What is Market Capitalization and Why Does it Matter?

Market capitalization, commonly referred to as market cap, is a crucial metric in the stock market that represents the total value of a company’s outstanding shares. It is calculated by multiplying the total number of outstanding shares by the current market price of one share. For instance, if a company has 10 million outstanding shares and the current market price is $100 per share, the market capitalization would be $1 billion.

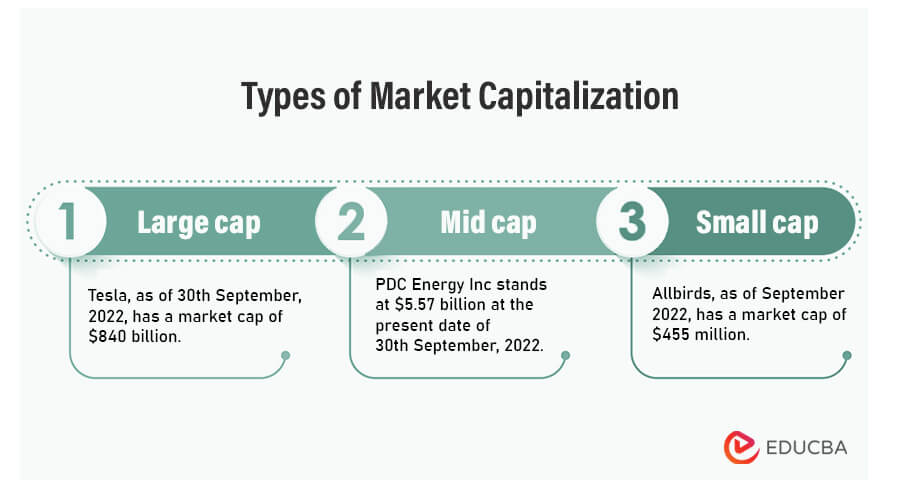

Market capitalization is a significant factor in the stock market as it helps investors and analysts understand the size and scope of a company. It is used to categorize companies into different segments, such as large-cap, mid-cap, and small-cap. Large-cap companies typically have a market capitalization of $10 billion or more, while mid-cap companies have a market capitalization between $2 billion and $10 billion. Small-cap companies, on the other hand, have a market capitalization of less than $2 billion.

Understanding market capitalization is essential for investors, as it can impact their investment decisions. For example, large-cap companies tend to be more stable and less volatile, while small-cap companies may offer higher growth potential but also come with higher risks. By considering market capitalization, investors can make more informed decisions about which companies to invest in and how to diversify their portfolios.

In the context of the stock market, market capitalization is often used in conjunction with other metrics, such as earnings per share (EPS) and price-to-earnings (P/E) ratio, to evaluate a company’s performance and potential for growth. By analyzing market capitalization and other key metrics, investors and analysts can gain a deeper understanding of a company’s value and make more informed investment decisions.

Furthermore, market capitalization plays a critical role in the stock market’s overall performance. Changes in market capitalization can impact the overall market trends and sentiment, influencing the performance of individual stocks and the broader market. As such, market capitalization is a key metric that investors, analysts, and market participants closely monitor to stay ahead of the curve.

How to Calculate Market Capitalization: A Step-by-Step Guide

Calculating market capitalization is a straightforward process that requires two key pieces of information: the total number of outstanding shares and the current market price of one share. The formula for calculating market capitalization is:

Market Capitalization = Total Number of Outstanding Shares x Current Market Price per Share

For example, let’s say we want to calculate the market capitalization of a company with 10 million outstanding shares and a current market price of $50 per share. Using the formula above, we would calculate the market capitalization as follows:

Market Capitalization = 10,000,000 x $50 = $500,000,000

It’s essential to use current stock prices and outstanding shares to get an accurate calculation of market capitalization. This is because market capitalization can fluctuate rapidly in response to changes in stock prices and outstanding shares.

In addition to using the formula above, investors and analysts can also use online tools and resources to calculate market capitalization. Many financial websites and platforms provide market capitalization data for publicly traded companies, making it easy to access and analyze this information.

When calculating market capitalization, it’s also important to consider the different types of shares that a company may have outstanding. For example, some companies may have multiple classes of shares with different voting rights or dividend payments. In these cases, the market capitalization calculation may need to be adjusted to reflect the different types of shares outstanding.

By following these steps and using the formula above, investors and analysts can easily calculate market capitalization and gain a better understanding of a company’s size and scope in the stock market.

Understanding the Different Types of Market Capitalization

While market capitalization is a widely used metric, there are different types of market capitalization that can provide a more nuanced understanding of a company’s value. In this section, we will explore three types of market capitalization: free float market capitalization, fully diluted market capitalization, and market capitalization with debt.

Free float market capitalization refers to the total value of a company’s outstanding shares that are available for trading on the open market. This type of market capitalization excludes shares that are held by insiders, such as executives and employees, as well as shares that are held by institutional investors. Free float market capitalization is often used by investors and analysts to get a more accurate picture of a company’s market value.

Fully diluted market capitalization, on the other hand, takes into account all outstanding shares, including those that are not available for trading on the open market. This type of market capitalization includes shares that are held by insiders, as well as shares that are held by institutional investors. Fully diluted market capitalization provides a more comprehensive picture of a company’s market value, but it can also be more volatile than free float market capitalization.

Market capitalization with debt is a type of market capitalization that takes into account a company’s debt obligations. This type of market capitalization is often used by investors and analysts to get a more complete picture of a company’s financial health. By including debt in the market capitalization calculation, investors can get a better understanding of a company’s ability to pay its debts and meet its financial obligations.

Each type of market capitalization has its pros and cons, and investors and analysts should carefully consider which type of market capitalization to use when evaluating a company’s value. For example, free float market capitalization may be more relevant for investors who are looking to buy or sell shares on the open market, while fully diluted market capitalization may be more relevant for investors who are looking to get a more comprehensive picture of a company’s market value.

By understanding the different types of market capitalization, investors and analysts can gain a more nuanced understanding of a company’s value and make more informed investment decisions. Whether you are a seasoned investor or just starting out, understanding market capitalization is essential for navigating the stock market and achieving your financial goals.

The Relationship Between Market Capitalization and Stock Price

Market capitalization and stock price are closely related, as changes in stock price can significantly impact a company’s market capitalization. In this section, we will explore the relationship between market capitalization and stock price, including how changes in stock price can impact market capitalization.

When a company’s stock price increases, its market capitalization also increases, as the total value of its outstanding shares rises. Conversely, when a company’s stock price decreases, its market capitalization decreases, as the total value of its outstanding shares falls. This relationship is straightforward, but it has important implications for investors and traders.

For example, if a company’s stock price increases by 10%, its market capitalization will also increase by 10%, assuming the number of outstanding shares remains constant. This means that investors who own shares of the company will see the value of their investment increase by 10%. On the other hand, if the company’s stock price decreases by 10%, its market capitalization will also decrease by 10%, resulting in a loss of value for investors.

The relationship between market capitalization and stock price is also influenced by the number of outstanding shares. If a company has a large number of outstanding shares, a small change in stock price can result in a significant change in market capitalization. Conversely, if a company has a small number of outstanding shares, a large change in stock price may be required to result in a significant change in market capitalization.

Understanding the relationship between market capitalization and stock price is essential for investors and traders, as it can help them make more informed investment decisions. By analyzing changes in stock price and market capitalization, investors can gain insights into a company’s financial health and potential for growth.

In addition, the relationship between market capitalization and stock price can also be influenced by other factors, such as the overall market trend and the company’s industry. For example, if the overall market is trending upward, a company’s stock price and market capitalization may increase, even if the company’s financial performance is not improving. Conversely, if the overall market is trending downward, a company’s stock price and market capitalization may decrease, even if the company’s financial performance is improving.

Market Capitalization vs. Enterprise Value: What’s the Difference?

Market capitalization and enterprise value are two commonly used metrics in the stock market to evaluate a company’s value. While they are related, they are not the same thing. In this section, we will explore the key differences between market capitalization and enterprise value, and discuss when to use each metric.

Market capitalization, as we discussed earlier, is the total value of a company’s outstanding shares. It is calculated by multiplying the total number of outstanding shares by the current market price of one share. Enterprise value, on the other hand, is a measure of a company’s total value, including its debt and cash reserves. It is calculated by adding the company’s market capitalization to its debt and subtracting its cash reserves.

The key difference between market capitalization and enterprise value is that market capitalization only looks at the company’s equity, while enterprise value looks at the company’s total value, including its debt and cash reserves. This means that enterprise value provides a more comprehensive picture of a company’s financial health and value.

When to use each metric depends on the context. Market capitalization is useful for evaluating a company’s size and market presence, while enterprise value is useful for evaluating a company’s financial health and value. For example, if you are looking to invest in a company with a strong market presence, market capitalization may be a more relevant metric. However, if you are looking to evaluate a company’s financial health and value, enterprise value may be a more relevant metric.

It’s also worth noting that market capitalization and enterprise value can be used together to get a more complete picture of a company’s value. For example, you can use market capitalization to evaluate a company’s size and market presence, and then use enterprise value to evaluate its financial health and value.

In addition, market capitalization and enterprise value can be used to identify potential investment opportunities. For example, if a company has a high market capitalization but a low enterprise value, it may indicate that the company is undervalued and has potential for growth. Conversely, if a company has a low market capitalization but a high enterprise value, it may indicate that the company is overvalued and has potential for decline.

How Market Capitalization Affects Investment Decisions

Market capitalization plays a significant role in investment decisions, as it can influence portfolio diversification, risk management, and stock selection. In this section, we will discuss how market capitalization can impact investment decisions and provide examples of how different market capitalization ranges can be used to identify investment opportunities.

Market capitalization can influence portfolio diversification by helping investors to allocate their investments across different asset classes and sectors. For example, investors may choose to invest in a mix of large-cap, mid-cap, and small-cap stocks to spread their risk and potentially increase their returns. By considering market capitalization, investors can make more informed decisions about which stocks to include in their portfolio and how to allocate their investments.

Market capitalization can also impact risk management by helping investors to assess the level of risk associated with a particular stock or investment. For example, large-cap stocks tend to be less volatile than small-cap stocks, which means that they may be less risky for investors. By considering market capitalization, investors can make more informed decisions about which stocks to invest in and how to manage their risk.

In addition, market capitalization can influence stock selection by helping investors to identify potential investment opportunities. For example, investors may choose to invest in stocks with a high market capitalization because they tend to be more stable and less volatile. Alternatively, investors may choose to invest in stocks with a low market capitalization because they may offer higher growth potential.

For example, let’s consider a company with a market capitalization of $10 billion. This company is considered a large-cap stock and may be less volatile than a company with a market capitalization of $100 million. However, the company with a market capitalization of $100 million may offer higher growth potential because it is smaller and more agile.

Another example is a company with a market capitalization of $50 billion. This company is considered a mid-cap stock and may offer a balance between stability and growth potential. Investors may choose to invest in this company because it is less volatile than a small-cap stock but still offers the potential for growth.

In conclusion, market capitalization plays a significant role in investment decisions by influencing portfolio diversification, risk management, and stock selection. By considering market capitalization, investors can make more informed decisions about which stocks to invest in and how to manage their risk.

Common Misconceptions About Market Capitalization

Market capitalization is a widely used metric in the stock market, but it is often misunderstood or misused. In this section, we will address common misconceptions about market capitalization and discuss the limitations of this metric.

One common misconception about market capitalization is that it is the only measure of a company’s value. While market capitalization can provide a snapshot of a company’s size and market presence, it does not capture other important factors such as profitability, growth potential, and financial health. Investors should use market capitalization in conjunction with other metrics, such as earnings per share, price-to-earnings ratio, and dividend yield, to get a more complete picture of a company’s value.

Another misconception about market capitalization is that it is a perfect measure of a company’s size. While market capitalization can provide a general idea of a company’s size, it does not capture other important factors such as revenue, profitability, and market share. For example, a company with a large market capitalization may not necessarily be the largest company in its industry in terms of revenue or market share.

Market capitalization is also often misunderstood as a measure of a company’s liquidity. While market capitalization can provide a general idea of a company’s liquidity, it does not capture other important factors such as trading volume and bid-ask spreads. For example, a company with a large market capitalization may not necessarily be highly liquid if it has a low trading volume or wide bid-ask spreads.

In addition, market capitalization is often misused as a measure of a company’s growth potential. While market capitalization can provide a general idea of a company’s size and market presence, it does not capture other important factors such as revenue growth, profitability, and return on equity. For example, a company with a large market capitalization may not necessarily have high growth potential if it has low revenue growth or profitability.

In conclusion, market capitalization is a useful metric in the stock market, but it should be used in conjunction with other metrics to get a more complete picture of a company’s value. Investors should be aware of the limitations of market capitalization and avoid common misconceptions about this metric.

Real-World Examples of Market Capitalization in Action

Market capitalization is a widely used metric in the stock market, and it has a significant impact on the performance of companies. In this section, we will provide real-world examples of how market capitalization is used in the stock market, including examples of companies with different market capitalization ranges.

One example of a company with a large market capitalization is Apple Inc. (AAPL). As of 2022, Apple’s market capitalization is over $2 trillion, making it one of the largest companies in the world. Apple’s large market capitalization is due to its strong brand recognition, innovative products, and loyal customer base.

Another example of a company with a mid-cap market capitalization is Netflix Inc. (NFLX). As of 2022, Netflix’s market capitalization is around $250 billion, making it a mid-cap company. Netflix’s mid-cap market capitalization is due to its strong growth in the streaming industry, as well as its increasing subscriber base.

An example of a company with a small-cap market capitalization is Shopify Inc. (SHOP). As of 2022, Shopify’s market capitalization is around $10 billion, making it a small-cap company. Shopify’s small-cap market capitalization is due to its relatively small size compared to other companies in the e-commerce industry, as well as its limited brand recognition.

These examples illustrate how market capitalization can impact the performance of companies. Companies with large market capitalizations tend to be more stable and less volatile, while companies with small market capitalizations tend to be more volatile and have higher growth potential.

In addition, market capitalization can also impact the way companies are perceived by investors. Companies with large market capitalizations tend to be seen as more established and stable, while companies with small market capitalizations tend to be seen as more innovative and growth-oriented.

Overall, market capitalization is an important metric in the stock market, and it can have a significant impact on the performance of companies. By understanding how market capitalization works and how it is used in the stock market, investors can make more informed decisions about which companies to invest in.

:max_bytes(150000):strip_icc()/Market-Capitalization-ba038aeebab54f03872ead839a2877a4.jpg)