What is Net Worth and Why Does it Matter?

Net worth is a fundamental concept in personal finance that represents the total value of an individual’s assets minus their liabilities. In essence, it provides a snapshot of one’s financial health and serves as a benchmark for measuring progress towards long-term financial goals. Understanding net worth is crucial, as it can significantly impact one’s ability to achieve financial freedom and security.

Calculating net worth is a relatively straightforward process. It involves adding up the total value of assets, such as cash, savings, investments, and real estate, and then subtracting the total amount of liabilities, including debts, loans, and credit card balances. The resulting figure provides a clear picture of one’s financial standing.

Net worth is an essential metric for assessing financial progress, particularly when evaluated in the context of age. Net worth percentile by age, for instance, can help individuals gauge their financial performance relative to their peers. By tracking changes in net worth over time, individuals can identify areas for improvement and make informed decisions to optimize their financial strategies.

A strong net worth can provide a sense of financial security, reduce stress, and increase confidence in one’s ability to achieve long-term goals. Conversely, a weak net worth can lead to financial difficulties, decreased credit scores, and reduced financial flexibility. By prioritizing net worth and making conscious financial decisions, individuals can set themselves up for long-term financial success.

Furthermore, understanding net worth can help individuals make informed decisions about investments, savings, and debt reduction. By recognizing the impact of these factors on net worth, individuals can develop effective strategies to improve their financial standing and achieve their goals.

How to Calculate Your Net Worth: A Step-by-Step Guide

Calculating net worth is a straightforward process that requires gathering information about your assets and liabilities. To get started, make a list of all your assets, including:

- Cash and savings accounts

- Investments, such as stocks, bonds, and mutual funds

- Retirement accounts, such as 401(k) and IRA

- Real estate, including your primary residence and any investment properties

- Vehicles, including cars, trucks, and other vehicles

- Other assets, such as jewelry, art, and collectibles

Next, make a list of all your liabilities, including:

- Credit card debt

- Personal loans

- Mortgages

- Car loans

- Student loans

- Other debts, such as medical bills and personal loans

Once you have gathered all the necessary information, subtract your total liabilities from your total assets to calculate your net worth. The resulting figure will give you a clear picture of your financial standing.

For example, let’s say John has the following assets and liabilities:

Assets:

- Cash and savings: $10,000

- Investments: $50,000

- Retirement accounts: $20,000

- Real estate: $200,000

- Vehicles: $10,000

- Other assets: $5,000

Liabilities:

- Credit card debt: $5,000

- Personal loan: $10,000

- Mortgage: $150,000

- Car loan: $10,000

- Student loan: $20,000

John’s total assets are $295,000, and his total liabilities are $195,000. Therefore, his net worth is $100,000.

Understanding your net worth is crucial for making informed financial decisions and achieving long-term financial goals. By tracking changes in your net worth over time, you can identify areas for improvement and make adjustments to optimize your financial strategy.

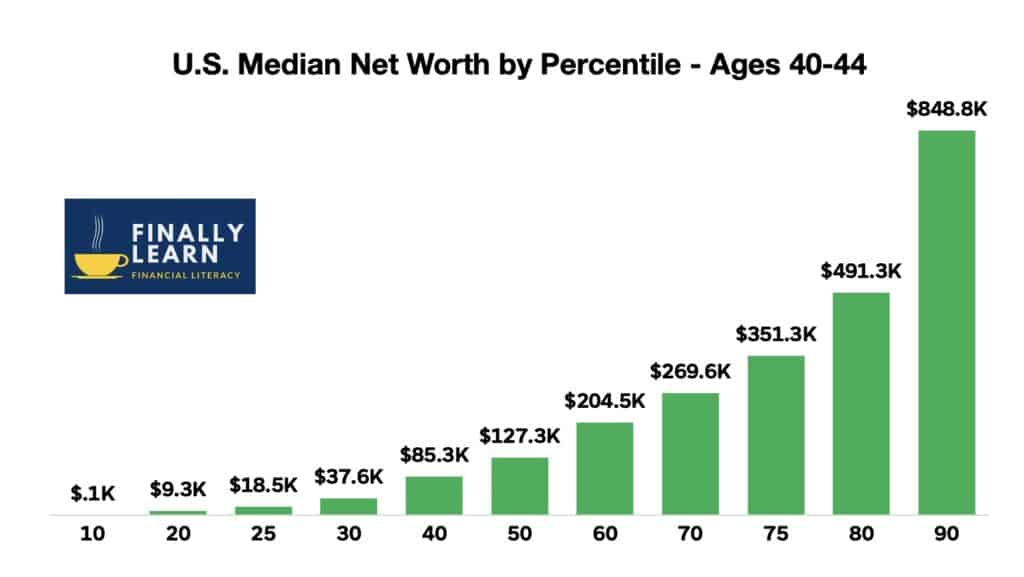

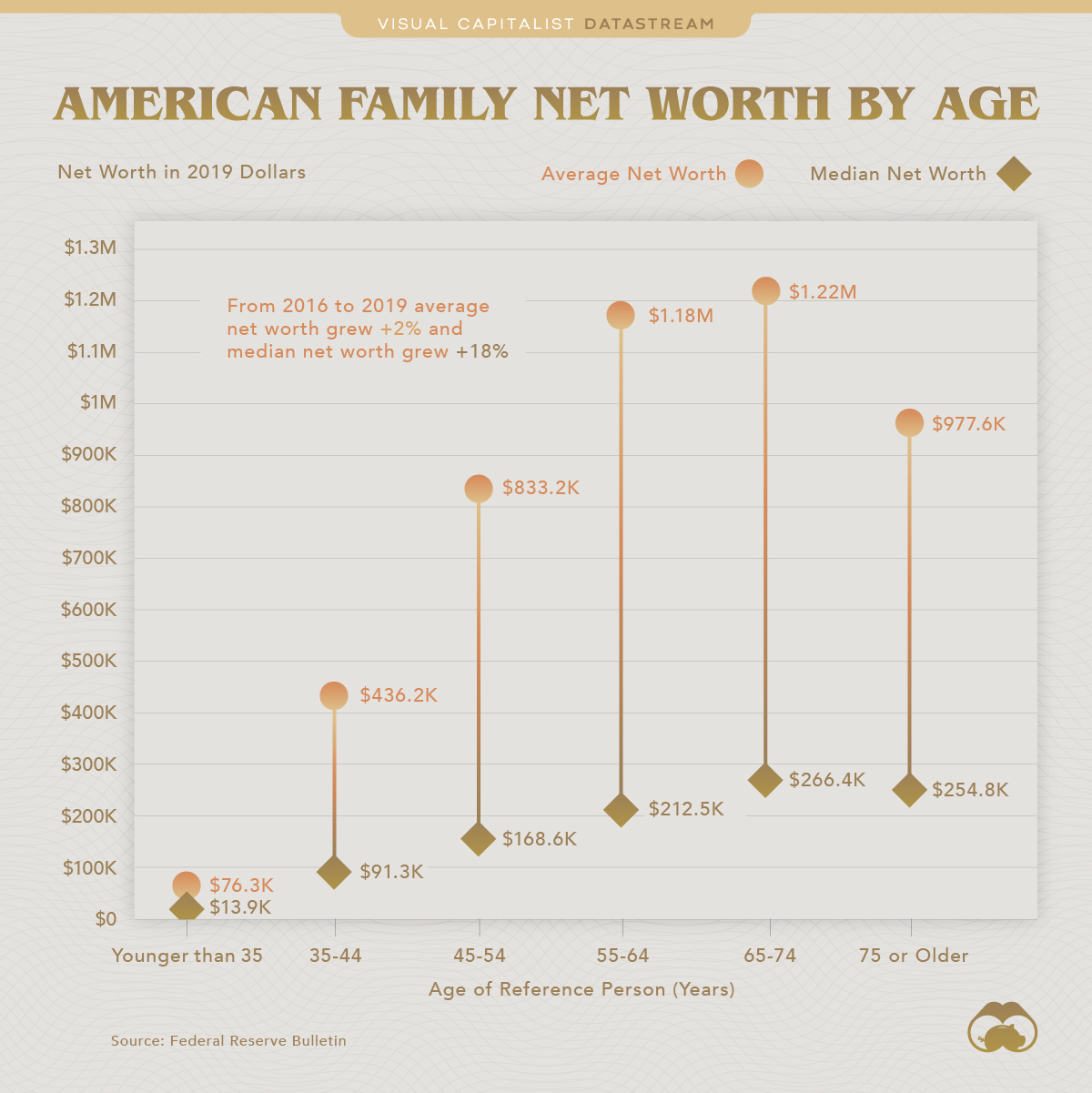

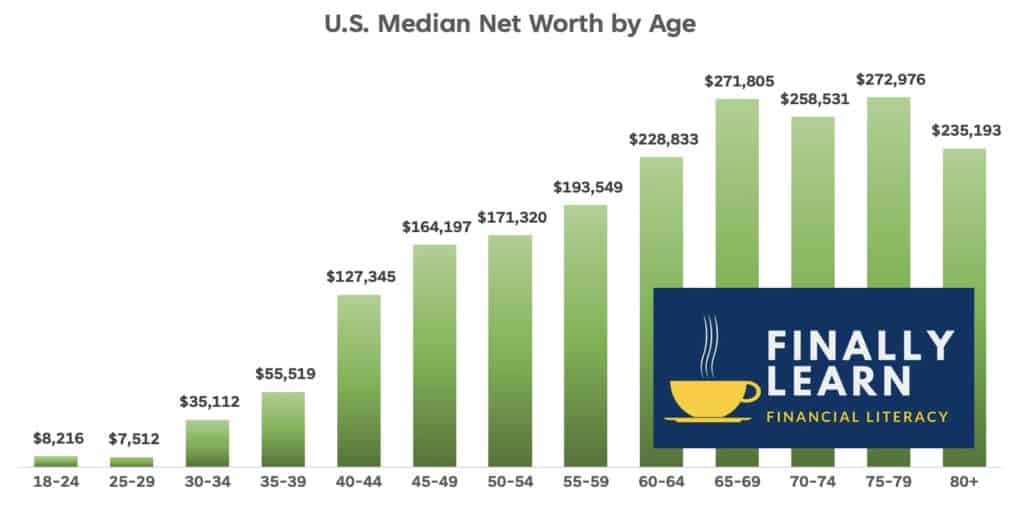

Net Worth Percentiles by Age: A Benchmark for Financial Success

Net worth percentiles by age provide a useful benchmark for assessing financial progress and comparing oneself to others in the same age group. By understanding where you stand in terms of net worth relative to your peers, you can identify areas for improvement and make informed decisions to optimize your financial strategy.

According to data from the Federal Reserve, the average net worth for different age groups in the United States is as follows:

- 20-24 years old: $13,900

- 25-29 years old: $43,800

- 30-34 years old: $91,300

- 35-39 years old: $142,800

- 40-44 years old: $201,500

- 45-49 years old: $264,800

- 50-54 years old: $331,200

- 55-59 years old: $402,800

- 60-64 years old: $474,800

- 65-69 years old: $546,800

- 70 years old and above: $618,800

These figures provide a general idea of the average net worth for each age group, but it’s essential to remember that individual circumstances can vary significantly. Factors such as income, education, occupation, and geographic location can all impact net worth.

Net worth percentiles by age can also help you identify potential financial challenges and opportunities. For example, if you’re in your 30s and your net worth is below the average for your age group, you may need to reassess your spending habits, debt levels, and investment strategies to get back on track.

On the other hand, if you’re in your 50s and your net worth is above the average for your age group, you may be able to consider more aggressive investment strategies or explore alternative sources of income to further boost your net worth.

Ultimately, net worth percentiles by age provide a useful framework for evaluating financial progress and making informed decisions to achieve long-term financial goals. By understanding where you stand relative to your peers and taking proactive steps to improve your financial situation, you can unlock financial freedom and achieve a more secure financial future.

Factors Affecting Net Worth: Income, Savings, Debt, and Investments

Several key factors influence an individual’s net worth, and understanding these elements is crucial for making informed financial decisions. Income, savings rates, debt levels, and investment strategies all play a significant role in determining net worth. By optimizing these factors, individuals can improve their net worth and move closer to achieving their long-term financial goals.

Income is a critical component of net worth, as it provides the foundation for savings and investments. A higher income can lead to increased savings and investments, which in turn can drive net worth growth. However, it’s essential to note that income alone is not a guarantee of net worth growth. Other factors, such as savings rates and debt levels, also play a significant role.

Savings rates are another vital factor in determining net worth. Consistently saving a portion of one’s income can help build wealth over time. A general rule of thumb is to save at least 10% to 20% of one’s income, but this can vary depending on individual circumstances. The key is to find a savings rate that works for you and stick to it.

Debt levels can also significantly impact net worth. High levels of debt, particularly high-interest debt, can erode net worth over time. It’s essential to manage debt effectively by paying off high-interest loans and credit cards, and avoiding new debt whenever possible.

Investment strategies also play a crucial role in determining net worth. A well-diversified investment portfolio can help grow wealth over time, but it’s essential to approach investing with a clear understanding of risk and return. A financial advisor can help individuals develop an investment strategy that aligns with their risk tolerance and financial goals.

Understanding the factors that affect net worth is essential for making informed financial decisions. By optimizing income, savings rates, debt levels, and investment strategies, individuals can improve their net worth and move closer to achieving their long-term financial goals. As individuals progress through different stages of life, their net worth percentile by age can serve as a benchmark for financial success. By monitoring and adjusting these factors, individuals can stay on track and achieve financial freedom.

Strategies for Improving Your Net Worth: Investing, Saving, and Reducing Debt

Improving net worth requires a combination of smart investing, saving, and debt reduction strategies. By implementing these tactics, individuals can increase their net worth and move closer to achieving their long-term financial goals. Here are some actionable tips to help improve net worth:

Investing is a crucial component of net worth growth. A well-diversified investment portfolio can help grow wealth over time. Consider the following investment strategies:

- Start early: The power of compound interest can help grow investments over time.

- Diversify: Spread investments across different asset classes, such as stocks, bonds, and real estate.

- Take calculated risks: Higher-risk investments can potentially yield higher returns, but it’s essential to understand the risks involved.

Saving is another essential aspect of net worth growth. Consider the following savings techniques:

- Automate savings: Set up automatic transfers from checking to savings or investment accounts.

- Take advantage of tax-advantaged accounts: Utilize tax-deferred accounts, such as 401(k) or IRA, to save for retirement.

- Build an emergency fund: Maintain a cushion of easily accessible savings to cover unexpected expenses.

Reducing debt is also critical for improving net worth. Consider the following debt reduction methods:

- Prioritize high-interest debt: Focus on paying off high-interest loans and credit cards first.

- Consolidate debt: Combine multiple debts into a single, lower-interest loan or credit card.

- Pay more than the minimum: Paying more than the minimum payment on debts can help reduce principal balances faster.

By implementing these strategies, individuals can improve their net worth and move closer to achieving their long-term financial goals. Remember, net worth percentile by age can serve as a benchmark for financial success. By monitoring and adjusting these factors, individuals can stay on track and achieve financial freedom.

For example, consider a 35-year-old individual with a net worth of $100,000. By implementing a combination of smart investing, saving, and debt reduction strategies, they can potentially increase their net worth to $200,000 by age 45. This would put them in a higher net worth percentile by age, indicating improved financial health and a greater likelihood of achieving long-term financial goals.

Common Mistakes to Avoid When Building Net Worth

Building net worth requires a combination of smart financial decisions and avoiding common pitfalls that can hinder progress. By understanding these mistakes, individuals can take proactive steps to avoid them and stay on track to achieving their long-term financial goals.

Lifestyle inflation is a common mistake that can erode net worth over time. As income increases, individuals may be tempted to inflate their lifestyle by spending more on luxuries, rather than saving and investing for the future. To avoid this mistake, it’s essential to prioritize saving and investing, and to avoid making impulse purchases.

Lack of emergency funds is another common mistake that can hinder net worth growth. Without a cushion of easily accessible savings, individuals may be forced to go into debt or make costly financial decisions when unexpected expenses arise. To avoid this mistake, it’s essential to build an emergency fund that covers at least 3-6 months of living expenses.

Poor investment decisions can also significantly impact net worth. Investing in high-risk or illiquid assets can lead to significant losses, while failing to diversify investments can lead to missed opportunities. To avoid this mistake, it’s essential to develop a well-diversified investment portfolio and to seek professional advice when needed.

Not monitoring net worth percentile by age is another mistake that can hinder progress. By failing to track progress and adjust financial strategies accordingly, individuals may miss opportunities to improve their net worth and achieve their long-term financial goals. To avoid this mistake, it’s essential to regularly review net worth and adjust financial strategies as needed.

Finally, not having a long-term financial plan can also hinder net worth growth. Without a clear plan, individuals may struggle to make progress towards their financial goals, and may be more likely to make costly financial mistakes. To avoid this mistake, it’s essential to develop a comprehensive financial plan that takes into account income, expenses, savings, investments, and debt reduction.

By avoiding these common mistakes, individuals can stay on track to achieving their long-term financial goals and improving their net worth. Remember, building net worth takes time and discipline, but with the right strategies and mindset, it is possible to achieve financial freedom and security.

Net Worth and Retirement: Planning for a Secure Financial Future

Retirement planning is a critical aspect of achieving financial freedom, and net worth plays a significant role in determining a secure financial future. Understanding the importance of net worth in retirement planning can help individuals make informed decisions about their financial goals and develop a sustainable plan for the future.

Savings is a crucial component of retirement planning, and net worth can provide a clear picture of an individual’s savings progress. By tracking net worth percentile by age, individuals can assess their savings progress and make adjustments to their plan as needed. For example, if an individual’s net worth is below the average for their age group, they may need to increase their savings rate or adjust their investment strategy.

Investments also play a critical role in retirement planning, and net worth can help individuals determine the right investment strategy for their goals. By considering their net worth and risk tolerance, individuals can develop an investment plan that balances growth and income, ensuring a sustainable retirement income stream.

Debt reduction is another essential aspect of retirement planning, and net worth can help individuals prioritize their debt repayment strategy. By focusing on high-interest debt and creating a plan to pay off debt before retirement, individuals can reduce their expenses and increase their net worth, ensuring a more secure financial future.

Creating a sustainable retirement plan requires a comprehensive approach that considers multiple factors, including net worth, income, expenses, and investments. By understanding the importance of net worth in retirement planning, individuals can develop a plan that ensures a secure financial future and achieves their long-term goals.

For example, consider a 50-year-old individual with a net worth of $500,000, who is planning to retire in 10 years. By tracking their net worth percentile by age and adjusting their investment strategy and savings rate, they can increase their net worth to $750,000 by retirement, providing a sustainable income stream and ensuring a secure financial future.

In conclusion, net worth plays a critical role in retirement planning, and understanding its importance can help individuals make informed decisions about their financial goals. By tracking net worth percentile by age and developing a comprehensive plan that considers multiple factors, individuals can create a sustainable retirement plan that ensures a secure financial future.

Conclusion: Taking Control of Your Financial Future

In conclusion, understanding net worth and its importance in measuring financial health is crucial for achieving long-term financial goals. By calculating net worth, tracking net worth percentile by age, and implementing strategies to improve it, individuals can take control of their financial futures and achieve financial freedom.

Throughout this article, we have discussed the concept of net worth, its calculation, and its significance in assessing financial progress. We have also explored the key factors that influence net worth, including income, savings rates, debt levels, and investment strategies. Additionally, we have provided actionable advice on how to improve net worth, including investment strategies, savings techniques, and debt reduction methods.

By taking proactive steps to improve net worth, individuals can create a sustainable financial future, achieve their long-term goals, and enjoy financial freedom. Remember, net worth is not just a number; it’s a reflection of one’s financial health and a benchmark for financial success.

As individuals progress through different stages of life, their net worth percentile by age can serve as a benchmark for financial success. By monitoring and adjusting their financial strategies accordingly, individuals can stay on track and achieve their long-term financial goals.

In today’s fast-paced and ever-changing financial landscape, it’s essential to stay informed and adapt to new challenges and opportunities. By understanding net worth and its importance in measuring financial health, individuals can make informed decisions about their financial futures and achieve financial freedom.

Take control of your financial future today by calculating your net worth, tracking your net worth percentile by age, and implementing strategies to improve it. With the right mindset and financial strategies, you can achieve financial freedom and enjoy a secure financial future.