Navigating the Complex World of Medicare Advantage

Medicare Advantage plans offer an alternative to Original Medicare, providing additional benefits and services to help individuals manage their healthcare needs. With a wide range of plans available, it can be overwhelming to navigate the complex world of Medicare Advantage. In this article, we will explore the basics of Medicare Advantage plans, including what they cover, how they differ from Original Medicare, and the benefits of choosing a Medicare Advantage plan.

A Medicare Advantage plan is a type of health insurance plan offered by private companies that contract with Medicare. These plans provide all the benefits of Original Medicare, including hospital and medical coverage, and often include additional benefits such as dental, vision, and hearing coverage. Medicare Advantage plans may also offer lower out-of-pocket costs and more predictable expenses compared to Original Medicare.

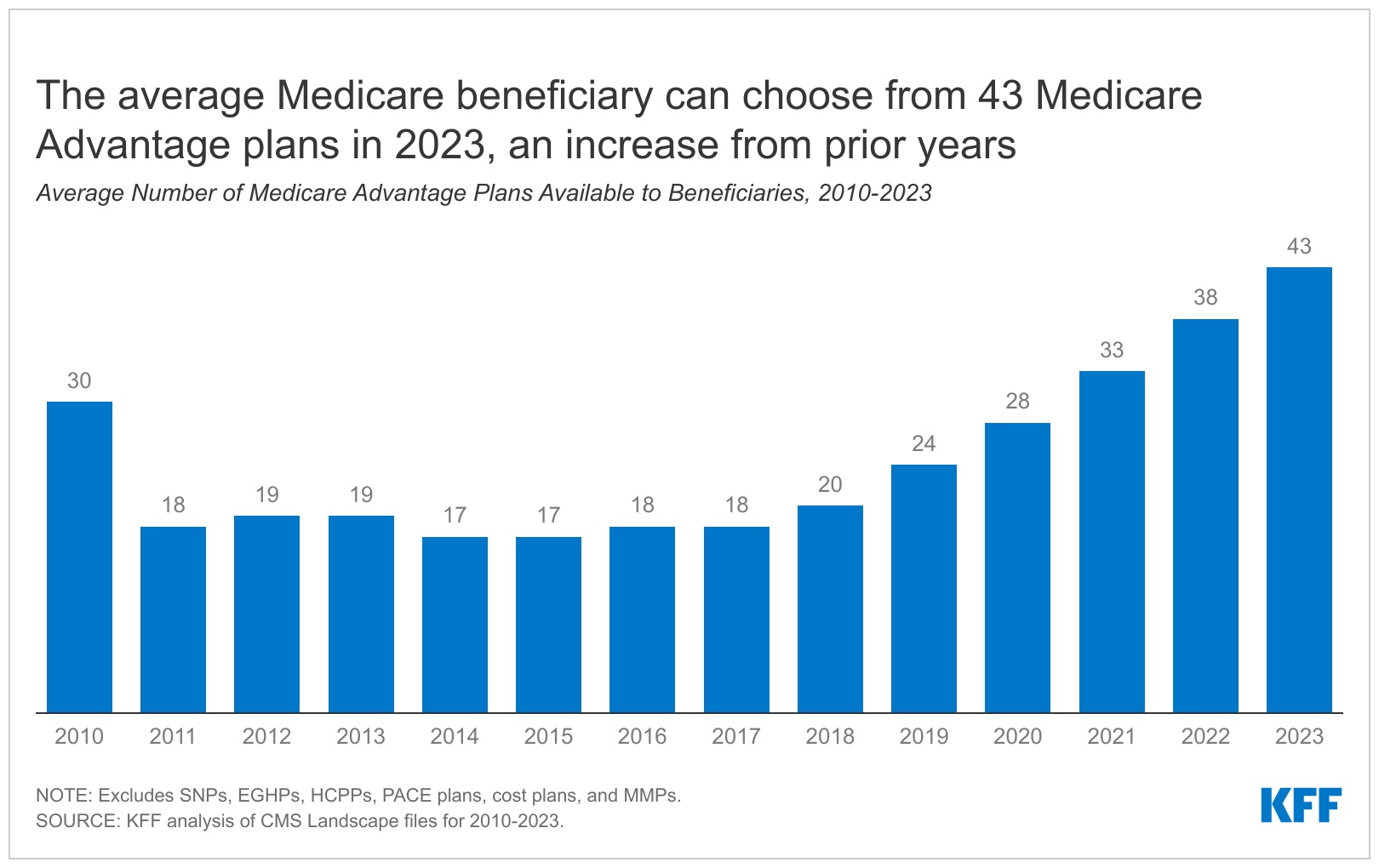

One of the key benefits of Medicare Advantage plans is the ability to choose from a variety of plans that cater to different needs and budgets. For example, some plans may offer a wider network of providers, while others may offer more comprehensive coverage for specific health conditions. By choosing a Medicare Advantage plan that aligns with their individual needs, individuals can enjoy greater flexibility and control over their healthcare.

When searching for a Medicare Advantage plan, it’s essential to consider the list of medicare advantage plans available in your area. This list can help you compare plans and find the one that best suits your needs. You can also use online tools and resources to research and compare plans, making it easier to find the right plan for you.

In addition to the benefits and flexibility offered by Medicare Advantage plans, they also provide an opportunity to save money on healthcare costs. By choosing a plan with lower premiums and out-of-pocket costs, individuals can reduce their healthcare expenses and enjoy greater financial security.

Overall, Medicare Advantage plans offer a range of benefits and services that can help individuals manage their healthcare needs and enjoy greater flexibility and control. By understanding the basics of Medicare Advantage plans and considering the list of medicare advantage plans available, individuals can make informed decisions about their healthcare and choose a plan that aligns with their needs and budget.

How to Choose the Right Medicare Advantage Plan for You

Choosing the right Medicare Advantage plan can be a daunting task, especially with the numerous options available. To make an informed decision, it’s essential to evaluate several factors, including network providers, costs, and additional benefits. Here are some tips to consider when selecting a Medicare Advantage plan:

First, evaluate the network providers associated with each plan. Consider the doctors, hospitals, and other healthcare providers that are part of the plan’s network. Ensure that your primary care physician and any specialists you see regularly are included in the network. You can check the plan’s website or contact the insurer directly to confirm the network providers.

Next, compare the costs associated with each plan. Medicare Advantage plans often have different premium costs, deductibles, copays, and coinsurance rates. Consider your budget and healthcare needs when evaluating the costs. You may also want to consider the plan’s maximum out-of-pocket (MOOP) costs, which can help you budget for unexpected medical expenses.

In addition to network providers and costs, consider the additional benefits offered by each plan. Some Medicare Advantage plans offer dental, vision, and hearing coverage, while others may offer gym memberships, transportation services, or meal delivery. Evaluate the benefits that are most important to you and choose a plan that aligns with your needs.

Another factor to consider is the plan’s star rating. Medicare assigns a star rating to each plan based on its quality and performance. Plans with higher star ratings tend to offer better care and services. You can check the plan’s star rating on the Medicare website or by contacting the insurer directly.

Finally, consider the list of medicare advantage plans available in your area. This list can help you compare plans and find the one that best suits your needs. You can also use online tools and resources to research and compare plans, making it easier to find the right plan for you.

By evaluating these factors and considering your individual needs, you can choose a Medicare Advantage plan that provides the right balance of coverage, cost, and benefits. Remember to carefully review each plan’s details and ask questions before making a decision.

Top Medicare Advantage Plans by Insurer

Several well-known insurers offer Medicare Advantage plans, each with their own strengths and weaknesses. Here are some of the top Medicare Advantage plans by insurer, including their pros and cons:

UnitedHealthcare (UHC) is one of the largest health insurers in the US, offering a wide range of Medicare Advantage plans. UHC’s plans are known for their comprehensive coverage, including dental, vision, and hearing benefits. However, some plans may have higher premiums and out-of-pocket costs.

Humana is another major insurer that offers Medicare Advantage plans. Humana’s plans are known for their affordable premiums and low out-of-pocket costs. However, some plans may have limited network providers and additional benefits.

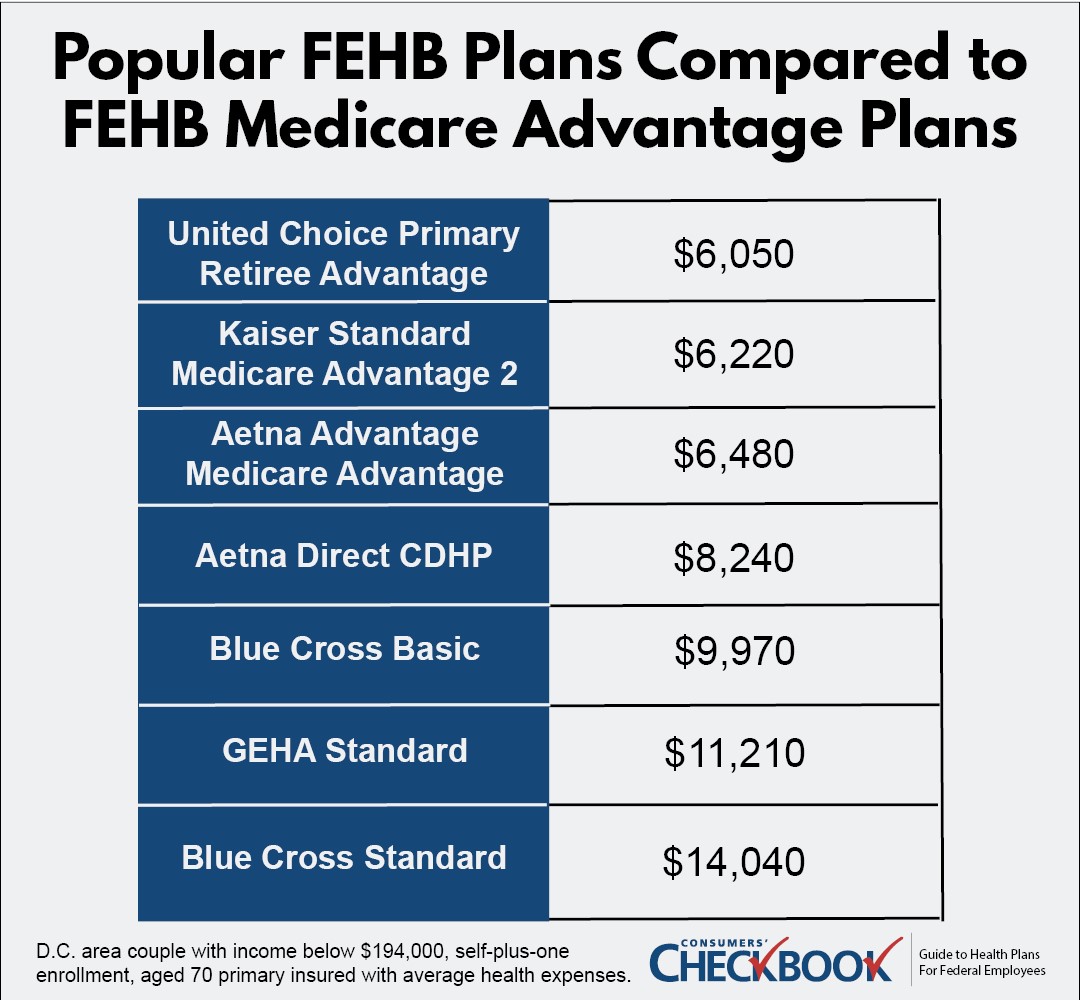

Aetna is a well-established insurer that offers Medicare Advantage plans with a focus on preventive care. Aetna’s plans are known for their comprehensive coverage, including dental, vision, and hearing benefits. However, some plans may have higher premiums and out-of-pocket costs.

Other top Medicare Advantage plans by insurer include Cigna, Anthem, and Kaiser Permanente. Each of these insurers offers a range of plans with different benefits and costs. It’s essential to research and compare plans from multiple insurers to find the one that best suits your needs.

When evaluating Medicare Advantage plans from different insurers, consider factors such as network providers, costs, and additional benefits. You can also check the plan’s star rating, which is assigned by Medicare based on the plan’s quality and performance.

By researching and comparing top Medicare Advantage plans by insurer, you can find a plan that provides the right balance of coverage, cost, and benefits. Remember to carefully review each plan’s details and ask questions before making a decision.

In addition to researching individual plans, you can also use online tools and resources to compare plans and find the best one for you. A list of medicare advantage plans can help you compare plans and find the one that best suits your needs.

Understanding the Different Types of Medicare Advantage Plans

Medicare Advantage plans come in different types, each with its own unique characteristics and benefits. Understanding the different types of plans can help you choose the one that best suits your needs. Here are the main types of Medicare Advantage plans:

Health Maintenance Organization (HMO) plans are one of the most common types of Medicare Advantage plans. HMO plans require you to receive medical care from a network of providers, and you may need a referral from your primary care physician to see a specialist. HMO plans often have lower premiums and out-of-pocket costs, but may have limited network providers.

Preferred Provider Organization (PPO) plans are another type of Medicare Advantage plan. PPO plans allow you to receive medical care from both in-network and out-of-network providers, but you may pay more for out-of-network care. PPO plans often have higher premiums and out-of-pocket costs than HMO plans, but offer more flexibility in terms of provider choice.

Special Needs Plans (SNPs) are designed for individuals with specific chronic conditions or disabilities. SNPs provide specialized care and services tailored to the individual’s needs, and may have additional benefits such as home health care and transportation services.

Medical Savings Account (MSA) plans are a type of Medicare Advantage plan that combines a high-deductible health plan with a medical savings account. MSA plans allow you to set aside a portion of your premium payments in a savings account, which can be used to pay for medical expenses.

When evaluating the different types of Medicare Advantage plans, consider factors such as network restrictions, out-of-pocket costs, and additional benefits. You can also use online tools and resources to compare plans and find the one that best suits your needs. A list of medicare advantage plans can help you compare plans and find the one that best suits your needs.

It’s essential to carefully review each plan’s details and ask questions before making a decision. You can also consult with a licensed insurance agent or broker to get personalized advice and guidance.

By understanding the different types of Medicare Advantage plans, you can make an informed decision and choose a plan that provides the right balance of coverage, cost, and benefits for your needs.

What to Expect from Medicare Advantage Plans in Terms of Costs

Medicare Advantage plans can have varying costs, and it’s essential to understand what to expect when choosing a plan. Here are some of the costs associated with Medicare Advantage plans:

Premiums: Medicare Advantage plans often have premiums, which can vary depending on the plan and the insurer. Some plans may have lower premiums, while others may have higher premiums.

Deductibles: Medicare Advantage plans may have deductibles, which are the amount you pay out-of-pocket for medical services before the plan starts paying. Deductibles can vary depending on the plan and the service.

Copays: Medicare Advantage plans often have copays, which are the amount you pay for each doctor visit or prescription. Copays can vary depending on the plan and the service.

Coinsurance: Medicare Advantage plans may have coinsurance, which is the percentage of the medical bill that you pay after meeting the deductible. Coinsurance can vary depending on the plan and the service.

Maximum Out-of-Pocket (MOOP) Costs: Medicare Advantage plans have a MOOP, which is the maximum amount you pay for medical expenses in a calendar year. After meeting the MOOP, the plan pays 100% of eligible expenses.

When evaluating Medicare Advantage plans, it’s essential to consider the costs and how they fit into your budget. You can use online tools and resources to compare plans and find the one that best suits your needs. A list of medicare advantage plans can help you compare plans and find the one that best suits your needs.

It’s also essential to consider the value of the plan’s benefits and services when evaluating costs. Some plans may have higher costs, but offer more comprehensive coverage and additional benefits.

By understanding the costs associated with Medicare Advantage plans, you can make an informed decision and choose a plan that provides the right balance of coverage, cost, and benefits for your needs.

Remember to carefully review each plan’s details and ask questions before making a decision. You can also consult with a licensed insurance agent or broker to get personalized advice and guidance.

Medicare Advantage Plans with Additional Benefits

Medicare Advantage plans can offer additional benefits beyond the standard Medicare coverage. These benefits can enhance overall health and well-being, and may include:

Gym memberships: Some Medicare Advantage plans offer gym memberships or fitness programs to help you stay active and healthy.

Transportation services: Some plans may offer transportation services to help you get to doctor’s appointments or other medical services.

Meal delivery: Some plans may offer meal delivery services to help you maintain a healthy diet.

Health and wellness programs: Some plans may offer health and wellness programs, such as weight management or stress reduction programs.

These additional benefits can be a valuable addition to your Medicare Advantage plan, and can help you maintain your overall health and well-being. When evaluating Medicare Advantage plans, be sure to consider the additional benefits offered by each plan.

Some Medicare Advantage plans may also offer additional benefits such as dental, vision, and hearing coverage. These benefits can be especially important for individuals who need regular dental, vision, or hearing care.

When searching for a Medicare Advantage plan, you can use online tools and resources to compare plans and find the one that best suits your needs. A list of medicare advantage plans can help you compare plans and find the one that best suits your needs.

It’s essential to carefully review each plan’s details and ask questions before making a decision. You can also consult with a licensed insurance agent or broker to get personalized advice and guidance.

By choosing a Medicare Advantage plan with additional benefits, you can get the most out of your plan and maintain your overall health and well-being.

Remember to always review the plan’s details and ask questions before making a decision. This will help you ensure that you are getting the best plan for your needs.

How to Enroll in a Medicare Advantage Plan

Enrolling in a Medicare Advantage plan can be a straightforward process, but it’s essential to understand the different enrollment periods and how to switch plans if needed. Here’s a step-by-step guide to help you enroll in a Medicare Advantage plan:

Initial Enrollment Period (IEP): If you’re new to Medicare, you can enroll in a Medicare Advantage plan during your IEP, which is the 7-month period surrounding your 65th birthday.

Annual Election Period (AEP): If you’re already enrolled in a Medicare Advantage plan, you can switch plans during the AEP, which typically runs from October 15 to December 7 each year.

Medicare Advantage Open Enrollment Period (OEP): If you’re already enrolled in a Medicare Advantage plan, you can switch plans during the OEP, which typically runs from January 1 to March 31 each year.

Special Enrollment Periods (SEPs): If you experience a qualifying life event, such as moving to a new area or losing your current coverage, you may be eligible for a SEP to enroll in a Medicare Advantage plan.

To enroll in a Medicare Advantage plan, you can:

Contact the plan directly: You can contact the Medicare Advantage plan you’re interested in directly to enroll.

Use the Medicare Plan Finder tool: The Medicare Plan Finder tool allows you to compare plans and enroll online.

Work with a licensed insurance agent or broker: A licensed insurance agent or broker can help you navigate the enrollment process and answer any questions you may have.

When enrolling in a Medicare Advantage plan, be sure to carefully review the plan’s details and ask questions before making a decision. You can also use online tools and resources to compare plans and find the one that best suits your needs. A list of medicare advantage plans can help you compare plans and find the one that best suits your needs.

Remember to always review the plan’s details and ask questions before making a decision. This will help you ensure that you are getting the best plan for your needs.

By following these steps and understanding the different enrollment periods, you can successfully enroll in a Medicare Advantage plan that meets your needs.

Maximizing Your Medicare Advantage Plan Benefits

Once you’ve enrolled in a Medicare Advantage plan, it’s essential to understand how to maximize your benefits. Here are some tips to help you get the most out of your plan:

Use preventive services: Medicare Advantage plans often cover preventive services such as annual physicals, vaccinations, and screenings. These services can help you stay healthy and prevent chronic conditions.

Manage chronic conditions: If you have a chronic condition, your Medicare Advantage plan may offer additional resources and support to help you manage your condition. This may include disease management programs, medication therapy management, and care coordination.

Access additional resources and support: Medicare Advantage plans often offer additional resources and support, such as health and wellness programs, fitness classes, and transportation services. These resources can help you maintain your overall health and well-being.

Take advantage of additional benefits: Some Medicare Advantage plans offer additional benefits such as dental, vision, and hearing coverage. These benefits can help you maintain your overall health and well-being.

Stay informed: It’s essential to stay informed about your Medicare Advantage plan and any changes that may occur. This may include changes to the plan’s network, benefits, or costs.

By following these tips, you can maximize your Medicare Advantage plan benefits and get the most out of your plan. Remember to always review your plan’s details and ask questions before making any decisions.

When searching for a Medicare Advantage plan, you can use online tools and resources to compare plans and find the one that best suits your needs. A list of medicare advantage plans can help you compare plans and find the one that best suits your needs.

By choosing the right Medicare Advantage plan and maximizing your benefits, you can maintain your overall health and well-being and enjoy a better quality of life.

Remember to always prioritize your health and well-being, and don’t hesitate to reach out to your plan’s customer service or a licensed insurance agent or broker if you have any questions or concerns.