Understanding the Benefits of Filing Jointly

Filing taxes jointly as a married couple can have numerous benefits, including the potential for lower tax rates and increased standard deductions. When married couples file jointly, their combined income is taxed at a lower rate compared to filing separately. This can lead to significant tax savings, especially for couples with disparate incomes. For instance, if one spouse earns a substantial income while the other has a lower income, filing jointly can help reduce the overall tax liability.

In addition to lower tax rates, married couples filing jointly can also claim a higher standard deduction. For the 2023 tax year, the standard deduction for joint filers is $27,700, compared to $13,850 for single filers. This increased standard deduction can result in a lower taxable income, leading to even more tax savings. Furthermore, joint filers can claim more tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, which can further reduce their tax liability.

It’s essential to note that married couples should carefully consider their individual financial situations before deciding to file jointly. While filing jointly can offer many benefits, it may not always be the best option for every couple. For example, if one spouse has significant medical expenses or other deductions, filing separately may be more beneficial. Ultimately, married couples should consult with a tax professional to determine the best filing status for their unique situation.

By understanding the benefits of filing jointly, married couples can make informed decisions about their tax strategy and potentially save thousands of dollars in taxes. As the tax landscape continues to evolve, it’s crucial for couples to stay informed about changes to the married filing joint tax brackets 2023 and other tax laws that may impact their financial situation.

How to Take Advantage of Joint Filing Status

Married couples can maximize their tax savings by taking advantage of joint filing status. One strategy is income splitting, where couples can split their income to minimize their tax liability. This can be especially beneficial for couples with disparate incomes, as it can help reduce the overall tax rate.

Another way to maximize tax savings is by claiming deductions and credits. Married couples can claim the standard deduction, which is $27,700 for joint filers in 2023. They can also claim itemized deductions, such as mortgage interest and charitable donations, which can help reduce their taxable income.

In addition to deductions, married couples can also claim tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. These credits can provide significant tax savings, especially for couples with children or low-income households.

It’s essential to note that married couples should consult with a tax professional to ensure accurate filing and maximize their tax savings. A tax professional can help couples navigate the complexities of joint filing and identify opportunities for tax savings.

By taking advantage of joint filing status, income splitting, deductions, and credits, married couples can minimize their tax liability and maximize their tax savings. This can help them achieve their financial goals and secure their financial future.

Common Mistakes to Avoid When Filing Jointly

When filing taxes jointly, married couples can make mistakes that can lead to delays, penalties, and even audits. One common mistake is incorrect income reporting. Couples must ensure that they report all income, including wages, interest, dividends, and capital gains. Failure to report income can result in penalties and interest.

Another mistake is missed deductions. Married couples can claim deductions for mortgage interest, charitable donations, and medical expenses. However, they must keep accurate records and ensure that they claim the correct deductions. Missed deductions can result in higher tax liability.

In addition to income reporting and deductions, couples must also ensure that they claim the correct credits. The Earned Income Tax Credit (EITC) and the Child Tax Credit are two common credits that couples can claim. However, they must meet specific requirements and follow the correct procedures to claim these credits.

Married couples can avoid these mistakes by keeping accurate records, consulting with a tax professional, and following the correct procedures. They should also ensure that they file their taxes on time and pay any taxes owed to avoid penalties and interest.

By avoiding common mistakes, married couples can ensure that they file their taxes accurately and minimize their tax liability. This can help them achieve their financial goals and secure their financial future.

Impact of Tax Law Changes on Married Couples

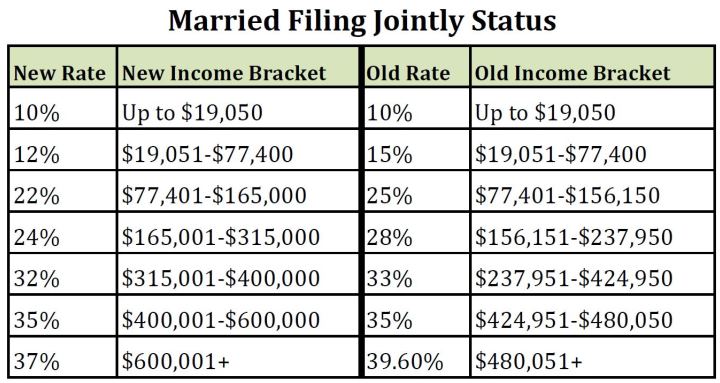

Recent changes to tax laws have significant implications for married couples filing jointly. The Tax Cuts and Jobs Act (TCJA) introduced in 2017 has brought about several changes to the tax code, including changes to the married filing joint tax brackets 2023. These changes can affect the tax liability of married couples, and it’s essential to understand how to adapt to the new tax landscape.

One of the key changes is the increase in the standard deduction for joint filers. The standard deduction for married couples filing jointly has increased to $27,700 for the 2023 tax year. This can result in lower tax liability for many couples, especially those with lower incomes.

Another change is the limitation on state and local taxes (SALT) deductions. The TCJA limits the SALT deduction to $10,000 for joint filers. This can affect couples who live in high-tax states and have significant state and local tax liabilities.

In addition to these changes, the TCJA has also introduced new tax credits and deductions for married couples. For example, the Child Tax Credit has been increased to $2,000 per child, and the credit is now refundable. This can result in significant tax savings for couples with children.

Married couples should consult with a tax professional to understand how these changes affect their specific situation. A tax professional can help couples navigate the complexities of the new tax laws and ensure that they take advantage of the available tax credits and deductions.

Strategies for Reducing Your Tax Liability

Married couples can reduce their tax liability by implementing several strategies. One effective way is to minimize income, which can be achieved by maximizing tax-deferred retirement contributions, such as 401(k) or IRA contributions. Additionally, couples can consider income splitting, where they allocate income to the spouse with the lower tax bracket.

Another strategy is to maximize deductions, which can include mortgage interest, charitable donations, and medical expenses. Couples should keep accurate records of these expenses and ensure they claim the correct deductions on their tax return.

Leveraging tax credits is also an effective way to reduce tax liability. The Earned Income Tax Credit (EITC) and the Child Tax Credit are two popular credits that can provide significant tax savings. Couples should consult with a tax professional to determine if they are eligible for these credits and ensure they claim them correctly.

Furthermore, married couples can consider tax-loss harvesting, which involves selling securities that have declined in value to offset gains from other investments. This can help reduce tax liability and minimize the impact of investment losses.

By implementing these strategies, married couples can reduce their tax liability and keep more of their hard-earned money. It’s essential to consult with a tax professional to determine the best strategies for their specific situation and ensure accurate filing.

How to File Your Taxes Jointly with Ease

Filing taxes jointly as a married couple can be a straightforward process if you follow the correct steps. To start, you’ll need to gather all the necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

Next, you’ll need to choose a filing status. As a married couple, you’ll file jointly, which means you’ll report your combined income and claim deductions and credits together.

Once you’ve gathered your documents and chosen your filing status, you can begin filling out your tax return. You can use tax software, such as TurboTax or H&R Block, or work with a tax professional to ensure accuracy and completeness.

When filling out your tax return, be sure to claim all the deductions and credits you’re eligible for. This may include the standard deduction, mortgage interest deduction, and child tax credit.

After completing your tax return, you’ll need to submit it to the IRS. You can do this electronically or by mail. If you’re due a refund, you can choose to have it direct deposited into your bank account or receive a paper check.

It’s essential to file your taxes on time to avoid penalties and interest. The deadline for filing taxes is typically April 15th, but you can request an extension if you need more time.

By following these steps and seeking the help of a tax professional if needed, you can file your taxes jointly with ease and ensure you’re taking advantage of all the tax savings available to you as a married couple.

Planning for Future Tax Savings as a Married Couple

As a married couple, it’s essential to plan for future tax savings to minimize your tax liability and maximize your financial security. One way to do this is to take advantage of tax-deferred retirement accounts, such as 401(k) or IRA accounts. These accounts allow you to contribute pre-tax dollars, reducing your taxable income and lowering your tax liability.

Another strategy is to consider tax-loss harvesting, which involves selling securities that have declined in value to offset gains from other investments. This can help reduce your tax liability and minimize the impact of investment losses.

Married couples can also benefit from long-term care planning, which involves planning for potential long-term care expenses, such as nursing home care or home health care. This can help reduce your tax liability and ensure that you have the resources you need to cover these expenses.

In addition to these strategies, it’s essential to stay informed about changes to tax laws and regulations that may affect married couples. This includes changes to the married filing joint tax brackets 2023, as well as other tax laws and regulations that may impact your tax liability.

By planning for future tax savings and staying informed about changes to tax laws and regulations, married couples can minimize their tax liability and maximize their financial security. It’s essential to consult with a tax professional to determine the best strategies for your specific situation and ensure accurate filing.

Planning for Future Tax Savings as a Married Couple

As a married couple, planning for future tax savings is crucial to minimize your tax liability and maximize your financial security. One way to do this is to take advantage of tax-deferred retirement accounts, such as 401(k) or IRA accounts. These accounts allow you to contribute pre-tax dollars, reducing your taxable income and lowering your tax liability.

Another strategy is to consider tax-loss harvesting, which involves selling securities that have declined in value to offset gains from other investments. This can help reduce your tax liability and minimize the impact of investment losses.

Married couples can also benefit from long-term care planning, which involves planning for potential long-term care expenses, such as nursing home care or home health care. This can help reduce your tax liability and ensure that you have the resources you need to cover these expenses.

In addition to these strategies, it’s essential to stay informed about changes to tax laws and regulations that may affect married couples. This includes changes to the married filing joint tax brackets 2023, as well as other tax laws and regulations that may impact your tax liability.

By planning for future tax savings and staying informed about changes to tax laws and regulations, married couples can minimize their tax liability and maximize their financial security. It’s essential to consult with a tax professional to determine the best strategies for your specific situation and ensure accurate filing.

Some other strategies to consider include:

- Maximizing deductions and credits

- Minimizing income

- Leveraging tax credits

- Planning for estate taxes

By incorporating these strategies into your long-term tax plan, you can ensure that you and your spouse are well-prepared for the future and can minimize your tax liability.