situations and goals. This may involve revising the will, trust, and other estate planning documents to reflect changes in the law or personal circumstances.

By coordinating the lifetime gift tax exclusion with other estate planning strategies, individuals can create a comprehensive and effective estate plan that minimizes taxes and ensures that assets are distributed according to their wishes.

The Role of Lifetime Gift Tax Exclusion in Reducing Estate Taxes

The lifetime gift tax exclusion plays a crucial role in reducing estate taxes. By making gifts during your lifetime, you can reduce the amount of your estate that is subject to estate taxes. This can result in significant tax savings, as estate taxes can be as high as 40% of the estate’s value.

One of the key benefits of the lifetime gift tax exclusion is that it allows you to transfer wealth to your beneficiaries without incurring estate taxes. By making gifts during your lifetime, you can reduce the amount of your estate that is subject to estate taxes, which can result in significant tax savings.

For example, let’s say you have an estate worth $10 million and you want to leave it to your children. If you don’t make any gifts during your lifetime, your estate will be subject to estate taxes, which could result in a tax liability of up to $4 million (40% of $10 million). However, if you make gifts of $5 million during your lifetime, you can reduce the amount of your estate that is subject to estate taxes, which could result in a tax liability of up to $2 million (40% of $5 million).

It’s also important to note that the lifetime gift tax exclusion is not the same as the estate tax exemption. While the lifetime gift tax exclusion is used to calculate gift taxes during your lifetime, the estate tax exemption is used to calculate estate taxes after your death. In 2023, the estate tax exemption is $12.92 million, which means that estates worth up to $12.92 million are not subject to estate taxes.

By understanding the relationship between the lifetime gift tax exclusion and estate taxes, you can make informed decisions about your estate plan and minimize your tax liability. It’s always a good idea to consult with a qualified tax professional or estate planning attorney to ensure that your estate plan is optimized for tax savings.

Special Considerations for Business Owners and Investors

Business owners and investors have unique considerations when it comes to using the lifetime gift tax exclusion. One of the key strategies to consider is the use of family limited partnerships (FLPs) and other business entities to transfer wealth and minimize taxes.

FLPs are a popular choice for business owners and investors because they allow for the transfer of assets to beneficiaries while maintaining control and minimizing taxes. By creating an FLP, business owners and investors can transfer assets to beneficiaries while reducing the value of the assets for gift tax purposes.

Another strategy to consider is the use of grantor retained annuity trusts (GRATs) and qualified personal residence trusts (QPRTs). These trusts allow business owners and investors to transfer assets to beneficiaries while minimizing taxes and maintaining control.

Business owners and investors should also consider the use of charitable lead trusts (CLTs) and charitable remainder trusts (CRTs). These trusts allow for the transfer of assets to charity while minimizing taxes and providing a steady income stream.

It’s also important for business owners and investors to consider the impact of the lifetime gift tax exclusion on their estate plan. By making gifts during their lifetime, business owners and investors can reduce the amount of their estate that is subject to estate taxes, which can result in significant tax savings.

Finally, business owners and investors should regularly review and update their lifetime gift tax exclusion strategy to ensure it remains aligned with their changing financial situation and goals. This may involve revising their estate plan, updating their trusts, and adjusting their gifting strategy.

Reviewing and Updating Your Lifetime Gift Tax Exclusion Strategy

Regularly reviewing and updating your lifetime gift tax exclusion strategy is crucial to ensure that it remains aligned with your changing financial situation and goals. This involves reviewing your estate plan, updating your trusts, and adjusting your gifting strategy to reflect changes in the tax laws and regulations.

One of the key reasons to review and update your lifetime gift tax exclusion strategy is to ensure that it remains compliant with the current tax laws and regulations. The tax laws and regulations surrounding gift tax exclusion are subject to change, and failing to update your strategy can result in unnecessary taxes and penalties.

Another reason to review and update your lifetime gift tax exclusion strategy is to ensure that it remains aligned with your changing financial situation and goals. As your financial situation and goals change, your lifetime gift tax exclusion strategy may need to be adjusted to reflect these changes.

When reviewing and updating your lifetime gift tax exclusion strategy, it’s essential to consider the following factors:

– Changes in the tax laws and regulations

– Changes in your financial situation and goals

– Changes in your estate plan and trusts

– Changes in your gifting strategy

By regularly reviewing and updating your lifetime gift tax exclusion strategy, you can ensure that it remains effective and efficient in minimizing taxes and achieving your financial goals.

It’s also important to consult with a qualified tax professional or estate planning attorney to ensure that your lifetime gift tax exclusion strategy is optimized for tax savings and compliance with the current tax laws and regulations.