Understanding the Basics: What is a Money Market Account?

A money market account is a type of savings account that offers a competitive interest rate and limited check-writing and debit card privileges. It is designed to provide individuals and businesses with a low-risk investment option that earns a higher interest rate than a traditional savings account. Money market accounts typically invest in low-risk, short-term instruments such as commercial paper, treasury bills, and certificates of deposit.

One of the primary benefits of a money market account is its liquidity. Unlike other investment options, such as stocks or mutual funds, money market accounts allow you to access your money when needed. This makes them an attractive option for those who want to earn a higher interest rate than a traditional savings account but still need easy access to their funds.

Money market accounts also offer a range of investment options, including tiered interest rates, which can help you earn a higher interest rate based on your account balance. Additionally, many money market accounts come with debit cards, checks, or online banking, making it easy to manage your account and access your funds.

When considering a money market account, it’s essential to evaluate your financial goals and risk tolerance. Money market accounts are generally considered low-risk, but they may not offer the same level of returns as other investment options. However, for those who want a stable, low-risk investment option with easy access to their funds, a money market account can be an excellent choice.

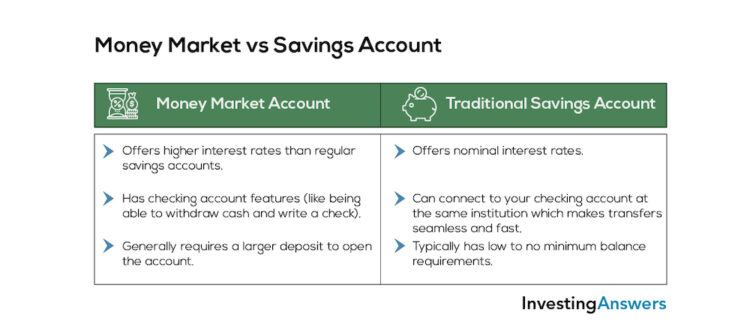

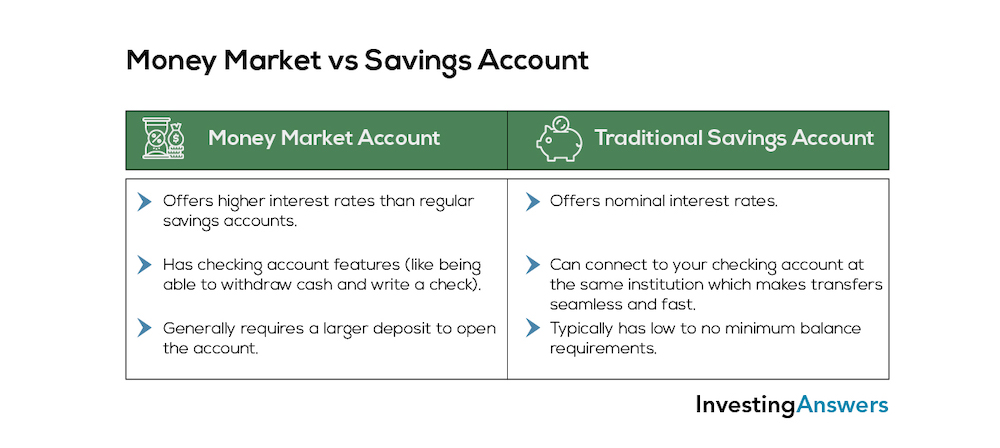

In comparison to savings accounts, money market accounts often offer higher interest rates and more investment options. However, they may also come with higher minimum balance requirements and more restrictions on withdrawals. Ultimately, the decision between a money market account and a savings account depends on your individual financial needs and goals.

The Savings Account Alternative: How Does it Compare?

A traditional savings account is a type of deposit account that allows individuals to store their money while earning a small amount of interest. Savings accounts are known for their liquidity and low-risk profile, making them an attractive option for those who want to keep their money safe and easily accessible.

One of the main benefits of a savings account is its simplicity. Savings accounts typically have a straightforward fee structure and few requirements, making them easy to understand and manage. Additionally, savings accounts often come with debit cards, checks, or online banking, making it easy to access and manage your funds.

However, savings accounts typically offer lower interest rates compared to money market accounts. This means that while savings accounts are a safe and liquid option, they may not provide the same level of returns as a money market account. Additionally, savings accounts may have more restrictions on withdrawals and may require a minimum balance to avoid fees.

When comparing savings accounts to money market accounts, it’s essential to consider your financial goals and risk tolerance. If you prioritize liquidity and a low-risk profile, a savings account may be the better choice. However, if you’re willing to take on a bit more risk and want to earn a higher interest rate, a money market account may be a better option.

It’s also worth noting that some savings accounts may offer tiered interest rates or other incentives to earn a higher interest rate. However, these accounts may also come with more requirements or restrictions, so it’s essential to carefully review the terms and conditions before opening an account.

How to Choose Between a Money Market Account and a Savings Account

When deciding between a money market account and a savings account, it’s essential to evaluate your financial goals, risk tolerance, and liquidity needs. Both types of accounts have their benefits and drawbacks, and the right choice for you will depend on your individual circumstances.

First, consider your financial goals. Are you looking to save for a short-term goal, such as a down payment on a house or a vacation? Or are you looking to save for a long-term goal, such as retirement? If you’re looking to save for a short-term goal, a savings account may be a better choice. However, if you’re looking to save for a long-term goal, a money market account may be a better option.

Next, consider your risk tolerance. Money market accounts typically invest in low-risk, short-term instruments such as commercial paper and treasury bills. However, they may also come with a slightly higher level of risk compared to savings accounts. If you’re risk-averse, a savings account may be a better choice. However, if you’re willing to take on a bit more risk in pursuit of higher returns, a money market account may be a better option.

Finally, consider your liquidity needs. Do you need to access your money quickly and easily? If so, a savings account may be a better choice. However, if you’re willing to keep your money locked in an account for a longer period of time, a money market account may be a better option.

It’s also important to consider the fees and minimum balance requirements associated with each type of account. Money market accounts may come with higher fees and minimum balance requirements compared to savings accounts. However, they may also offer higher interest rates and more investment options.

Ultimately, the decision between a money market account and a savings account will depend on your individual financial goals and needs. By carefully evaluating your options and considering your financial goals, risk tolerance, and liquidity needs, you can make an informed decision about which type of account is right for you.

Money Market Account vs Savings Account: A Side-by-Side Comparison

When deciding between a money market account and a savings account, it’s essential to compare the key features of each type of account. Here is a side-by-side comparison of the two:

| Feature | Money Market Account | Savings Account |

|---|---|---|

| Interest Rate | Generally higher than savings accounts | Generally lower than money market accounts |

| Fees | May have higher fees than savings accounts | Typically has lower fees than money market accounts |

| Minimum Balance Requirements | May have higher minimum balance requirements than savings accounts | Typically has lower minimum balance requirements than money market accounts |

| Liquidity | May have limited check-writing and debit card privileges | Typically has easy access to funds via debit card, checks, or online banking |

| Investment Options | May invest in low-risk, short-term instruments such as commercial paper and treasury bills | Typically does not invest in external instruments |

This comparison highlights the key differences between money market accounts and savings accounts. While money market accounts may offer higher interest rates and more investment options, they may also come with higher fees and minimum balance requirements. Savings accounts, on the other hand, may offer easier access to funds and lower fees, but may also have lower interest rates.

Ultimately, the decision between a money market account and a savings account will depend on your individual financial goals and needs. By carefully evaluating the features of each type of account, you can make an informed decision about which one is right for you.

Real-World Examples: Popular Money Market and Savings Accounts

There are many popular money market and savings accounts available in the market today. Here are a few examples:

Ally Bank’s Money Market Account is a popular option for those looking for a high-yield money market account. It offers a competitive interest rate, low fees, and easy access to funds via online banking and mobile banking apps. Additionally, Ally Bank’s Money Market Account has a low minimum balance requirement and no monthly maintenance fees.

Marcus by Goldman Sachs’ High-Yield Savings Account is another popular option for those looking for a high-yield savings account. It offers a competitive interest rate, no fees, and easy access to funds via online banking and mobile banking apps. Additionally, Marcus by Goldman Sachs’ High-Yield Savings Account has no minimum balance requirement and no monthly maintenance fees.

CIT Bank’s High Yield Savings Account is a popular option for those looking for a high-yield savings account with a low minimum balance requirement. It offers a competitive interest rate, low fees, and easy access to funds via online banking and mobile banking apps. Additionally, CIT Bank’s High Yield Savings Account has a low minimum balance requirement and no monthly maintenance fees.

Discover Bank’s Online Savings Account is a popular option for those looking for a high-yield savings account with easy access to funds. It offers a competitive interest rate, no fees, and easy access to funds via online banking and mobile banking apps. Additionally, Discover Bank’s Online Savings Account has no minimum balance requirement and no monthly maintenance fees.

These are just a few examples of popular money market and savings accounts available in the market today. When choosing a money market or savings account, it’s essential to consider your individual financial goals and needs, as well as the features and benefits of each account.

Maximizing Your Earnings: Strategies for Getting the Most Out of Your Account

To maximize your earnings in a money market account or savings account, there are several strategies you can use. Here are a few tips to help you get the most out of your account:

Optimize your interest rate: One of the most important factors in maximizing your earnings is to optimize your interest rate. Look for accounts that offer competitive interest rates and consider opening multiple accounts to take advantage of different rates.

Minimize fees: Fees can eat into your earnings, so it’s essential to minimize them as much as possible. Look for accounts with low or no fees, and avoid accounts with high maintenance fees or overdraft fees.

Take advantage of compounding interest: Compounding interest can help your earnings grow over time. Look for accounts that offer compounding interest and consider opening a long-term account to take advantage of this feature.

Monitor your account regularly: Regularly monitoring your account can help you stay on top of your earnings and make adjustments as needed. Consider setting up automatic transfers to your account to make saving easier and less prone to being neglected.

Consider a tiered interest rate: Some accounts offer tiered interest rates, which can help you earn more interest on your savings. Consider opening an account with a tiered interest rate to maximize your earnings.

Use a savings calculator: A savings calculator can help you determine how much you need to save each month to reach your financial goals. Consider using a savings calculator to help you stay on track and maximize your earnings.

By following these strategies, you can maximize your earnings in a money market account or savings account and reach your financial goals faster.

Avoiding Common Pitfalls: Mistakes to Watch Out for in Money Market and Savings Accounts

When using money market accounts and savings accounts, there are several common pitfalls to watch out for. Here are a few mistakes to avoid:

Neglecting to read the fine print: Before opening a money market account or savings account, it’s essential to read the fine print and understand the terms and conditions. This includes understanding the interest rate, fees, and minimum balance requirements.

Ignoring fees: Fees can eat into your earnings, so it’s essential to understand the fees associated with your account. This includes maintenance fees, overdraft fees, and other charges.

Failing to monitor interest rates: Interest rates can change over time, so it’s essential to monitor them regularly. This includes checking the interest rate on your account and comparing it to other accounts.

Not taking advantage of compounding interest: Compounding interest can help your earnings grow over time. Make sure to take advantage of this feature by leaving your interest earnings in the account.

Not evaluating your financial goals: Before opening a money market account or savings account, it’s essential to evaluate your financial goals. This includes understanding your risk tolerance, liquidity needs, and investment horizon.

Not considering alternative options: There are many alternative options available, including certificates of deposit (CDs), treasury bills, and other investment vehicles. Make sure to consider these options before opening a money market account or savings account.

By avoiding these common pitfalls, you can make the most of your money market account or savings account and achieve your financial goals.

Conclusion: Making an Informed Decision for Your Financial Future

In conclusion, when it comes to choosing between a money market account and a savings account, it’s essential to make an informed decision that aligns with your financial goals and needs. Both types of accounts have their benefits and drawbacks, and the right choice for you will depend on your individual circumstances.

By understanding the key features and benefits of money market accounts and savings accounts, you can make a more informed decision about which type of account is right for you. Remember to consider your financial goals, risk tolerance, and liquidity needs when making your decision.

Ultimately, the decision between a money market account and a savings account comes down to your individual financial goals and needs. By doing your research and making an informed decision, you can choose the type of account that is right for you and start achieving your financial goals.

Whether you choose a money market account or a savings account, remember to always read the fine print, monitor interest rates, and avoid common pitfalls. By doing so, you can maximize your earnings and achieve your financial goals.

By following the tips and strategies outlined in this article, you can make the most of your money market account or savings account and achieve your financial goals. Remember to always prioritize your financial goals and needs, and don’t hesitate to seek professional advice if you need help making a decision.