Breaking Free from Debt: Understanding the Benefits of Consolidation

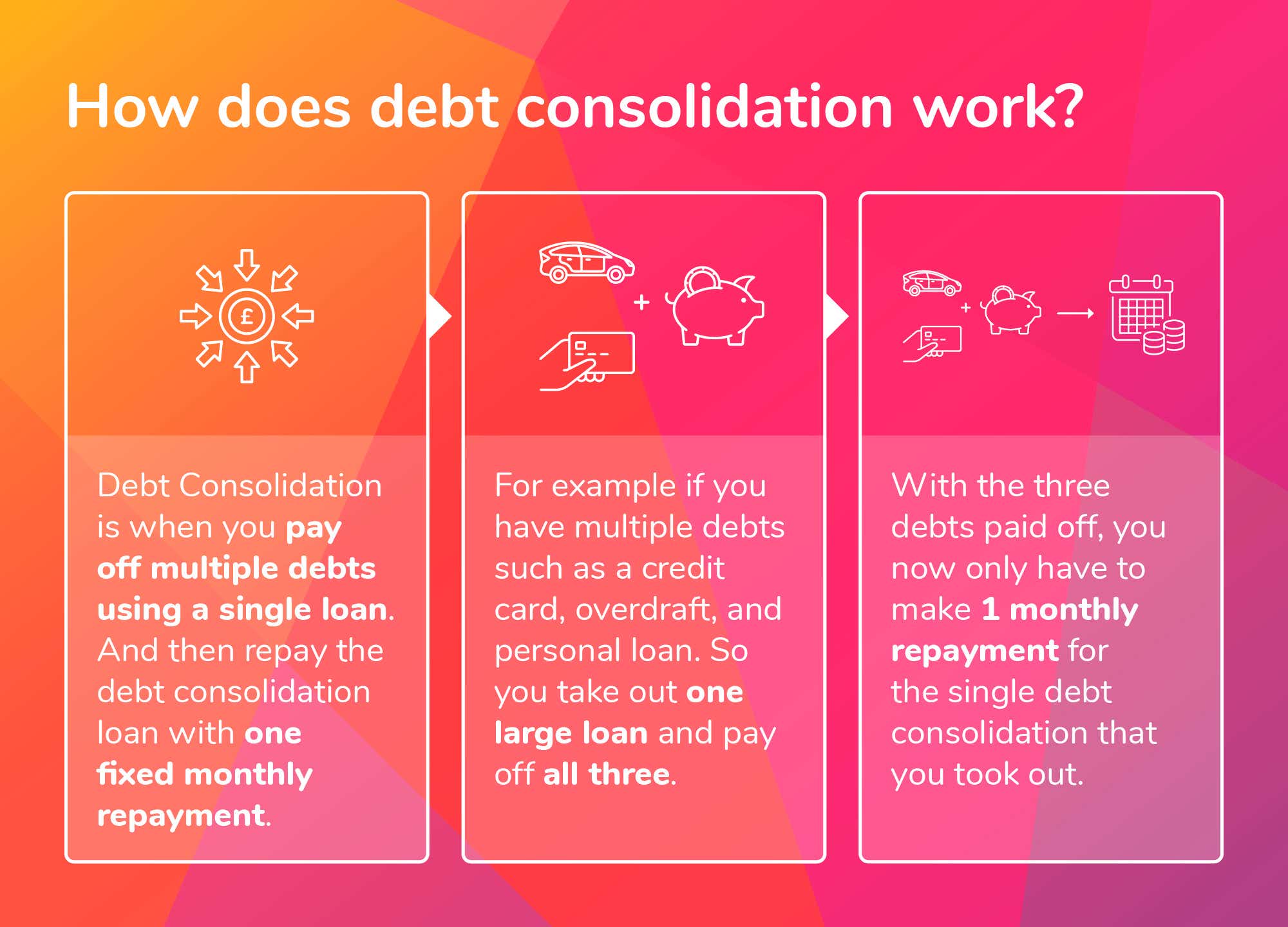

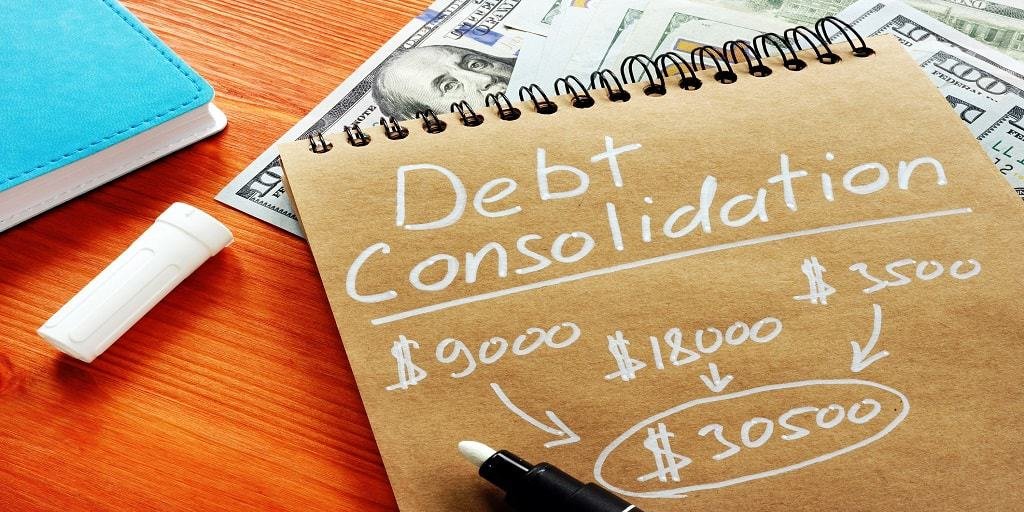

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan with a lower interest rate, lower monthly payments, and a simplified repayment schedule. This approach can be particularly effective for individuals struggling with multiple debts, such as credit card balances, personal loans, and medical bills. By consolidating debt with personal loans, individuals can break free from the debt cycle and achieve financial stability.

One of the primary benefits of debt consolidation is reduced monthly payments. By combining multiple debts into a single loan, individuals can lower their overall monthly payments, making it easier to manage their finances. Additionally, debt consolidation often involves lower interest rates, which can save individuals money on interest charges over time. For example, consolidating high-interest credit card debt into a personal loan with a lower interest rate can help individuals save hundreds or even thousands of dollars in interest charges.

Another benefit of debt consolidation is simplified financial management. When individuals have multiple debts with different due dates, interest rates, and payment amounts, it can be challenging to keep track of their finances. By consolidating debt into a single loan, individuals can simplify their financial management, making it easier to stay on top of their payments and avoid late fees.

Personal loans to consolidate debt can also provide individuals with a fresh start. By combining multiple debts into a single loan, individuals can eliminate the stress and anxiety associated with managing multiple debts. This can help individuals feel more in control of their finances and more confident in their ability to achieve financial stability.

Furthermore, debt consolidation can also help individuals improve their credit scores. By making timely payments on a consolidated loan, individuals can demonstrate responsible credit behavior, which can help improve their credit scores over time. This can be particularly beneficial for individuals who have struggled with credit card debt or other types of debt in the past.

In summary, debt consolidation with personal loans can provide individuals with a range of benefits, including reduced monthly payments, lower interest rates, simplified financial management, and improved credit scores. By understanding the benefits of debt consolidation, individuals can take the first step towards breaking free from the debt cycle and achieving financial stability.

How to Choose the Right Personal Loan for Debt Consolidation

When it comes to consolidating debt with personal loans, selecting the right loan is crucial to achieving financial stability. With numerous lenders offering personal loans to consolidate debt, it can be overwhelming to choose the best option. To make an informed decision, consider the following key factors:

Interest Rates: The interest rate on a personal loan can significantly impact the overall cost of the loan. Look for lenders offering competitive interest rates, and consider factors such as credit score, loan term, and loan amount. A lower interest rate can save you money on interest charges over time, making it easier to pay off the loan.

Fees: In addition to interest rates, consider the fees associated with the loan. Origination fees, late payment fees, and prepayment fees can add up quickly, increasing the overall cost of the loan. Opt for lenders with minimal or no fees to save money.

Loan Terms: The loan term, or repayment period, can range from a few months to several years. Consider a loan term that aligns with your financial goals and budget. A longer loan term may result in lower monthly payments, but you’ll pay more in interest over time. A shorter loan term, on the other hand, may result in higher monthly payments, but you’ll pay less in interest.

Lender Reputation: Research the lender’s reputation and read reviews from previous customers. A reputable lender will offer transparent loan terms, competitive interest rates, and excellent customer service. Be wary of lenders with poor reviews or a history of predatory lending practices.

Credit Score Requirements: Some lenders may have strict credit score requirements, while others may be more lenient. If you have a poor credit score, consider lenders that cater to borrowers with bad credit. Keep in mind that these loans may come with higher interest rates or fees.

Loan Amount: Consider the loan amount you need to consolidate your debt. Ensure the lender offers loan amounts that meet your needs, and consider the impact of borrowing too much or too little. Borrowing too much may result in higher monthly payments, while borrowing too little may not fully address your debt.

By carefully evaluating these factors, you can choose the right personal loan to consolidate debt and achieve financial stability. Remember to always read the fine print, ask questions, and seek professional advice if needed. With the right loan, you can break free from the debt cycle and start building a brighter financial future.

When searching for personal loans to consolidate debt, consider online lenders, credit unions, and traditional banks. Online lenders often offer competitive interest rates and flexible loan terms, while credit unions and traditional banks may offer more personalized service and competitive rates. By comparing rates and terms from multiple lenders, you can find the best personal loan to consolidate debt and achieve your financial goals.

Debt Consolidation Loans: A Closer Look at the Options

When it comes to consolidating debt with personal loans, there are several options available. Understanding the different types of loans can help individuals make an informed decision and choose the best loan for their needs. Here are some of the most common types of personal loans to consolidate debt:

Unsecured Loans: Unsecured loans are a popular option for debt consolidation. These loans are not secured by collateral, such as a house or car, and are often offered by online lenders, credit unions, and traditional banks. Unsecured loans typically have higher interest rates than secured loans, but they offer more flexibility and are often easier to qualify for.

Secured Loans: Secured loans, on the other hand, are secured by collateral, such as a house or car. These loans often have lower interest rates than unsecured loans, but they require borrowers to put their assets at risk. Secured loans are often offered by traditional banks and credit unions, and are typically used for larger loan amounts.

Balance Transfer Loans: Balance transfer loans are a type of personal loan that allows borrowers to transfer their existing credit card balances to a new loan with a lower interest rate. These loans often have 0% introductory APRs, which can save borrowers money on interest charges. However, balance transfer loans often come with fees, such as balance transfer fees and origination fees.

Debt Consolidation Loans with Co-Signers: Some lenders offer debt consolidation loans with co-signers, which can be beneficial for borrowers with poor credit. Co-signers with good credit can help borrowers qualify for loans with lower interest rates and more favorable terms. However, co-signers are equally responsible for repaying the loan, which can be a risk if the borrower defaults.

Peer-to-Peer Loans: Peer-to-peer loans are a type of personal loan that allows borrowers to borrow from individual investors. These loans often have lower interest rates than traditional loans, and are often offered by online lenders. However, peer-to-peer loans can be riskier than traditional loans, as borrowers are borrowing from individual investors rather than established lenders.

When choosing a personal loan to consolidate debt, it’s essential to consider the interest rate, fees, loan terms, and lender reputation. By understanding the different types of loans available, individuals can make an informed decision and choose the best loan for their needs. Remember to always read the fine print, ask questions, and seek professional advice if needed.

Personal loans to consolidate debt can be a powerful tool for achieving financial stability. By choosing the right loan and managing finances effectively, individuals can break free from the debt cycle and start building a brighter financial future.

Managing Your Finances: Tips for Successful Debt Consolidation

After consolidating debt with personal loans, it’s essential to manage finances effectively to ensure long-term financial stability. Here are some practical tips to help individuals manage their finances successfully:

Create a Budget: A budget is a powerful tool for managing finances. It helps individuals track their income and expenses, identify areas for cost-cutting, and allocate funds towards debt repayment. Create a budget that accounts for all income and expenses, and prioritize debt repayment.

Prioritize Expenses: Prioritizing expenses is crucial for managing finances effectively. Essential expenses, such as rent/mortgage, utilities, and food, should be prioritized over non-essential expenses, such as entertainment and hobbies. Allocate funds towards essential expenses first, and then allocate any remaining funds towards debt repayment.

Build an Emergency Fund: An emergency fund is a safety net that helps individuals cover unexpected expenses, such as car repairs or medical bills. Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account. This fund will help individuals avoid accumulating new debt when unexpected expenses arise.

Monitor Credit Scores: Credit scores play a significant role in determining interest rates and loan terms. Monitor credit scores regularly, and work towards improving them by making timely payments, reducing debt, and avoiding new credit inquiries.

Avoid New Debt: Avoid accumulating new debt, especially during the debt consolidation process. Avoid using credit cards, and refrain from taking on new loans or credit lines. Focus on repaying existing debt, and avoid accumulating new debt that can hinder progress.

Communicate with Creditors: Communicate with creditors regularly, and keep them informed about any changes in income or expenses. This can help creditors understand individual circumstances and work towards finding a solution that benefits both parties.

Consider a Debt Repayment Plan: A debt repayment plan can help individuals stay on track with debt repayment. Consider working with a credit counselor or financial advisor to create a personalized debt repayment plan that suits individual needs and goals.

By following these tips, individuals can manage their finances effectively after consolidating debt with personal loans. Remember, debt consolidation is just the first step towards achieving financial stability. Ongoing financial management and discipline are essential for maintaining long-term financial health.

Personal loans to consolidate debt can be a powerful tool for achieving financial stability. By managing finances effectively and following these tips, individuals can break free from the debt cycle and start building a brighter financial future.

Common Mistakes to Avoid When Consolidating Debt with Personal Loans

Consolidating debt with personal loans can be a powerful tool for achieving financial stability. However, there are common pitfalls to avoid when consolidating debt with personal loans. Here are some of the most common mistakes to avoid:

Accumulating New Debt: One of the most common mistakes to avoid when consolidating debt with personal loans is accumulating new debt. This can happen when individuals use credit cards or take on new loans while still paying off existing debt. To avoid this, focus on repaying existing debt and avoid accumulating new debt.

Neglecting Credit Scores: Credit scores play a significant role in determining interest rates and loan terms. Neglecting credit scores can lead to higher interest rates and less favorable loan terms. Monitor credit scores regularly, and work towards improving them by making timely payments, reducing debt, and avoiding new credit inquiries.

Ignoring Loan Terms: Ignoring loan terms can lead to unexpected fees, penalties, and interest charges. Read the fine print, and understand the loan terms before signing any agreement. Pay attention to interest rates, fees, loan terms, and repayment schedules.

Not Creating a Budget: Not creating a budget can lead to overspending and accumulating new debt. Create a budget that accounts for all income and expenses, and prioritize debt repayment. Allocate funds towards essential expenses first, and then allocate any remaining funds towards debt repayment.

Not Prioritizing Expenses: Not prioritizing expenses can lead to overspending and accumulating new debt. Prioritize essential expenses, such as rent/mortgage, utilities, and food, over non-essential expenses, such as entertainment and hobbies. Allocate funds towards essential expenses first, and then allocate any remaining funds towards debt repayment.

Not Building an Emergency Fund: Not building an emergency fund can lead to accumulating new debt when unexpected expenses arise. Build an emergency fund that covers 3-6 months’ worth of living expenses. This fund will help individuals avoid accumulating new debt when unexpected expenses arise.

By avoiding these common mistakes, individuals can successfully consolidate debt with personal loans and achieve financial stability. Remember, debt consolidation is just the first step towards achieving financial stability. Ongoing financial management and discipline are essential for maintaining long-term financial health.

Personal loans to consolidate debt can be a powerful tool for achieving financial stability. By avoiding common mistakes and following best practices, individuals can break free from the debt cycle and start building a brighter financial future.

Real-Life Examples: How Personal Loans Can Help with Debt Consolidation

Personal loans to consolidate debt can be a powerful tool for achieving financial stability. Here are some real-life examples of individuals who have successfully consolidated debt using personal loans:

Example 1: Sarah’s Story

Sarah had accumulated $10,000 in credit card debt with an average interest rate of 20%. She was struggling to make monthly payments and was feeling overwhelmed by her debt. Sarah decided to consolidate her debt with a personal loan, which offered a lower interest rate of 12% and a longer repayment period. With the personal loan, Sarah was able to reduce her monthly payments by $200 and save $1,000 in interest charges over the life of the loan.

Example 2: John’s Story

John had accumulated $20,000 in debt from multiple sources, including credit cards, personal loans, and medical bills. He was struggling to keep track of his debt and was feeling overwhelmed by the number of payments he had to make each month. John decided to consolidate his debt with a personal loan, which offered a lower interest rate and a single monthly payment. With the personal loan, John was able to simplify his finances and reduce his monthly payments by $500.

Example 3: Emily’s Story

Emily had accumulated $5,000 in debt from a car loan and credit cards. She was struggling to make monthly payments and was feeling overwhelmed by her debt. Emily decided to consolidate her debt with a personal loan, which offered a lower interest rate and a longer repayment period. With the personal loan, Emily was able to reduce her monthly payments by $100 and save $500 in interest charges over the life of the loan.

These examples illustrate the benefits of using personal loans to consolidate debt. By consolidating debt with a personal loan, individuals can reduce their monthly payments, save money on interest charges, and simplify their finances. However, it’s essential to remember that debt consolidation is just the first step towards achieving financial stability. Ongoing financial management and discipline are essential for maintaining long-term financial health.

Personal loans to consolidate debt can be a powerful tool for achieving financial stability. By understanding the benefits and challenges of debt consolidation, individuals can make informed decisions about their financial future.

Alternatives to Personal Loans: Exploring Other Debt Consolidation Options

While personal loans to consolidate debt can be a powerful tool for achieving financial stability, they may not be the best option for everyone. Here are some alternative debt consolidation options to consider:

Credit Counseling: Credit counseling is a free or low-cost service that provides individuals with personalized advice and guidance on managing debt. Credit counselors can help individuals create a budget, prioritize expenses, and develop a plan to pay off debt. Credit counseling agencies are often non-profit organizations that offer free or low-cost services.

Debt Management Plans: Debt management plans are a type of debt consolidation that involves working with a credit counselor to create a plan to pay off debt. Debt management plans typically involve consolidating debt into a single monthly payment, which is then distributed to creditors. Debt management plans can be a good option for individuals who are struggling to make multiple payments each month.

Balance Transfer Credit Cards: Balance transfer credit cards are a type of credit card that allows individuals to transfer existing credit card balances to a new card with a lower interest rate. Balance transfer credit cards can be a good option for individuals who have good credit and can pay off debt quickly. However, balance transfer credit cards often come with fees and may have higher interest rates after the introductory period ends.

Debt Settlement: Debt settlement is a type of debt consolidation that involves negotiating with creditors to reduce the amount of debt owed. Debt settlement can be a good option for individuals who are struggling to make payments and are facing financial hardship. However, debt settlement can have negative impacts on credit scores and may not be suitable for everyone.

Bankruptcy: Bankruptcy is a type of debt consolidation that involves filing for bankruptcy protection. Bankruptcy can be a good option for individuals who are facing financial hardship and have no other options for paying off debt. However, bankruptcy can have serious negative impacts on credit scores and may not be suitable for everyone.

When considering alternative debt consolidation options, it’s essential to weigh the pros and cons of each option and consider individual financial circumstances. Personal loans to consolidate debt can be a powerful tool for achieving financial stability, but they may not be the best option for everyone. By exploring alternative debt consolidation options, individuals can find the best solution for their unique financial situation.

Ultimately, the key to achieving financial stability is to find a debt consolidation solution that works for individual circumstances. By considering personal loans to consolidate debt and alternative debt consolidation options, individuals can take control of their finances and achieve long-term financial stability.

Taking Control of Your Finances: Next Steps After Debt Consolidation

After consolidating debt with personal loans, it’s essential to take control of your finances to maintain a healthy credit score, build wealth, and achieve long-term financial stability. Here are some next steps to consider:

Maintain a Healthy Credit Score: A healthy credit score is essential for achieving long-term financial stability. To maintain a healthy credit score, make timely payments on your consolidated loan, keep credit utilization low, and monitor your credit report for errors.

Build Wealth: Building wealth requires a long-term perspective and a solid financial plan. Consider investing in a retirement account, such as a 401(k) or IRA, and take advantage of employer matching contributions. You can also consider investing in a taxable brokerage account or a robo-advisor.

Achieve Long-Term Financial Stability: Achieving long-term financial stability requires a combination of financial discipline and smart financial planning. Consider working with a financial advisor to create a personalized financial plan that aligns with your goals and values.

Stay Disciplined: Staying disciplined is essential for maintaining financial stability. Avoid accumulating new debt, prioritize needs over wants, and make smart financial decisions.

Monitor Progress: Monitoring progress is essential for achieving financial stability. Consider using a budgeting app or spreadsheet to track your income and expenses, and make adjustments as needed.

By following these next steps, individuals can take control of their finances and achieve long-term financial stability after consolidating debt with personal loans. Remember, debt consolidation is just the first step towards achieving financial stability. Ongoing financial management and discipline are essential for maintaining long-term financial health.

Personal loans to consolidate debt can be a powerful tool for achieving financial stability. By taking control of your finances and following these next steps, individuals can build wealth, maintain a healthy credit score, and achieve long-term financial stability.