Why Mergers and Acquisitions Matter for Startup Success

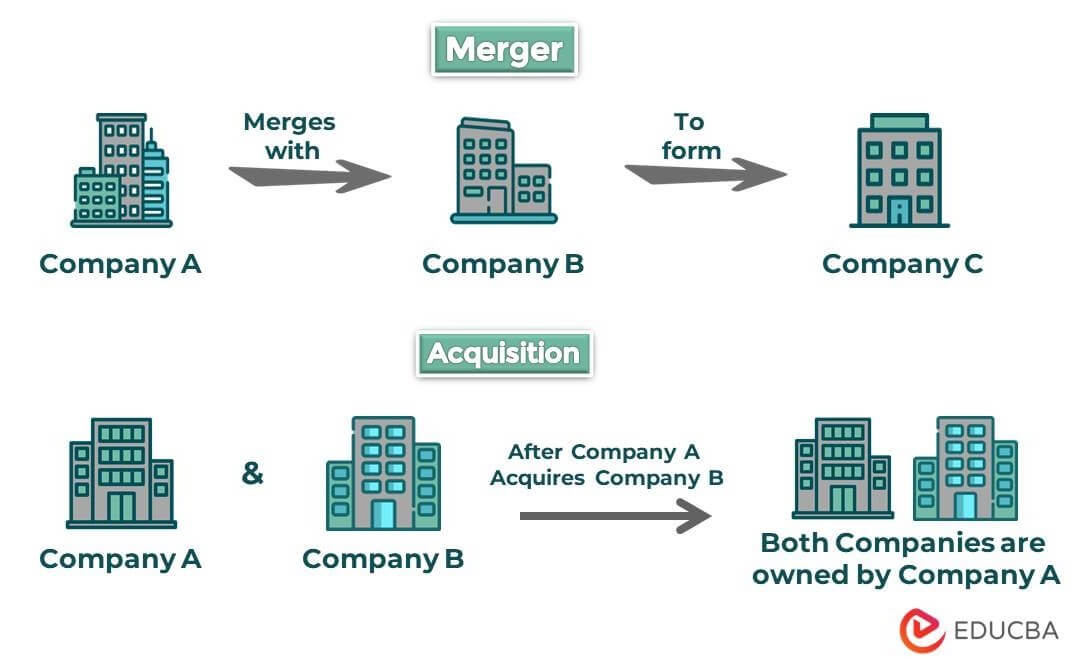

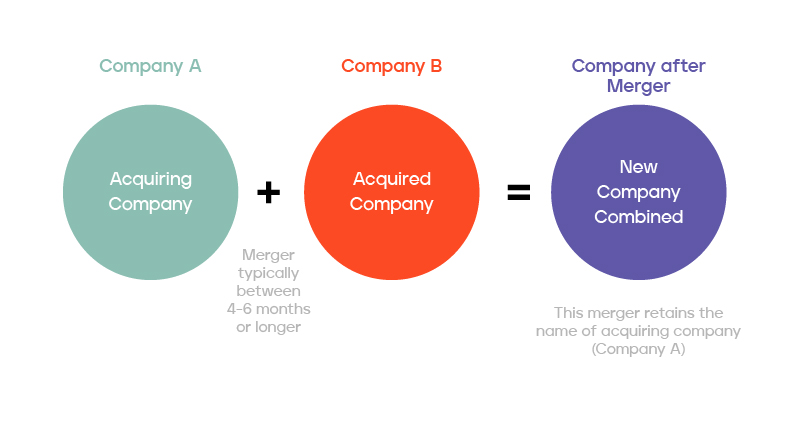

Mergers and acquisitions (M&A) play a vital role in the startup ecosystem, offering a strategic pathway for growth, expansion, and increased competitiveness. For startups, M&A can be a game-changer, providing access to new markets, technologies, and talent. By leveraging the strengths of both companies, startups can accelerate their development, enhance their product offerings, and improve their market position.

In today’s fast-paced and rapidly evolving business landscape, startups must be agile and adaptable to stay ahead of the competition. Mergers and acquisitions for startups provide a means to achieve this, enabling them to respond quickly to changing market conditions, capitalize on emerging trends, and stay competitive. By acquiring or merging with another company, startups can fill gaps in their product or service offerings, expand their customer base, and increase their revenue streams.

Moreover, M&A can provide startups with access to new technologies, expertise, and resources, enabling them to innovate and improve their products and services. This, in turn, can lead to increased customer satisfaction, improved brand reputation, and enhanced competitiveness. Furthermore, M&A can also provide startups with a means to expand their geographic reach, entering new markets and increasing their global presence.

According to a recent study, startups that engage in M&A activity tend to experience higher growth rates, increased profitability, and improved competitiveness compared to those that do not. This highlights the importance of M&A in the startup ecosystem, providing a strategic pathway for growth, expansion, and success.

However, it’s essential to note that M&A can be a complex and challenging process, requiring careful planning, strategic decision-making, and thorough due diligence. Startups must carefully evaluate potential acquisition targets, assess the cultural fit, and ensure that the acquisition aligns with their overall business strategy.

By understanding the benefits and challenges of M&A, startups can make informed decisions about their growth and expansion strategies, leveraging the power of mergers and acquisitions to drive success and competitiveness in today’s fast-paced business landscape.

How to Prepare Your Startup for a Successful Acquisition

Preparing your startup for a potential acquisition requires careful planning, strategic decision-making, and a solid understanding of the mergers and acquisitions process. By taking the right steps, startups can increase their chances of a successful acquisition and maximize their value.

One of the most critical steps in preparing for an acquisition is building a strong financial foundation. This includes maintaining accurate and transparent financial records, ensuring compliance with regulatory requirements, and demonstrating a clear understanding of the company’s financial performance. Startups should also focus on developing a unique value proposition, highlighting their competitive advantages and differentiators in the market.

Establishing a solid management team is also essential for a successful acquisition. This includes having a clear organizational structure, defining roles and responsibilities, and ensuring that key team members are aligned with the company’s goals and objectives. Startups should also focus on building a strong company culture, fostering a positive and productive work environment that will attract and retain top talent.

In addition to these internal preparations, startups should also focus on building relationships with potential acquirers. This includes networking with industry leaders, attending conferences and events, and engaging in strategic partnerships and collaborations. By building these relationships, startups can increase their visibility and attractiveness to potential acquirers.

Another critical step in preparing for an acquisition is ensuring that the company’s intellectual property is protected. This includes filing patents and trademarks, maintaining confidentiality agreements, and ensuring that all employees and contractors understand the importance of protecting the company’s IP.

Finally, startups should also focus on demonstrating a clear understanding of their market and industry. This includes conducting market research, analyzing industry trends, and developing a comprehensive understanding of the competitive landscape. By demonstrating this understanding, startups can increase their attractiveness to potential acquirers and maximize their value.

By following these steps, startups can prepare themselves for a successful acquisition and maximize their value in the mergers and acquisitions process. Whether you’re looking to exit your business or simply want to increase your company’s value, careful preparation and planning are essential for achieving your goals.

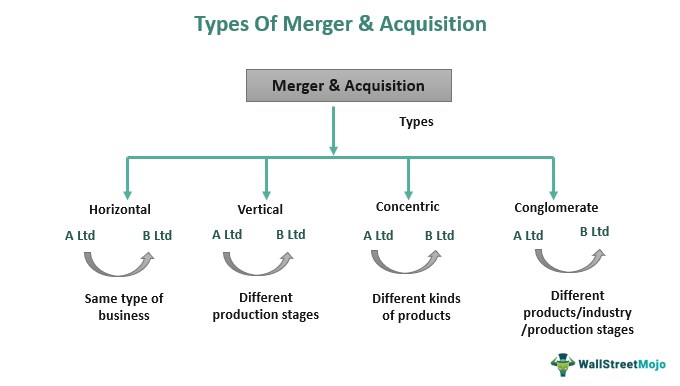

Understanding the Different Types of Mergers and Acquisitions

Mergers and acquisitions (M&A) can take various forms, each with its own unique characteristics and benefits. Understanding the different types of M&A is essential for startups looking to navigate the complex world of startup acquisitions.

Horizontal integration is one of the most common types of M&A, where two companies in the same industry merge to increase market share and reduce competition. For example, the acquisition of Instagram by Facebook is a classic example of horizontal integration, where Facebook expanded its social media presence and increased its market share.

Vertical integration, on the other hand, involves the acquisition of a company that operates at a different stage of the supply chain. This type of M&A can help startups to control costs, improve efficiency, and increase profitability. For instance, the acquisition of Nest by Google is an example of vertical integration, where Google expanded its presence in the smart home market and gained control over the supply chain.

Conglomerate mergers involve the acquisition of a company in a different industry, often to diversify the acquirer’s portfolio and reduce risk. This type of M&A can provide startups with access to new markets, technologies, and talent. For example, the acquisition of WhatsApp by Facebook is an example of a conglomerate merger, where Facebook expanded its presence in the messaging market and gained access to new technologies.

Joint ventures are another type of M&A, where two or more companies collaborate to achieve a common goal. This type of M&A can provide startups with access to new markets, technologies, and talent, while also sharing the risks and costs associated with the venture. For instance, the joint venture between Microsoft and Nokia is an example of a successful joint venture, where both companies collaborated to develop a new line of smartphones.

Understanding the different types of M&A is essential for startups looking to navigate the complex world of startup acquisitions. By understanding the benefits and risks associated with each type of M&A, startups can make informed decisions about their growth and expansion strategies.

In addition to understanding the different types of M&A, startups should also consider the cultural fit between the two companies. A successful M&A requires a deep understanding of the cultural nuances and values of both companies, as well as a clear communication strategy to ensure a smooth transition.

Finally, startups should also consider the financial implications of an M&A, including the valuation of the target company, the financing structure of the deal, and the potential return on investment. By carefully evaluating these factors, startups can ensure a successful M&A that drives growth and profitability.

Valuation Strategies for Startups in Mergers and Acquisitions

Valuation is a critical component of mergers and acquisitions (M&A) for startups. Accurate valuation is essential to ensure that the startup is fairly priced and that the acquisition is successful. There are several valuation methods used in M&A, each with its own strengths and weaknesses.

The discounted cash flow (DCF) model is a widely used valuation method in M&A. This method estimates the present value of future cash flows by discounting them using a risk-free rate. The DCF model is useful for startups with a clear revenue stream and a well-defined growth strategy. For example, the acquisition of LinkedIn by Microsoft used the DCF model to value the company at $26.2 billion.

Comparable company analysis (CCA) is another valuation method used in M&A. This method involves comparing the startup’s financial metrics to those of similar companies in the same industry. CCA is useful for startups with a similar business model and growth stage. For instance, the acquisition of Instagram by Facebook used CCA to value the company at $1 billion.

Precedent transaction analysis (PTA) is a valuation method that involves analyzing the prices paid for similar companies in previous M&A transactions. PTA is useful for startups with a unique business model or limited financial data. For example, the acquisition of WhatsApp by Facebook used PTA to value the company at $19 billion.

Other valuation methods used in M&A include the venture capital method, the cost approach, and the market approach. Each method has its own strengths and weaknesses, and the choice of method depends on the specific circumstances of the startup and the acquisition.

In addition to these valuation methods, startups should also consider other factors that can impact the valuation, such as the company’s growth stage, market position, and competitive landscape. A thorough understanding of these factors is essential to ensure that the startup is fairly priced and that the acquisition is successful.

It’s also important to note that valuation is not a one-time event, but rather an ongoing process that requires continuous monitoring and adjustment. Startups should regularly review their financial performance and adjust their valuation accordingly to ensure that they remain competitive in the market.

In conclusion, valuation is a critical component of M&A for startups. By understanding the different valuation methods and factors that impact valuation, startups can ensure that they are fairly priced and that the acquisition is successful.

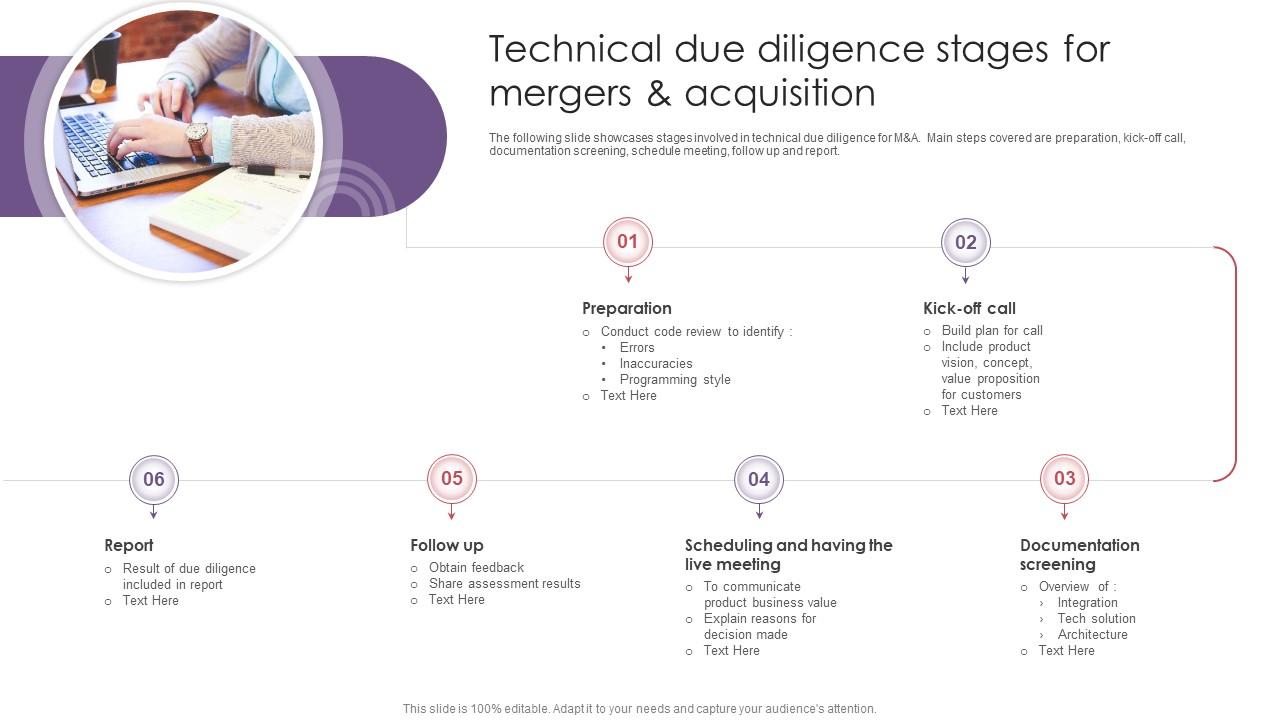

Due Diligence and Integration Planning for a Smooth Transition

Due diligence and integration planning are critical components of a successful merger or acquisition. These processes help ensure that the acquiring company thoroughly understands the target company’s operations, finances, and culture, and that the integration process is smooth and efficient.

Due diligence involves a thorough review of the target company’s financial statements, contracts, and other documents to identify potential risks and opportunities. This process helps the acquiring company to understand the target company’s financial performance, management team, and competitive position in the market.

Integration planning involves developing a comprehensive plan for integrating the target company’s operations, systems, and culture into the acquiring company. This plan should include strategies for managing the transition, communicating with employees and customers, and addressing any cultural or operational differences between the two companies.

A thorough due diligence process can help to identify potential risks and opportunities, such as undervalued assets, hidden liabilities, or untapped markets. It can also help to ensure that the acquiring company is making an informed decision about the acquisition, and that the integration process is smooth and efficient.

Integration planning is also critical to the success of a merger or acquisition. A well-planned integration process can help to minimize disruptions to the business, ensure continuity of operations, and maximize the value of the acquisition.

Some key considerations for due diligence and integration planning include:

Reviewing financial statements and contracts to identify potential risks and opportunities

Assessing the target company’s management team and organizational structure

Evaluating the target company’s competitive position in the market

Developing a comprehensive plan for integrating the target company’s operations, systems, and culture

Communicating with employees and customers to ensure a smooth transition

Addressing any cultural or operational differences between the two companies

By conducting thorough due diligence and integration planning, acquiring companies can ensure a smooth and successful transition, and maximize the value of the acquisition.

Common Mistakes to Avoid in Startup Mergers and Acquisitions

While mergers and acquisitions can be a great way for startups to grow and expand, there are also common mistakes that can lead to failure. In this section, we’ll highlight some of the most common pitfalls to avoid in startup mergers and acquisitions.

Overvaluation is one of the most common mistakes made in startup mergers and acquisitions. This occurs when the acquiring company pays too much for the target company, often due to a lack of thorough due diligence or an overestimation of the target company’s value. For example, the acquisition of AOL by Time Warner in 2001 is often cited as one of the most failed acquisitions in history, with Time Warner writing down the value of AOL by $99 billion just a few years after the acquisition.

Poor cultural fit is another common mistake made in startup mergers and acquisitions. When two companies with different cultures and values merge, it can lead to conflicts and difficulties in integrating the two companies. For example, the acquisition of Nokia by Microsoft in 2014 was widely seen as a failure due to the poor cultural fit between the two companies.

Inadequate integration planning is also a common mistake made in startup mergers and acquisitions. When two companies merge, it’s essential to have a clear plan for integrating the two companies, including their operations, systems, and cultures. For example, the acquisition of HP by Compaq in 2002 was widely seen as a failure due to the inadequate integration planning, which led to significant layoffs and a decline in the company’s stock price.

Other common mistakes to avoid in startup mergers and acquisitions include:

Underestimating the complexity of the integration process

Overlooking potential risks and liabilities

Failing to communicate effectively with employees and customers

Not having a clear plan for post-merger integration

By avoiding these common mistakes, startups can increase their chances of success in mergers and acquisitions and achieve their growth and expansion goals.

Real-Life Examples of Successful Startup Acquisitions

There are many examples of successful startup acquisitions that demonstrate the potential benefits of mergers and acquisitions for startups. Here are a few examples:

The acquisition of Instagram by Facebook in 2012 is a prime example of a successful startup acquisition. Instagram was a small startup with a strong brand and user base, and Facebook was looking to expand its presence in the photo-sharing market. The acquisition was a strategic move by Facebook to acquire Instagram’s talent, technology, and user base, and it has proven to be a successful move for both companies.

Another example of a successful startup acquisition is the acquisition of WhatsApp by Facebook in 2014. WhatsApp was a messaging app with a strong user base and a unique value proposition, and Facebook was looking to expand its presence in the messaging market. The acquisition was a strategic move by Facebook to acquire WhatsApp’s talent, technology, and user base, and it has proven to be a successful move for both companies.

The acquisition of Nest by Google in 2014 is another example of a successful startup acquisition. Nest was a home automation company with a strong brand and user base, and Google was looking to expand its presence in the home automation market. The acquisition was a strategic move by Google to acquire Nest’s talent, technology, and user base, and it has proven to be a successful move for both companies.

These examples demonstrate the potential benefits of mergers and acquisitions for startups, including access to new markets, technologies, and talent. They also highlight the importance of careful planning, strategic decision-making, and thorough due diligence in mergers and acquisitions for startups.

In each of these examples, the acquiring company was able to leverage the startup’s talent, technology, and user base to expand its presence in a new market or industry. The startups, in turn, were able to benefit from the resources and expertise of the acquiring company, and to achieve their growth and expansion goals.

These examples also highlight the importance of cultural fit and integration planning in mergers and acquisitions for startups. In each of these examples, the acquiring company was able to successfully integrate the startup’s culture and operations into its own, and to achieve a smooth transition.

Conclusion: Navigating the Complex World of Startup Acquisitions

Mergers and acquisitions can be a complex and challenging process for startups, but with careful planning, strategic decision-making, and thorough due diligence, they can also be a powerful tool for growth and expansion. By understanding the different types of mergers and acquisitions, valuation strategies, and common pitfalls to avoid, startups can navigate the complex world of startup acquisitions and achieve their goals.

Throughout this article, we have discussed the importance of mergers and acquisitions in the startup ecosystem, including the benefits of strategic partnerships, increased market share, and access to new technologies. We have also provided tips and strategies for startups to prepare for a potential acquisition, including building a strong financial foundation, developing a unique value proposition, and establishing a solid management team.

In addition, we have explained the different types of mergers and acquisitions, including horizontal and vertical integrations, conglomerate mergers, and joint ventures. We have also discussed the different valuation methods used in mergers and acquisitions, including the discounted cash flow (DCF) model, comparable company analysis, and precedent transaction analysis.

We have also emphasized the importance of thorough due diligence and integration planning in mergers and acquisitions, including reviewing financial statements, assessing cultural fit, and evaluating intellectual property. We have also highlighted common pitfalls to avoid in startup mergers and acquisitions, including overvaluation, poor cultural fit, and inadequate integration planning.

Finally, we have showcased successful startup acquisitions, including the acquisition of Instagram by Facebook, the acquisition of WhatsApp by Facebook, and the acquisition of Nest by Google. We have analyzed the strategies and factors that contributed to their success, and provided lessons learned from these examples.

In conclusion, mergers and acquisitions can be a powerful tool for startups to achieve their growth and expansion goals. By understanding the complex world of startup acquisitions, and by following the tips and strategies outlined in this article, startups can navigate the challenges of mergers and acquisitions and achieve success.