Breaking Free from the Cubicle: The Rise of Remote Work

The modern workplace is undergoing a significant transformation, with remote work emerging as a viable and increasingly popular option. The traditional 9-to-5 office routine is no longer the only way to be productive, and many employees are seeking more flexibility and work-life balance. Part-time jobs with health insurance that can be done from home are becoming more sought after, as they offer the perfect blend of flexibility, security, and benefits.

According to a recent survey, 63% of companies have remote workers, and the number is expected to grow in the coming years. This shift towards remote work is driven by advances in technology, changing workforce demographics, and the need for businesses to stay competitive in a global market. As a result, part-time remote jobs with health insurance are becoming more mainstream, offering employees the opportunity to work from the comfort of their own homes while still receiving comprehensive benefits.

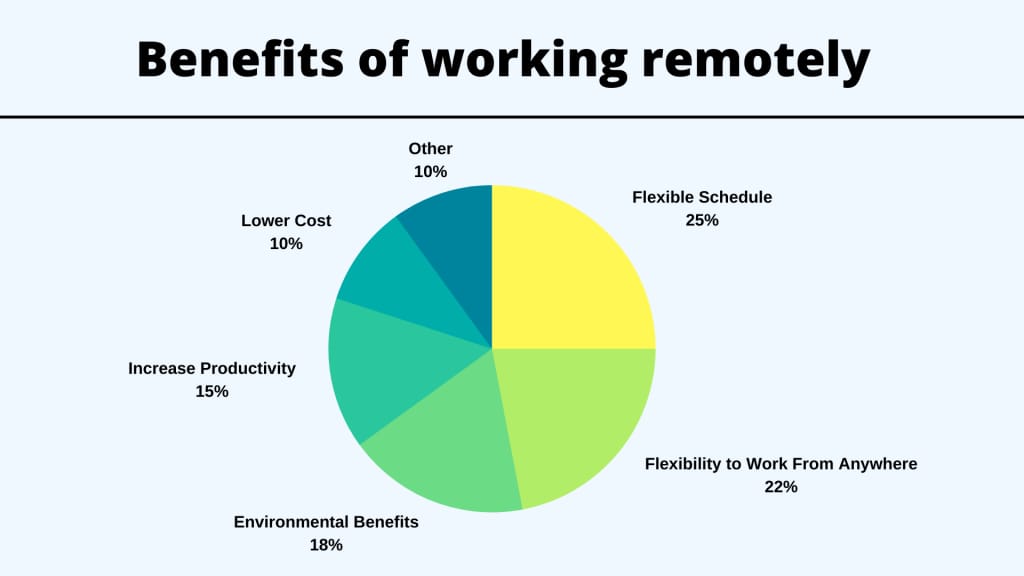

The benefits of remote work are numerous, including increased flexibility, reduced commuting time, and improved work-life balance. Without the constraints of a traditional office environment, remote workers can create their own schedules, work at their own pace, and achieve a better balance between work and personal life. Additionally, remote work can lead to increased productivity, reduced stress, and improved overall well-being.

As the demand for part-time remote jobs with health insurance continues to grow, companies are responding by offering more flexible work arrangements and comprehensive benefits packages. This shift towards remote work is not only beneficial for employees but also for employers, who can tap into a global talent pool, reduce overhead costs, and improve employee satisfaction and retention.

In the next section, we will explore the key factors to consider when searching for a part-time remote job with health insurance, including job requirements, company culture, and benefits packages.

What to Look for in a Part-Time Remote Job with Health Insurance

When searching for a part-time remote job with health insurance, there are several key factors to consider. Job requirements, company culture, and benefits packages are all crucial elements to evaluate when determining whether a job is a good fit. In this section, we will explore each of these factors in more detail, providing you with a comprehensive understanding of what to look for in a part-time remote job with health insurance.

Job requirements are a critical aspect of any job search. When looking for a part-time remote job with health insurance, consider the type of work you will be doing, the number of hours you will be working, and the level of experience required. Make sure you understand the job responsibilities and requirements, and that you have the necessary skills and qualifications to perform the job successfully.

Company culture is another important factor to consider. A company’s culture can greatly impact your job satisfaction and overall well-being. Look for companies that prioritize work-life balance, offer flexible scheduling, and provide a supportive and inclusive work environment. A positive company culture can make a big difference in your job satisfaction and overall quality of life.

Benefits packages are also a crucial aspect of any job search. When looking for a part-time remote job with health insurance, make sure to evaluate the benefits package carefully. Consider the type of health insurance offered, the level of coverage, and any additional benefits such as dental or vision insurance. Also, consider other benefits such as paid time off, retirement plans, and professional development opportunities.

In addition to these factors, it’s also important to consider the company’s reputation and stability. Research the company’s history, mission, and values to get a sense of their commitment to their employees and customers. Also, check online reviews and ratings to get a sense of the company’s reputation and level of customer satisfaction.

By carefully evaluating these factors, you can find a part-time remote job with health insurance that meets your needs and provides you with a fulfilling and rewarding career.

Top Industries for Part-Time Remote Jobs with Health Insurance

Certain industries are more likely to offer part-time remote jobs with health insurance than others. In this section, we will highlight some of the top industries that commonly offer these types of jobs. By understanding which industries are more likely to offer part-time remote jobs with health insurance, you can focus your job search and increase your chances of finding a job that meets your needs.

Healthcare is one industry that frequently offers part-time remote jobs with health insurance. Many healthcare companies, including hospitals, medical groups, and insurance companies, offer remote work options for nurses, doctors, and other healthcare professionals. These jobs may involve working from home, telemedicine, or other forms of remote care.

Technology is another industry that commonly offers part-time remote jobs with health insurance. Many tech companies, including software developers, IT firms, and cybersecurity companies, offer remote work options for employees. These jobs may involve working from home, coding, testing, or other technical tasks.

Education is also an industry that frequently offers part-time remote jobs with health insurance. Many educational institutions, including universities, colleges, and online schools, offer remote work options for teachers, instructors, and other education professionals. These jobs may involve teaching online, developing curriculum, or other educational tasks.

Other industries that may offer part-time remote jobs with health insurance include finance, marketing, and customer service. These jobs may involve working from home, answering customer calls, or performing other tasks that can be done remotely.

When searching for part-time remote jobs with health insurance, it’s essential to consider the industry and the type of job you’re looking for. By focusing on industries that commonly offer these types of jobs, you can increase your chances of finding a job that meets your needs and provides you with the benefits you’re looking for.

How to Search for Part-Time Remote Jobs with Health Insurance

Searching for part-time remote jobs with health insurance can be a challenging task, but there are several strategies and resources that can help. In this section, we will provide tips and advice on how to search for part-time remote jobs with health insurance, including job boards, company websites, and professional networks.

One of the most effective ways to search for part-time remote jobs with health insurance is to use job boards that specialize in remote work. Some popular job boards for remote work include Remote.co, We Work Remotely, and FlexJobs. These job boards allow you to search for part-time remote jobs with health insurance by location, job title, and industry.

Another way to search for part-time remote jobs with health insurance is to visit the websites of companies that offer remote work options. Many companies, including Amazon, UnitedHealth Group, and IBM, offer part-time remote jobs with health insurance. You can search for these companies on job search websites such as LinkedIn or Glassdoor, and then visit their websites to learn more about their remote work options.

Professional networks can also be a valuable resource when searching for part-time remote jobs with health insurance. Joining professional networks such as LinkedIn or Remote Workers can connect you with other professionals who work remotely and may have knowledge of part-time remote job opportunities with health insurance.

When searching for part-time remote jobs with health insurance, it’s also important to use keywords that are relevant to your job search. Some keywords to use include “part-time remote jobs with health insurance,” “remote work with benefits,” and “telecommute jobs with health insurance.” Using these keywords can help you find job listings that match your search criteria.

Finally, it’s essential to be proactive and persistent when searching for part-time remote jobs with health insurance. It may take some time to find the right job, but with the right strategies and resources, you can increase your chances of success.

Companies that Offer Part-Time Remote Jobs with Health Insurance

Several companies offer part-time remote jobs with health insurance, providing employees with the flexibility and benefits they need to thrive. In this section, we will showcase some of the top companies that offer part-time remote jobs with health insurance, including Amazon, UnitedHealth Group, and IBM.

Amazon is one of the largest employers of remote workers, offering a range of part-time remote jobs with health insurance. From customer service representatives to software developers, Amazon provides employees with the flexibility to work from home and receive comprehensive benefits, including health insurance.

UnitedHealth Group is another company that offers part-time remote jobs with health insurance. As a leading healthcare company, UnitedHealth Group provides employees with a range of benefits, including health insurance, dental insurance, and vision insurance. Remote workers can choose from a variety of part-time jobs, including customer service representatives, claims examiners, and medical coders.

IBM is a technology company that offers part-time remote jobs with health insurance. From software developers to data analysts, IBM provides employees with the flexibility to work from home and receive comprehensive benefits, including health insurance. IBM also offers a range of training and development programs to help employees advance their careers.

Other companies that offer part-time remote jobs with health insurance include Convergys, SYKES, and Working Solutions. These companies provide employees with the flexibility to work from home and receive comprehensive benefits, including health insurance.

When searching for part-time remote jobs with health insurance, it’s essential to research companies that offer these types of jobs. By understanding the companies that offer part-time remote jobs with health insurance, you can increase your chances of finding a job that meets your needs and provides you with the benefits you deserve.

Freelance and Contract Work: Alternative Options for Part-Time Remote Jobs with Health Insurance

Freelance and contract work can be alternative options for part-time remote jobs with health insurance. While these types of work arrangements may not offer traditional employer-provided health insurance, they can provide flexibility and autonomy for workers. In this section, we will discuss the benefits and drawbacks of freelance and contract work as alternative options for part-time remote jobs with health insurance.

One of the benefits of freelance and contract work is the flexibility to choose your own projects and clients. This can be especially appealing to workers who value autonomy and independence. Additionally, freelance and contract work can provide opportunities for professional development and skill-building, as workers can take on a variety of projects and clients.

However, freelance and contract work also have some drawbacks. One of the main drawbacks is the lack of traditional employer-provided health insurance. Freelancers and contractors are responsible for securing their own health insurance, which can be expensive and time-consuming. Additionally, freelance and contract work can be unpredictable and unstable, with variable income and uncertain benefits.

Despite these drawbacks, many workers are turning to freelance and contract work as a way to achieve flexibility and autonomy. According to a recent survey, 57% of freelancers report being satisfied with their work arrangement, citing flexibility and autonomy as key benefits. Additionally, 63% of freelancers report being able to choose their own projects and clients, which can be a major advantage for workers who value independence.

For workers who are considering freelance or contract work as an alternative to part-time remote jobs with health insurance, there are several options to consider. One option is to purchase private health insurance, which can be expensive but provides comprehensive coverage. Another option is to join a professional association or union, which may offer group health insurance rates. Finally, workers can also consider negotiating with clients or employers to provide health insurance benefits as part of their contract.

Negotiating Health Insurance Benefits as a Part-Time Remote Worker

As a part-time remote worker, negotiating health insurance benefits can be a crucial aspect of your employment contract. While some companies may offer comprehensive health insurance benefits to their part-time remote workers, others may not. In this section, we will offer advice on how to negotiate health insurance benefits as a part-time remote worker, including understanding company policies and advocating for yourself.

Before negotiating health insurance benefits, it’s essential to understand the company’s policies and procedures. Research the company’s benefits package and understand what is included and what is not. This will help you to identify areas where you can negotiate and advocate for yourself.

When negotiating health insurance benefits, it’s crucial to be clear and direct about your needs and expectations. Explain to your employer why health insurance benefits are essential to you and how they will impact your ability to perform your job. Be prepared to provide evidence of your research and to make a strong case for why you deserve comprehensive health insurance benefits.

Some tips for negotiating health insurance benefits as a part-time remote worker include:

- Be flexible and open-minded: Be willing to consider different options and compromises.

- Do your research: Understand the company’s policies and procedures and be prepared to make a strong case for why you deserve comprehensive health insurance benefits.

- Be clear and direct: Explain your needs and expectations clearly and directly.

- Be prepared to advocate for yourself: Be prepared to make a strong case for why you deserve comprehensive health insurance benefits.

By following these tips and being prepared to negotiate, you can increase your chances of securing comprehensive health insurance benefits as a part-time remote worker.

Conclusion: Finding the Right Part-Time Remote Job with Health Insurance for You

In conclusion, finding a part-time remote job with health insurance can be a challenging task, but with the right strategies and resources, it is possible. By understanding the benefits of remote work, knowing what to look for in a part-time remote job with health insurance, and utilizing the right job search strategies, you can increase your chances of finding a job that meets your needs and goals.

Remember to consider the key factors to look for in a part-time remote job with health insurance, including job requirements, company culture, and benefits packages. Also, be sure to research companies that offer part-time remote jobs with health insurance and utilize job boards, company websites, and professional networks to find job opportunities.

Additionally, consider freelance and contract work as alternative options for part-time remote jobs with health insurance. These types of work arrangements can provide flexibility and autonomy, but may require you to negotiate your own health insurance benefits.

By following the tips and advice outlined in this article, you can find a part-time remote job with health insurance that meets your needs and goals. Remember to stay flexible, be open-minded, and be prepared to advocate for yourself throughout the job search process.

Start your search today and find a part-time remote job with health insurance that provides you with the flexibility, autonomy, and benefits you deserve.